PROTECTED SOURCE SCRIPT

Stocker++

Stocker++ Comprehensive Documentation

Overview

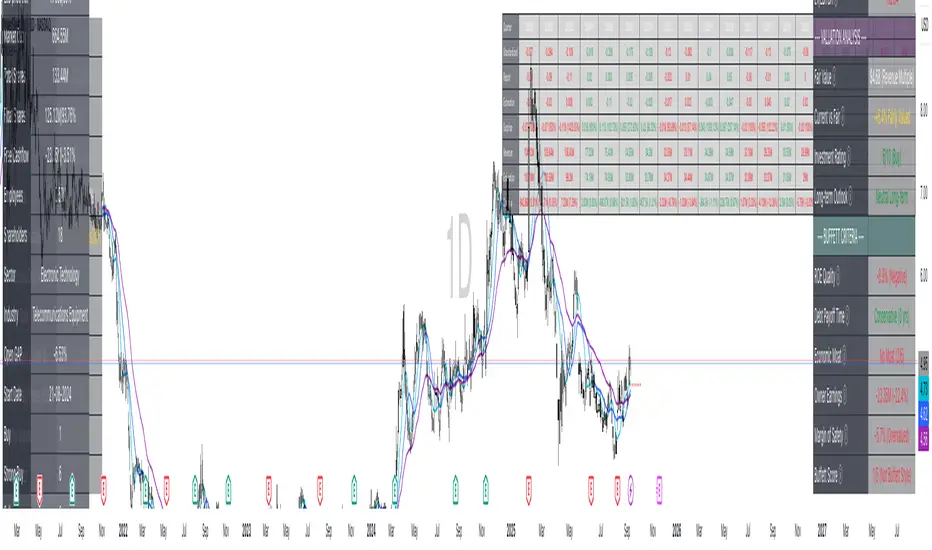

Stocker++ is an advanced stock analysis indicator that combines technical trend analysis with fundamental company data to provide comprehensive investment insights. This all-in-one tool displays multiple moving averages for trend identification and presents detailed financial information through organized data tables, helping investors make informed decisions based on both price action and company fundamentals.

Key Features

1. Customizable Moving Averages

Up to 6 configurable moving averages (MA1-MA6)

Choice between Simple Moving Average (SMA) and Exponential Moving Average (EMA)

Individual color customization for each MA

Adjustable lengths, timeframes, and visibility toggles

Default setup includes 10, 20, and 50-period MAs for short to medium-term trend analysis

2. Risk Management Table

Displays critical position sizing and risk calculations:

Account Size: Your total trading capital

Risk Money: Dollar amount and percentage at risk per trade

Stop Loss: Calculated using either ATR or Low of Day

Shares to Buy: Optimal position size based on risk parameters

Position Size: Total dollar amount and percentage of account

Max Allowed Position: Maximum position based on liquidity constraints (Daily Volume ÷ 200)

Min Required Daily Vol: Minimum liquidity needed for your position size

Liquidity Ratio: How many times over the minimum liquidity requirement

Average Daily Volume ($): 20-day average dollar volume

Average Daily Shares Volume: 20-day average share volume

Relative Volume: Current volume compared to 20-day average

Volume Buzz: Percentage increase/decrease from average volume

3. Company Info Table

Essential company metrics and market data:

Change: Daily price change in dollars

ATR: Average True Range for volatility measurement

ADR: Average Daily Range percentage

LoD price/dist: Low of Day price and distance percentage

Market Cap: Total market capitalization

Total Shares: Outstanding shares

Float Shares: Tradeable shares and percentage of total

Free Cashflow: Cash generation and percentage of market cap

Employees: Total employee count

Shareholders: Number of shareholders

Sector/Industry: Business classification

Open GAP: Gap percentage from previous day

Analyst Ratings: Buy/Strong Buy/Hold/Sell/Strong Sell recommendations with totals

4. Earnings Table

Quarterly earnings history displaying:

