OPEN-SOURCE SCRIPT

VIX bottom/top with color scale [Ox_kali]

📊 Introduction

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

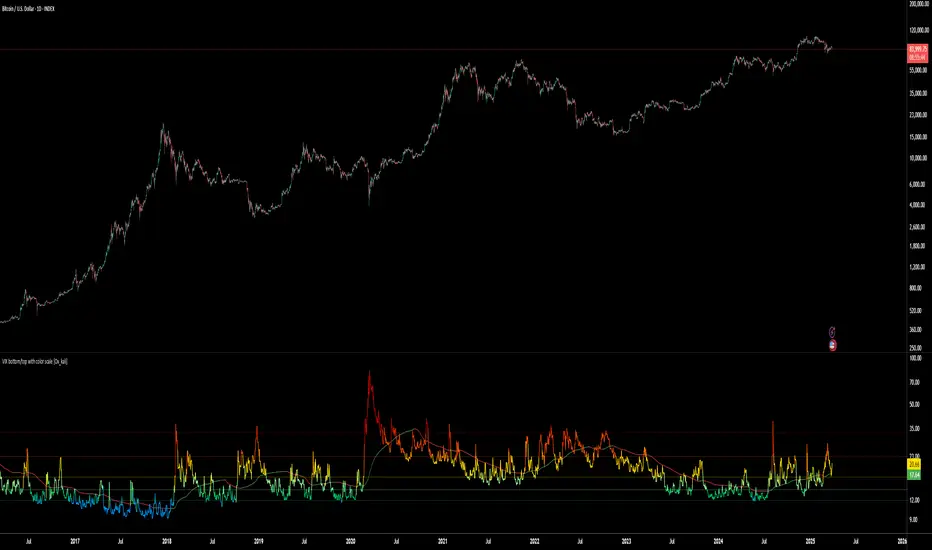

The “VIX Bottom/Top with Color Scale” script is designed to provide an intuitive, color-coded visualization of the VIX (Volatility Index), helping traders interpret market sentiment and volatility extremes in real time.

It segments the VIX into clear threshold zones, each associated with a specific market condition—ranging from fear to calm—using a dynamic color-coded system.

This script offers significant value for the following reasons:

Intuitive Risk Interpretation: Color-coded zones make it easy to interpret market sentiment at a glance.

Dynamic Trend Detection: A 200-period SMA of the VIX is plotted and dynamically colored based on trend direction.

Customization and Flexibility: All colors are editable in the parameters panel, grouped under “## Color parameters ##”.

Visual Clarity: Key thresholds are marked with horizontal lines for quick reference.

Practical Trading Tool: Helps identify high-risk and low-risk environments based on volatility levels.

🔍 Key Indicators

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

VIX (CBOE Volatility Index): Measures market volatility and investor fear.

SMA 200: Long-term trendline of the VIX, with color-coded direction (green = uptrend, red = downtrend).

Color-coded VIX Levels:

🔴 33+ → Something bad just happened

🟠 23–33 → Something bad is happening

🟡 17–23 → Something bad might happen

🟢 14–17 → Nothing bad is happening

✅ 12–14 → Nothing bad will ever happen

🔵 <12 → Something bad is going to happen

🧠 Originality and Purpose

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Unlike traditional VIX indicators that only plot a line, this script enhances interpretation through visual segmentation and dynamic trend tracking.

It serves as a risk-awareness tool that transforms the VIX into a simple, emotional market map.

This is the first version of the script, and future updates may include alerts, background fills, and more advanced features.

⚙️ How It Works

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The script maps the current VIX value to a range and applies the corresponding color.

It calculates a SMA 200 and colors it green or red depending on its slope.

It displays horizontal dotted lines at key thresholds (12, 14, 17, 23, 33).

All colors are configurable via input parameters under the group: "## Color parameters ##".

🧭 Indicator Visualization and Interpretation

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The VIX line changes color based on market condition zones.

The SMA line shows long-term direction with dynamic color.

Horizontal threshold lines visually mark the transitions between volatility zones.

Ideal for quickly identifying periods of fear, caution, or stability.

🛠️ Script Parameters

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Grouped under “## Color parameters ##”, the following elements are customizable:

🎨VIX Zone Colors:

33+ → Red

23–33 → Orange

17–23 → Yellow

14–17 → Light Green

12–14 → Dark Green

<12 → Blue

📈 SMA Colors:

Uptrend → Green

Downtrend → Red

These settings allow users to match the script’s visuals to their preferred chart style or theme.

