PROTECTED SOURCE SCRIPT

Telah dikemas kini 🧠 STWP Dashboard (Bull Call Spread / Bear Put Spread)

________________________________________

🧠 STWP Options Strategy Dashboard (Bull Call Spread/ Bear Put Spread)

Author: simpletradewithpatience

Markets: NSE (India)

Best timeframe: 1-second chart

Built with: Pine Script v5

________________________________________

📌 Overview

A real-time options strategy dashboard tailored for NSE traders, designed for two-leg spreads:

✅ Bull Call Spread → Buy Lower Strike CE, Sell Higher Strike CE

✅ Bear Put Spread → Buy Higher Strike PE, Sell Lower Strike PE

This tool gives you a real-time, color-coded visual interface with:

Entry premiums & breakeven levels

Live LTPs & PnL

ROI & Risk: Reward

Smart Exit logic

Alerts for expiry, Greeks, and PnL events

It’s fully manual, for educational and tracking use only — not for automated trading.

________________________________________

📌 Key Features

✅ Track Bull Call & Bear Put Spreads

✅ Live LTP tracking via symbol input

✅ Real-time PnL, breakeven, max profit/loss

✅ ROI & Risk:Reward calculation

✅ Smart Exit logic with trade verdicts

✅ Invalidation logic with Reversal Exit

✅ Manual input of Greeks (Delta, Gamma, Theta, IV%)

✅ Greek-based alerts for Gamma Risk, IV Crush, Theta Decay

✅ Days to Expiry (DTE) tracking

✅ Fully customizable alert system

✅ Clean, emoji-labelled dashboard UI

✅ Built for Indian NSE options only

✅ Requires 1-second chart for correct data

________________________________________

📌 Option Symbol Inputs (LTP Tracking)

✅ Long Leg Symbol (Buy): Lower strike CE (Bull Call) or higher strike PE (Bear Put)

✅ Short Leg Symbol (Sell): Higher strike CE (Bull Call) or lower strike PE (Bear Put)

✅ Symbol Tips: Use TradingView's dropdown to select NSE option symbols like NSE:RELIANCE25JUL3000CE

⚠️ Providing valid option symbols is crucial — it powers all live tracking and calculations.

________________________________________

📌 Trade Setup Parameters

Spot Price at Entry

Long & Short Strike Prices

Buy Price (Long Leg)

Sell Price (Short Leg)

Lot Size & Number of Lots

Loss Bearable Amount (₹) → Used by Smart Exit logic to issue early warnings

________________________________________

📌 Expiry Date Input

Expiry Year, Month, and Day

🎯 Used to calculate Days to Expiry (DTE) and enable:

⏱️ Expiry alerts like “Less than 2 Days”, “Theta Risk”, and more

📉 Smart Exit logic adjusts based on time decay

________________________________________

📌 Greeks (Optional)

🔹 Default Mode: Don’t Enter Greeks

🔹 Optional Mode: Enter Greeks for both legs (Delta, Gamma, Theta, IV%)

🔍 Enabling Greeks unlocks:

Net Delta, Gamma, Theta, IV

Greek-based warnings (e.g. Gamma Risk, Theta Risk)

A dashboard Greek Verdict:

