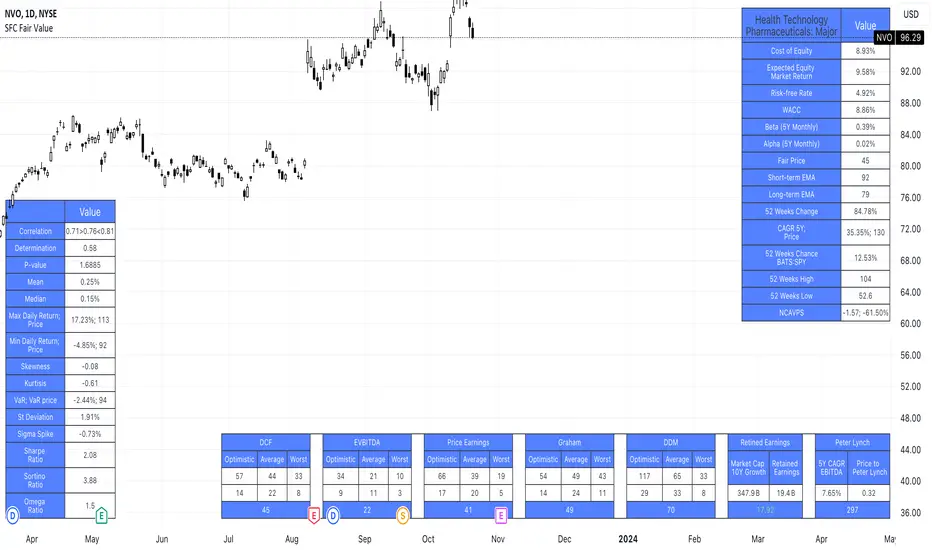

SFC Valuation Model - Fair Value

Fundamental analysis is often employed in valuation, although several other methods may be employed such as the capital asset pricing model (CAPM) or the dividend discount model (DDM), Discounted Cash Flow (DCF) and many others.

A valuation can be useful when trying to determine the fair value of a security, which is determined by what a buyer is willing to pay a seller, assuming both parties enter the transaction willingly. When a security trades on an exchange, buyers and sellers determine the market value of a stock or bond.

There is no universal standard for calculating the intrinsic value of a company or stock. Financial analysts attempt to determine an asset's intrinsic value by using fundamental and technical analyses to gauge its actual financial performance.

Intrinsic value is useful because it can help an investor understand whether a potential investment is overvalued or undervalued.

This indicator allows investors to simulate different scenarios depending on their view of the stock's value. It calculates different models automatically, but users can define the fair value manually by changing the settings.

For example: change the weight of the model; choose how conservatively want to evaluate the stock; use different growth rate or discount rate and so on.

The indicator shows other useful metrics in order to help investors to evaluate the stock.

This indicator can save users hours of searching financial data and calculating fair value.

There are few valuation methods/steps

- Macroeconomics - analyse the current economic;

- Define how the sector is performing;

- Relative valuation method - compare few stocks and find the Outlier;

- Absolute valuation method historically- define how the stock performed in the past;

- Absolute valuation method - define how the stock is performed now and find the fair value;

- Technical analysis

How to use:

1. Once you have completed the initial evaluation steps, simply load the indicator.

2. Check the default settings and see if they suit you.

3. Find the fair value and wait for the stock to reach it.

- added more metrics for full analysis

- added Graham valuation model

- added Net current asset value per share (NCAVPS)

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi SerpentForexClub secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi SerpentForexClub secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.