Quarter: Year/Month of earnings

Standardized: Standardized EPS

Report: Actual reported EPS

Estimation: Analyst consensus estimate

Surprise: Beat/miss amount and percentage

Revenue: Actual quarterly revenue

Estimation: Revenue estimates

Surprise: Revenue beat/miss with percentage

Color-coded results (green for beats, red for misses)

5. Financial Analysis Table

Comprehensive fundamental analysis across multiple sections:

Income Statement:

Revenue (Quarterly)

Gross Profit with margin percentage

Operating Income with margin

Net Income with margin

Earnings Per Share (EPS)

Balance Sheet:

Total Assets

Total Liabilities

Shareholders Equity

Cash & Equivalents

Total Debt

Debt/Equity Ratio

Valuation Metrics:

Market Cap

Enterprise Value

EV/Revenue

Price/Book Ratio

Book Value per Share

Return on Equity (ROE)

Return on Assets (ROA)

Key Multipliers:

P/E Ratio

P/S Ratio

PEG Ratio

EV/EBITDA

Valuation Analysis:

Fair Value calculation using multiple methods

Current vs Fair Value percentage

Investment Rating (0-10 scale)

Long-term Outlook assessment

Warren Buffett Criteria:

ROE Quality (>15% target)

Debt Payoff Time (<3 years ideal)

Economic Moat score (0-6)

Owner Earnings with margin

Margin of Safety (>25% target)

Overall Buffett Score (0-5)

Settings Configuration

Moving Average Settings

Enable/Disable: Toggle each MA on/off

MA Type: Choose SMA or EMA for each line

Length: Set period for each MA (default: 10, 20, 50, 100, 150, 200)

Timeframe: Set specific timeframe for each MA

Colors: Customize each MA line color

Table Settings

Each table includes:

Show/Hide Toggle: Enable or disable individual tables

Position: Choose from 6 screen positions

Text Size: Auto, Tiny, Small, Normal, Large, or Huge

Colors: Customize table background, highlight, and text colors

Risk Management Settings

Account Size: Your trading capital

Risk Per Trade (%): Percentage to risk per position

Position Multiplier: Adjustment factor for position sizing

Stop Loss Level: Choose between ADR or Low of Day

ADR/ATR Length: Periods for volatility calculations

Usage Tips

Trend Analysis: Use moving averages to identify trend direction and strength. Price above all MAs suggests uptrend.

Position Sizing: Use the Risk Management table to calculate proper position size based on your risk tolerance.

Liquidity Check: Ensure the Liquidity Ratio is >1 (preferably >2) before entering large positions.

Earnings Analysis: Review earnings history for consistency and trend. Look for companies that consistently beat estimates.

Buffett Score: A score of 4-5 indicates a potential long-term value investment following Warren Buffett's principles.

Investment Rating: Scores above 7 suggest strong investment potential, while below 4 indicates caution.

Important Notes

Designed exclusively for stock market analysis

All recommendations are for educational purposes only

Best used in conjunction with personal research and risk tolerance

Data updates in real-time during market hours

Some financial metrics may not be available for all stocks (particularly pre-revenue companies)

Overview

Stocker++ is an advanced stock analysis indicator that combines technical trend analysis with fundamental company data to provide comprehensive investment insights. This all-in-one tool displays multiple moving averages for trend identification and presents detailed financial information through organized data tables, helping investors make informed decisions based on both price action and company fundamentals.

Key Features

1. Customizable Moving Averages

Up to 6 configurable moving averages (MA1-MA6)

Choice between Simple Moving Average (SMA) and Exponential Moving Average (EMA)

Individual color customization for each MA

Adjustable lengths, timeframes, and visibility toggles

Default setup includes 10, 20, and 50-period MAs for short to medium-term trend analysis

2. Risk Management Table

Displays critical position sizing and risk calculations:

Account Size: Your total trading capital

Risk Money: Dollar amount and percentage at risk per trade

Stop Loss: Calculated using either ATR or Low of Day

Shares to Buy: Optimal position size based on risk parameters

Position Size: Total dollar amount and percentage of account

Max Allowed Position: Maximum position based on liquidity constraints (Daily Volume ÷ 200)

