PROTECTED SOURCE SCRIPT

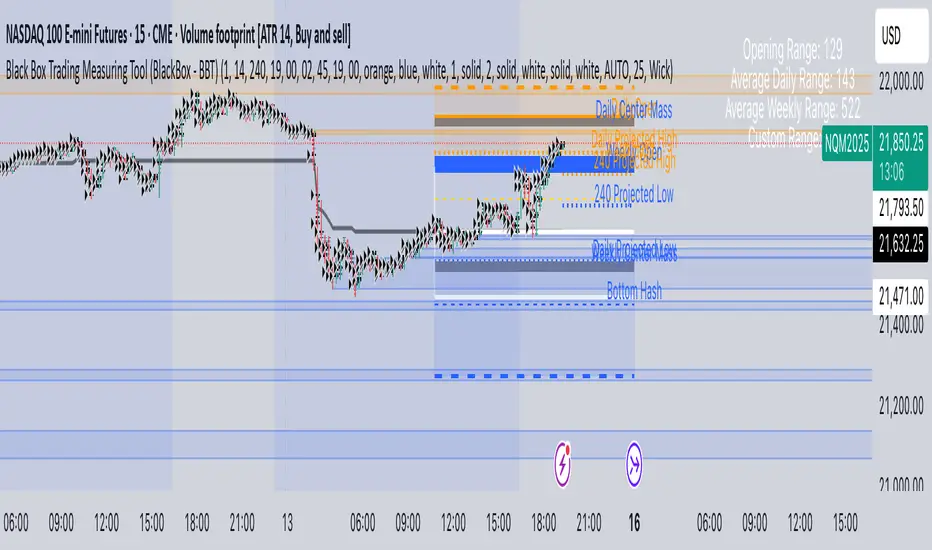

Telah dikemas kini Black Box Trading Measuring Tool (BlackBox - BBT)

Overview

The Black Box Trading Indicator is a comprehensive technical analysis tool that combines multiple trading concepts into a single, powerful indicator. It displays custom session ranges, Average Daily Range (ADR) projections, support/resistance levels, and order blocks to help traders identify key market levels and potential trading opportunities.

Key Features

1. Custom Session Ranges

Define and visualize any trading session with customizable start and end times

Automatically calculates session high, low, and midpoint

Displays quarter levels (25% and 75% of range)

Shows range projections at 100%, 150%, 200%, and 250% extensions

2. Average Daily Range (ADR) Analysis

Calculates and displays ADR for daily, weekly, monthly, and custom timeframes

Shows projected high and low targets based on ADR

Includes "hash" levels at 50% ADR from session midpoint

Visual range boxes highlight potential support/resistance zones

3. Market Structure Levels

Daily and weekly opening prices with dynamic coloring

Previous daily and weekly center mass (50% of previous period's range)

Real-time range statistics displayed in an information table

4. Order Block Detection

Automatically identifies bullish and bearish order blocks

Visual representation with customizable colors and transparency

Mitigation tracking to remove invalidated blocks

Alert system for price interaction with order blocks

Parameter Guide

Display Settings

Show Blocks

Enables/disables order block visualization

Useful for cleaner charts when focusing on other elements

Show Previous Daily/Weekly Center Mass

Displays the midpoint of the previous period's range

Helps identify potential support/resistance from prior price acceptance areas

Show Daily/Weekly Open

Shows opening prices with color coding (blue for bullish, orange for bearish)

Important reference points for intraday trading

Show ADR Targets

Displays projected highs and lows based on Average Daily Range

Essential for setting realistic profit targets and stop losses

Show Range Projection

Extends the session range by multiples (1x, 1.5x, 2x, 2.5x)

Helps identify potential price targets during trending moves

Show Average Daily Range

Displays the ADR statistics table

Shows current range metrics for multiple timeframes

Display range in pips

Converts range values to pips for forex traders

Provides standardized measurement across different instruments

ADR Configuration

ADR Days

Number of days to include in current ADR calculation

Default: 1 (shows today's developing range)

