OPEN-SOURCE SCRIPT

Telah dikemas kini CE - Market Performance Table

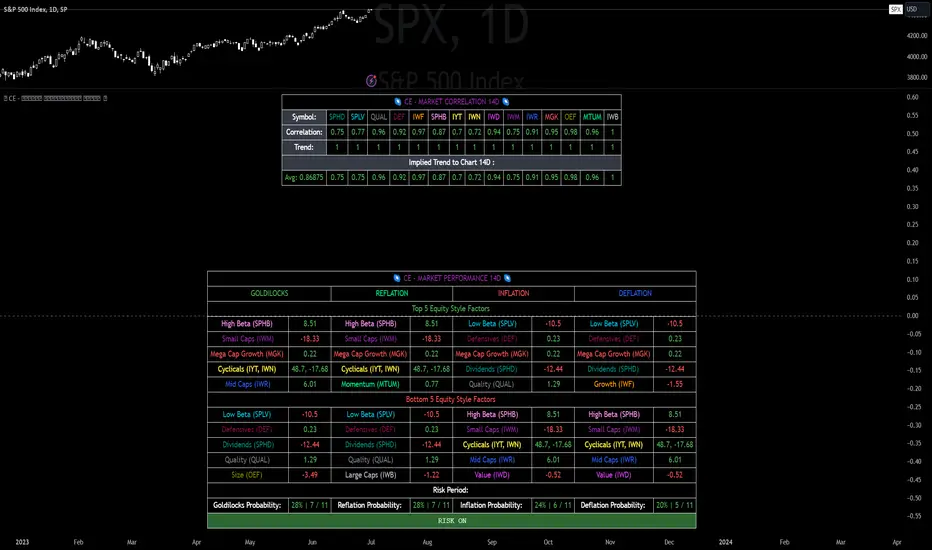

The 𝓜𝓪𝓻𝓴𝓮𝓽 𝓟𝓮𝓻𝓯𝓸𝓻𝓶𝓪𝓷𝓬𝓮 𝓣𝓪𝓫𝓵𝓮 is a sophisticated market tool designed to provide valuable insights into the current market trends and the approximate current position in the Macroeconomic Regime.

Furthermore the 𝓜𝓪𝓻𝓴𝓮𝓽 𝓟𝓮𝓻𝓯𝓸𝓻𝓶𝓪𝓷𝓬𝓮 𝓣𝓪𝓫𝓵𝓮 provides the Correlation Implied Trend for the Asset on the Chart. Lastly it provides information about current "RISK ON" or "RISK OFF" periods.

Methodology:

𝓜𝓪𝓻𝓴𝓮𝓽 𝓟𝓮𝓻𝓯𝓸𝓻𝓶𝓪𝓷𝓬𝓮 𝓣𝓪𝓫𝓵𝓮 tracks the 15 underlying Stock ETF's to identify their performance and puts the combined performances together to visualize 42MACRO's GRID Equity Model.

For this it uses the below ETF's:

Overall Settings:

The main time values you want to change are:

Visuals:

There is a variety of options to change the visual settings of what is being plotted and the two table positions and additional considerations.

Everything that is relevant in the underlying logic that can help comprehension can be visualized with these options.

Market Correlation:

The Market Correlation Table takes the Correlation of the above ETF's to the Asset on the Chart, it furthermore uses the Normalized KAMA Oscillator by IkkeOmar to analyse the current trend of every single ETF.

It then Implies a Correlation based on the Trend and the Correlation to give a probabilistically adjusted expectation for the future Chart Asset Movement. This is strengthened by taking the average of all Implied Trends.

With this the Correlation Table provides valuable insights about probabilistically likely Movement of the Asset, for Traders and Investors alike, over the defined time duration.

Market Performance:

𝓜𝓪𝓻𝓴𝓮𝓽 𝓟𝓮𝓻𝓯𝓸𝓻𝓶𝓪𝓷𝓬𝓮 𝓣𝓪𝓫𝓵𝓮 is the actual valuable part of this Indicator.

It provides valuable information about the current market environment (whether it's risk on or risk off), the rough GRID models from 42MACRO and the actual market performance.

This allows you to obtain a deeper understanding of how the market works and makes it simple to identify the actual market direction.

Utility:

The 𝓜𝓪𝓻𝓴𝓮𝓽 𝓟𝓮𝓻𝓯𝓸𝓻𝓶𝓪𝓷𝓬𝓮 𝓣𝓪𝓫𝓵𝓮 is divided in 4 Sections which are the GRID regimes:

Economic Growth:

Top 5 Equity Style Factors:

Are the values green for a specific Column? If so then the market reflects the corresponding GRID behavior.

Bottom 5 Equity Style Factors:

Are the values red for a specific Column? If so then the market reflects the corresponding GRID behavior.

So if we have Goldilocks as current regime we would see green values in the Top 5 Goldilocks Cells and red values in the Bottom 5 Goldilocks Cells.

