PROTECTED SOURCE SCRIPT

Telah dikemas kini Pullback Indicator

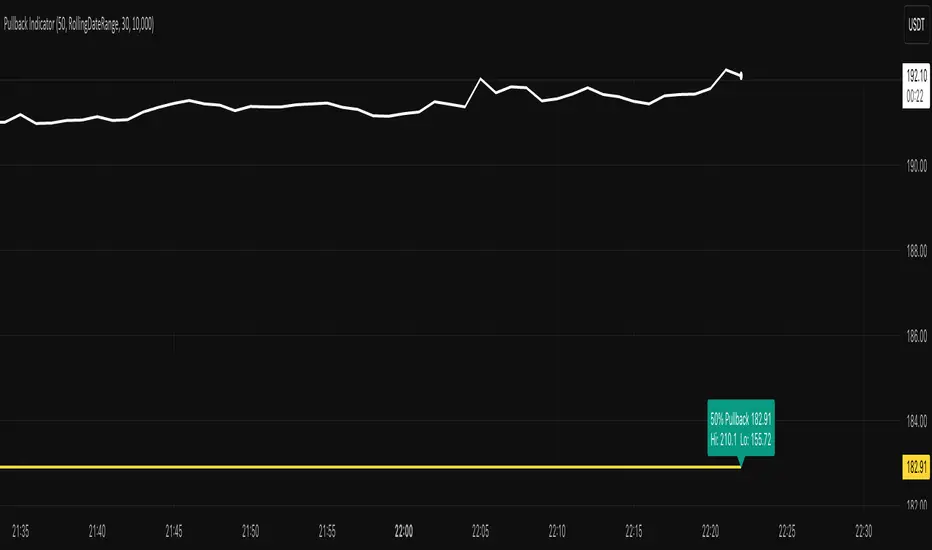

Pullback Indicator

Plots a retracement level between a detected swing High and Low at a user-defined % (e.g., 38.2, 50, 61.8).

Formula: Level = Low + (High − Low) × (Pullback % / 100).

Merging Y-Axis into one

Once you add this indicator to the chart, you will see two Y-axes (or two price scales). Right-click on the price scales on the right, select “Merge all scales into one,” and choose “On the right.”

Modes

• Rolling → High/Low from last N bars on the chart’s timeframe. Recomputed every bar. Good for intraday, fast-adapting ranges.

• RollingDateRange → High/Low from a calendar window (Daily context). Options:

• RollDays = last N calendar days

• or Use Fixed Start Date (window expands day by day)

• Exclude Forming Day = ignore today’s incomplete daily candle for stable intraday levels.

Levels update once per daily bar unless today is included.

Inputs

• Pullback %

• Range Mode (Rolling | RollingDateRange)

• Lookback (bars)

• RollDays / Fixed Start Date

• Exclude Forming Day

• Show Pullback Label

Why range choice matters

Peak & trough are subjective—different windows give different High/Low. Select your window based on trading horizon:

• Intraday → Rolling (bars)

• Swing/position → RollingDateRange (days/fixed date)

How often are High/Low recomputed?

• Rolling (bars):

Recomputed on every bar of the chart’s timeframe using the most recent lookbackBars window. Levels can change frequently.

• RollingDateRange (Daily context):

Computed once per daily bar for the configured calendar window.

• With Exclude Forming Day = ON, the High/Low only update after the prior daily bar closes.

• With it OFF, the current (forming) daily bar can update the High/Low intraday if it sets a new extreme.

⸻

Plots a retracement level between a detected swing High and Low at a user-defined % (e.g., 38.2, 50, 61.8).

Formula: Level = Low + (High − Low) × (Pullback % / 100).

Merging Y-Axis into one

Once you add this indicator to the chart, you will see two Y-axes (or two price scales). Right-click on the price scales on the right, select “Merge all scales into one,” and choose “On the right.”

Modes

• Rolling → High/Low from last N bars on the chart’s timeframe. Recomputed every bar. Good for intraday, fast-adapting ranges.

• RollingDateRange → High/Low from a calendar window (Daily context). Options:

• RollDays = last N calendar days

• or Use Fixed Start Date (window expands day by day)

• Exclude Forming Day = ignore today’s incomplete daily candle for stable intraday levels.

Levels update once per daily bar unless today is included.