✅ Conclusion

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The “VIX Bottom/Top with Color Scale” is a clean, powerful script designed to simplify how traders view volatility.

By combining long-term trend data with real-time color-coded sentiment analysis, this script becomes a go-to reference for managing risk, timing trades, or simply staying in tune with market mood.

🧪 Notes

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

This is version 1 of the script. More features such as alert conditions, background fill, and dashboard elements may be added soon. Feedback is welcome!

💡Color code concept inspired by the original VIX interpretation chart by @nsquaredvalue on Twitter. Big thanks for the visual clarity! 💡

⚠️ Disclaimer

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

This script is a visual tool designed to assist in market analysis. It does not guarantee future performance and should be used in conjunction with proper risk management. Past performance is not indicative of future results.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The “VIX Bottom/Top with Color Scale” script is designed to provide an intuitive, color-coded visualization of the VIX (Volatility Index), helping traders interpret market sentiment and volatility extremes in real time.

It segments the VIX into clear threshold zones, each associated with a specific market condition—ranging from fear to calm—using a dynamic color-coded system.

This script offers significant value for the following reasons:

Intuitive Risk Interpretation: Color-coded zones make it easy to interpret market sentiment at a glance.

Dynamic Trend Detection: A 200-period SMA of the VIX is plotted and dynamically colored based on trend direction.

Customization and Flexibility: All colors are editable in the parameters panel, grouped under “## Color parameters ##”.

Visual Clarity: Key thresholds are marked with horizontal lines for quick reference.

Practical Trading Tool: Helps identify high-risk and low-risk environments based on volatility levels.

🔍 Key Indicators

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

VIX (CBOE Volatility Index): Measures market volatility and investor fear.

SMA 200: Long-term trendline of the VIX, with color-coded direction (green = uptrend, red = downtrend).

Color-coded VIX Levels:

🔴 33+ → Something bad just happened

🟠 23–33 → Something bad is happening

🟡 17–23 → Something bad might happen

🟢 14–17 → Nothing bad is happening

✅ 12–14 → Nothing bad will ever happen

🔵 <12 → Something bad is going to happen

🧠 Originality and Purpose

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Unlike traditional VIX indicators that only plot a line, this script enhances interpretation through visual segmentation and dynamic trend tracking.

It serves as a risk-awareness tool that transforms the VIX into a simple, emotional market map.

This is the first version of the script, and future updates may include alerts, background fills, and more advanced features.

⚙️ How It Works

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The script maps the current VIX value to a range and applies the corresponding color.

It calculates a SMA 200 and colors it green or red depending on its slope.

It displays horizontal dotted lines at key thresholds (12, 14, 17, 23, 33).

All colors are configurable via input parameters under the group: "## Color parameters ##".

🧭 Indicator Visualization and Interpretation

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The VIX line changes color based on market condition zones.

The SMA line shows long-term direction with dynamic color.

Horizontal threshold lines visually mark the transitions between volatility zones.

Ideal for quickly identifying periods of fear, caution, or stability.

🛠️ Script Parameters

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Grouped under “## Color parameters ##”, the following elements are customizable:

🎨VIX Zone Colors:

33+ → Red

23–33 → Orange

17–23 → Yellow

14–17 → Light Green

12–14 → Dark Green

<12 → Blue

📈 SMA Colors:

Uptrend → Green

Downtrend → Red

These settings allow users to match the script’s visuals to their preferred chart style or theme.

✅ Conclusion

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The “VIX Bottom/Top with Color Scale” is a clean, powerful script designed to simplify how traders view volatility.

By combining long-term trend data with real-time color-coded sentiment analysis, this script becomes a go-to reference for managing risk, timing trades, or simply staying in tune with market mood.

🧪 Notes

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

This is version 1 of the script. More features such as alert conditions, background fill, and dashboard elements may be added soon. Feedback is welcome!

💡Color code concept inspired by the original VIX interpretation chart by @nsquaredvalue on Twitter. Big thanks for the visual clarity! 💡

⚠️ Disclaimer

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

This script is a visual tool designed to assist in market analysis. It does not guarantee future performance and should be used in conjunction with proper risk management. Past performance is not indicative of future results.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.