OPEN-SOURCE SCRIPT

BTC Correlation Percentage

Purpose

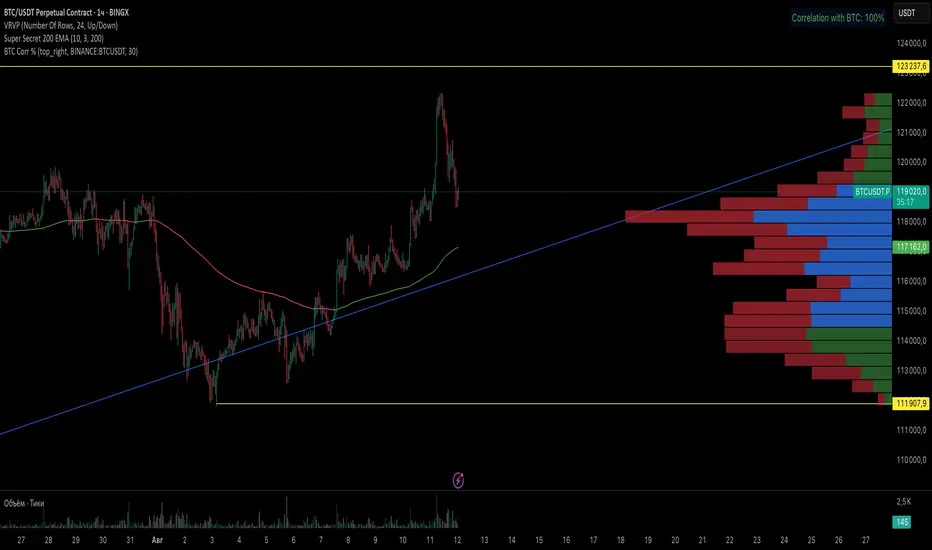

This indicator displays the correlation percentage between the current trading instrument and Bitcoin (BTC/USDT) as a text label on the chart. It helps traders quickly assess how closely an asset's price movements align with Bitcoin's fluctuations.

Key Features

Precise Calculation: Shows correlation as a percentage with one decimal place (e.g., 25.6%).

Customizable Appearance: Allows adjustment of colors, position, and calculation period.

Clean & Simple: Displays only essential information without cluttering the chart.

Universal Compatibility: Works on any timeframe and with any trading pair.

Input Settings

Core Parameters:

BTC Symbol – Ticker for Bitcoin (default: BINANCE:BTCUSDT).

Correlation Period – Number of bars used for calculation (default: 50 candles).

Show Correlation Label – Toggle visibility of the correlation label.

Visual Customization:

Text Color – Label text color (default: white).

Background Color – Label background color (default: semi-transparent blue).

Border Color – Border color around the label (default: gray).

Label Position – Where the label appears on the chart (default: top-right).

Interpreting Correlation Values

70% to 100% → Strong positive correlation (asset moves in sync with BTC).

30% to 70% → Moderate positive correlation.

-30% to 30% → Weak or no correlation.

-70% to -30% → Moderate negative correlation (asset moves opposite to BTC).

-100% to -70% → Strong negative correlation.

Practical Use Cases

For Altcoins: A correlation above 50% suggests high dependence on Bitcoin’s price action.

For Futures Trading: Helps assess systemic risks tied to BTC movements.

During High Volatility: Determines whether an asset’s price change is driven by its own factors or broader market trends.

How It Works

The indicator recalculates automatically with each new candle. For the most reliable results, it is recommended for use on daily or higher timeframes.

This tool provides traders with a quick, visual way to gauge Bitcoin’s influence on other assets, improving decision-making in crypto markets. 🚀

This response is AI-generated, for reference only.

New chat

This indicator displays the correlation percentage between the current trading instrument and Bitcoin (BTC/USDT) as a text label on the chart. It helps traders quickly assess how closely an asset's price movements align with Bitcoin's fluctuations.

Key Features

Precise Calculation: Shows correlation as a percentage with one decimal place (e.g., 25.6%).

Customizable Appearance: Allows adjustment of colors, position, and calculation period.

Clean & Simple: Displays only essential information without cluttering the chart.

Universal Compatibility: Works on any timeframe and with any trading pair.

Input Settings

Core Parameters:

BTC Symbol – Ticker for Bitcoin (default: BINANCE:BTCUSDT).

Correlation Period – Number of bars used for calculation (default: 50 candles).

Show Correlation Label – Toggle visibility of the correlation label.

Visual Customization:

Text Color – Label text color (default: white).

Background Color – Label background color (default: semi-transparent blue).

Border Color – Border color around the label (default: gray).

Label Position – Where the label appears on the chart (default: top-right).

Interpreting Correlation Values

70% to 100% → Strong positive correlation (asset moves in sync with BTC).

30% to 70% → Moderate positive correlation.

-30% to 30% → Weak or no correlation.

-70% to -30% → Moderate negative correlation (asset moves opposite to BTC).

-100% to -70% → Strong negative correlation.

Practical Use Cases

For Altcoins: A correlation above 50% suggests high dependence on Bitcoin’s price action.

For Futures Trading: Helps assess systemic risks tied to BTC movements.

During High Volatility: Determines whether an asset’s price change is driven by its own factors or broader market trends.

How It Works

The indicator recalculates automatically with each new candle. For the most reliable results, it is recommended for use on daily or higher timeframes.

This tool provides traders with a quick, visual way to gauge Bitcoin’s influence on other assets, improving decision-making in crypto markets. 🚀

This response is AI-generated, for reference only.

New chat

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.