ADR Period

Lookback period for calculating average range

Default: 14 days (standard period for volatility measurement)

Custom Range

Select between 60-minute or 240-minute timeframes

Allows analysis of intermediate timeframes

Session Time Settings (EST)

Start Hour/Minute

Define when your custom session begins

Default: 19:00 EST (Asian session open)

End Hour/Minute

Define when your custom session ends

Default: 02:45 EST (London session approach)

Extend To Hour/Minute

How far to extend the horizontal lines

Default: 19:00 EST (full 24-hour extension)

Visual Customization

Color Settings

Top Color: Used for upper levels and bullish projections

Bottom Color: Used for lower levels and bearish projections

Range Outline Color: Main session range boundaries

Center Range Line Color: Session midpoint visualization

Line Settings

Range Outline Width: Thickness of range box borders

Session Line Width: Thickness of horizontal level lines

Line Styles: Choose between solid, dashed, or dotted

Text Settings

Text Color: Color for all labels

Text Size: AUTO, tiny, small, normal, or large

Order Block Settings

Sensitivity

Percentage threshold for order block detection (1-100)

Higher values = fewer but stronger blocks

Default: 25 (detects 25% price movements)

OB Mitigation Type

Close: Block is mitigated when price closes beyond it

Wick: Block is mitigated when price wicks beyond it

Color Configuration

Separate colors for bullish and bearish blocks

Border and background colors can be customized independently

Trading Applications

1. Session-Based Trading

Identify the initial balance (first hour of trading)

Trade breakouts from defined session ranges

Use range projections for profit targets

Monitor for range-bound vs trending conditions

2. ADR-Based Strategies

Set daily profit targets based on ADR projections

Identify overextended moves when price exceeds ADR

Use ADR levels for position sizing and risk management

Compare current range to average for volatility assessment

3. Support/Resistance Trading

Use previous period center mass as dynamic S/R

Trade bounces from daily/weekly opens

Combine multiple timeframe levels for confluence

Monitor order blocks for potential reversal zones

4. Order Block Trading

Enter trades when price returns to unmitigated blocks

Use blocks as stop loss placement guides

Look for confluence with other indicator levels

Monitor block mitigation for trend confirmation

Best Practices

1. Multi-Timeframe Analysis

Use higher timeframe blocks for major levels

Combine with lower timeframe entries

Monitor weekly levels on daily charts

2. Confluence Trading

Look for areas where multiple levels align

Combine order blocks with ADR targets

Use session ranges with center mass levels

3. Risk Management

Use ADR for realistic daily profit targets

Place stops beyond order blocks or range extremes

Size positions based on distance to key levels

4. Alert Usage

Set alerts for ADR target hits

Monitor order block interactions

Track range breakouts and hash level tests

Tips for Effective Use

Start Simple: Begin with basic session ranges and ADR before adding all features

Color Coding: Use consistent colors across your trading setup

Time Zones: Ensure session times match your trading schedule

Clean Charts: Toggle off unused features for clarity

Backtesting: Study how price respects these levels historically

Journaling: Document which levels work best for your traded instruments

Common Trading Scenarios

Range Trading

Enter longs at session low or lower projections

Enter shorts at session high or upper projections

Target the session midpoint or opposite extreme

Breakout Trading

Wait for clear breaks of session range

Use range width for measuring targets

Monitor ADR to gauge breakout potential

Trend Following

Use order blocks as pullback entries

Trail stops using range projections

Scale out at ADR targets

Reversal Trading

Look for price rejection at ADR extremes

Monitor order block mitigation failures

Use center mass as reversal confirmation

The Black Box Trading Indicator is a comprehensive technical analysis tool that combines multiple trading concepts into a single, powerful indicator. It displays custom session ranges, Average Daily Range (ADR) projections, support/resistance levels, and order blocks to help traders identify key market levels and potential trading opportunities.