🟢 Conservative 🟡 Moderate Risk 🔴 Aggressive Risk

________________________________________

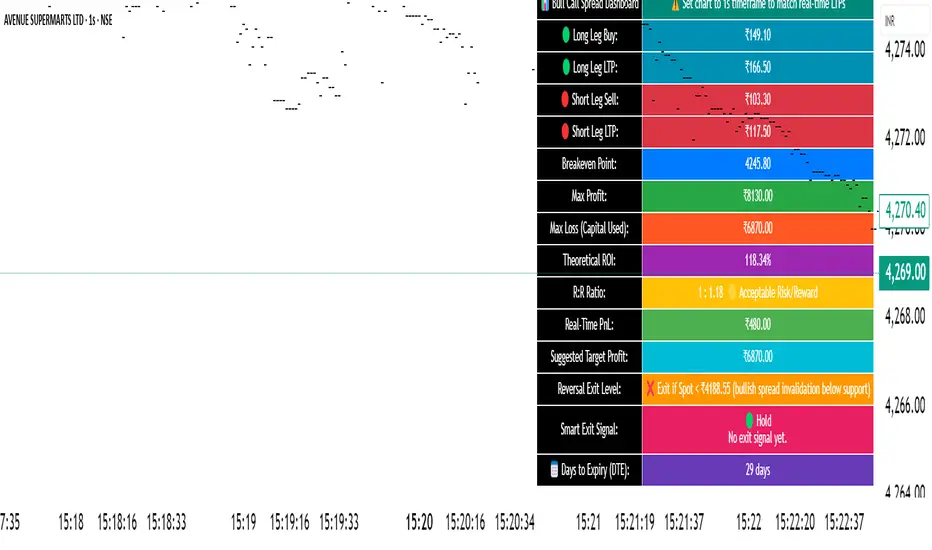

📌 Dashboard Display

🎯 Strategy Type (Bull or Bear Spread)

📈 Entry Premiums & Live LTPs

💹 Breakeven, Max Profit/Loss, Net Premium

📊 ROI % & Risk:Reward (with verdict)

📉 Real-time PnL using tick-by-tick data

🚦 Smart Exit verdict: Hold, Exit Soon, or Book Profit

🔁 Reversal Exit Price (spread invalidation logic)

📆 Days to Expiry (DTE)

📐 Greek Data (if enabled) with Net & Average values

⚠️ Greek Risk Verdict for managing directional risk

________________________________________

📌 Alert System (Built-in Alerts)

🎯 Target Profit Hit

❌ Max Loss Reached

🛑 Loss Bearable Limit Breached

📍 Hold Signal

📉 Book Loss / Exit Soon

⏳ Expiry Nearing

⚠️ Spread Invalidation Alert (via Reversal Price breach)

💥 High Gamma Risk (if Gamma > ±0.05)

📉 High IV Alert (if IV > 35%)

🚨 Combined Master Alert – fires if any key condition is triggered

________________________________________

📌 Smart Exit System

⚙️ Context-aware, dynamic trade assistant

✅ Analyses real-time market, PnL, expiry risk, reversal risk

✅ Gives exit suggestions based on:

Time decay

Price invalidation

Breach of defined loss/profit thresholds

✅ Keeps you objective — no emotional exits

________________________________________

📌 Reversal Exit Logic

🔁 Detects directional failure in spread structure

Bull Call Spread: Invalidation = Spot falls 25% of net premium below long strike

Bear Put Spread: Invalidation = Spot rises 25% of net premium above short strike

📉 Alerts you to exit even before loss appears

🎯 Designed for directional traders using spread logic

💡 Acts as a breakdown or breakout filter

________________________________________

⚠️ Important Notes

✅ Built for NSE Options – not for global exchanges

✅ Only for Bull Call & Bear Put spreads

✅ Use on 1-second chart only

❌ Will not work properly on higher timeframes

✅ Manual tool only – doesn’t place trades

✅ For educational and research use only

________________________________________

💬 How to Use This Dashboard

Choose Your Strategy

Bull Call or Bear Put

Input Symbols & Strikes

Use Tradingview dropdown to select accurate NSE option symbols

Enter Buy/Sell Prices

Add premiums, lot size, no. of lots

(Optional) Enable Greeks

Add Delta, Gamma, Theta, IV for both legs

Set Expiry Date

Year, Month, Day — activates DTE & expiry alerts

Monitor Dashboard

Live PnL, Max P/L, ROI, R:R, Smart Exit, Reversal Levels

(Optional) Enable Alerts

Get notified for PnL events, expiry risk, Greek risk, spread failure

________________________________________

🤝 Final Note

This tool was built with patience and care by simpletradewithpatience to help fellow options traders trade more objectively, systematically, and confidently.

