OPEN-SOURCE SCRIPT

True Hour Open

🧠 Why Count an Hour from 30th Minute to 30th Minute?

✅ Traditional Hour vs. Functional Hour

Traditional Time Logic: We’re used to viewing time in clean hourly chunks: 12:00 to 1:00, 1:00 to 2:00, and so on. This structure is fine for general purposes like clocks, meetings, and schedules.

Market Logic: Markets, however, don’t always respect these arbitrary human-made time divisions. Price action often develops momentum, structure, and transitions based on market participants' behavior, not on the clock.

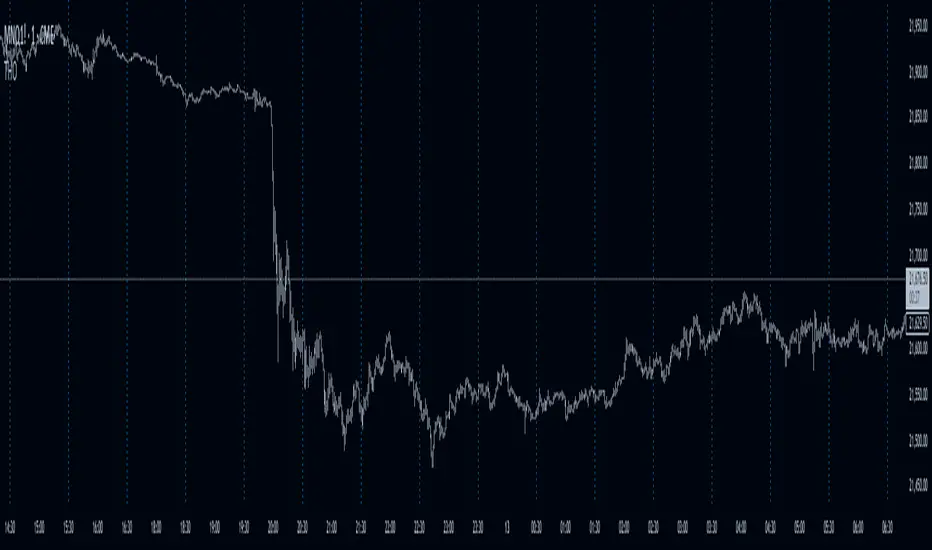

🛠 What the Indicator Does

Marks the start of each hour at the 30th minute past the hour (e.g., 1:30, 2:30, 3:30).

Can highlight or segment candles that fall within a “30-to-30” hourly window.

Optionally draws background shading, lines, or boxes to visually group candles from one 30-minute mark to the next.

This helps you:

Visually align your trading with more accurate price behavior windows.

Anchor time blocks around actual market rhythm, not artificial time slots.

Backtest and strategize based on how candles behave in these alternative hourly segments.

📈 Summary

Trading is about timing. But great trading is about timing that makes sense.

By redefining the hour from 30 to 30, you’re not changing time—you’re aligning with how price moves in time.

✅ Traditional Hour vs. Functional Hour

Traditional Time Logic: We’re used to viewing time in clean hourly chunks: 12:00 to 1:00, 1:00 to 2:00, and so on. This structure is fine for general purposes like clocks, meetings, and schedules.

Market Logic: Markets, however, don’t always respect these arbitrary human-made time divisions. Price action often develops momentum, structure, and transitions based on market participants' behavior, not on the clock.

🛠 What the Indicator Does

Marks the start of each hour at the 30th minute past the hour (e.g., 1:30, 2:30, 3:30).

Can highlight or segment candles that fall within a “30-to-30” hourly window.

Optionally draws background shading, lines, or boxes to visually group candles from one 30-minute mark to the next.

This helps you:

Visually align your trading with more accurate price behavior windows.

Anchor time blocks around actual market rhythm, not artificial time slots.

Backtest and strategize based on how candles behave in these alternative hourly segments.

📈 Summary

Trading is about timing. But great trading is about timing that makes sense.

By redefining the hour from 30 to 30, you’re not changing time—you’re aligning with how price moves in time.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.