OPEN-SOURCE SCRIPT

💻 RSI Dual-Band Reversal Strategy (Hacker Mode)

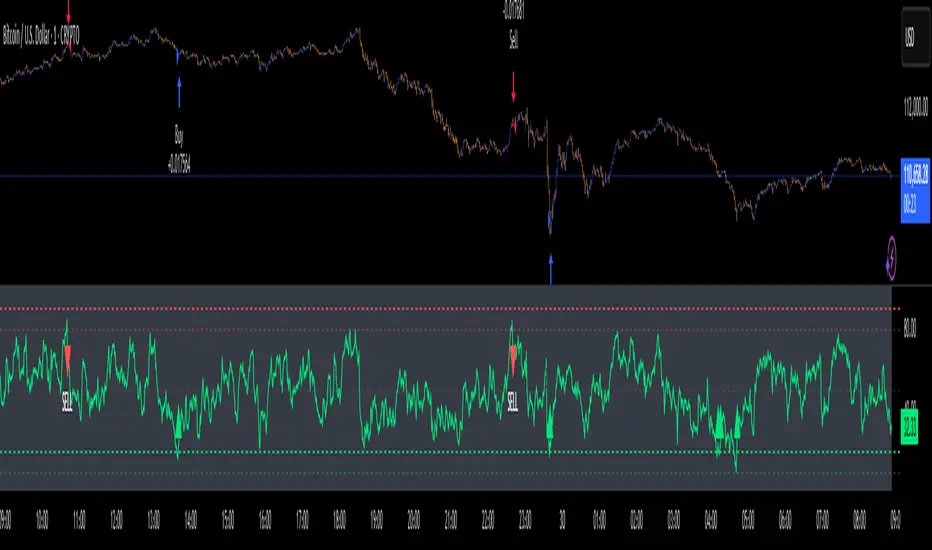

This 💻 RSI Dual-Band Reversal Strategy (Hacker Mode) is a mean-reversion trading strategy built on the Relative Strength Index (RSI) indicator.

It identifies potential trend reversals when price momentum reaches extreme overbought or oversold levels — then enters trades expecting the price to revert.

⚙️ Strategy Concept

The RSI measures market momentum on a scale of 0–100.

When RSI is too low, it signals an oversold market → potential buy.

When RSI is too high, it signals an overbought market → potential sell.

This strategy sets two reversal zones using dual RSI bands:

Zone RSI Range Meaning Action

Upper Band 80–90 Overbought Prepare to Sell

Lower Band 10–20 Oversold Prepare to Buy

🧩 Code Breakdown

1. Input Parameters

rsiLength = input.int(14)

upperBandHigh = input.float(90.0)

upperBandLow = input.float(80.0)

lowerBandLow = input.float(10.0)

lowerBandHigh = input.float(20.0)

You can adjust:

RSI Length (default 14) → sensitivity of the RSI.

Upper/Lower Bands → control when buy/sell triggers occur.

2. RSI Calculation

rsi = ta.rsi(close, rsiLength)

Calculates the RSI of the closing price over 14 periods.

3. Signal Logic

buySignal = ta.crossover(rsi, lowerBandHigh)

sellSignal = ta.crossunder(rsi, upperBandLow)

Buy Signal: RSI crosses up through 20 → market rebounding from oversold.

Sell Signal: RSI crosses down through 80 → market turning from overbought.

4. Plotting

RSI line (lime green)

Bands:

🔴 80–90 (Sell Zone)

🟢 10–20 (Buy Zone)

Gray midline at 50 for reference.

Triangle markers for signals:

🟢 “BUY” below chart

🔴 “SELL” above chart

5. Trading Logic

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell", BTCUSD strategy.short

BTCUSD strategy.short  XAUUSD )

XAUUSD )

Opens a long position on a buy signal.

Opens a short position on a sell signal.

No explicit stop loss or take profit — positions reverse when an opposite signal appears.

🧠 How It Works (Step-by-Step Example)

RSI drops below 20 → oversold → buy signal triggers.

RSI rises toward 80 → overbought → sell signal triggers.

Strategy flips position, always staying in the market (either long or short).

