OPEN-SOURCE SCRIPT

Quarterly Theory ICT 04 [TradingFinder] SSMT 4Quarter Divergence

🔵Introduction

Sequential SMT Divergence is an advanced price-action-based analytical technique rooted in the ICT (Inner Circle Trader) methodology. Its primary objective is to identify early-stage divergences between correlated assets within precise time structures. This tool not only breaks down market structure but also enables traders to detect engineered liquidity traps before the market reacts.

In simple terms, SMT (Smart Money Technique) occurs when two correlated assets—such as indices (ES and NQ), currency pairs (EURUSD and GBPUSD), or commodities (Gold and Silver)—exhibit different reactions at key price levels (swing highs or lows). This lack of alignment is often a sign of smart money manipulation and signals a lack of confirmation in the ongoing trend—hinting at an imminent reversal or at least a pause in momentum.

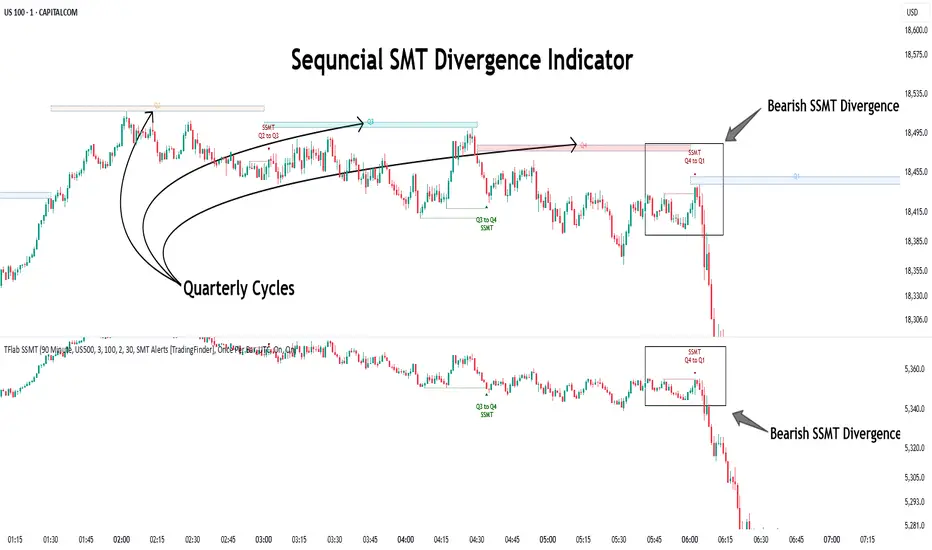

In its Sequential form, SMT divergences are examined through a more granular temporal lens—between intraday quarters (Q1 through Q4). When SMT appears at the transition from one quarter to another (e.g., Q1 to Q2 or Q3 to Q4), the signal becomes significantly more powerful, often aligning with a critical phase in the Quarterly Theory—a framework that segments market behavior into four distinct phases: Accumulation, Manipulation, Distribution, and Reversal/Continuation.

For instance, a Bullish SMT forms when one asset prints a new low while its correlated counterpart fails to break the corresponding low from the previous quarter. This usually indicates absorption of selling pressure and the beginning of accumulation by smart money. Conversely, a Bearish SMT arises when one asset makes a higher high, but the second asset fails to confirm, signaling distribution or a fake-out before a decline.

However, SMT alone is not enough. To confirm a true Market Structure Break (MSB), the appearance of a Precision Swing Point (PSP) is essential—a specific candlestick formation on a lower timeframe (typically 5 to 15 minutes) that reveals the entry of institutional participants. The combination of SMT and PSP provides a more accurate entry point and better understanding of premium and discount zones.

The Sequential SMT Indicator, introduced in this article, dynamically scans charts for such divergence patterns across multiple sessions. It is applicable to various markets including Forex, crypto, commodities, and indices, and shows particularly strong performance during mid-week sessions (Wednesdays and Thursdays)—when most weekly highs and lows tend to form.

Bullish Sequential SMT:

Bearish Sequential SMT:

🔵How to Use

The Sequential SMT (SSMT) indicator is designed to detect time and structure-based divergences between two correlated assets. This divergence occurs when both assets print a similar swing (high or low) in the previous quarter (e.g., Q3), but in the current quarter (e.g., Q4), only one asset manages to break that swing level—while the other fails to reach it.

This temporal mismatch is precisely identified by the SSMT indicator and often signals smart money activity, a market phase transition, or even the presence of an engineered liquidity trap. The signal becomes especially powerful when paired with a Precision Swing Point (PSP)—a confirming candle on lower timeframes (5m–15m) that typically indicates a market structure break (MSB) and the entry of smart liquidity.

🟣Bullish Sequential SMT

This time-based divergence reflects declining selling pressure, potential absorption, and often marks the end of a manipulation phase and the start of accumulation. If confirmed by a bullish PSP candle, it offers a strong long opportunity, with stop-losses defined just below the swing low.