Key Features

1. Custom Session Ranges

Define and visualize any trading session with customizable start and end times

Automatically calculates session high, low, and midpoint

Displays quarter levels (25% and 75% of range)

Shows range projections at 100%, 150%, 200%, and 250% extensions

2. Average Daily Range (ADR) Analysis

Calculates and displays ADR for daily, weekly, monthly, and custom timeframes

Shows projected high and low targets based on ADR

Includes "hash" levels at 50% ADR from session midpoint

Visual range boxes highlight potential support/resistance zones

3. Market Structure Levels

Daily and weekly opening prices with dynamic coloring

Previous daily and weekly center mass (50% of previous period's range)

Real-time range statistics displayed in an information table

4. Order Block Detection

Automatically identifies bullish and bearish order blocks

Visual representation with customizable colors and transparency

Mitigation tracking to remove invalidated blocks

Alert system for price interaction with order blocks

Parameter Guide

Display Settings

Show Blocks

Enables/disables order block visualization

Useful for cleaner charts when focusing on other elements

Show Previous Daily/Weekly Center Mass

Displays the midpoint of the previous period's range

Helps identify potential support/resistance from prior price acceptance areas

Show Daily/Weekly Open

Shows opening prices with color coding (blue for bullish, orange for bearish)

Important reference points for intraday trading

Show ADR Targets

Displays projected highs and lows based on Average Daily Range

Essential for setting realistic profit targets and stop losses

Show Range Projection

Extends the session range by multiples (1x, 1.5x, 2x, 2.5x)

Helps identify potential price targets during trending moves

Show Average Daily Range

Displays the ADR statistics table

Shows current range metrics for multiple timeframes

Display range in pips

Converts range values to pips for forex traders

Provides standardized measurement across different instruments

ADR Configuration

ADR Days

Number of days to include in current ADR calculation

Default: 1 (shows today's developing range)

ADR Period

Lookback period for calculating average range

Default: 14 days (standard period for volatility measurement)

Custom Range

Select between 60-minute or 240-minute timeframes

Allows analysis of intermediate timeframes

Session Time Settings (EST)

Start Hour/Minute

Define when your custom session begins

Default: 19:00 EST (Asian session open)

End Hour/Minute

Define when your custom session ends

Default: 02:45 EST (London session approach)

Extend To Hour/Minute

How far to extend the horizontal lines

Default: 19:00 EST (full 24-hour extension)

Visual Customization

Color Settings

Top Color: Used for upper levels and bullish projections

Bottom Color: Used for lower levels and bearish projections

Range Outline Color: Main session range boundaries

Center Range Line Color: Session midpoint visualization

Line Settings

Range Outline Width: Thickness of range box borders

Session Line Width: Thickness of horizontal level lines

Line Styles: Choose between solid, dashed, or dotted

Text Settings

Text Color: Color for all labels

Text Size: AUTO, tiny, small, normal, or large

Order Block Settings

Sensitivity

Percentage threshold for order block detection (1-100)

Higher values = fewer but stronger blocks

Default: 25 (detects 25% price movements)

OB Mitigation Type

Close: Block is mitigated when price closes beyond it

Wick: Block is mitigated when price wicks beyond it

Color Configuration

Separate colors for bullish and bearish blocks

Border and background colors can be customized independently

Trading Applications

1. Session-Based Trading

Identify the initial balance (first hour of trading)

