OPEN-SOURCE SCRIPT

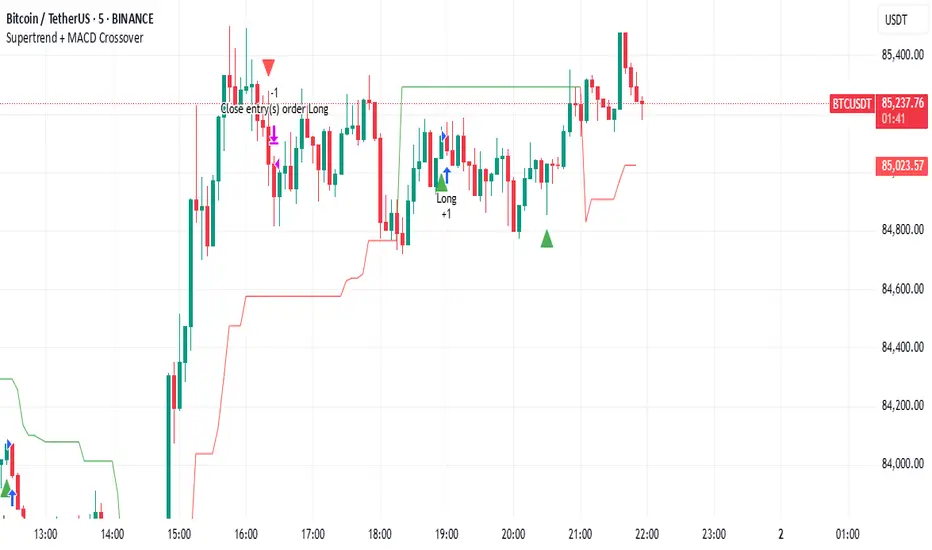

Supertrend + MACD Crossover

Key Elements of the Template:

Supertrend Settings:

supertrendFactor: Adjustable to control the sensitivity of the Supertrend.

supertrendATRLength: ATR length used for Supertrend calculation.

MACD Settings:

macdFastLength, macdSlowLength, macdSignalSmoothing: These settings allow you to fine-tune the MACD for better results.

Risk Management:

Stop-Loss: The stop-loss is based on the ATR (Average True Range), a volatility-based indicator.

Take-Profit: The take-profit is based on the risk-reward ratio (set to 3x by default).

Both stop-loss and take-profit are dynamic, based on ATR, which adjusts according to market volatility.

Buy and Sell Signals:

Buy Signal: Supertrend is bullish, and MACD line crosses above the Signal line.

Sell Signal: Supertrend is bearish, and MACD line crosses below the Signal line.

Visual Elements:

The Supertrend line is plotted in green (bullish) and red (bearish).

Buy and Sell signals are shown with green and red triangles on the chart.

Next Steps for Optimization:

Backtesting:

Run backtests on BTC in the 5-minute timeframe and adjust parameters (Supertrend factor, MACD settings, risk-reward ratio) to find the optimal configuration for the 60% win ratio.

Fine-Tuning Parameters:

Adjust supertrendFactor and macdFastLength to find more optimal values based on BTC's market behavior.

Tweak the risk-reward ratio to maximize profitability while maintaining a good win ratio.

Evaluate Market Conditions:

The performance of the strategy can vary based on market volatility. It may be helpful to evaluate performance in different market conditions or pair it with a filter like RSI or volume.

Let me know if you'd like further tweaks or explanations!

Supertrend Settings:

supertrendFactor: Adjustable to control the sensitivity of the Supertrend.

supertrendATRLength: ATR length used for Supertrend calculation.

MACD Settings:

macdFastLength, macdSlowLength, macdSignalSmoothing: These settings allow you to fine-tune the MACD for better results.

Risk Management:

Stop-Loss: The stop-loss is based on the ATR (Average True Range), a volatility-based indicator.

Take-Profit: The take-profit is based on the risk-reward ratio (set to 3x by default).

Both stop-loss and take-profit are dynamic, based on ATR, which adjusts according to market volatility.

Buy and Sell Signals:

Buy Signal: Supertrend is bullish, and MACD line crosses above the Signal line.

Sell Signal: Supertrend is bearish, and MACD line crosses below the Signal line.

Visual Elements:

The Supertrend line is plotted in green (bullish) and red (bearish).

Buy and Sell signals are shown with green and red triangles on the chart.

Next Steps for Optimization:

Backtesting:

Run backtests on BTC in the 5-minute timeframe and adjust parameters (Supertrend factor, MACD settings, risk-reward ratio) to find the optimal configuration for the 60% win ratio.

Fine-Tuning Parameters:

Adjust supertrendFactor and macdFastLength to find more optimal values based on BTC's market behavior.

Tweak the risk-reward ratio to maximize profitability while maintaining a good win ratio.

Evaluate Market Conditions:

The performance of the strategy can vary based on market volatility. It may be helpful to evaluate performance in different market conditions or pair it with a filter like RSI or volume.

Let me know if you'd like further tweaks or explanations!

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.