OPEN-SOURCE SCRIPT

AMASling - All Moving Average Sling Shot

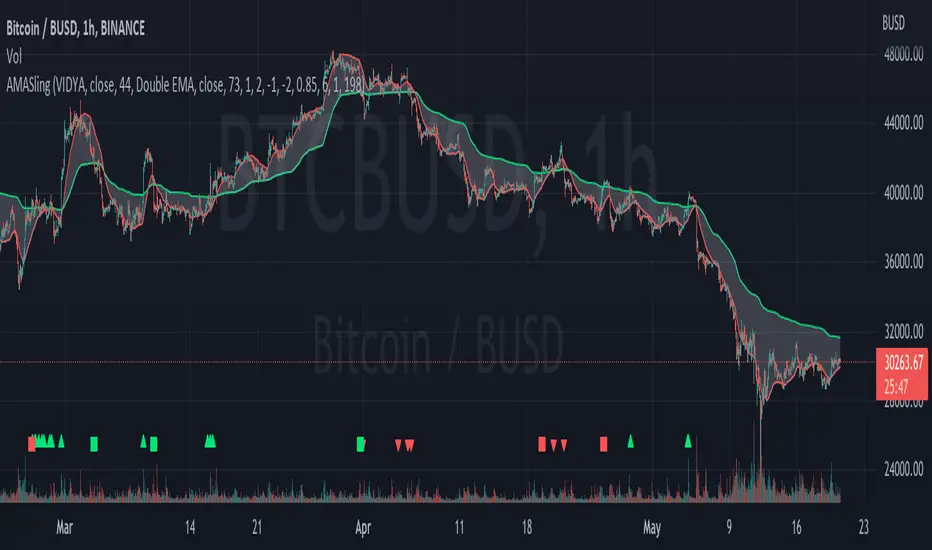

This indicator modifies the SlingShot System by Chris Moody to allow it to be based on 'any' Fast and Slow moving average pair. Open Long / Close Long / Open Short / Close Short alerts can be generated for automated bot trading based on the SlingShot strategy:

• Conservative Entry = Fast MA above Slow MA, and previous bar close below Fast MA, and current price above Fast MA

• Conservative Entry = Fast MA below Slow MA, and previous bar close above Fast MA, and current price below Fast MA

• Aggressive Entry = Fast MA above Slow MA, and price below Fast MA

• Aggressive Exit = Fast MA below Slow MA, and price above Fast MA

Entries and exits can also be made based on moving average crossovers, I initially put this in to make it easy to compare to a more standard strategy, but upon backtesting combining crossovers with the SlingShot appeared to produce better results on some charts.

Alerts can also be filtered to allow long deals only when the fast moving average is above the slow moving average (uptrend) and short deals only when the fast moving average is below the slow moving averages (downtrend).

If you have a strategy that can buy based on External Indicators you can use the 'Backtest Signal' which plots the values set in the 'Long / Short Signals' section.

The Fast, Slow and Signal Moving Averages can be set to:

• Simple Moving Average (SMA)

• Exponential Moving Average (EMA)

• Weighted Moving Average (WMA)

• Volume-Weighted Moving Average (VWMA)

• Hull Moving Average (HMA)

• Exponentially Weighted Moving Average (RMA) (SMMA)

• Linear regression curve Moving Average (LSMA)

• Double EMA (DEMA)

• Double SMA (DSMA)

• Double WMA (DWMA)

• Double RMA (DRMA)

• Triple EMA (TEMA)

• Triple SMA (TSMA)

• Triple WMA (TWMA)

• Triple RMA (TRMA)

• Symmetrically Weighted Moving Average (SWMA) ** length does not apply **

• Arnaud Legoux Moving Average (ALMA)

• Variable Index Dynamic Average (VIDYA)

• Fractal Adaptive Moving Average (FRAMA)

'Backtest Signal' and 'Deal State' are plotted to display.none, so change the Style Settings for the chart if you need to see them for testing.

Yes I did choose the name because 'It's Amasling!'

• Conservative Entry = Fast MA above Slow MA, and previous bar close below Fast MA, and current price above Fast MA

• Conservative Entry = Fast MA below Slow MA, and previous bar close above Fast MA, and current price below Fast MA

• Aggressive Entry = Fast MA above Slow MA, and price below Fast MA

• Aggressive Exit = Fast MA below Slow MA, and price above Fast MA

Entries and exits can also be made based on moving average crossovers, I initially put this in to make it easy to compare to a more standard strategy, but upon backtesting combining crossovers with the SlingShot appeared to produce better results on some charts.

Alerts can also be filtered to allow long deals only when the fast moving average is above the slow moving average (uptrend) and short deals only when the fast moving average is below the slow moving averages (downtrend).

If you have a strategy that can buy based on External Indicators you can use the 'Backtest Signal' which plots the values set in the 'Long / Short Signals' section.

The Fast, Slow and Signal Moving Averages can be set to:

• Simple Moving Average (SMA)

• Exponential Moving Average (EMA)

• Weighted Moving Average (WMA)

• Volume-Weighted Moving Average (VWMA)

• Hull Moving Average (HMA)

• Exponentially Weighted Moving Average (RMA) (SMMA)

• Linear regression curve Moving Average (LSMA)

• Double EMA (DEMA)

• Double SMA (DSMA)

• Double WMA (DWMA)

• Double RMA (DRMA)

• Triple EMA (TEMA)

• Triple SMA (TSMA)

• Triple WMA (TWMA)

• Triple RMA (TRMA)

• Symmetrically Weighted Moving Average (SWMA) ** length does not apply **

• Arnaud Legoux Moving Average (ALMA)

• Variable Index Dynamic Average (VIDYA)

• Fractal Adaptive Moving Average (FRAMA)

'Backtest Signal' and 'Deal State' are plotted to display.none, so change the Style Settings for the chart if you need to see them for testing.

Yes I did choose the name because 'It's Amasling!'

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.