OPEN-SOURCE SCRIPT

Telah dikemas kini RISK

## Main Purpose

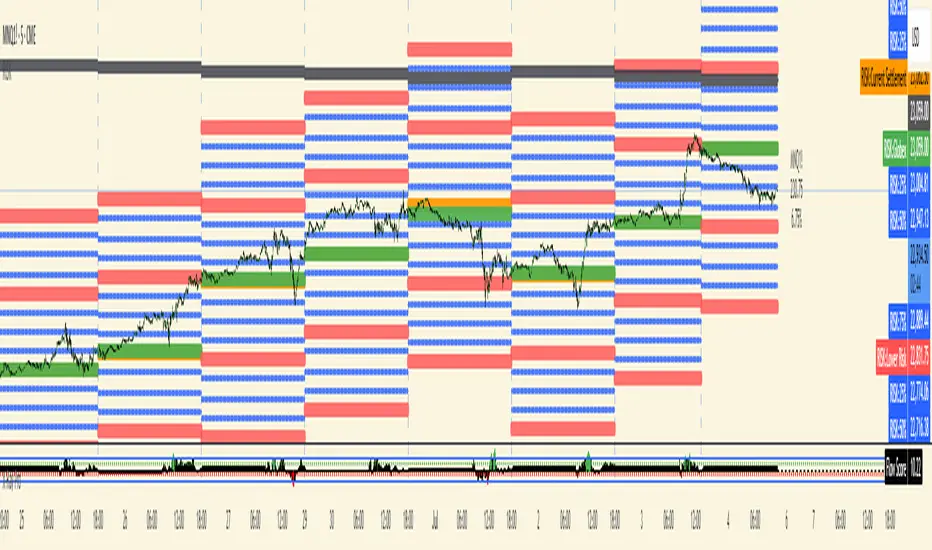

The indicator calculates and displays risk levels based on margin requirements and daily settlement prices, helping traders visualize their potential risk exposure.

## Key Features

**Inputs:**

- **Margin for Calculation**: The CME long margin requirement for the asset

- **HTF Margin Line**: An anchor point for higher timeframe margin calculations

**Core Calculations:**

1. **Settlement Price Tracking**: Captures daily settlement prices during specific session times (6:58-6:59 PM ET for close, 6:00-6:01 PM ET for new day open)

2. **Risk Percentage**: Calculates `margin / (point value × settlement price)` - with special handling for Micro contracts (symbols starting with "M") that uses 10× point value

3. **Risk Intervals**: Determines price intervals representing one margin unit of risk

## Visual Display

The indicator plots multiple risk levels on the chart:

- **Settlement price** (orange circles)

- **Globex open** (green circles)

- **Upper/Lower Risk levels** (red circles) - one and two risk intervals away

- **Subdivision levels** (blue crosses) - 25%, 50%, and 75% of each risk interval

- **MHP+ level** (black crosses) - HTF anchor adjusted by risk percentage

- **HTF Anchor** (black crosses)

## Practical Use

This helps futures traders:

- Visualize how far price can move before hitting margin calls

- See risk levels relative to daily settlements

- Plan position sizing and risk management

- Understand exposure in terms of actual margin requirements

The indicator essentially transforms abstract margin numbers into concrete price levels on the chart, making risk management more visual and intuitive.

The indicator calculates and displays risk levels based on margin requirements and daily settlement prices, helping traders visualize their potential risk exposure.

## Key Features

**Inputs:**

- **Margin for Calculation**: The CME long margin requirement for the asset

- **HTF Margin Line**: An anchor point for higher timeframe margin calculations

**Core Calculations:**

1. **Settlement Price Tracking**: Captures daily settlement prices during specific session times (6:58-6:59 PM ET for close, 6:00-6:01 PM ET for new day open)

2. **Risk Percentage**: Calculates `margin / (point value × settlement price)` - with special handling for Micro contracts (symbols starting with "M") that uses 10× point value

3. **Risk Intervals**: Determines price intervals representing one margin unit of risk

## Visual Display

The indicator plots multiple risk levels on the chart:

- **Settlement price** (orange circles)

- **Globex open** (green circles)

- **Upper/Lower Risk levels** (red circles) - one and two risk intervals away

- **Subdivision levels** (blue crosses) - 25%, 50%, and 75% of each risk interval

- **MHP+ level** (black crosses) - HTF anchor adjusted by risk percentage

- **HTF Anchor** (black crosses)

## Practical Use

This helps futures traders:

- Visualize how far price can move before hitting margin calls

- See risk levels relative to daily settlements

- Plan position sizing and risk management

- Understand exposure in terms of actual margin requirements

The indicator essentially transforms abstract margin numbers into concrete price levels on the chart, making risk management more visual and intuitive.

Nota Keluaran

Updated to show settlement correctly regardless of chart settingsSkrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.