OPEN-SOURCE SCRIPT

Support & Resistance Zone Hunter [BOSWaves]

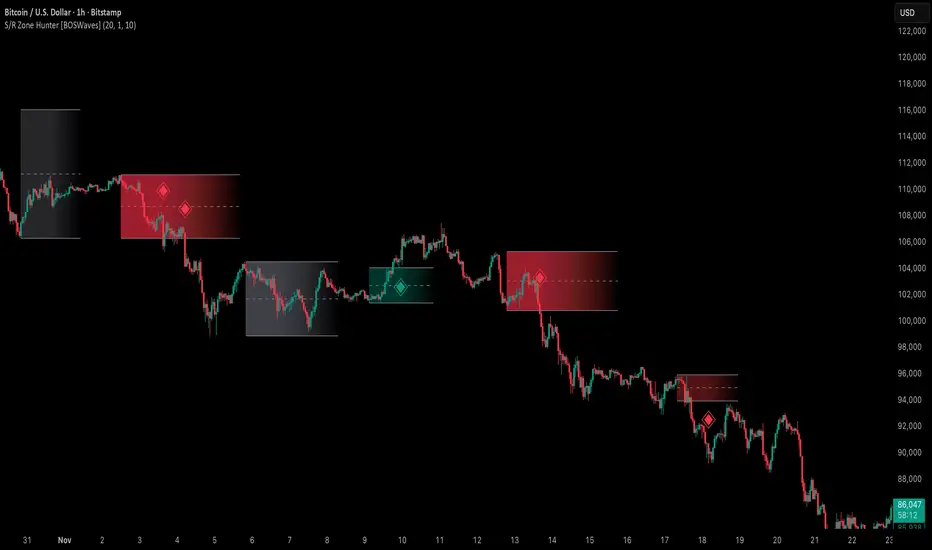

Support & Resistance Zone Hunter [BOSWaves] - Dynamic Structural Zones with Real-Time Breakout Intelligence

Overview

The Support & Resistance Zone Hunter [BOSWaves] is a professional-grade structural mapping framework designed to automatically detect high-probability support and resistance areas in real time. Unlike traditional static levels or manually drawn zones, this system leverages pivot detection, range thresholds, and optional volume validation to create dynamic zones that reflect the true structural architecture of the market.

Zones evolve as price interacts with their boundaries. The first touch of a zone determines its bias - bullish, bearish, or neutral - and the system tracks the full lifecycle of each zone from formation, testing, and bias establishment to potential breakout events. Diamond-shaped breakout signals highlight structurally significant price expansions while filtering noise using a configurable cooldown period.

By visualizing market structure in this way, traders gain a deeper understanding of price behavior, trend momentum, and areas where liquidity and reactive forces are concentrated.

Theoretical Foundation

The Support & Resistance Zone Hunter is built on the premise that meaningful structural zones arise from two core principles:

Markets naturally generate numerous micro-pivots that do not carry predictive significance. By filtering out minor swings and validating zones against volume and range, the system isolates levels that are more likely to attract future price interaction or act as catalysts for breakout moves.

This framework captures not only where price is likely to react but also the direction of potential pressure, providing a statistically grounded, visually intuitive representation of market structure.

How It Works

The Support & Resistance Zone Hunter constructs zones through a multi-layered process that blends pivot logic, range validation, and real-time bias determination:

1. Pivot Detection Core

The indicator identifies pivot highs and pivot lows using a configurable lookback period. Zones are only considered valid when both a top and bottom pivot are present.

2. Zone Qualification Engine

Prospective zones must satisfy two conditions:

Only zones meeting these criteria are drawn, reducing noise and emphasizing high-probability structural levels.

3. Zone Lifecycle

Once a valid top and bottom pivot exist:

Inactive zones stop expanding but remain visible historically to maintain a clear structural context.

4. Visual Rendering

Active zones are displayed as filled boxes with color corresponding to their bias. Top, bottom, and midpoint lines are drawn for reference. Once a zone becomes inactive, its lines are removed while the filled box remains as a historical footprint.

5. Breakout Detection

Breakout signals occur when price closes above the top boundary or below the bottom boundary of an active zone. The system applies a cooldown period and requires price to return to the zone since the previous breakout to prevent signal spam. Bullish and bearish breakouts are visually represented by diamond-shaped markers with configurable colors.

Interpretation

The Support & Resistance Zone Hunter provides a structural view of market balance:

Zones do not simply indicate past levels; they dynamically reflect the evolving battle between buyers and sellers, providing actionable context for both trend continuation and reversion strategies.

Strategy Integration

The Support & Resistance Zone Hunter is versatile and can be applied across multiple trading approaches:

Technical Implementation Details

Suggested Optimal Parameters

These suggested parameters should be used as a baseline; their effectiveness depends on the asset and timeframe, so fine-tuning is expected for optimal performance.

Performance Characteristics

High Effectiveness:

Reduced Effectiveness:

Integration Guidelines

Disclaimer

The Support & Resistance Zone Hunter [BOSWaves] provides structural zone mapping and breakout analytics. It does not predict price movement or guarantee profitability. Success requires disciplined risk management, proper parameter calibration, and integration into a comprehensive trading strategy.

Overview

The Support & Resistance Zone Hunter [BOSWaves] is a professional-grade structural mapping framework designed to automatically detect high-probability support and resistance areas in real time. Unlike traditional static levels or manually drawn zones, this system leverages pivot detection, range thresholds, and optional volume validation to create dynamic zones that reflect the true structural architecture of the market.