You will find that Reflation will look similar, as it is also a sign of Economic Growth.

Same is the case for the two Contraction regimes.

Furthermore the 𝓜𝓪𝓻𝓴𝓮𝓽 𝓟𝓮𝓻𝓯𝓸𝓻𝓶𝓪𝓷𝓬𝓮 𝓣𝓪𝓫𝓵𝓮 provides the Correlation Implied Trend for the Asset on the Chart. Lastly it provides information about current "RISK ON" or "RISK OFF" periods.

Methodology:

𝓜𝓪𝓻𝓴𝓮𝓽 𝓟𝓮𝓻𝓯𝓸𝓻𝓶𝓪𝓷𝓬𝓮 𝓣𝓪𝓫𝓵𝓮 tracks the 15 underlying Stock ETF's to identify their performance and puts the combined performances together to visualize 42MACRO's GRID Equity Model.

For this it uses the below ETF's:

- Dividends (SPHD)

- Low Beta (SPLV)

- Quality (QUAL)

- Defensives (DEF)

- Growth (IWF)

- High Beta (SPHB)

- Cyclicals (IYT, IWN)

- Value (IWD)

- Small Caps (IWM)

- Mid Caps (IWR)

- Mega Cap Growth (MGK)

- Size (OEF)

- Momentum (MTUM)

- Large Caps (IWB)

Overall Settings:

The main time values you want to change are:

- Correlation Length

- Defines the time horizon for the Correlation Table - ROC Period

- Defines the time horizon for the Performance Table - Normalization lookback

- Defines the time horizon for the Trend calculation of the ETF's

- For longer term Trends over weeks or months a length of 50 is usually pretty accurate

Visuals:

There is a variety of options to change the visual settings of what is being plotted and the two table positions and additional considerations.

Everything that is relevant in the underlying logic that can help comprehension can be visualized with these options.

Market Correlation:

The Market Correlation Table takes the Correlation of the above ETF's to the Asset on the Chart, it furthermore uses the Normalized KAMA Oscillator by IkkeOmar to analyse the current trend of every single ETF.

It then Implies a Correlation based on the Trend and the Correlation to give a probabilistically adjusted expectation for the future Chart Asset Movement. This is strengthened by taking the average of all Implied Trends.

With this the Correlation Table provides valuable insights about probabilistically likely Movement of the Asset, for Traders and Investors alike, over the defined time duration.

Market Performance:

𝓜𝓪𝓻𝓴𝓮𝓽 𝓟𝓮𝓻𝓯𝓸𝓻𝓶𝓪𝓷𝓬𝓮 𝓣𝓪𝓫𝓵𝓮 is the actual valuable part of this Indicator.

It provides valuable information about the current market environment (whether it's risk on or risk off), the rough GRID models from 42MACRO and the actual market performance.

This allows you to obtain a deeper understanding of how the market works and makes it simple to identify the actual market direction.

Utility:

The 𝓜𝓪𝓻𝓴𝓮𝓽 𝓟𝓮𝓻𝓯𝓸𝓻𝓶𝓪𝓷𝓬𝓮 𝓣𝓪𝓫𝓵𝓮 is divided in 4 Sections which are the GRID regimes:

Economic Growth:

- Goldilocks

- Reflation

Economic Contraction: - Inflation

- Deflation

Top 5 Equity Style Factors:

Are the values green for a specific Column? If so then the market reflects the corresponding GRID behavior.

Bottom 5 Equity Style Factors:

Are the values red for a specific Column? If so then the market reflects the corresponding GRID behavior.

So if we have Goldilocks as current regime we would see green values in the Top 5 Goldilocks Cells and red values in the Bottom 5 Goldilocks Cells.

You will find that Reflation will look similar, as it is also a sign of Economic Growth.

Same is the case for the two Contraction regimes.

Nota Keluaran

Improved Standard Visual LayoutNota Keluaran

Improved UI for better User experience and more intuitive handlingNota Keluaran

This little update makes it possible to hide either or both tables for better organization.Nota Keluaran

Improved upon the Visuals of the Code and made it possible to change the size of the table textNota Keluaran

Updated some of the Code and optimized precisionSkrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

No statements or claims aim to be financial advice,

neither are any signals from us or our indicators.

Want to learn Trading, Investing or system building?

Join the Community via Discord or Website! 👇

discord.gg/FMZDM3bZ9T

neither are any signals from us or our indicators.

Want to learn Trading, Investing or system building?

Join the Community via Discord or Website! 👇

discord.gg/FMZDM3bZ9T

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

No statements or claims aim to be financial advice,

neither are any signals from us or our indicators.

Want to learn Trading, Investing or system building?

Join the Community via Discord or Website! 👇

discord.gg/FMZDM3bZ9T

neither are any signals from us or our indicators.

Want to learn Trading, Investing or system building?

Join the Community via Discord or Website! 👇

discord.gg/FMZDM3bZ9T

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.