Trade breakouts from defined session ranges

Use range projections for profit targets

Monitor for range-bound vs trending conditions

2. ADR-Based Strategies

Set daily profit targets based on ADR projections

Identify overextended moves when price exceeds ADR

Use ADR levels for position sizing and risk management

Compare current range to average for volatility assessment

3. Support/Resistance Trading

Use previous period center mass as dynamic S/R

Trade bounces from daily/weekly opens

Combine multiple timeframe levels for confluence

Monitor order blocks for potential reversal zones

4. Order Block Trading

Enter trades when price returns to unmitigated blocks

Use blocks as stop loss placement guides

Look for confluence with other indicator levels

Monitor block mitigation for trend confirmation

Best Practices

1. Multi-Timeframe Analysis

Use higher timeframe blocks for major levels

Combine with lower timeframe entries

Monitor weekly levels on daily charts

2. Confluence Trading

Look for areas where multiple levels align

Combine order blocks with ADR targets

Use session ranges with center mass levels

3. Risk Management

Use ADR for realistic daily profit targets

Place stops beyond order blocks or range extremes

Size positions based on distance to key levels

4. Alert Usage

Set alerts for ADR target hits

Monitor order block interactions

Track range breakouts and hash level tests

Tips for Effective Use

Start Simple: Begin with basic session ranges and ADR before adding all features

Color Coding: Use consistent colors across your trading setup

Time Zones: Ensure session times match your trading schedule

Clean Charts: Toggle off unused features for clarity

Backtesting: Study how price respects these levels historically

Journaling: Document which levels work best for your traded instruments

Common Trading Scenarios

Range Trading

Enter longs at session low or lower projections

Enter shorts at session high or upper projections

Target the session midpoint or opposite extreme

Breakout Trading

Wait for clear breaks of session range

Use range width for measuring targets

Monitor ADR to gauge breakout potential

Trend Following

Use order blocks as pullback entries

Trail stops using range projections

Scale out at ADR targets

Reversal Trading

Look for price rejection at ADR extremes

Monitor order block mitigation failures

Use center mass as reversal confirmation

Nota Keluaran

Swing Trading Strategies Using Black Box Trading IndicatorStrategy 1: Weekly Range Breakout System

Setup

Timeframe: Daily chart

Session Settings: Set to weekly range (Monday 00:00 to Friday 23:59)

Key Levels: Weekly high/low, weekly center mass, ADR projections

Entry Rules

Long Entry:

Wait for price to break above weekly high with daily close

Confirm weekly ADR hasn't been exhausted (price below weekly projected high)

Enter on retest of broken weekly high or at weekly center mass

Short Entry:

Wait for price to break below weekly low with daily close

Confirm weekly ADR hasn't been exhausted (price above weekly projected low)

Enter on retest of broken weekly low or at weekly center mass

Exit Rules

Target 1: Weekly ADR projection (50% position)

Target 2: 1.5x weekly range extension (remaining position)

Stop Loss: Below/above weekly center mass or entry order block

Risk Management

Risk 1-2% per trade

Only take trades when weekly range is within 20% of average weekly ADR

Strategy 2: Order Block Accumulation Method

Setup

Timeframe: 4-hour and daily charts

Order Block Sensitivity: 30-40 (higher for cleaner signals)

Focus: Unmitigated order blocks on daily timeframe

Entry Rules

Long Entry:

Identify bullish order block on daily chart

Wait for price to return to block after initial move away

Confirm with 4H bullish market structure (higher highs/lows)

Enter when price touches order block with bullish reaction

Short Entry:

Identify bearish order block on daily chart

Wait for price to return to block after initial move away

Confirm with 4H bearish market structure (lower highs/lows)

Enter when price touches order block with bearish reaction

Exit Rules

Target 1: Previous swing high/low (50% position)

Target 2: Daily ADR projection or next major order block

Stop Loss: Beyond order block range (use 1.5x block height)

Trade Management

Move stop to breakeven after Target 1

Trail stop using 4H order blocks

Hold maximum 5-10 days

Strategy 3: ADR Exhaustion Reversal

Setup

Timeframe: Daily chart with 4H confirmation

Key Indicators: Daily/Weekly ADR projections

Best Markets: Ranging or weak trending conditions

Entry Rules

Long Entry:

