OPEN-SOURCE SCRIPT

Dominant Cycle Adaptive MACD

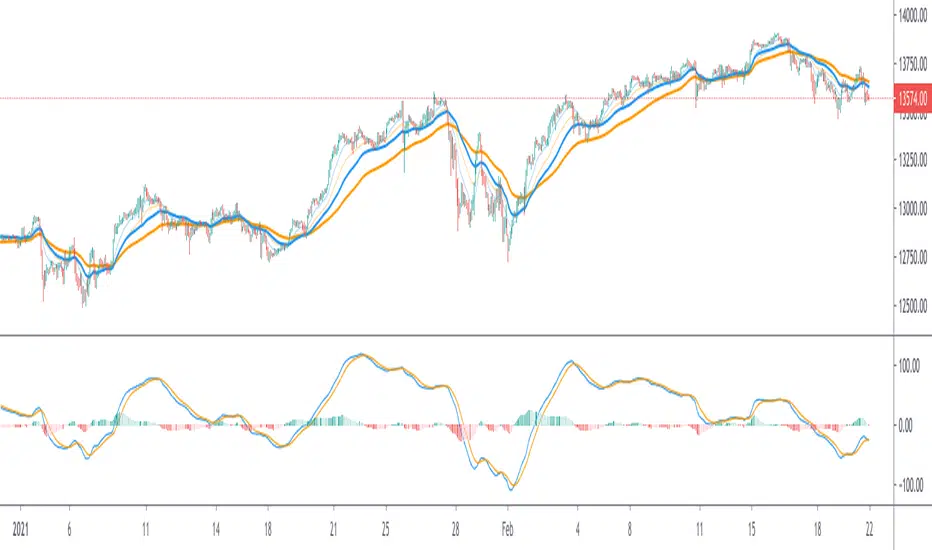

This Indicator is based on classic MACD but with an exceptional smoothing.

This smoothing eliminates the noise of the classic MACD as you see in the Chart

Adaptive MACD is compiled using with two adaptive moving averages, one adaptive to the dominant cycle and the other adaptive to twice the dominant cycle. As the basic behind the MACD is the difference of two moving averages we cannot find much difference between the conventional MACD (12, 26) and the adaptive MACD. However the adaptive MACD is less prone for less whipsaws and it catches the trends very well at the same time the catches the turning points in time. The Adaptive MACD is definite one notch better than the conventional MACD.

Dominant Cycle Period is calculated using Ehler's Method {Mentioned in the code}

This is how the Adaptiveness Impacts the Price Chart

1. (12, 26 EMA) VS Adaptive Dominant Cycle EMA

2. See how the Adaptive Lengths {both FastLength and SlowLength changes with time!}

Enjoy!

This smoothing eliminates the noise of the classic MACD as you see in the Chart

Adaptive MACD is compiled using with two adaptive moving averages, one adaptive to the dominant cycle and the other adaptive to twice the dominant cycle. As the basic behind the MACD is the difference of two moving averages we cannot find much difference between the conventional MACD (12, 26) and the adaptive MACD. However the adaptive MACD is less prone for less whipsaws and it catches the trends very well at the same time the catches the turning points in time. The Adaptive MACD is definite one notch better than the conventional MACD.

Dominant Cycle Period is calculated using Ehler's Method {Mentioned in the code}

This is how the Adaptiveness Impacts the Price Chart

1. (12, 26 EMA) VS Adaptive Dominant Cycle EMA

2. See how the Adaptive Lengths {both FastLength and SlowLength changes with time!}

Enjoy!

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.