OPEN-SOURCE SCRIPT

Market Thrust Indicator

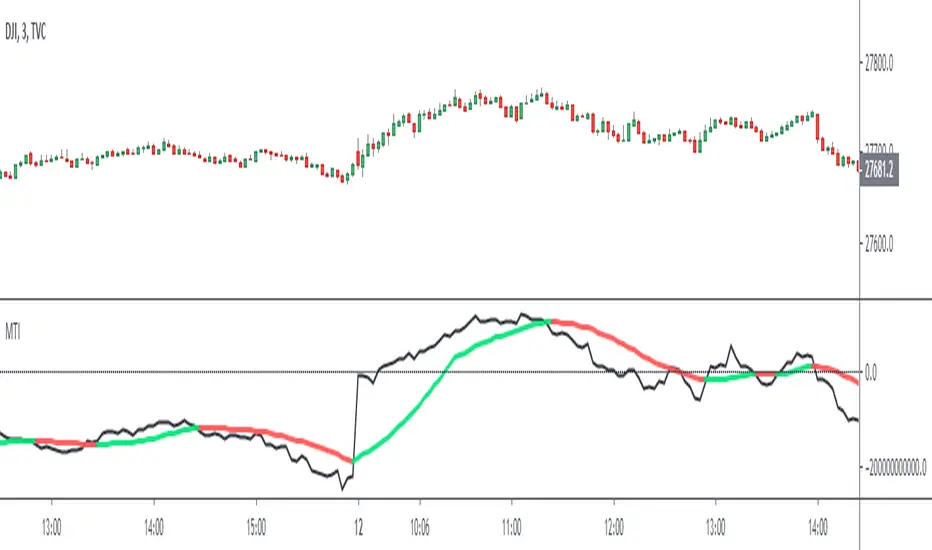

The Market Thrust indicator is a powerful measure of the stock market's internal strength or weakness. There are four components to this indicator:

1-Advancing Issues on the New York Stock Exchange (NYSE) – AADV

2-Advancing Volume on the NYSE – UUVOL

3-Declining Issues on the NYSE – DDECL

4-Declining Volume on the NYSE – DDVOL

The formula for Market Thrust is given below:

(AADV x UUVOL)-(DDECL x DDVOL)

When used for day-trading, the trend of the Market Thrust indicator is what is most important.

Rising Market Thrust Indicator: Considered a bullish sign; can act as a confirmation signal when combined with a rising stock, index ETF, or stock index future's price.

Falling Market Thrust Indicator: Considered a bearish sign; can act as a confirmation signal of a decreasing market price.

The Market Thrust indicator could be used for detecting divergences in trends. Divergences occur when:

- Price is trending higher, but the Market Thrust indicator is not moving higher or is even going down.

- Price is trending lower, however, the Market Thrust technical analysis tool is not trending lower, it is either not trending or is trending higher.

Add a fully configurable trend line over MTI.

Read more at: commodity.com/technical-analysis/market-thrust/

1-Advancing Issues on the New York Stock Exchange (NYSE) – AADV

2-Advancing Volume on the NYSE – UUVOL

3-Declining Issues on the NYSE – DDECL

4-Declining Volume on the NYSE – DDVOL

The formula for Market Thrust is given below:

(AADV x UUVOL)-(DDECL x DDVOL)

When used for day-trading, the trend of the Market Thrust indicator is what is most important.

Rising Market Thrust Indicator: Considered a bullish sign; can act as a confirmation signal when combined with a rising stock, index ETF, or stock index future's price.

Falling Market Thrust Indicator: Considered a bearish sign; can act as a confirmation signal of a decreasing market price.

The Market Thrust indicator could be used for detecting divergences in trends. Divergences occur when:

- Price is trending higher, but the Market Thrust indicator is not moving higher or is even going down.

- Price is trending lower, however, the Market Thrust technical analysis tool is not trending lower, it is either not trending or is trending higher.

Add a fully configurable trend line over MTI.

Read more at: commodity.com/technical-analysis/market-thrust/

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.