🟣Bearish Sequential SMT

This type of divergence signals weakening bullish momentum and the likelihood of distribution or a fake-out before a price drop. When followed by a bearish PSP candle, it sets up a strong shorting opportunity with targets in the discount zone and protective stops placed above the swing high.

🔵Settings

⚙️Logical Settings

Quarterly Cycles Type: Select the time segmentation method for SMT analysis.

Available modes include: Yearly, Monthly, Weekly, Daily, 90 Minute, and Micro.

These define how the indicator divides market time into Q1–Q4 cycles.

Symbol: Choose the secondary asset to compare with the main chart asset (e.g., XAUUSD, US100, GBPUSD).

Pivot Period: Sets the sensitivity of the pivot detection algorithm. A smaller value increases responsiveness to price swings.

Activate Max Pivot Back: When enabled, limits the maximum number of past pivots to be considered for divergence detection.

Max Pivot Back Length: Defines how many past pivots can be used (if the above toggle is active).

Pivot Sync Threshold: The maximum allowed difference (in bars) between pivots of the two assets for them to be compared.

Validity Pivot Length: Defines the time window (in bars) during which a divergence remains valid before it's considered outdated.

🎨Display Settings

Show Cycle:Toggles the visual display of the current Quarter (Q1 to Q4) based on the selected time segmentation

Show Cycle Label: Shows the name (e.g., "Q2") of each detected Quarter on the chart.

Show Bullish SMT Line: Draws a line connecting the bullish divergence points.

Show Bullish SMT Label: Displays a label on the chart when a bullish divergence is detected.

Bullish Color: Sets the color for bullish SMT markers (label, shape, and line).

Show Bearish SMT Line: Draws a line for bearish divergence.

Show Bearish SMT Label: Displays a label when a bearish SMT divergence is found.

Bearish Color: Sets the color for bearish SMT visual elements.

🔔Alert Settings

Alert Name: Custom name for the alert messages (used in TradingView’s alert system).

Message Frequency:

Time Zone Display: Choose the time zone in which alert timestamps are displayed (e.g., UTC).

Bullish SMT Divergence Alert: Enable/disable alerts specifically for bullish signals.

Bearish SMT Divergence Alert: Enable/disable alerts specifically for bearish signals

🔵Conclusion

The Sequential SMT (SSMT) indicator is a powerful and precise tool for identifying structural divergences between correlated assets within a time-based framework. Unlike traditional divergence models that rely solely on sequential pivot comparisons, SSMT leverages Quarterly Theory, in combination with concepts like liquidity sweeps, market structure breaks (MSB) and precision swing points (PSP), to provide a deeper and more actionable view of market dynamics.

By using SSMT, traders gain not only the ability to identify where divergence occurs, but also when it matters most within the market cycle. This empowers them to anticipate major moves or traps before they fully materialize, and position themselves accordingly in high-probability trade zones.

Whether you're trading Forex, crypto, indices, or commodities, the true strength of this indicator is revealed when used in sync with the Accumulation, Manipulation, Distribution, and Reversal phases of the market. Integrated with other confluence tools and market models, SSMT can serve as a core component in a professional, rule-based, and highly personalized trading strategy.

Sequential SMT Divergence is an advanced price-action-based analytical technique rooted in the ICT (Inner Circle Trader) methodology. Its primary objective is to identify early-stage divergences between correlated assets within precise time structures. This tool not only breaks down market structure but also enables traders to detect engineered liquidity traps before the market reacts.

In simple terms, SMT (Smart Money Technique) occurs when two correlated assets—such as indices (ES and NQ), currency pairs (EURUSD and GBPUSD), or commodities (Gold and Silver)—exhibit different reactions at key price levels (swing highs or lows). This lack of alignment is often a sign of smart money manipulation and signals a lack of confirmation in the ongoing trend—hinting at an imminent reversal or at least a pause in momentum.

In its Sequential form, SMT divergences are examined through a more granular temporal lens—between intraday quarters (Q1 through Q4). When SMT appears at the transition from one quarter to another (e.g., Q1 to Q2 or Q3 to Q4), the signal becomes significantly more powerful, often aligning with a critical phase in the Quarterly Theory—a framework that segments market behavior into four distinct phases: Accumulation, Manipulation, Distribution, and Reversal/Continuation.

For instance, a Bullish SMT forms when one asset prints a new low while its correlated counterpart fails to break the corresponding low from the previous quarter. This usually indicates absorption of selling pressure and the beginning of accumulation by smart money. Conversely, a Bearish SMT arises when one asset makes a higher high, but the second asset fails to confirm, signaling distribution or a fake-out before a decline.

However, SMT alone is not enough. To confirm a true Market Structure Break (MSB), the appearance of a Precision Swing Point (PSP) is essential—a specific candlestick formation on a lower timeframe (typically 5 to 15 minutes) that reveals the entry of institutional participants. The combination of SMT and PSP provides a more accurate entry point and better understanding of premium and discount zones.