📈 Visual Summary

Imagine the RSI line oscillating between 0 and 100:

100 ────────────────────────────────

90 ───── Upper Band High (Sell Limit)

80 ───── Upper Band Low (Sell Trigger)

50 ───── Midline

20 ───── Lower Band High (Buy Trigger)

10 ───── Lower Band Low (Buy Limit)

0 ────────────────────────────────

When RSI moves above 80 → SELL

When RSI moves below 20 → BUY

⚡ Strategy Profile

Category Description

Type Mean Reversion

Entry Rule RSI crosses up 20 → Buy

Exit/Reverse Rule RSI crosses down 80 → Sell

Strengths Simple, effective in sideways/range markets, minimal lag

Weaknesses Weak in strong trends, no stop-loss or take-profit logic

💡 Suggested Improvements

You can enhance this script by adding:

Stop loss & take profit levels (e.g., % or ATR-based).

Trend filter (e.g., trade only in direction of 200 EMA).

RSI smoothing to reduce noise.

It identifies potential trend reversals when price momentum reaches extreme overbought or oversold levels — then enters trades expecting the price to revert.

⚙️ Strategy Concept

The RSI measures market momentum on a scale of 0–100.

When RSI is too low, it signals an oversold market → potential buy.

When RSI is too high, it signals an overbought market → potential sell.

This strategy sets two reversal zones using dual RSI bands:

Zone RSI Range Meaning Action

Upper Band 80–90 Overbought Prepare to Sell

Lower Band 10–20 Oversold Prepare to Buy

🧩 Code Breakdown

1. Input Parameters

rsiLength = input.int(14)

upperBandHigh = input.float(90.0)

upperBandLow = input.float(80.0)

lowerBandLow = input.float(10.0)

lowerBandHigh = input.float(20.0)

You can adjust:

RSI Length (default 14) → sensitivity of the RSI.

Upper/Lower Bands → control when buy/sell triggers occur.

2. RSI Calculation

rsi = ta.rsi(close, rsiLength)

Calculates the RSI of the closing price over 14 periods.

3. Signal Logic

buySignal = ta.crossover(rsi, lowerBandHigh)

sellSignal = ta.crossunder(rsi, upperBandLow)

Buy Signal: RSI crosses up through 20 → market rebounding from oversold.

Sell Signal: RSI crosses down through 80 → market turning from overbought.

4. Plotting

RSI line (lime green)

Bands:

🔴 80–90 (Sell Zone)

🟢 10–20 (Buy Zone)

Gray midline at 50 for reference.

Triangle markers for signals:

🟢 “BUY” below chart

🔴 “SELL” above chart

5. Trading Logic

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell",

Opens a long position on a buy signal.

Opens a short position on a sell signal.

No explicit stop loss or take profit — positions reverse when an opposite signal appears.

🧠 How It Works (Step-by-Step Example)

RSI drops below 20 → oversold → buy signal triggers.

RSI rises toward 80 → overbought → sell signal triggers.

Strategy flips position, always staying in the market (either long or short).

📈 Visual Summary

Imagine the RSI line oscillating between 0 and 100:

100 ────────────────────────────────

90 ───── Upper Band High (Sell Limit)

80 ───── Upper Band Low (Sell Trigger)

50 ───── Midline

20 ───── Lower Band High (Buy Trigger)

10 ───── Lower Band Low (Buy Limit)

0 ────────────────────────────────

When RSI moves above 80 → SELL

When RSI moves below 20 → BUY

⚡ Strategy Profile

Category Description

Type Mean Reversion

Entry Rule RSI crosses up 20 → Buy

Exit/Reverse Rule RSI crosses down 80 → Sell

Strengths Simple, effective in sideways/range markets, minimal lag

Weaknesses Weak in strong trends, no stop-loss or take-profit logic

💡 Suggested Improvements

You can enhance this script by adding:

Stop loss & take profit levels (e.g., % or ATR-based).

Trend filter (e.g., trade only in direction of 200 EMA).

RSI smoothing to reduce noise.

Skrip sumber terbuka

Dalam semangat sebenar TradingView, pencipta skrip ini telah menjadikannya sumber terbuka supaya pedagang dapat menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupun anda boleh menggunakannya secara percuma, ingat bahawa menerbitkan semula kod ini adalah tertakluk kepada Peraturan Dalaman kami.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat sebenar TradingView, pencipta skrip ini telah menjadikannya sumber terbuka supaya pedagang dapat menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupun anda boleh menggunakannya secara percuma, ingat bahawa menerbitkan semula kod ini adalah tertakluk kepada Peraturan Dalaman kami.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.