OPEN-SOURCE SCRIPT

Telah dikemas kini TrianglePoint strategy

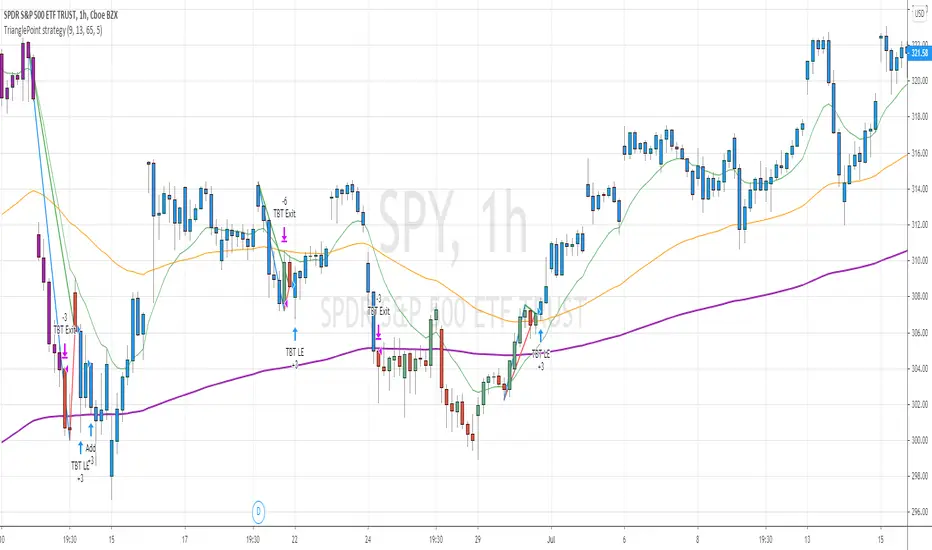

This is trend following strategy ... when price is trading well above 200 ema and forms a triangle (based on number of bars defined)

BUY

====

when fast ema > 200 ema

check for triangle of last N bars (default set to 9)

EXIT

======

when fast ema crosses down middle term ema

if price reaches above 5% of buy , it changes the color to purple. You can close any time or wait for above signal.

STOP LOSS

=======

stop loss default value set to 5%

Note: No triangle shown on the chart. I will find out how to add the lines to the chart.

Warning

=========

For the use of educational purposes only

BUY

====

when fast ema > 200 ema

check for triangle of last N bars (default set to 9)

EXIT

======

when fast ema crosses down middle term ema

if price reaches above 5% of buy , it changes the color to purple. You can close any time or wait for above signal.

STOP LOSS

=======

stop loss default value set to 5%

Note: No triangle shown on the chart. I will find out how to add the lines to the chart.

Warning

=========

For the use of educational purposes only

Nota Keluaran

I have added Triangle drawings to the chart.Also I have noticed that when position is taken LONG, mostly price reaches the half of the height of the Triangle. You can lock profits there or raise the stop loss ....

if the price goes south (downwards) half of the height of the triangle , you can wind up the position rather than waiting for defined 5% loss

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.