OPEN-SOURCE SCRIPT

Telah dikemas kini Kaufman's Adaptive Moving Average (KAMA) - Multi timeframe

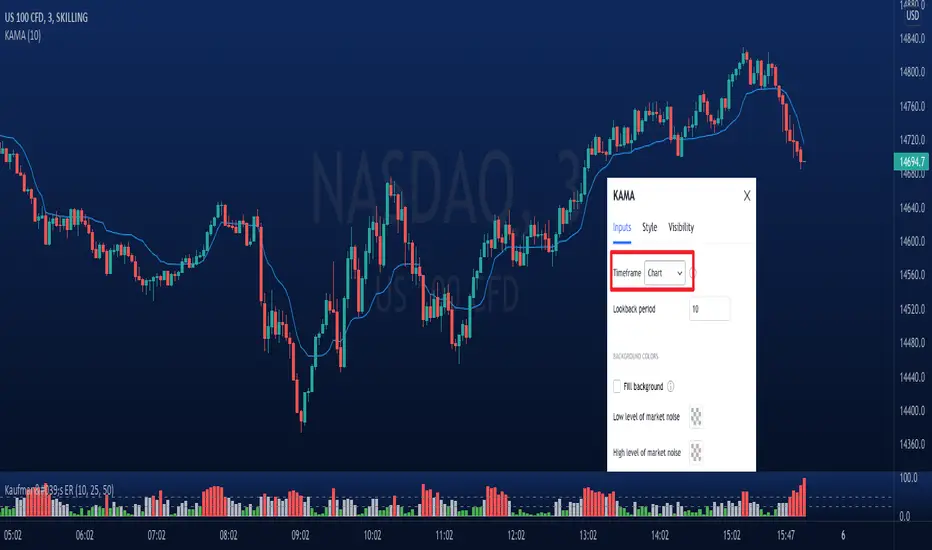

Kaufman's Adaptive Moving Average (KAMA)

KAMA was developed by Perry Kaufman to give better directions of short term market trends.

Idea is similar to an EMA, but it makes adjustments to the smoothing factor by taking Market Noise into consideration. Levels of noise in KAMA is modelled using Kaufman's Efficiency Ratio.

The problem with traditional of moving averages (ie. SMA/EMA) is that they are very sensitive to sudden price movements.

Applications:

- Less prone to false signals compared to other types of moving averages. When price suddenly surges or tanks, KAMA will lag behind telling us that the move is rather abnormal.

- On the other hand, when volatility of price movements is low, KAMA will be close to the ranging candles with a slope approximate to zero. KAMA can be used for filtering out choppy markets.

Other features:

- Multi-timeframe.

- Can visualize levels of market noise with background color mode turned on.

KAMA was developed by Perry Kaufman to give better directions of short term market trends.

Idea is similar to an EMA, but it makes adjustments to the smoothing factor by taking Market Noise into consideration. Levels of noise in KAMA is modelled using Kaufman's Efficiency Ratio.

The problem with traditional of moving averages (ie. SMA/EMA) is that they are very sensitive to sudden price movements.

Applications:

- Less prone to false signals compared to other types of moving averages. When price suddenly surges or tanks, KAMA will lag behind telling us that the move is rather abnormal.

- On the other hand, when volatility of price movements is low, KAMA will be close to the ranging candles with a slope approximate to zero. KAMA can be used for filtering out choppy markets.

Other features:

- Multi-timeframe.

- Can visualize levels of market noise with background color mode turned on.

Nota Keluaran

New feature: Coded candles to identify price crossing with MA.Nota Keluaran

Amended line 43, calling of nz(src=kama, replacement=close). Previously, param. replacement==0Nota Keluaran

Features:- Added: Option to show smooth KAMA (least of squares over same KAMA period).

- Added: Low/high thresholds for background colors linked to noise (if turned on)

- Removed: bar colors during crosses

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.