PROTECTED SOURCE SCRIPT

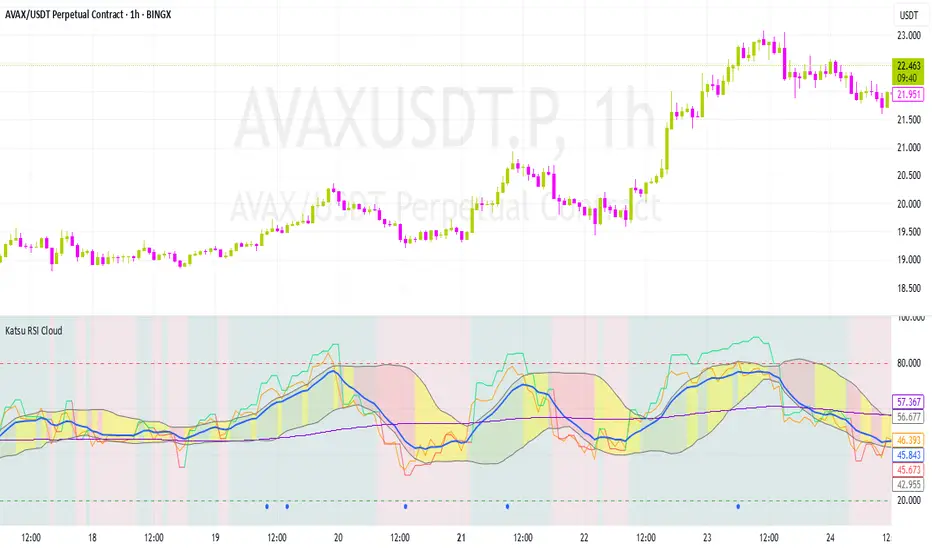

Katsu mtf RSI Cloud

Katsu MTF RSI and Cloud

Multi-timeframe RSI-based analytical tool for advanced traders

The Katsu MTF RSI is a sophisticated indicator that combines two RSI signals from different timeframes into one powerful toolkit. It’s perfect for those looking for multi-timeframe confluence to make more precise trading decisions.

Key Features:

Dual RSI Setup (fully customizable timeframe and length):

The first RSI behaves in a traditional way.

The second RSI uses color-coding to visually indicate the dominant trend direction:

🟢 Green = Bullish, 🔴 Red = Bearish.

RSI EMA – Smoothed RSI Average:

Used to determine short-term direction. This moving average is essential for crafting entries and forming your overall trading strategy.

Dynamic Midline – Adaptive Overbought/Oversold Levels:

The overbought/oversold zones are not fixed (like 70/30), but are dynamically adjusted based on the RSI’s average behavior.

When RSI touches these adaptive levels, a small blue arrow appears, signaling a potential momentum shift.

This provides more precise signals than traditional static thresholds (e.g., 70/30 or 80/20).

RSI-Based Cloud Visualization:

The RSI is used to generate a visual cloud that reflects market structure:

When RSI breaks out above the cloud, followed by RSI2, it can signal a strong entry point.

When RSI enters the cloud and reverses, it may indicate a potential exit or reversal zone.

The cloud uses three distinct colors to represent momentum:

Visual Momentum Feedback (Background Highlight):

The background color shifts to indicate whether RSI is moving above or below 50, giving a quick read on bullish or bearish momentum.

This indicator is especially powerful for multi-timeframe strategies where entries are made on a lower timeframe, but confirmation comes from a higher one. It provides a dynamic, visual framework to stay in sync with the market’s rhythm.

Multi-timeframe RSI-based analytical tool for advanced traders

The Katsu MTF RSI is a sophisticated indicator that combines two RSI signals from different timeframes into one powerful toolkit. It’s perfect for those looking for multi-timeframe confluence to make more precise trading decisions.

Key Features:

Dual RSI Setup (fully customizable timeframe and length):

The first RSI behaves in a traditional way.

The second RSI uses color-coding to visually indicate the dominant trend direction:

🟢 Green = Bullish, 🔴 Red = Bearish.

RSI EMA – Smoothed RSI Average:

Used to determine short-term direction. This moving average is essential for crafting entries and forming your overall trading strategy.

Dynamic Midline – Adaptive Overbought/Oversold Levels:

The overbought/oversold zones are not fixed (like 70/30), but are dynamically adjusted based on the RSI’s average behavior.

When RSI touches these adaptive levels, a small blue arrow appears, signaling a potential momentum shift.

This provides more precise signals than traditional static thresholds (e.g., 70/30 or 80/20).

RSI-Based Cloud Visualization:

The RSI is used to generate a visual cloud that reflects market structure:

When RSI breaks out above the cloud, followed by RSI2, it can signal a strong entry point.

When RSI enters the cloud and reverses, it may indicate a potential exit or reversal zone.

The cloud uses three distinct colors to represent momentum:

- Green: RSI is above the cloud → Strong bullish pressure, price well above the trend zone.

- Red: RSI is below the cloud → Strong bearish pressure, price well below the trend zone.

- Yellow: RSI is inside the cloud → Sideways or corrective move, often a potential exit zone, as the trend may be stalling.

Visual Momentum Feedback (Background Highlight):

The background color shifts to indicate whether RSI is moving above or below 50, giving a quick read on bullish or bearish momentum.

This indicator is especially powerful for multi-timeframe strategies where entries are made on a lower timeframe, but confirmation comes from a higher one. It provides a dynamic, visual framework to stay in sync with the market’s rhythm.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Magyar Discord Szerver -> Link Tagsághoz: whop.com/kriptoarenayt/

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Magyar Discord Szerver -> Link Tagsághoz: whop.com/kriptoarenayt/

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.