PROTECTED SOURCE SCRIPT

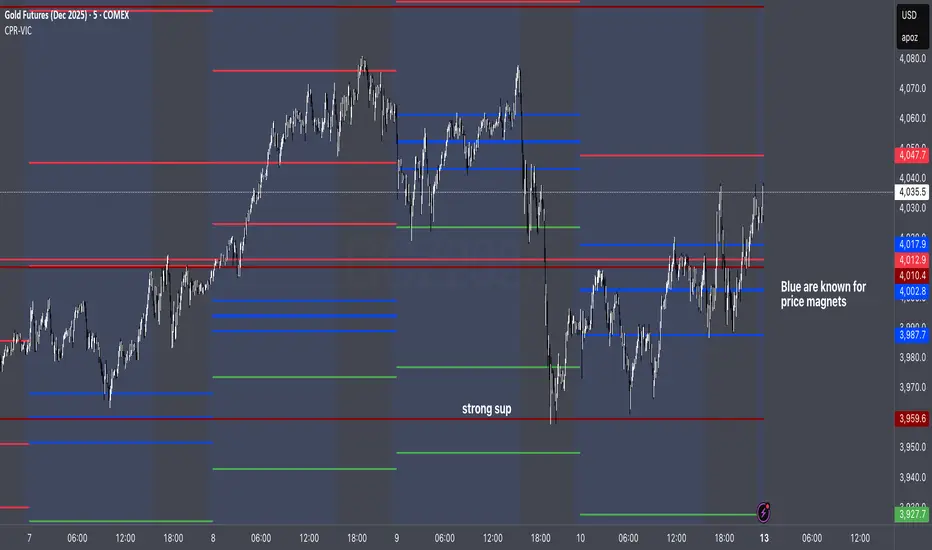

CPR by VictorV

Central Pivot Range

Where price is vs CPR

Above TC: bullish bias; TC/BC act as support. Hold above TC → trend day likely.

Inside CPR (BC–TC): balanced/choppy; expect mean reversion between edges until a clean break.

Below BC: bearish bias; BC/TC act as resistance.

Width of the CPR

Narrow: energy coiled → higher chance of breakout/trend day.

Wide: balanced market → range-bound behavior more likely.

Shift vs yesterday

CPR shifted up: bullish undertone.

Shifted down: bearish undertone.

Overlapping: neutral/indecisive.

Intraday tells

Acceptance: Several candles holding outside BC/TC = expansion in that direction.

Rejection: Wicks through BC/TC that close back inside = likely fade back toward the opposite edge.

Pivot (P) magnet: On non-trend days, price often gravitates back to P.

Where price is vs CPR

Above TC: bullish bias; TC/BC act as support. Hold above TC → trend day likely.

Inside CPR (BC–TC): balanced/choppy; expect mean reversion between edges until a clean break.

Below BC: bearish bias; BC/TC act as resistance.

Width of the CPR

Narrow: energy coiled → higher chance of breakout/trend day.

Wide: balanced market → range-bound behavior more likely.

Shift vs yesterday

CPR shifted up: bullish undertone.

Shifted down: bearish undertone.

Overlapping: neutral/indecisive.

Intraday tells

Acceptance: Several candles holding outside BC/TC = expansion in that direction.

Rejection: Wicks through BC/TC that close back inside = likely fade back toward the opposite edge.

Pivot (P) magnet: On non-trend days, price often gravitates back to P.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.