Inputs

• Pullback %

• Range Mode (Rolling | RollingDateRange)

• Lookback (bars)

• RollDays / Fixed Start Date

• Exclude Forming Day

• Show Pullback Label

Why range choice matters

Peak & trough are subjective—different windows give different High/Low. Select your window based on trading horizon:

• Intraday → Rolling (bars)

• Swing/position → RollingDateRange (days/fixed date)

How often are High/Low recomputed?

• Rolling (bars):

Recomputed on every bar of the chart’s timeframe using the most recent lookbackBars window. Levels can change frequently.

• RollingDateRange (Daily context):

Computed once per daily bar for the configured calendar window.

• With Exclude Forming Day = ON, the High/Low only update after the prior daily bar closes.

• With it OFF, the current (forming) daily bar can update the High/Low intraday if it sets a new extreme.

⸻

Nota Keluaran

Pullback IndicatorPlots a retracement level between a detected swing High and Low at a user-defined % (e.g., 38.2, 50, 61.8).

Formula: Level = Low + (High − Low) × (Pullback % / 100).

Merging Y-Axis into one

Once you add this indicator to the chart, you will see two Y-axes (or two price scales). Right-click on the price scales on the right, select “Merge all scales into one,” and choose “On the right.”

Modes

• Rolling → High/Low from last N bars on the chart’s timeframe. Recomputed every bar. Good for intraday, fast-adapting ranges.

• RollingDateRange → High/Low from a calendar window (Daily context). Options:

• RollDays = last N calendar days

• or Use Fixed Start Date (window expands day by day)

• Exclude Forming Day = ignore today’s incomplete daily candle for stable intraday levels.

Levels update once per daily bar unless today is included.

Inputs

• Pullback %

• Range Mode (Rolling | RollingDateRange)

• Lookback (bars)

• RollDays / Fixed Start Date

• Exclude Forming Day

• Show Pullback Label

Why range choice matters

Peak & trough are subjective—different windows give different High/Low. Select your window based on trading horizon:

• Intraday → Rolling (bars)

• Swing/position → RollingDateRange (days/fixed date)

How often are High/Low recomputed?

• Rolling (bars):

Recomputed on every bar of the chart’s timeframe using the most recent lookbackBars window. Levels can change frequently.

• RollingDateRange (Daily context):

Computed once per daily bar for the configured calendar window.

• With Exclude Forming Day = ON, the High/Low only update after the prior daily bar closes.

• With it OFF, the current (forming) daily bar can update the High/Low intraday if it sets a new extreme.

Nota Keluaran

Pullback IndicatorPlots a retracement level between a detected swing High and Low at a user-defined % (e.g., 38.2, 50, 61.8).

Formula: Level = Low + (High − Low) × (Pullback % / 100).

Merging Y-Axis into one

Once you add this indicator to the chart, you will see two Y-axes (or two price scales). Right-click on the price scales on the right, select “Merge all scales into one,” and choose “On the right.” Also, please right-click again, select Labels -> make sure "Indicators and financials value label" is checked

Modes

• Rolling → High/Low from last N bars on the chart’s timeframe. Recomputed every bar. Good for intraday, fast-adapting ranges.

• RollingDateRange → High/Low from a calendar window (Daily context). Options:

• RollDays = last N calendar days

• or Use Fixed Start Date (window expands day by day)

• Exclude Forming Day = ignore today’s incomplete daily candle for stable intraday levels.

Levels update once per daily bar unless today is included.

Inputs

• Pullback %

• Range Mode (Rolling | RollingDateRange)

• Lookback (bars)

• RollDays / Fixed Start Date

• Exclude Forming Day

• Show Pullback Label

Why range choice matters

Peak & trough are subjective—different windows give different High/Low. Select your window based on trading horizon:

• Intraday → Rolling (bars)

• Swing/position → RollingDateRange (days/fixed date)

How often are High/Low recomputed?

• Rolling (bars):

Recomputed on every bar of the chart’s timeframe using the most recent lookbackBars window. Levels can change frequently.

• RollingDateRange (Daily context):

Computed once per daily bar for the configured calendar window.

• With Exclude Forming Day = ON, the High/Low only update after the prior daily bar closes.

• With it OFF, the current (forming) daily bar can update the High/Low intraday if it sets a new extreme.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.