OPEN-SOURCE SCRIPT

Telah dikemas kini Supertrend - SSL Strategy with Toggle [AlPashaTrader]

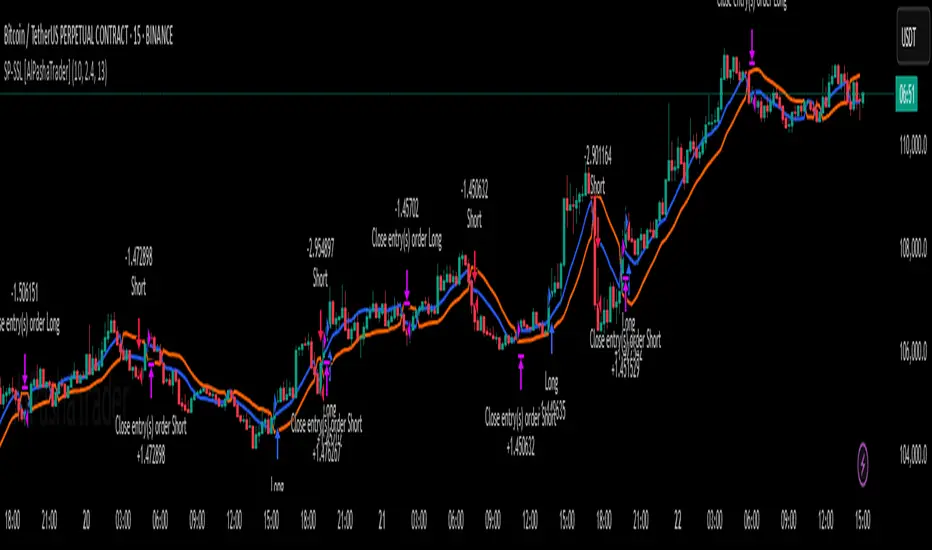

📈 Overview of the Supertrend - SSL Strategy with Toggle Indicator

This strategy combines two powerful technical tools—Supertrend and SSL Channel—to deliver precise and reliable trading signals, designed for traders who value confirmation and risk management. 🎯

⚙️ How This Indicator Was Created

The strategy was meticulously crafted to harness the complementary strengths of:

Supertrend Indicator: A trend-following tool based on Average True Range (ATR) and a multiplier factor, it detects bullish or bearish trends by calculating dynamic support and resistance levels. 📊

SSL Channel: A channel indicator built using two Simple Moving Averages (SMA) of the highs and lows over a set period. It cleverly determines trend direction by comparing price action relative to these moving averages. 🔄

These two indicators are merged into one cohesive strategy with an optional toggle feature allowing the trader to choose whether to require confirmation from both indicators before taking a position or to act on signals from either. 🎚️

The script includes user-friendly controls for:

Defining a custom trading date range 📅, useful for backtesting or restricting trading to specific market conditions.

Setting the ATR length and multiplier for Supertrend sensitivity ⚙️.

Adjusting the SSL channel period for responsiveness to price changes ⏱️.

Choosing whether to require dual confirmation (both Supertrend and SSL signals) for more conservative trading or a single indicator trigger for a more aggressive approach 🛡️ vs ⚔️.

🔍 How This Indicator Works

Signal Generation:

Supertrend analyzes market volatility and trend direction, signaling a potential buy when the trend turns bullish 📈 and a sell when bearish 📉.

SSL Channel tracks price relative to its high and low moving averages to identify uptrends and downtrends. A crossover of the SSL Up and SSL Down lines generates buy or sell signals 🔔.

Confirmation Logic:

When confirmation is enabled, the strategy waits for agreement between both indicators before entering a trade ✅, reducing false signals.

When confirmation is disabled, it trades based on signals from either indicator ⚡, allowing more frequent entries but potentially higher risk.

Entry and Exit Rules:

Entry occurs when the indicator(s) signal a new trend direction 🚀 for long, or decline for short.

Exit happens when opposing signals appear 🛑, closing existing positions to lock in profits or cut losses.

Visual Aids:

The SSL Channel lines are plotted directly on the chart with distinct colors to intuitively show trend shifts 🎨.

The system respects the specified date range ⏳, ensuring trades only occur within user-defined periods.

🎯 How to Use This Strategy Effectively

Set Your Preferences: Adjust ATR length, factor, and SSL period to your style. More sensitive? Decrease lengths. Smoother? Increase them ⚙️.

Choose Confirmation Mode: Use the toggle depending on your risk appetite:

Confirmation ON ✅: For conservative traders wanting high-probability setups.

