OPEN-SOURCE SCRIPT

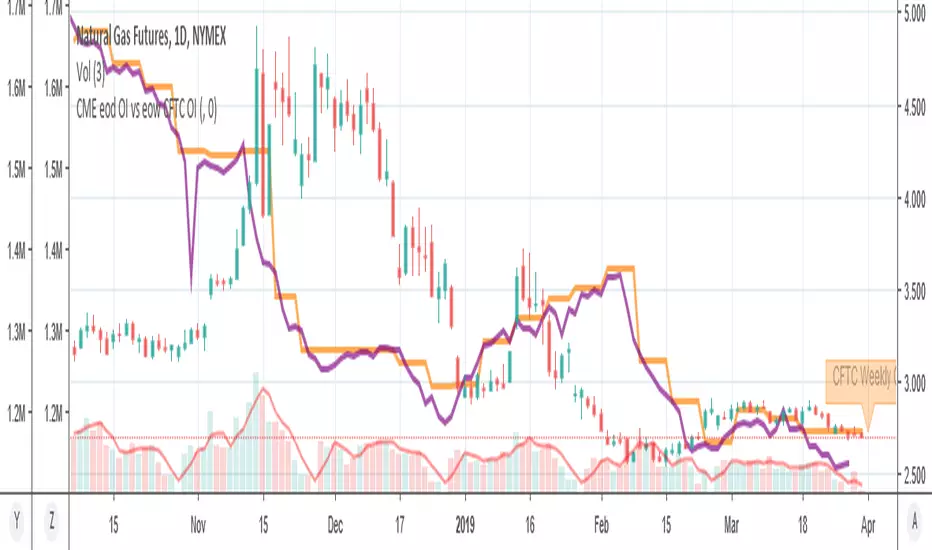

Telah dikemas kini MY_CME eod OI vs CFTC eow OI

Daily e-o-d Open Interest as published by CME.

As CFTC COT Open Interest relates to last Tuesday, here you can have an idea how things evolved day-by-day since then.

As CME total OI is not accessibl as data, here I sum OI of the next 9 outstanding contracts, which gives a fair idea of the trend in OI

As CFTC COT Open Interest relates to last Tuesday, here you can have an idea how things evolved day-by-day since then.

As CME total OI is not accessibl as data, here I sum OI of the next 9 outstanding contracts, which gives a fair idea of the trend in OI

Nota Keluaran

One can input a "preliminary" e-o-d Open Interest if published hereon CME sitecmegroup.com/market-data/volume-open-interest/metals-volume.html as the "final" data becomes available on tv quite late

Nota Keluaran

fixed colorsNota Keluaran

fixed offset of CME "final" OI, -1 on weekends,-2 weektime, as OI should be public within the next day, and relates to the previous day. But noton weekends...anyway you get the meaningNota Keluaran

offset fixNota Keluaran

Cleaned code, now sums OI of the next 20 contracts. Good for gold and E-mini. WTI is not too suitable, as it has dozens of conracts active for the next 3/4 years .

Nota Keluaran

Added new input "number of contracts"This script uses the QUANDL:CHRIS datasets, that records CME e-o-d data by quandl, and is exported daily to tradinview

The number of outstanding contracts CME differs from product to product

eg Gold has 16 oustanding contracts, E-mini has 4, NatGas has 43!

The scripts has max 20. You can add as many as you like in the source code,but toomuch typing for me

// NUMBER OF CONTRACTS

// eg:

// CME Vol and Open Interesst page eg. for GOLD:

// cmegroup.com/trading/metals/precious/gold_quotes_volume_voi.html?optid=7489&optionProductId=7488

// Totals Volume & OI (last line of table) are not exported by CME to quaandl

// CME data is recorded&exported daily by quandl.com to tradingview

// via the che CHRIS/CME datasets

// quandl.com/data/CHRIS

// Eg. Nat GAs cntract n. 20, field n. 7(OI)

// quandl.com/data/CHRIS/CME_NG20 (@quandl.com)

// this data is (should be) exported daily to tradinview

// tradingview.com/e/?symbol=QUANDL:CHRIS/CME_NG20|7 (TradingView)

// This script tries to sum all the fut cntrcts' Vol&OI to obtain a fair total

//

// Number of outstanding cntrcts per commodity differ.

// eg E-mini (ES) has 4 contracts, Gold(GC) 16 cntrcts, NatGas(NG) has 43, WTI(CL) has 38 etc

// see doc by quandl:

// s3.amazonaws.com/quandl-production-static/Ticker+CSV's/Futures/continuous.csv

Nota Keluaran

This latest version sets automatically the number of outstanding contracts' OI to sum upbasen on the ticker future code

data is taken from QUNDL:CHRIS/CME_ dataset

// Number of outstanding cntrcts per commodity CME differ.

// eg E-mini (ES) has 4 contracts, Gold(GC) 16 cntrcts, NatGas(NG) has 43, WTI(CL) has 38 etc

// this script now gets the n.of outstandig cntrcts' OI to sum from the following table:

// s3.amazonaws.com/quandl-production-static/Ticker+CSV's/Futures/continuous.csv

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.