Ekoparaloji Strategy Crypto

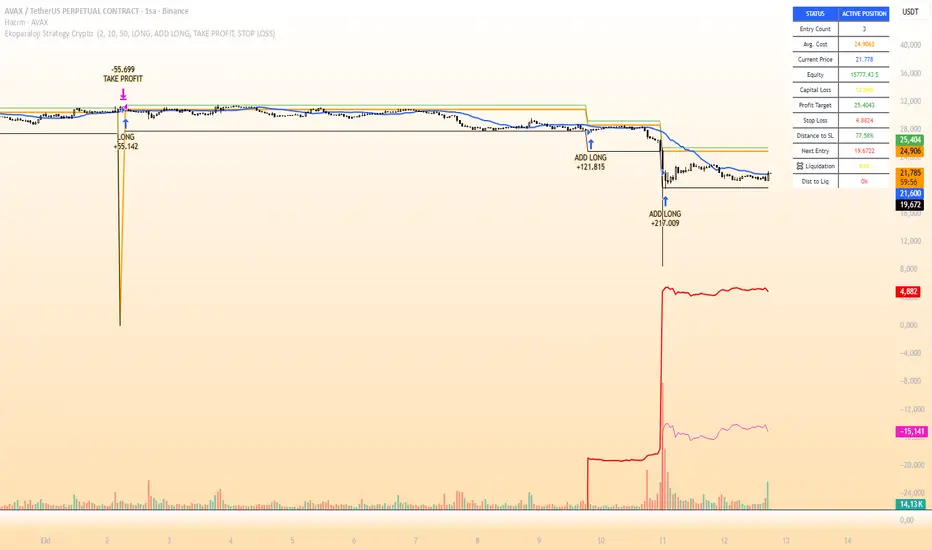

📊 Strategy Overview

This strategy provides long-term position management in cryptocurrency markets using the averaging down (pyramiding) technique. The basic logic is to controllably grow positions as prices decline and exit when specific profit targets are reached.

🎯 Key Features

✅ Automatic Entry System

Market direction is determined using a proprietary trend identification algorithm

Trades are only opened in uptrends

Initial position opens automatically when specific conditions are met

📈 Pyramiding Mechanism

New positions are automatically added as price decreases

Up to 10 positions can be added maximum

Each addition occurs at predetermined decline levels

Risk management through dynamic position sizing

💰 Profit and Loss Management

Take Profit: All positions close when the specified percentage above average cost is reached

Stop Loss (Optional): Protects a specified percentage of total capital

A certain ratio of available capital is used in each trade

📊 Visual Tracking System

The following information is displayed in real-time on the chart:

✅ Average cost level

✅ Profit target level

✅ Stop loss level (if active)

✅ Next pyramiding level

✅ Liquidation (capital reset) level

✅ Trend indicator

🛡️ Risk Management Features

1. Dynamic Capital Protection

Automatic exit when losses exceed a specified percentage of total capital

Complete loss scenario can be previewed through liquidation level calculation

2. Position Control System

Protection preventing multiple trades on the same bar

Double trigger prevention mechanism

Maximum position limit

3. Time Filter

Optional trading within a date range

Ideal for testing on historical data

📱 Information Panel

Information table always visible in the upper right corner of the strategy:

When Position is Open:

Number of active positions

Average cost

Current price

Total capital status

Capital loss percentage

Profit target

Stop loss level and distance

Next entry level

Liquidation level and distance

When No Position:

Market trend (Uptrend/Downtrend)

Ready to trade?

Reason for waiting

Initial position size

Target profit percentage

⚙️ Adjustable Parameters

Customizable by user:

💵 Capital Amount: Base amount to be used for each position

📊 Profit Target: Profit percentage at which to exit

🛑 Stop Loss: Usage status and maximum loss percentage

📅 Time Filter: Start and end dates for testing

💬 Trade Comments: Custom labels for each trade

📘 Understanding Leverage Effect

1. What is the Leverage Effect?

Although there's no real leverage in the spot market, when Capital Amount is increased, capital usage works like leverage:

Capital Amount 5% (1.0x): 100% capital usage with full pyramiding = All your money in trades

Capital Amount 10% (2.0x): 200% capital usage with full pyramiding = Attempting to open trades worth 2x your capital

Capital Amount 15% (3.0x): 300% capital usage with full pyramiding = Attempting to open trades worth 3x your capital

⚠️ IMPORTANT: If your capital runs out in the spot market, you cannot open new positions, therefore it's recommended to keep Capital Amount at 5% or below!

⚠️ Important Warnings

Pyramiding Risk: If price continues to decline, position grows and risk increases

Capital Requirements: Up to 10 positions can be added, requiring sufficient capital

Trend Dependency: Only works in uptrends

Backtest Results: Past performance is not a guarantee of future results

Real Trading Risks: Slippage, commissions, and market conditions can affect results

🎓 How to Use

Add the strategy to your chart

Adjust parameters according to your risk appetite

Examine past performance by backtesting

Optionally set up alerts to activate notifications

Test with paper trading first

This strategy is for educational purposes. Do your own research and only trade with capital you can afford to lose.

Disclaimer: This strategy is not financial advice. All investment decisions are the user's responsibility.

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi Ekoparaloji secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

X : Ekoparaloji

Yotube: youtube.com/@Ekoparaloji

Instagram : Ekoparaloji

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi Ekoparaloji secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

X : Ekoparaloji

Yotube: youtube.com/@Ekoparaloji

Instagram : Ekoparaloji