Feel free to share feedback on Tradingview.

Happy Trading! 📈

Stay disciplined. Stay smart.

________________________________________

🔠 Glossary

PnL – Profit & Loss

LTP – Last Traded Price

IV – Implied Volatility

DTE – Days to Expiry

ROI – Return on Investment

R:R – Risk to Reward Ratio

CE / PE – Call / Put Option

SEBI – Securities and Exchange Board of India

________________________________________

⚠️ Disclaimer

This script is for educational and research purposes only.

I am not a SEBI-registered advisor.

No buy or sell recommendations are made.

Trading options involves significant risk.

Use proper risk management and always consult a licensed advisor if in doubt.

The author is not responsible for any financial losses incurred.

By using this tool, you agree to these terms.

________________________________________

🧠 STWP Options Strategy Dashboard (Bull Call Spread/ Bear Put Spread)

Author: simpletradewithpatience

Markets: NSE (India)

Best timeframe: 1-second chart

Built with: Pine Script v5

________________________________________

📌 Overview

A real-time options strategy dashboard tailored for NSE traders, designed for two-leg spreads:

✅ Bull Call Spread → Buy Lower Strike CE, Sell Higher Strike CE

✅ Bear Put Spread → Buy Higher Strike PE, Sell Lower Strike PE

This tool gives you a real-time, color-coded visual interface with:

Entry premiums & breakeven levels

Live LTPs & PnL

ROI & Risk: Reward

Smart Exit logic

Alerts for expiry, Greeks, and PnL events

It’s fully manual, for educational and tracking use only — not for automated trading.

________________________________________

📌 Key Features

✅ Track Bull Call & Bear Put Spreads

✅ Live LTP tracking via symbol input

✅ Real-time PnL, breakeven, max profit/loss

✅ ROI & Risk:Reward calculation

✅ Smart Exit logic with trade verdicts

✅ Invalidation logic with Reversal Exit

✅ Manual input of Greeks (Delta, Gamma, Theta, IV%)

✅ Greek-based alerts for Gamma Risk, IV Crush, Theta Decay

✅ Days to Expiry (DTE) tracking

✅ Fully customizable alert system

✅ Clean, emoji-labelled dashboard UI

✅ Built for Indian NSE options only

✅ Requires 1-second chart for correct data

________________________________________

📌 Option Symbol Inputs (LTP Tracking)

✅ Long Leg Symbol (Buy): Lower strike CE (Bull Call) or higher strike PE (Bear Put)

✅ Short Leg Symbol (Sell): Higher strike CE (Bull Call) or lower strike PE (Bear Put)

✅ Symbol Tips: Use TradingView's dropdown to select NSE option symbols like NSE:RELIANCE25JUL3000CE

⚠️ Providing valid option symbols is crucial — it powers all live tracking and calculations.

________________________________________

📌 Trade Setup Parameters

Spot Price at Entry

Long & Short Strike Prices

Buy Price (Long Leg)

Sell Price (Short Leg)

Lot Size & Number of Lots

Loss Bearable Amount (₹) → Used by Smart Exit logic to issue early warnings

________________________________________

📌 Expiry Date Input

Expiry Year, Month, and Day

🎯 Used to calculate Days to Expiry (DTE) and enable:

⏱️ Expiry alerts like “Less than 2 Days”, “Theta Risk”, and more

📉 Smart Exit logic adjusts based on time decay

________________________________________

📌 Greeks (Optional)

🔹 Default Mode: Don’t Enter Greeks

🔹 Optional Mode: Enter Greeks for both legs (Delta, Gamma, Theta, IV%)

🔍 Enabling Greeks unlocks:

Net Delta, Gamma, Theta, IV

Greek-based warnings (e.g. Gamma Risk, Theta Risk)

A dashboard Greek Verdict:

🟢 Conservative 🟡 Moderate Risk 🔴 Aggressive Risk

________________________________________

📌 Dashboard Display

🎯 Strategy Type (Bull or Bear Spread)

