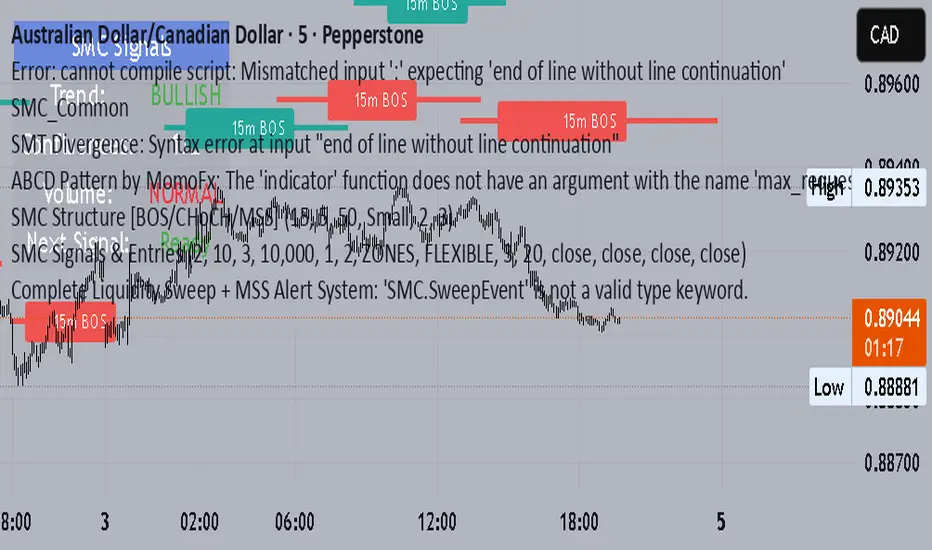

SMC_Common

Common types and utilities for Smart Money Concepts indicators

get_future_time(bars_ahead)

Parameters:

bars_ahead (int)

get_time_at_offset(offset)

Parameters:

offset (int)

get_mid_time(time1, time2)

Parameters:

time1 (int)

time2 (int)

timeframe_to_string(tf)

Parameters:

tf (string)

is_psychological_level(price)

Parameters:

price (float)

detect_swing_high(src_high, lookback)

Parameters:

src_high (float)

lookback (int)

detect_swing_low(src_low, lookback)

Parameters:

src_low (float)

lookback (int)

detect_fvg(h, l, min_size)

Parameters:

h (float)

l (float)

min_size (float)

analyze_volume(vol, volume_ma)

Parameters:

vol (float)

volume_ma (float)

create_label(x, y, label_text, bg_color, label_size, use_time)

Parameters:

x (int)

y (float)

label_text (string)

bg_color (color)

label_size (string)

use_time (bool)

SwingPoint

Fields:

price (series float)

bar_index (series int)

bar_time (series int)

swing_type (series string)

strength (series int)

is_major (series bool)

timeframe (series string)

LiquidityLevel

Fields:

price (series float)

bar_index (series int)

bar_time (series int)

liq_type (series string)

touch_count (series int)

is_swept (series bool)

quality_score (series float)

level_type (series string)

OrderBlock

Fields:

start_bar (series int)

end_bar (series int)

start_time (series int)

end_time (series int)

top (series float)

bottom (series float)

ob_type (series string)

has_liquidity_sweep (series bool)

has_fvg (series bool)

is_mitigated (series bool)

is_breaker (series bool)

timeframe (series string)

mitigation_level (series float)

StructureBreak

Fields:

level (series float)

break_bar (series int)

break_time (series int)

break_type (series string)

direction (series string)

is_confirmed (series bool)

source_swing_bar (series int)

source_time (series int)

SignalData

Fields:

signal_type (series string)

entry_price (series float)

stop_loss (series float)

take_profit (series float)

risk_reward_ratio (series float)

confluence_count (series int)

confidence_score (series float)

strength (series string)

Added:

f_detect_pivots(left_strength, right_strength)

Parameters:

left_strength (int): (int) Number of bars to the left that must be lower/higher.

right_strength (int): (int) Number of bars to the right that must be lower/higher.

Returns: A tuple: [pivot_high_price, pivot_high_time, pivot_low_price, pivot_low_time]

f_tf_to_string(tf)

Parameters:

tf (string)

f_draw_liquidity_level(level, liq_color, size)

Parameters:

level (LiquidityLevel): (LiquidityLevel) The liquidity level object to draw.

liq_color (color)

size (string): (string) The size for the label.

f_update_swept_liquidity_drawing(level, swept_color)

Parameters:

level (LiquidityLevel)

swept_color (color)

f_extend_liquidity_lines(liq_array)

Parameters:

liq_array (array<LiquidityLevel>)

f_draw_structure_break(break_obj, line_color, tf_label)

Parameters:

break_obj (StructureBreak)

line_color (color)

tf_label (string)

f_draw_order_block(ob)

Parameters:

ob (OrderBlock)

SweepEvent

Fields:

price (series float)

sweep_time (series int)

liq_type (series string)

timeframe (series string)

Updated:

LiquidityLevel

Fields:

price (series float)

bar_index (series int)

bar_time (series int)

liq_type (series string)

is_swept (series bool)

timeframe (series string)

line_id (series line)

label_id (series label)

is_active (series bool)

OrderBlock

Fields:

start_time (series int)

end_time (series int)

top (series float)

bottom (series float)

ob_type (series string)

is_mitigated (series bool)

timeframe (series string)

box_id (series box)

StructureBreak

Fields:

level (series float)

break_time (series int)

break_type (series string)

direction (series string)

source_time (series int)

timeframe (series string)

Removed:

get_future_time(bars_ahead)

get_time_at_offset(offset)

get_mid_time(time1, time2)

timeframe_to_string(tf)

is_psychological_level(price)

detect_swing_high(src_high, lookback)

detect_swing_low(src_low, lookback)

detect_fvg(h, l, min_size)

analyze_volume(vol, volume_ma)

create_label(x, y, label_text, bg_color, label_size, use_time)

SignalData

Perpustakaan Pine

Dalam semangat TradingView sebenar, penulis telah menerbitkan kod Pine ini sebagai perpustakaan sumber terbuka supaya pengaturcara Pine lain dari komuniti kami boleh menggunakannya semula. Sorakan kepada penulis! Anda boleh menggunakan perpustakaan ini secara peribadi atau dalam penerbitan sumber terbuka lain, tetapi penggunaan semula kod ini dalam penerbitan adalah dikawal selia oleh Peraturan Dalaman.

Penafian

Perpustakaan Pine

Dalam semangat TradingView sebenar, penulis telah menerbitkan kod Pine ini sebagai perpustakaan sumber terbuka supaya pengaturcara Pine lain dari komuniti kami boleh menggunakannya semula. Sorakan kepada penulis! Anda boleh menggunakan perpustakaan ini secara peribadi atau dalam penerbitan sumber terbuka lain, tetapi penggunaan semula kod ini dalam penerbitan adalah dikawal selia oleh Peraturan Dalaman.