OPEN-SOURCE SCRIPT

RSI Z-score | Lemniscuss

🧠 Introducing RSI Z-Score (RSI-Z) by Lemniscuss

🛠️ Overview

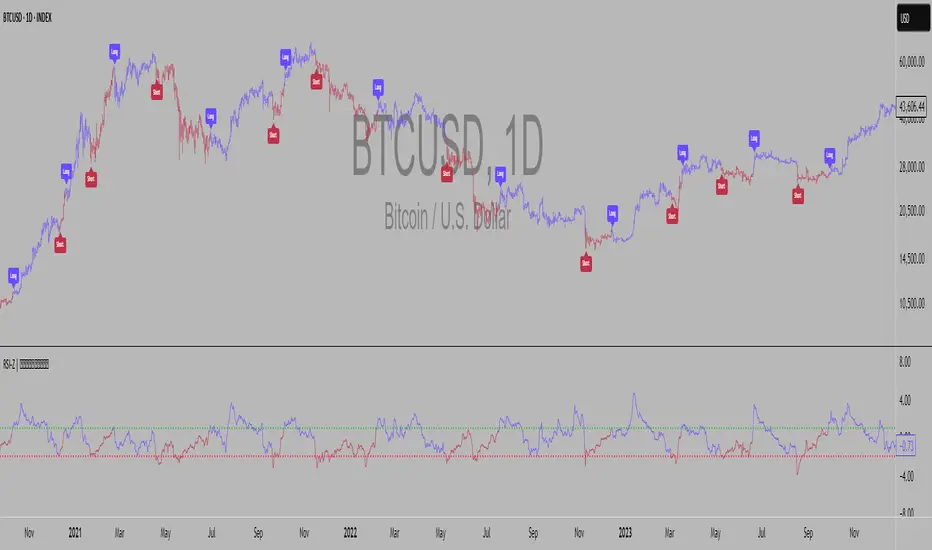

RSI Z-Score (RSI-Z) is a momentum-based market condition detector that transforms the classic Relative Strength Index (RSI) into a standardized volatility framework.

By applying Z-Score normalization to the RSI, this tool allows traders to identify statistically significant deviations in momentum — cutting through noise and highlighting high-probability turning points.

RSI-Z is optimized for trend inflection detection and overextension spotting, providing both visual clarity and actionable trade signals with dynamic labeling and optional bar coloring.

🔍 How It Works

1️⃣ RSI Foundation

The system starts with a standard RSI calculation on a user-defined source and length (default: 45).

2️⃣ Z-Score Normalization

The RSI values are standardized by subtracting their mean and dividing by the standard deviation over the same lookback.

This converts RSI into a statistical measure — revealing how many standard deviations current momentum is from its mean.

3️⃣ Threshold Logic

Two customizable thresholds define actionable zones:

• Long Threshold → Signals bullish momentum shifts when crossed upward

• Short Threshold → Signals bearish momentum shifts when crossed downward

4️⃣ Signal State Tracking

A state variable locks in a bias (Long / Short / Neutral) until an opposing trigger appears, ensuring clear and consistent market bias mapping.

✨ Key Features

🔹 Statistically Driven Momentum Detection — Moves beyond fixed RSI overbought/oversold levels by using standard deviations for adaptive accuracy.

🔹 Customizable Thresholds — Fine-tune long/short triggers for different volatility environments.

🔹 Clear Visual Feedback — Candle coloring and signal labels make trade setups instantly recognizable.

🔹 Overlay-Friendly — Works directly on your main chart or in a separate pane.

⚙️ Custom Settings

• Source: Price stream for RSI calculation (default: close)

• RSI Length: Lookback period for RSI & Z-Score (default: 45)

• Long Threshold: Z-score value for bullish signal (default: 1)

• Short Threshold: Z-score value for bearish signal (default: -1.9)

• Long/Cash Signal Labels: Toggle for "Long"/"Short" markers

• Bar Coloring: Toggle for trend-based candle coloring

📌 Trading Applications

✅ Trend Reversals → Spot statistically significant shifts in momentum before traditional RSI signals trigger

✅ Overextension Monitoring → Identify when momentum has deviated too far from the mean

✅ Mean Reversion Setups → Use extreme Z-score values as potential reversion points

✅ Bias Confirmation → Combine with trend tools for higher conviction entries/exits

📌 Conclusion

RSI-Z by Lemniscuss offers a clean, statistics-backed upgrade to the classic RSI.