Price reaches daily projected low (100% ADR down)

Weekly ADR shows less than 70% exhaustion

Price shows rejection (pin bar, engulfing) at level

Enter on 4H close back inside daily ADR range

Short Entry:

Price reaches daily projected high (100% ADR up)

Weekly ADR shows less than 70% exhaustion

Price shows rejection at level

Enter on 4H close back inside daily ADR range

Exit Rules

Target 1: Daily center mass/50% ADR (50% position)

Target 2: Opposite ADR extreme or weekly center mass

Stop Loss: 20% beyond ADR projection

Filters

Avoid during strong trending markets (weekly close beyond ADR)

Best during consolidation phases

Check monthly ADR for additional context

Strategy 4: Multi-Timeframe Center Mass Confluence

Setup

Timeframe: Daily chart

Key Levels: Daily, weekly, and monthly center mass

Additional: Order blocks for confirmation

Entry Rules

Long Entry:

Price pulls back to area where 2+ center mass levels converge

Bullish order block present at confluence zone

Price shows bullish structure on 4H (higher low)

Enter on daily close above confluence area

Short Entry:

Price rallies to area where 2+ center mass levels converge

Bearish order block present at confluence zone

Price shows bearish structure on 4H (lower high)

Enter on daily close below confluence area

Exit Rules

Target 1: Next timeframe's center mass

Target 2: ADR projection in trade direction

Stop Loss: Beyond the furthest center mass level

Position Sizing

Larger position when 3 timeframes align

Reduce size if only 2 timeframes converge

Strategy 5: Range Projection Momentum

Setup

Timeframe: Daily and 4H charts

Session: Custom 3-day range

Key Tool: Range projections (100%, 150%, 200%)

Entry Rules

Long Entry:

Price breaks above 3-day range high with momentum

Daily close above range high

Enter on retest of range high or at 100% projection

ADR supports further movement (less than 60% used)

Short Entry:

Price breaks below 3-day range low with momentum

Daily close below range low

Enter on retest of range low or at 100% projection

ADR supports further movement

Exit Rules

Target 1: 150% range projection (50% position)

Target 2: 200% range projection or weekly ADR limit

Stop Loss: Back inside range midpoint

Trade Management

Scale out at each projection level

Use 4H order blocks to trail stops

Maximum hold time: 7 trading days

Strategy 6: Weekly Open Reversion

Setup

Timeframe: Daily and 4H charts

Key Level: Weekly open price

Supporting Levels: Order blocks, ADR levels

Entry Rules

Long Entry:

Price moves below weekly open by 50-100% of daily ADR

Bullish order block forms on 4H below weekly open

Price reclaims weekly open with 4H close

Enter on retest of weekly open from above

Short Entry:

Price moves above weekly open by 50-100% of daily ADR

Bearish order block forms on 4H above weekly open

Price loses weekly open with 4H close

Enter on retest of weekly open from below

Exit Rules

Target 1: Previous week's high/low (50% position)

Target 2: Weekly ADR projection

Stop Loss: Beyond triggering order block

Best Conditions

Works best in ranging markets

Avoid during strong weekly trends

Most effective Tuesday-Thursday

Pro Tips for All Strategies

1. Market Condition Filters

Use monthly ADR to gauge overall volatility

Avoid reversal strategies in strong trends

Prefer breakout strategies when weekly range is narrow

2. Time-Based Filters

Best entries Tuesday-Thursday

Avoid Mondays and Fridays for new positions

Consider economic calendar for volatility

3. Risk Management Rules

Never risk more than 2% per trade

Limit to 2-3 open swing positions

Use correlation analysis for portfolio risk

4. Optimization Tips

Backtest sensitivity settings for your markets

Adjust ADR period based on market volatility

Fine-tune session times for your instruments

5. Combining Strategies

Use ADR exhaustion for entries, order blocks for exits

Combine center mass confluence with range projections

Layer multiple timeframe analysis for confirmation

Strategy Selection Guide

Trending Markets: Use Strategy 1 (Breakout) and Strategy 5 (Momentum)

