OPEN-SOURCE SCRIPT

Telah dikemas kini ICT Sessions_One Setup for Life [MK]

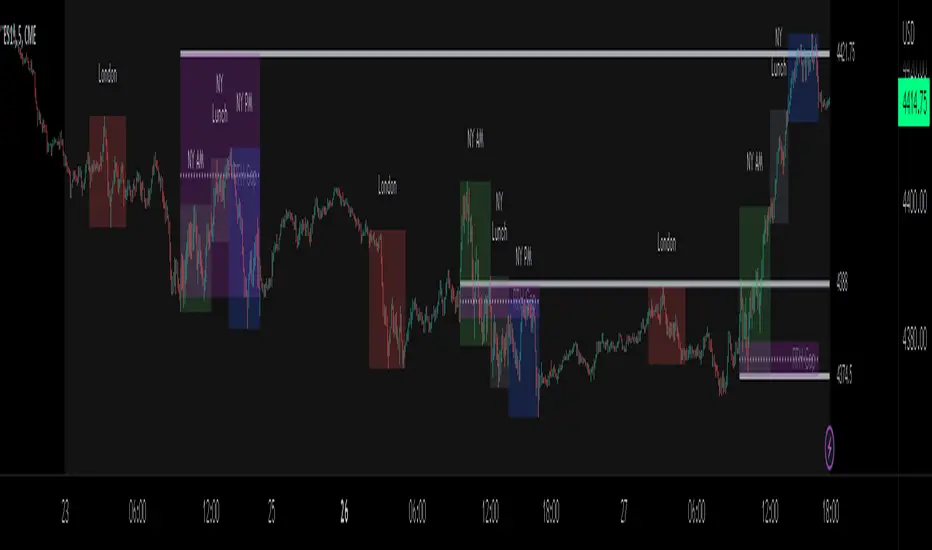

The script plots the High/Low of the following trading sessions:

London - 02:00-05:00

NY AM - 09:30-12:00

New York Lunch - 12:00-13:30

New York PM - 13:30-16:00

Due to the high level of liquidity (resting orders), highs and lows of these sessions may be used as buy/sell areas and also as profit target areas. Typically, buy orders would be initiated below a session low and sell orders would be initiated above a

session high.

The script also plots 'RTH (Regular Trading Hours) Opening Gaps'. The RTH gaps are drawn from the closing price of regular trading at 16:15 (EST) to the open price of regular trading at 09:30 (EST). Gaps can be areas that traders might anticipate to be filled at some time in the future. A gap 'midline' is available if needed and yesterday RTH close line can be shown and extended to the current bar.

This script is simply a means to draw boxes around certain areas/periods on the charts. It is in no way a trading strategy and users should spend much time to study the concept and should also perform extensive back-testing before taking any trades.

By setting the lookback value to a much higher value then the default of 6, users can utilise the script to perform their own backtesting studies.

The above chart shows the default setup of the indicator. Note that the user has to choose how far (in days) to lookback and draw the sessions/gaps.

It is also possible to show the session high//low lines and extend them to the current bar time. If this is used it is advised to keep the lookback period as low as possible to ensure charts stay clean/uncluttered.

All boxes/lines styles/colors are fully customisable.

London - 02:00-05:00

NY AM - 09:30-12:00

New York Lunch - 12:00-13:30

New York PM - 13:30-16:00

Due to the high level of liquidity (resting orders), highs and lows of these sessions may be used as buy/sell areas and also as profit target areas. Typically, buy orders would be initiated below a session low and sell orders would be initiated above a

session high.

The script also plots 'RTH (Regular Trading Hours) Opening Gaps'. The RTH gaps are drawn from the closing price of regular trading at 16:15 (EST) to the open price of regular trading at 09:30 (EST). Gaps can be areas that traders might anticipate to be filled at some time in the future. A gap 'midline' is available if needed and yesterday RTH close line can be shown and extended to the current bar.

This script is simply a means to draw boxes around certain areas/periods on the charts. It is in no way a trading strategy and users should spend much time to study the concept and should also perform extensive back-testing before taking any trades.

By setting the lookback value to a much higher value then the default of 6, users can utilise the script to perform their own backtesting studies.

The above chart shows the default setup of the indicator. Note that the user has to choose how far (in days) to lookback and draw the sessions/gaps.

It is also possible to show the session high//low lines and extend them to the current bar time. If this is used it is advised to keep the lookback period as low as possible to ensure charts stay clean/uncluttered.

All boxes/lines styles/colors are fully customisable.

Nota Keluaran

Added Session H/L mitigationRTH gaps + midlines extend to current bar

Default lookback days to 10

Default RTH gaps + midlines lookback to 3

Nota Keluaran

Added option for session 50% lineAdded option for user to decide how many hours forward RTH gaps are projected

Added RTH gap 25%/75% line options

Nota Keluaran

added 00:00 and 08:30 (EST) opening linesNota Keluaran

fixed issue with RTH gap displaying incorrectly when new week has daylight savings. ie timezone changes from GMT-5 to GMT-4.Nota Keluaran

Update to restore 00:00 and 08:30 open lines which went missing when I published an old version by mistake.Nota Keluaran

Added 0930, Weekly, Monthly and Yearly opening lines.Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.