Confirmation OFF ⚡: For aggressive traders who want more signals.

Apply Date Filters: Focus your trading or backtesting on specific periods 📅.

Monitor Entry/Exit Signals: Watch crossovers and Supertrend changes closely 👀.

Risk Management: The strategy uses position sizing as a percentage of equity (default 15%) 💰. Adjust accordingly.

Combine with Other Tools: Enhance results by combining this with volume, price action, or fundamentals 🔧.

📝 Summary

This Supertrend - SSL Strategy with Toggle is a dynamic and flexible trading tool blending volatility-based trend detection with moving-average channel insights. It empowers traders to customize confirmation strictness, control trading periods, and efficiently capture trending opportunities while managing risk smartly.

By integrating proven indicators in a user-friendly, visually intuitive package, this strategy stands as a sophisticated tool suitable for various markets and trading styles. 🚀📊

This strategy combines two powerful technical tools—Supertrend and SSL Channel—to deliver precise and reliable trading signals, designed for traders who value confirmation and risk management. 🎯

⚙️ How This Indicator Was Created

The strategy was meticulously crafted to harness the complementary strengths of:

Supertrend Indicator: A trend-following tool based on Average True Range (ATR) and a multiplier factor, it detects bullish or bearish trends by calculating dynamic support and resistance levels. 📊

SSL Channel: A channel indicator built using two Simple Moving Averages (SMA) of the highs and lows over a set period. It cleverly determines trend direction by comparing price action relative to these moving averages. 🔄

These two indicators are merged into one cohesive strategy with an optional toggle feature allowing the trader to choose whether to require confirmation from both indicators before taking a position or to act on signals from either. 🎚️

The script includes user-friendly controls for:

Defining a custom trading date range 📅, useful for backtesting or restricting trading to specific market conditions.

Setting the ATR length and multiplier for Supertrend sensitivity ⚙️.

Adjusting the SSL channel period for responsiveness to price changes ⏱️.

Choosing whether to require dual confirmation (both Supertrend and SSL signals) for more conservative trading or a single indicator trigger for a more aggressive approach 🛡️ vs ⚔️.

🔍 How This Indicator Works

Signal Generation:

Supertrend analyzes market volatility and trend direction, signaling a potential buy when the trend turns bullish 📈 and a sell when bearish 📉.

SSL Channel tracks price relative to its high and low moving averages to identify uptrends and downtrends. A crossover of the SSL Up and SSL Down lines generates buy or sell signals 🔔.

Confirmation Logic:

When confirmation is enabled, the strategy waits for agreement between both indicators before entering a trade ✅, reducing false signals.

When confirmation is disabled, it trades based on signals from either indicator ⚡, allowing more frequent entries but potentially higher risk.

Entry and Exit Rules:

Entry occurs when the indicator(s) signal a new trend direction 🚀 for long, or decline for short.

Exit happens when opposing signals appear 🛑, closing existing positions to lock in profits or cut losses.

Visual Aids:

The SSL Channel lines are plotted directly on the chart with distinct colors to intuitively show trend shifts 🎨.

The system respects the specified date range ⏳, ensuring trades only occur within user-defined periods.

🎯 How to Use This Strategy Effectively

Set Your Preferences: Adjust ATR length, factor, and SSL period to your style. More sensitive? Decrease lengths. Smoother? Increase them ⚙️.

Choose Confirmation Mode: Use the toggle depending on your risk appetite:

Confirmation ON ✅: For conservative traders wanting high-probability setups.

Confirmation OFF ⚡: For aggressive traders who want more signals.

Apply Date Filters: Focus your trading or backtesting on specific periods 📅.

Monitor Entry/Exit Signals: Watch crossovers and Supertrend changes closely 👀.

Risk Management: The strategy uses position sizing as a percentage of equity (default 15%) 💰. Adjust accordingly.

Combine with Other Tools: Enhance results by combining this with volume, price action, or fundamentals 🔧.

📝 Summary

This Supertrend - SSL Strategy with Toggle is a dynamic and flexible trading tool blending volatility-based trend detection with moving-average channel insights. It empowers traders to customize confirmation strictness, control trading periods, and efficiently capture trending opportunities while managing risk smartly.

By integrating proven indicators in a user-friendly, visually intuitive package, this strategy stands as a sophisticated tool suitable for various markets and trading styles. 🚀📊

Nota Keluaran

Minor changes , Bug fixes , To update: Refresh, remove & re-add the indicator to your chart.Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.