Ranging Markets: Use Strategy 3 (ADR Reversal) and Strategy 6 (Weekly Open)

All Conditions: Strategy 2 (Order Blocks) and Strategy 4 (Center Mass)

High Volatility: Focus on ADR-based strategies

Low Volatility: Focus on range and order block strategies

Nota Keluaran

colors updateNota Keluaran

Scalping Strategies Using Black Box Trading IndicatorStrategy 1: Session Range Breakout Scalp

Setup

Timeframe: 5-minute chart

Session Settings: Set to first hour of London or NY session

Key Focus: Initial Balance (IB) range and immediate breakouts

Entry Rules

Long Entry:

Wait for 5-min close above session high (first hour range)

Confirm with increased volume

Enter immediately on breakout candle close

ADR must show less than 30% exhaustion

Short Entry:

Wait for 5-min close below session low (first hour range)

Confirm with increased volume

Enter immediately on breakout candle close

ADR must show less than 30% exhaustion

Exit Rules

Target 1: 50% of session range (50% position)

Target 2: 100% of session range projection

Stop Loss: 10 pips beyond opposite side of range

Time Stop: Exit after 30 minutes if no profit

Risk Management

Risk 0.5% per trade

Maximum 3 trades per session

Stop trading if 2 consecutive losses

Strategy 2: Order Block Quick Rejection

Setup

Timeframe: 1-minute and 5-minute charts

Order Block Sensitivity: 15-20 (lower for more signals)

Session: Active market hours only

Entry Rules

Long Entry:

Identify fresh bullish order block on 5-min

Price returns to block within 10 candles

1-min shows immediate rejection (wick/pin bar)

Enter on 1-min close above block high

Short Entry:

Identify fresh bearish order block on 5-min

Price returns to block within 10 candles

1-min shows immediate rejection

Enter on 1-min close below block low

Exit Rules

Target: 15-20 pips or previous 5-min swing

Stop Loss: 5 pips beyond order block

Trail: Move stop to breakeven at 10 pips profit

Trade Management

One trade per order block only

Skip if price consolidates in block over 5 candles

Exit if price doesn't move within 10 minutes

Strategy 3: ADR Hash Level Bounce

Setup

Timeframe: 5-minute chart

Key Levels: Daily hash levels (50% ADR from midpoint)

Best Time: 30 minutes after session open

Entry Rules

Long Entry:

Price touches bottom hash level (first touch of day)

5-min candle shows rejection (lower wick)

Next candle breaks high of rejection candle

Enter on break with momentum

Short Entry:

Price touches top hash level (first touch of day)

5-min candle shows rejection (upper wick)

Next candle breaks low of rejection candle

Enter on break with momentum

Exit Rules

Target 1: Session midpoint (70% position)

Target 2: Opposite hash level

Stop Loss: 10 pips beyond hash level

Quick Exit: If no movement in 15 minutes

Filters

Only first touch of day

Skip if price gaps through level

Avoid during news events

Strategy 4: Range Midpoint Reversion Scalp

Setup

Timeframe: 3-minute chart

Session: Custom 2-hour range

Key Level: Session midpoint and quarter levels

Entry Rules

Long Entry:

Price moves to lower quarter (25%) of range

Shows rejection within 2 candles

Breaks above rejection high

Midpoint hasn't been tested in last hour

Short Entry:

Price moves to upper quarter (75%) of range

Shows rejection within 2 candles

Breaks below rejection low

Midpoint hasn't been tested in last hour

Exit Rules

Target: Session midpoint (full position)