By framing momentum in standard deviation terms, it empowers traders to separate normal fluctuations from truly significant market moves — making it a valuable tool for both trend traders and mean reversion specialists.

🔹 Summary Highlights

1️⃣ Statistical upgrade to RSI for higher-quality signals

2️⃣ Threshold-based, customizable long/short triggers

3️⃣ Visual candle coloring & signal labels for clarity

4️⃣ Adaptable to trend, swing, or intraday strategies

📌 Disclaimer: Past performance is not indicative of future results. No indicator guarantees profitability — always test and manage risk appropriately.

🛠️ Overview

RSI Z-Score (RSI-Z) is a momentum-based market condition detector that transforms the classic Relative Strength Index (RSI) into a standardized volatility framework.

By applying Z-Score normalization to the RSI, this tool allows traders to identify statistically significant deviations in momentum — cutting through noise and highlighting high-probability turning points.

RSI-Z is optimized for trend inflection detection and overextension spotting, providing both visual clarity and actionable trade signals with dynamic labeling and optional bar coloring.

🔍 How It Works

1️⃣ RSI Foundation

The system starts with a standard RSI calculation on a user-defined source and length (default: 45).

2️⃣ Z-Score Normalization

The RSI values are standardized by subtracting their mean and dividing by the standard deviation over the same lookback.

This converts RSI into a statistical measure — revealing how many standard deviations current momentum is from its mean.

3️⃣ Threshold Logic

Two customizable thresholds define actionable zones:

• Long Threshold → Signals bullish momentum shifts when crossed upward

• Short Threshold → Signals bearish momentum shifts when crossed downward

4️⃣ Signal State Tracking

A state variable locks in a bias (Long / Short / Neutral) until an opposing trigger appears, ensuring clear and consistent market bias mapping.

✨ Key Features

🔹 Statistically Driven Momentum Detection — Moves beyond fixed RSI overbought/oversold levels by using standard deviations for adaptive accuracy.

🔹 Customizable Thresholds — Fine-tune long/short triggers for different volatility environments.

🔹 Clear Visual Feedback — Candle coloring and signal labels make trade setups instantly recognizable.

🔹 Overlay-Friendly — Works directly on your main chart or in a separate pane.

⚙️ Custom Settings

• Source: Price stream for RSI calculation (default: close)

• RSI Length: Lookback period for RSI & Z-Score (default: 45)

• Long Threshold: Z-score value for bullish signal (default: 1)

• Short Threshold: Z-score value for bearish signal (default: -1.9)

• Long/Cash Signal Labels: Toggle for "Long"/"Short" markers

• Bar Coloring: Toggle for trend-based candle coloring

📌 Trading Applications

✅ Trend Reversals → Spot statistically significant shifts in momentum before traditional RSI signals trigger

✅ Overextension Monitoring → Identify when momentum has deviated too far from the mean

✅ Mean Reversion Setups → Use extreme Z-score values as potential reversion points

✅ Bias Confirmation → Combine with trend tools for higher conviction entries/exits

📌 Conclusion

RSI-Z by Lemniscuss offers a clean, statistics-backed upgrade to the classic RSI.

By framing momentum in standard deviation terms, it empowers traders to separate normal fluctuations from truly significant market moves — making it a valuable tool for both trend traders and mean reversion specialists.

🔹 Summary Highlights

1️⃣ Statistical upgrade to RSI for higher-quality signals

2️⃣ Threshold-based, customizable long/short triggers

3️⃣ Visual candle coloring & signal labels for clarity

4️⃣ Adaptable to trend, swing, or intraday strategies

📌 Disclaimer: Past performance is not indicative of future results. No indicator guarantees profitability — always test and manage risk appropriately.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.