OPEN-SOURCE SCRIPT

Telah dikemas kini MOEX Sectors: % Above MA 50/100/200 (EMA/SMA)

🧠 Name:

MOEX Sectors: % Above MA 50/100/200 (EMA/SMA)

📋 Description (for TradingView “Description” tab):

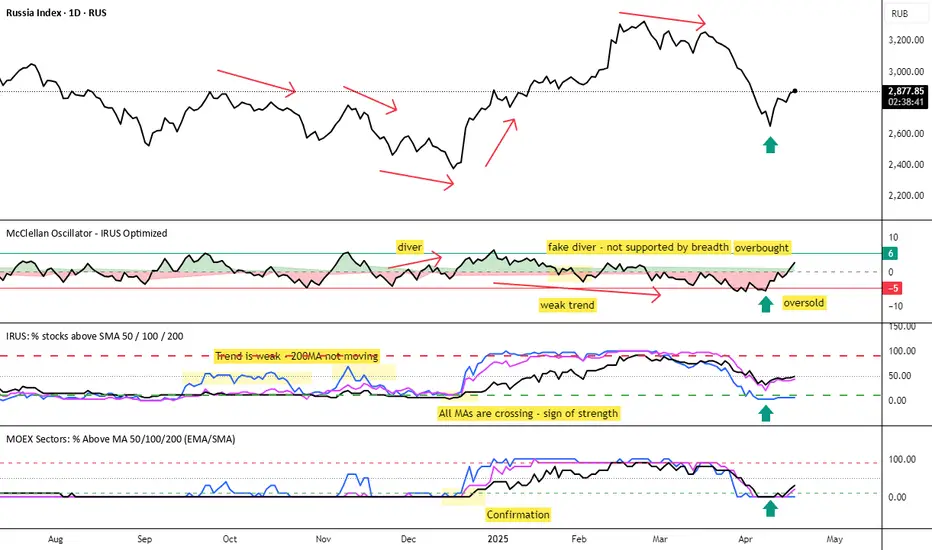

This indicator shows the percentage of Moscow Exchange sectoral indices trading above the selected moving average (SMA or EMA) with periods of 50, 100, or 200.

It uses 10 official MOEX sector indices:

MOEXOG (Oil & Gas)

MOEXCH (Chemicals)

MOEXMM (Metals & Mining)

MOEXTN (Transport)

MOEXCN (Consumer)

MOEXFN (Financials)

MOEXTL (Telecom)

MOEXEU (Utilities)

MOEXIT (IT)

MOEXRE (Real Estate)

The indicator plots up to 3 lines representing the % of sectors trading above MA 50, 100, and/or 200. The MA type is user-selectable: EMA (default) or SMA.

Horizontal reference levels (90, 50, 10) help interpret market conditions:

🔼 >90% — Overbought zone, potential market exhaustion

⚖️ ~50% — Neutral state

🔽 <10% — Oversold zone, possible rebound

📈 How to Use in Strategy:

✅ 1. Trend Filter

If >50% of sectors are above MA 200 → market in long-term uptrend

If <50% → avoid long bias, bearish regime likely

✅ 2. Bottom Detection

When <10% of sectors are above MA 200, the market is heavily oversold — often a bottoming signal

✅ 3. Trend Confirmation

If the main index is rising and % of sectors above MA is growing, the trend is supported by breadth

If the index rises while breadth declines → bearish divergence

✅ 4. Contrarian Setups

>90% of sectors above MA 50 → market may be overheated, watch for pullback

<20% above MA 50 → potential local bottom

⚙️ Tips:

Overlay this indicator on the IMOEX index chart to detect narrow leadership

Combine with other breadth metrics or RSI on the index

Use the EMA/SMA toggle to fine-tune sensitivity

MOEX Sectors: % Above MA 50/100/200 (EMA/SMA)

📋 Description (for TradingView “Description” tab):

This indicator shows the percentage of Moscow Exchange sectoral indices trading above the selected moving average (SMA or EMA) with periods of 50, 100, or 200.

It uses 10 official MOEX sector indices:

MOEXOG (Oil & Gas)

MOEXCH (Chemicals)

MOEXMM (Metals & Mining)

MOEXTN (Transport)

MOEXCN (Consumer)

MOEXFN (Financials)

MOEXTL (Telecom)

MOEXEU (Utilities)

MOEXIT (IT)

MOEXRE (Real Estate)

The indicator plots up to 3 lines representing the % of sectors trading above MA 50, 100, and/or 200. The MA type is user-selectable: EMA (default) or SMA.

Horizontal reference levels (90, 50, 10) help interpret market conditions:

🔼 >90% — Overbought zone, potential market exhaustion

⚖️ ~50% — Neutral state

🔽 <10% — Oversold zone, possible rebound

📈 How to Use in Strategy:

✅ 1. Trend Filter

If >50% of sectors are above MA 200 → market in long-term uptrend

If <50% → avoid long bias, bearish regime likely

✅ 2. Bottom Detection

When <10% of sectors are above MA 200, the market is heavily oversold — often a bottoming signal

✅ 3. Trend Confirmation

If the main index is rising and % of sectors above MA is growing, the trend is supported by breadth

If the index rises while breadth declines → bearish divergence

✅ 4. Contrarian Setups

>90% of sectors above MA 50 → market may be overheated, watch for pullback

<20% above MA 50 → potential local bottom

⚙️ Tips:

Overlay this indicator on the IMOEX index chart to detect narrow leadership

Combine with other breadth metrics or RSI on the index

Use the EMA/SMA toggle to fine-tune sensitivity

Nota Keluaran

📝 This indicator tracks market breadth across sector indices of the Moscow Exchange (MOEX). It calculates the percentage of sectors trading above selected moving averages (SMA or EMA) with user-defined periods (50, 100, or 200).It provides a high-level view of market participation and internal strength, helping to identify broad trends, divergences, and potential reversals.

📦 Tracked MOEX Sector Indices:

mathematica

Copy

Edit

MOEXOG — Oil & Gas

MOEXCH — Chemicals

MOEXMM — Metals & Mining

MOEXTN — Transport

MOEXCN — Consumer

MOEXFN — Financials

MOEXTL — Telecom

MOEXEU — Utilities

MOEXIT — Information Technology

MOEXRE — Real Estate

📈 How to Use:

>50% above MA 200 → Bullish market regime

<50% above MA 200 → Weak breadth, caution advised

>90% above MA 50 → Market may be overbought

<10% above MA 200 → Market oversold, possible bottom

Combine with the IMOEX index to assess participation behind major moves

Use as a trend filter or divergence detector

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.