📈 Entry Premiums & Live LTPs

💹 Breakeven, Max Profit/Loss, Net Premium

📊 ROI % & Risk:Reward (with verdict)

📉 Real-time PnL using tick-by-tick data

🚦 Smart Exit verdict: Hold, Exit Soon, or Book Profit

🔁 Reversal Exit Price (spread invalidation logic)

📆 Days to Expiry (DTE)

📐 Greek Data (if enabled) with Net & Average values

⚠️ Greek Risk Verdict for managing directional risk

________________________________________

📌 Alert System (Built-in Alerts)

🎯 Target Profit Hit

❌ Max Loss Reached

🛑 Loss Bearable Limit Breached

📍 Hold Signal

📉 Book Loss / Exit Soon

⏳ Expiry Nearing

⚠️ Spread Invalidation Alert (via Reversal Price breach)

💥 High Gamma Risk (if Gamma > ±0.05)

📉 High IV Alert (if IV > 35%)

🚨 Combined Master Alert – fires if any key condition is triggered

________________________________________

📌 Smart Exit System

⚙️ Context-aware, dynamic trade assistant

✅ Analyses real-time market, PnL, expiry risk, reversal risk

✅ Gives exit suggestions based on:

Time decay

Price invalidation

Breach of defined loss/profit thresholds

✅ Keeps you objective — no emotional exits

________________________________________

📌 Reversal Exit Logic

🔁 Detects directional failure in spread structure

Bull Call Spread: Invalidation = Spot falls 25% of net premium below long strike

Bear Put Spread: Invalidation = Spot rises 25% of net premium above short strike

📉 Alerts you to exit even before loss appears

🎯 Designed for directional traders using spread logic

💡 Acts as a breakdown or breakout filter

________________________________________

⚠️ Important Notes

✅ Built for NSE Options – not for global exchanges

✅ Only for Bull Call & Bear Put spreads

✅ Use on 1-second chart only

❌ Will not work properly on higher timeframes

✅ Manual tool only – doesn’t place trades

✅ For educational and research use only

________________________________________

💬 How to Use This Dashboard

Choose Your Strategy

Bull Call or Bear Put

Input Symbols & Strikes

Use Tradingview dropdown to select accurate NSE option symbols

Enter Buy/Sell Prices

Add premiums, lot size, no. of lots

(Optional) Enable Greeks

Add Delta, Gamma, Theta, IV for both legs

Set Expiry Date

Year, Month, Day — activates DTE & expiry alerts

Monitor Dashboard

Live PnL, Max P/L, ROI, R:R, Smart Exit, Reversal Levels

(Optional) Enable Alerts

Get notified for PnL events, expiry risk, Greek risk, spread failure

________________________________________

🤝 Final Note

This tool was built with patience and care by simpletradewithpatience to help fellow options traders trade more objectively, systematically, and confidently.

Feel free to share feedback on Tradingview.

Happy Trading! 📈

Stay disciplined. Stay smart.

________________________________________

🔠 Glossary

PnL – Profit & Loss

LTP – Last Traded Price

IV – Implied Volatility

DTE – Days to Expiry

ROI – Return on Investment

R:R – Risk to Reward Ratio

CE / PE – Call / Put Option

SEBI – Securities and Exchange Board of India

________________________________________

⚠️ Disclaimer

This script is for educational and research purposes only.

I am not a SEBI-registered advisor.

No buy or sell recommendations are made.

Trading options involves significant risk.

Use proper risk management and always consult a licensed advisor if in doubt.

The author is not responsible for any financial losses incurred.

By using this tool, you agree to these terms.

________________________________________

Nota Keluaran

Updated - Columns added = Buying Price | Selling Price | Net LTPSkrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

STWP | Mentor & Demand-Supply Specialist | Empowering traders through structured learning |

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

STWP | Mentor & Demand-Supply Specialist | Empowering traders through structured learning |

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.