Min Required Daily Vol: Minimum liquidity needed for your position size

Liquidity Ratio: How many times over the minimum liquidity requirement

Average Daily Volume ($): 20-day average dollar volume

Average Daily Shares Volume: 20-day average share volume

Relative Volume: Current volume compared to 20-day average

Volume Buzz: Percentage increase/decrease from average volume

3. Company Info Table

Essential company metrics and market data:

Change: Daily price change in dollars

ATR: Average True Range for volatility measurement

ADR: Average Daily Range percentage

LoD price/dist: Low of Day price and distance percentage

Market Cap: Total market capitalization

Total Shares: Outstanding shares

Float Shares: Tradeable shares and percentage of total

Free Cashflow: Cash generation and percentage of market cap

Employees: Total employee count

Shareholders: Number of shareholders

Sector/Industry: Business classification

Open GAP: Gap percentage from previous day

Analyst Ratings: Buy/Strong Buy/Hold/Sell/Strong Sell recommendations with totals

4. Earnings Table

Quarterly earnings history displaying:

Quarter: Year/Month of earnings

Standardized: Standardized EPS

Report: Actual reported EPS

Estimation: Analyst consensus estimate

Surprise: Beat/miss amount and percentage

Revenue: Actual quarterly revenue

Estimation: Revenue estimates

Surprise: Revenue beat/miss with percentage

Color-coded results (green for beats, red for misses)

5. Financial Analysis Table

Comprehensive fundamental analysis across multiple sections:

Income Statement:

Revenue (Quarterly)

Gross Profit with margin percentage

Operating Income with margin

Net Income with margin

Earnings Per Share (EPS)

Balance Sheet:

Total Assets

Total Liabilities

Shareholders Equity

Cash & Equivalents

Total Debt

Debt/Equity Ratio

Valuation Metrics:

Market Cap

Enterprise Value

EV/Revenue

Price/Book Ratio

Book Value per Share

Return on Equity (ROE)

Return on Assets (ROA)

Key Multipliers:

P/E Ratio

P/S Ratio

PEG Ratio

EV/EBITDA

Valuation Analysis:

Fair Value calculation using multiple methods

Current vs Fair Value percentage

Investment Rating (0-10 scale)

Long-term Outlook assessment

Warren Buffett Criteria:

ROE Quality (>15% target)

Debt Payoff Time (<3 years ideal)

Economic Moat score (0-6)

Owner Earnings with margin

Margin of Safety (>25% target)

Overall Buffett Score (0-5)

Settings Configuration

Moving Average Settings

Enable/Disable: Toggle each MA on/off

MA Type: Choose SMA or EMA for each line

Length: Set period for each MA (default: 10, 20, 50, 100, 150, 200)

Timeframe: Set specific timeframe for each MA

Colors: Customize each MA line color

Table Settings

Each table includes:

Show/Hide Toggle: Enable or disable individual tables

Position: Choose from 6 screen positions

Text Size: Auto, Tiny, Small, Normal, Large, or Huge

Colors: Customize table background, highlight, and text colors

Risk Management Settings

Account Size: Your trading capital

Risk Per Trade (%): Percentage to risk per position

Position Multiplier: Adjustment factor for position sizing

Stop Loss Level: Choose between ADR or Low of Day

ADR/ATR Length: Periods for volatility calculations

Usage Tips

Trend Analysis: Use moving averages to identify trend direction and strength. Price above all MAs suggests uptrend.

Position Sizing: Use the Risk Management table to calculate proper position size based on your risk tolerance.

Liquidity Check: Ensure the Liquidity Ratio is >1 (preferably >2) before entering large positions.

Earnings Analysis: Review earnings history for consistency and trend. Look for companies that consistently beat estimates.

Buffett Score: A score of 4-5 indicates a potential long-term value investment following Warren Buffett's principles.

Investment Rating: Scores above 7 suggest strong investment potential, while below 4 indicates caution.

Important Notes

Designed exclusively for stock market analysis

All recommendations are for educational purposes only

Best used in conjunction with personal research and risk tolerance

Data updates in real-time during market hours

Some financial metrics may not be available for all stocks (particularly pre-revenue companies)

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.