OPEN-SOURCE SCRIPT

Combo RSI + MACD + ADX MTF (Avec Alertes)

✅ Recommended Title:

Multi-Signal Oscillator: ADX Trend + DI + RSI + MACD (MTF, Cross Alerts)

✅ Detailed Description

📝 Overview

This indicator combines advanced technical analysis tools to identify trend direction, capture reversals, and filter false signals.

It includes:

ADX (Multi-TimeFrame) for trend and trend strength detection.

DI+ / DI- for directional bias.

RSI + ZLSMA for oscillation analysis and divergence detection.

Zero-Lag Normalized MACD for momentum and entry timing.

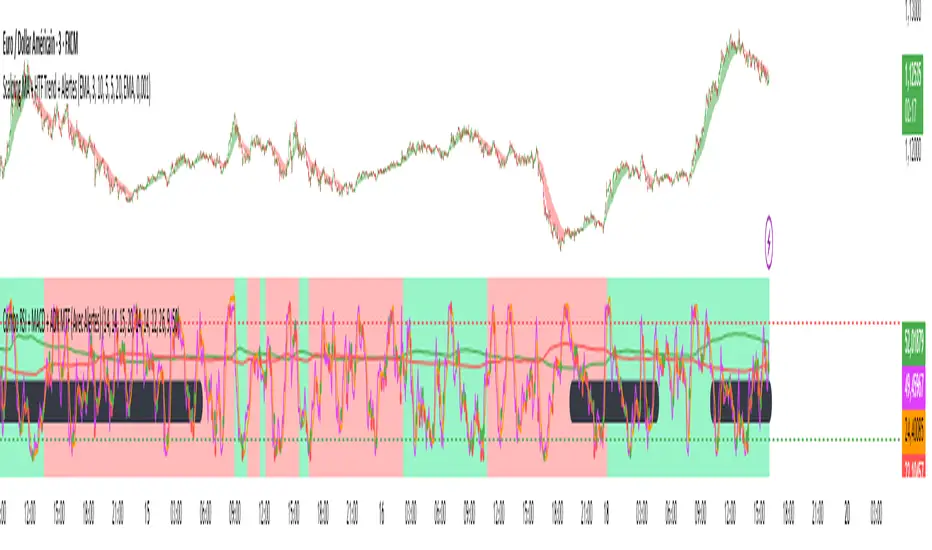

⚙️ Visual Components

✅ Green/Red Background: Displays overall trend based on Multi-TimeFrame ADX.

✅ DI+ / DI- Lines: Green and red curves showing directional bias.

✅ Normalized RSI: Blue oscillator with orange ZLSMA smoothing.

✅ Zero-Lag MACD: Violet or fuchsia/orange oscillator depending on the version.

✅ Crossover Points: Colored circles marking buy and sell signals.

✅ ADX Strength Dots: Small black dots when ADX exceeds the strength threshold.

🚨 Included Alert System

✅ RSI / ZLSMA Crossovers (Buy / Sell).

✅ MACD / Signal Line Crossovers (Buy / Sell).

✅ DI+ / DI- Crossovers (Buy / Sell).

✅ Double Confirmation DI+ / RSI or DI+ / MACD.

✅ Double Confirmation DI- / RSI or DI- / MACD.

✅ Trend Change Alerts via Background Color.

✅ ADX Strength Alerts (Above Threshold).

🛠️ Suggested Configuration Examples

1. Short-Term Reversal Detection:

RSI Length: 7 to 14

ZLSMA Length: 7 to 14

MACD Fast/Slow: 5 / 13

ADX MTF Period: 5 to 15

ADX Threshold: 15 to 20

2. Long-Term Trend Following:

RSI Length: 21 to 30

ZLSMA Length: 21 to 30

MACD Fast/Slow: 12 / 26

ADX MTF Period: 30 to 50

ADX Threshold: 20 to 25

3. Scalping / Day Trading:

RSI Length: 5 to 9

ZLSMA Length: 5 to 9

MACD Fast/Slow: 3 / 7

ADX MTF Period: 5 to 10

ADX Threshold: 10 to 15

🎯 Why Use This Tool?

Filters false signals using ADX-based background coloring.

Provides multi-source alerting (RSI, MACD, ADX).

Helps identify true market strength zones.

Works on all markets: Forex, Crypto, Stocks, Indices.

Multi-Signal Oscillator: ADX Trend + DI + RSI + MACD (MTF, Cross Alerts)

✅ Detailed Description

📝 Overview

This indicator combines advanced technical analysis tools to identify trend direction, capture reversals, and filter false signals.

It includes:

ADX (Multi-TimeFrame) for trend and trend strength detection.

DI+ / DI- for directional bias.

RSI + ZLSMA for oscillation analysis and divergence detection.

Zero-Lag Normalized MACD for momentum and entry timing.

⚙️ Visual Components

✅ Green/Red Background: Displays overall trend based on Multi-TimeFrame ADX.

✅ DI+ / DI- Lines: Green and red curves showing directional bias.

✅ Normalized RSI: Blue oscillator with orange ZLSMA smoothing.

✅ Zero-Lag MACD: Violet or fuchsia/orange oscillator depending on the version.

✅ Crossover Points: Colored circles marking buy and sell signals.

✅ ADX Strength Dots: Small black dots when ADX exceeds the strength threshold.

🚨 Included Alert System

✅ RSI / ZLSMA Crossovers (Buy / Sell).

✅ MACD / Signal Line Crossovers (Buy / Sell).

✅ DI+ / DI- Crossovers (Buy / Sell).

✅ Double Confirmation DI+ / RSI or DI+ / MACD.

✅ Double Confirmation DI- / RSI or DI- / MACD.

✅ Trend Change Alerts via Background Color.

✅ ADX Strength Alerts (Above Threshold).

🛠️ Suggested Configuration Examples

1. Short-Term Reversal Detection:

RSI Length: 7 to 14

ZLSMA Length: 7 to 14

MACD Fast/Slow: 5 / 13

ADX MTF Period: 5 to 15

ADX Threshold: 15 to 20

2. Long-Term Trend Following:

RSI Length: 21 to 30

ZLSMA Length: 21 to 30

MACD Fast/Slow: 12 / 26

ADX MTF Period: 30 to 50

ADX Threshold: 20 to 25

3. Scalping / Day Trading:

RSI Length: 5 to 9

ZLSMA Length: 5 to 9

MACD Fast/Slow: 3 / 7

ADX MTF Period: 5 to 10

ADX Threshold: 10 to 15

🎯 Why Use This Tool?

Filters false signals using ADX-based background coloring.

Provides multi-source alerting (RSI, MACD, ADX).

Helps identify true market strength zones.

Works on all markets: Forex, Crypto, Stocks, Indices.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.