Zones evolve as price interacts with their boundaries. The first touch of a zone determines its bias - bullish, bearish, or neutral - and the system tracks the full lifecycle of each zone from formation, testing, and bias establishment to potential breakout events. Diamond-shaped breakout signals highlight structurally significant price expansions while filtering noise using a configurable cooldown period.

By visualizing market structure in this way, traders gain a deeper understanding of price behavior, trend momentum, and areas where liquidity and reactive forces are concentrated.

Theoretical Foundation

The Support & Resistance Zone Hunter is built on the premise that meaningful structural zones arise from two core principles:

- Pivot-Based Turning Points: Only significant highs and lows that represent actual swings in price are considered.

- Contextual Validation: Zones must pass minimum range criteria and optional volume thresholds to ensure their relevance.

Markets naturally generate numerous micro-pivots that do not carry predictive significance. By filtering out minor swings and validating zones against volume and range, the system isolates levels that are more likely to attract future price interaction or act as catalysts for breakout moves.

This framework captures not only where price is likely to react but also the direction of potential pressure, providing a statistically grounded, visually intuitive representation of market structure.

How It Works

The Support & Resistance Zone Hunter constructs zones through a multi-layered process that blends pivot logic, range validation, and real-time bias determination:

1. Pivot Detection Core

The indicator identifies pivot highs and pivot lows using a configurable lookback period. Zones are only considered valid when both a top and bottom pivot are present.

2. Zone Qualification Engine

Prospective zones must satisfy two conditions:

- Range Threshold: The distance between pivot high and low must exceed the minimum percentage set by the user.

- Volume Requirement: If enabled, the current volume must exceed the 50-period moving average.

Only zones meeting these criteria are drawn, reducing noise and emphasizing high-probability structural levels.

3. Zone Lifecycle

Once a valid top and bottom pivot exist:

- The zone is created starting from the pivot formation bar.

- Zones remain active until both boundaries have been touched by price.

- The first boundary touched establishes bias: resistance first → bullish bias ,support first → bearish bias, neither → neutral.

Inactive zones stop expanding but remain visible historically to maintain a clear structural context.

4. Visual Rendering

Active zones are displayed as filled boxes with color corresponding to their bias. Top, bottom, and midpoint lines are drawn for reference. Once a zone becomes inactive, its lines are removed while the filled box remains as a historical footprint.

5. Breakout Detection

Breakout signals occur when price closes above the top boundary or below the bottom boundary of an active zone. The system applies a cooldown period and requires price to return to the zone since the previous breakout to prevent signal spam. Bullish and bearish breakouts are visually represented by diamond-shaped markers with configurable colors.

Interpretation

The Support & Resistance Zone Hunter provides a structural view of market balance:

- Bullish Zones: Form when resistance is tested first, indicating upward pressure and potential continuation.

- Bearish Zones: Form when support is tested first, reflecting downward pressure and continuation risk.

- Neutral Zones: Fresh zones that have not yet been interacted with, representing undiscovered liquidity.

- Breakout Diamonds: Highlight significant structural price expansions, helping traders identify confirmed continuation moves while filtering noise.

Zones do not simply indicate past levels; they dynamically reflect the evolving battle between buyers and sellers, providing actionable context for both trend continuation and reversion strategies.

Strategy Integration

The Support & Resistance Zone Hunter is versatile and can be applied across multiple trading approaches:

- Trend Continuation: Use bullish and bearish zones to confirm directional bias. Breakout diamonds indicate structural continuation opportunities.

- Reversion Entries: Neutral zones often act as magnets in ranging markets, allowing for high-probability mean-reversion setups.

- Breakout Trading: Diamonds mark true structural expansions, reducing false breakout risk and guiding stop placement or momentum entries.

- Liquidity Zone Alignment: Combining the indicator with order block, breaker, or volume-based tools helps validate zones against broader market participation.

Technical Implementation Details

- Pivot Engine: Two-sided pivot detection based on configurable lookback.

- Zone Qualification: Minimum range requirement and optional volume filter.

- Bias Logic: Determined by the first boundary touched.

- Zone Lifecycle: Active until both boundaries are touched, historical visibility retained.

- Breakout Signals: Diamond markers with cooldown filtering and price-return validation.

- Visuals: Transparent filled zones with live top, bottom, and midpoint lines.

Suggested Optimal Parameters

- Pivot Lookback: 10 - 30 for intraday, 20 - 50 for swing trading.

- Minimum Range %: 0.5 - 2% for crypto or indices, 1 - 3% for metals or forex.

- Volume Filter: Enable for assets with inconsistent liquidity; disable for consistently liquid markets.

- Breakout Cooldown: 5 - 20 bars depending on volatility.

These suggested parameters should be used as a baseline; their effectiveness depends on the asset and timeframe, so fine-tuning is expected for optimal performance.

Performance Characteristics

High Effectiveness:

- Markets with clear pivot structure and reliable volume.

- Trending symbols with consistent retests.

- Assets where zones attract repeated price interaction.

Reduced Effectiveness:

- Random walk markets lacking structural pivots.

- Low-volatility periods with minimal price reaction.

- Assets with irregular volume distribution or erratic price action.

Integration Guidelines

- Use zone color as contextual bias rather than a standalone signal.

- Combine with structural tools, order blocks, or volume-based indicators for confluence.

- Validate zones on higher timeframes to refine lower timeframe entries.

- Treat breakout diamonds as confirmation of continuation rather than independent triggers.

Disclaimer

The Support & Resistance Zone Hunter [BOSWaves] provides structural zone mapping and breakout analytics. It does not predict price movement or guarantee profitability. Success requires disciplined risk management, proper parameter calibration, and integration into a comprehensive trading strategy.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.