Stop Loss: Beyond session extreme

Breakeven: At 50% of target distance

Time Exit: 20 minutes maximum

Position Management

Scale out 50% at halfway point

Move stop to breakeven

Let remainder run to midpoint

Strategy 5: Opening Drive Continuation

Setup

Timeframe: 1-minute and 5-minute charts

Time: First 30 minutes of London/NY session

Tools: Previous day's high/low, overnight range

Entry Rules

Long Entry:

Price breaks above previous day high in first 15 min

1-min pullback to broken level (2-5 candles)

Bullish order block forms at retest

Enter on 1-min close above pullback high

Short Entry:

Price breaks below previous day low in first 15 min

1-min pullback to broken level (2-5 candles)

Bearish order block forms at retest

Enter on 1-min close below pullback low

Exit Rules

Target 1: 20 pips (50% position)

Target 2: 50% daily ADR projection

Stop Loss: 10 pips

Trail: 10-pip trailing stop after Target 1

Trade Filters

Only one trade per session

Skip if overnight range exceeds 50% of daily ADR

Avoid if gap is larger than 20 pips

Strategy 6: Micro Range Breakout

Setup

Timeframe: 1-minute chart

Range Period: 15-minute micro ranges

Best Sessions: High volatility periods

Entry Rules

Long Entry:

Identify 15-min consolidation (range < 15 pips)

Mark range high/low on 1-min chart

Enter on 1-min close above range high

Volume must increase on breakout

Short Entry:

Identify 15-min consolidation

Mark range high/low on 1-min chart

Enter on 1-min close below range low

Volume must increase on breakout

Exit Rules

Target: 100% of range size

Stop Loss: Middle of consolidation range

Quick Stop: Exit if price returns to range within 3 candles

Range Requirements

Minimum 5 pips, maximum 15 pips range

At least 10 candles of consolidation

Clear boundaries (2+ touches each side)

Strategy 7: News Fade Using ADR

Setup

Timeframe: 1-minute and 5-minute charts

Time: 5-30 minutes after major news

Key Levels: ADR projections and hash levels

Entry Rules

Long Entry (Fade down move):

News causes spike down to/beyond daily projected low

Price shows exhaustion (multiple 1-min wicks)

5-min candle closes back inside ADR range

Enter on retest of daily projected low from above

Short Entry (Fade up move):

News causes spike up to/beyond daily projected high

Price shows exhaustion

5-min candle closes back inside ADR range

Enter on retest of daily projected high from below

Exit Rules

Target 1: Hash level (50% position)

Target 2: Session midpoint or center mass

Stop Loss: 15 pips beyond ADR projection

Maximum Time: 45 minutes

Risk Controls

Only trade high-impact news

Wait minimum 5 minutes after release

One trade per news event

Advanced Scalping Tips

1. Time-Based Optimization

Best Hours: First 2 hours of London/NY

Avoid: Lunch hours (12-1 PM EST)

Friday: Reduce position size by 50%

2. Multi-Timeframe Confirmation

Always check 15-min order blocks

Confirm trend on hourly chart

Use 1-min for precise entries only

3. Speed of Execution

Use hotkeys for entries/exits

Pre-set stop loss and take profit

Have emergency flatten button ready

4. Scalping-Specific Settings

Order Block Sensitivity: 10-20

Tighter session ranges (30-60 min)

Focus on quarter levels for quick bounces

5. Risk Management Rules

Maximum 5 trades per day

Stop after 3 consecutive losses

Daily loss limit: 2% of account

Win rate target: >65%

Quick Reference Decision Tree

Market Open (First 30 min)

Gap Up/Down → Strategy 5 (Opening Drive)

Narrow Range → Strategy 1 (IB Breakout)

Trending → Strategy 2 (Order Block Rejection)

Mid-Session

Ranging → Strategy 4 (Midpoint Reversion)

Consolidating → Strategy 6 (Micro Breakout)

At ADR Levels → Strategy 3 (Hash Bounce)

News Events

Always → Strategy 7 (News Fade)

Then → Return to normal strategies

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.