The Sequential SMT Indicator, introduced in this article, dynamically scans charts for such divergence patterns across multiple sessions. It is applicable to various markets including Forex, crypto, commodities, and indices, and shows particularly strong performance during mid-week sessions (Wednesdays and Thursdays)—when most weekly highs and lows tend to form.

Bullish Sequential SMT:

Bearish Sequential SMT:

🔵How to Use

The Sequential SMT (SSMT) indicator is designed to detect time and structure-based divergences between two correlated assets. This divergence occurs when both assets print a similar swing (high or low) in the previous quarter (e.g., Q3), but in the current quarter (e.g., Q4), only one asset manages to break that swing level—while the other fails to reach it.

This temporal mismatch is precisely identified by the SSMT indicator and often signals smart money activity, a market phase transition, or even the presence of an engineered liquidity trap. The signal becomes especially powerful when paired with a Precision Swing Point (PSP)—a confirming candle on lower timeframes (5m–15m) that typically indicates a market structure break (MSB) and the entry of smart liquidity.

🟣Bullish Sequential SMT

- In the previous quarter, both assets form a similar swing low.

- In the current quarter, one asset (e.g., EURUSD) breaks that low and trades below it.

- The other asset (e.g., GBPUSD) fails to reach the same low, preserving the structure.

This time-based divergence reflects declining selling pressure, potential absorption, and often marks the end of a manipulation phase and the start of accumulation. If confirmed by a bullish PSP candle, it offers a strong long opportunity, with stop-losses defined just below the swing low.

🟣Bearish Sequential SMT

- In the previous quarter, both assets form a similar swing high.

- In the current quarter, one asset (e.g., NQ) breaks above that high.

- The other asset (e.g., ES) fails to reach that high, remaining below it.

This type of divergence signals weakening bullish momentum and the likelihood of distribution or a fake-out before a price drop. When followed by a bearish PSP candle, it sets up a strong shorting opportunity with targets in the discount zone and protective stops placed above the swing high.

🔵Settings

⚙️Logical Settings

Quarterly Cycles Type: Select the time segmentation method for SMT analysis.

Available modes include: Yearly, Monthly, Weekly, Daily, 90 Minute, and Micro.

These define how the indicator divides market time into Q1–Q4 cycles.

Symbol: Choose the secondary asset to compare with the main chart asset (e.g., XAUUSD, US100, GBPUSD).

Pivot Period: Sets the sensitivity of the pivot detection algorithm. A smaller value increases responsiveness to price swings.

Activate Max Pivot Back: When enabled, limits the maximum number of past pivots to be considered for divergence detection.

Max Pivot Back Length: Defines how many past pivots can be used (if the above toggle is active).

Pivot Sync Threshold: The maximum allowed difference (in bars) between pivots of the two assets for them to be compared.

Validity Pivot Length: Defines the time window (in bars) during which a divergence remains valid before it's considered outdated.

🎨Display Settings

Show Cycle:Toggles the visual display of the current Quarter (Q1 to Q4) based on the selected time segmentation

Show Cycle Label: Shows the name (e.g., "Q2") of each detected Quarter on the chart.

Show Bullish SMT Line: Draws a line connecting the bullish divergence points.

Show Bullish SMT Label: Displays a label on the chart when a bullish divergence is detected.

Bullish Color: Sets the color for bullish SMT markers (label, shape, and line).

Show Bearish SMT Line: Draws a line for bearish divergence.

Show Bearish SMT Label: Displays a label when a bearish SMT divergence is found.

Bearish Color: Sets the color for bearish SMT visual elements.

🔔Alert Settings

Alert Name: Custom name for the alert messages (used in TradingView’s alert system).

Message Frequency:

- All: Every signal triggers an alert.

- Once Per Bar: Alerts once per bar regardless of how many signals occur.

- Per Bar Close: Only triggers when the bar closes and the signal still exists.

Time Zone Display: Choose the time zone in which alert timestamps are displayed (e.g., UTC).

Bullish SMT Divergence Alert: Enable/disable alerts specifically for bullish signals.

Bearish SMT Divergence Alert: Enable/disable alerts specifically for bearish signals

🔵Conclusion

The Sequential SMT (SSMT) indicator is a powerful and precise tool for identifying structural divergences between correlated assets within a time-based framework. Unlike traditional divergence models that rely solely on sequential pivot comparisons, SSMT leverages Quarterly Theory, in combination with concepts like liquidity sweeps, market structure breaks (MSB) and precision swing points (PSP), to provide a deeper and more actionable view of market dynamics.

By using SSMT, traders gain not only the ability to identify where divergence occurs, but also when it matters most within the market cycle. This empowers them to anticipate major moves or traps before they fully materialize, and position themselves accordingly in high-probability trade zones.

Whether you're trading Forex, crypto, indices, or commodities, the true strength of this indicator is revealed when used in sync with the Accumulation, Manipulation, Distribution, and Reversal phases of the market. Integrated with other confluence tools and market models, SSMT can serve as a core component in a professional, rule-based, and highly personalized trading strategy.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.