OPEN-SOURCE SCRIPT

Technical Strength Index (TSI)

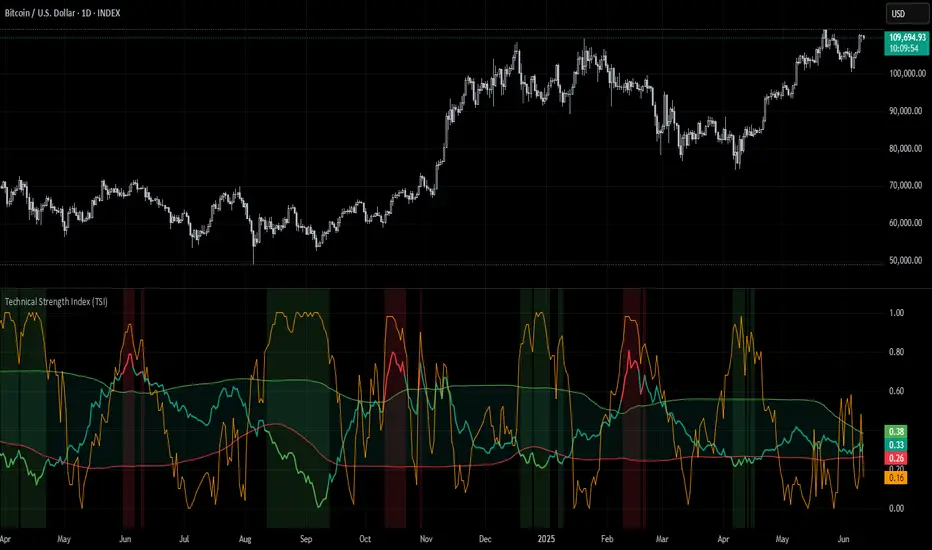

📘 TSI with Dynamic Bands – Technical Strength Index

The TSI with Dynamic Bands is a multi-factor indicator designed to measure the statistical strength and structure of a trend. It combines several quantitative metrics into a single, normalized score between 0 and 1, allowing traders to assess the technical quality of market moves and detect overbought/oversold conditions with adaptive precision.

🧠 Core Components

This indicator draws from the StatMetrics library, blending:

📈 Trend Persistence: via the Hurst exponent, indicating whether price action is mean-reverting or trending.

📉 Risk-Adjusted Volatility: via the inverted [Coefficient of Variation (CV)], rewarding smoother, less erratic price movement.

🚀 Momentum Strength: using a combination of directional momentum and Z-score–normalized returns.

These components are normalized and averaged into the TSI line.

🎯 Features

TSI Line: Composite score of trend quality (0 = weak/noise, 1 = strong/structured).

Dynamic Bands: Mean ± 1 standard deviation envelopes provide adaptive context.

Overbought/Oversold Detection: Based on a rolling quantile (e.g. 90th/10th percentile of TSI history).

Signal Strength Bar (optional): Measures how statistically extreme the current TSI value is, helping validate confidence in trade setups.

Dynamic Color Cues: Background and bar gradients help visually identify statistically significant zones.

📈 How to Use

Look for overbought (red background) or oversold (green background) conditions as potential reversal zones.

Confirm trend strength with the optional signal strength bar — stronger values suggest higher signal confidence.

Use the TSI line and context bands to filter out noisy ranges and focus on structured price moves.

⚙️ Inputs

Lookback Period: Controls the smoothing and window size for statistical calculations.

Overbought/Oversold Quantiles: Adjust the thresholds for signal zones.

Plot Signal Strength: Enable or disable the signal confidence bar.

Overlay Signal Strength: Show signal strength in the same panel (compact) or not (cleaner TSI-only view).

🛠 Example Use Cases

Mean reversion traders identifying reversal zones with statistical backing

Momentum/Trend traders confirming structure before entries

Quantitative dashboards or multi-asset screening tools

⚠️ Disclaimer

This script is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any financial instrument.

This AI is not a financial advisor; please consult your financial advisor for personalized advice.

The TSI with Dynamic Bands is a multi-factor indicator designed to measure the statistical strength and structure of a trend. It combines several quantitative metrics into a single, normalized score between 0 and 1, allowing traders to assess the technical quality of market moves and detect overbought/oversold conditions with adaptive precision.

🧠 Core Components

This indicator draws from the StatMetrics library, blending:

📈 Trend Persistence: via the Hurst exponent, indicating whether price action is mean-reverting or trending.

📉 Risk-Adjusted Volatility: via the inverted [Coefficient of Variation (CV)], rewarding smoother, less erratic price movement.

🚀 Momentum Strength: using a combination of directional momentum and Z-score–normalized returns.

These components are normalized and averaged into the TSI line.

🎯 Features

TSI Line: Composite score of trend quality (0 = weak/noise, 1 = strong/structured).

Dynamic Bands: Mean ± 1 standard deviation envelopes provide adaptive context.

Overbought/Oversold Detection: Based on a rolling quantile (e.g. 90th/10th percentile of TSI history).

Signal Strength Bar (optional): Measures how statistically extreme the current TSI value is, helping validate confidence in trade setups.

Dynamic Color Cues: Background and bar gradients help visually identify statistically significant zones.

📈 How to Use

Look for overbought (red background) or oversold (green background) conditions as potential reversal zones.

Confirm trend strength with the optional signal strength bar — stronger values suggest higher signal confidence.

Use the TSI line and context bands to filter out noisy ranges and focus on structured price moves.

⚙️ Inputs

Lookback Period: Controls the smoothing and window size for statistical calculations.

Overbought/Oversold Quantiles: Adjust the thresholds for signal zones.

Plot Signal Strength: Enable or disable the signal confidence bar.

Overlay Signal Strength: Show signal strength in the same panel (compact) or not (cleaner TSI-only view).

🛠 Example Use Cases

Mean reversion traders identifying reversal zones with statistical backing

Momentum/Trend traders confirming structure before entries

Quantitative dashboards or multi-asset screening tools

⚠️ Disclaimer

This script is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any financial instrument.

This AI is not a financial advisor; please consult your financial advisor for personalized advice.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.