Reversal Probability Zone & Levels [LuxAlgo]The Reversal Probability Zone & Levels tool allows traders to identify a zone starting from the last detected reversal to highlight the probability of where the next reversal would be from a price and time perspective.

Price and time levels within the zone are displayed for up to 4 percentiles defined by the user.

🔶 USAGE

By default, the tool displays a zone with the 25th, 50th, 75th and 90th percentiles on both the price and time axis, indicating where, when and how many of the past reversals have occurred.

Traders can select the length for swing detection and the maximum number of reversals for probability calculations. The tool considers both bullish and bearish reversals separately, which means that if the last reversal was a swing high, the zone would show the probabilities for the last defined Maximum reversals

The Maximum reversals value has a direct impact on the probabilities, the more data traders use the more significant the result, probabilities over 10 occurrences are far weak compared to probabilities over 1000 occurrences.

🔹 Percentiles

Traders can fine-tune the percentile parameters in the settings panel.

A given percentile means that the number of occurrences in the data set is less than or equal to the percentile.

In English, this means

Percentile 20th: 20% of the occurrences are less than or equal to this value, so 80% of the occurrences are greater than this value.

Percentile 50th: 50% of the occurrences are below and 50% are above this value.

Percentile 80th: 80% of occurrences are lower than or equal to this value, so 20% of occurrences are greater than this value.

🔹 Normalize data

The Normalize Data feature allows traders to make an apples to apples comparison when we have a lot of historical data on high timeframe charts, using returns between swings instead of raw price.

🔹 Display Style

By default, the tool has the No overlapping feature enabled to display a clean chart, traders can turn it off, but this can fill the chart with too much information and barely see the price.

Traders can enable/disable settings to show only the last zone and the swing markers on the chart.

🔶 SETTINGS

Swing Length: The maximum length in bars used to identify a swing

Maximum Reversals: Maximum number of reversals included in calculations

Normalize Data: Use returns between swings instead of raw price

Percentiles: Enable/disable each of the four percentiles and select the percentile number, line style, colors, and size

🔹 Style

No Overlapping Zones: Enable or disable the No overlap between zones feature

Show Only Last Zone: Enable/disable display of last zone only

Show Marks: Enable/disable reversal markers

Luxalgo

Volume Zones Internal Visualizer [LuxAlgo]The Volume Zones Internal Visualizer is an alternate candle type intended to reveal lower timeframe volume activity while on a higher timeframe chart.

It displays the candle's range, the highest and lowest zones of accumulated volume throughout the candle, and the Lower Timeframe (LTF) candle close, which contained the most volume in the session (Candle Session).

🔶 USAGE

The indicator is intended to be used as its own independent candle type. It is not a replacement for traditional candlesticks; however, it is recommended that you hide the chart's display when using this indicator. Another option is to display this indicator in an additional pane alongside the normal chart, as displayed above.

The display consists of candle ranges represented by outlined boxes, within the ranges you will notice a transparent-colored zone, a solid-colored zone, and a line.

Each of these displays different points of volume-related information from an analysis of LTF data.

In addition to this analysis, the indicator also locates the LTF candle with the highest volume, and displays its close represented by the line. This line is considered as the "Peak Activity Level" (PAL), since throughout the (HTF) candle session, this candle's close is the outcome of the most volume transacted at the time.

We are further tracking these PALs by continuing to extend them into the future, looking towards them for potential further interaction. Once a PAL is crossed, we are removing it from display as it has been mitigated.

🔶 DETAILS

The indicator aggregates the volume data from each LTF candle and creates a volume profile from it; the number of rows in the profile is determined by the "Row Size" setting.

With this profile, it locates and displays the highest (solid area) and lowest (transparent area) volume zones from the profile created.

🔶 SETTINGS

Row Size: Sets the number of rows used for the calculation of the volume profile based on LTF data.

Intrabar Timeframe: Sets the Lower Timeframe to use for calculations.

Show Last Unmitigated PALs: Choose how many Unmitigated PALs to extend.

Style: Toggle on and off features, as well as adjust colors for each.

Market Performance by Yearly Seasons [LuxAlgo]The Market Performance by Yearly Seasons tool allows traders to analyze the average returns of the four seasons of the year and the raw returns of each separate season.

🔶 USAGE

By default, the tool displays the average returns for each season over the last 10 years in the form of bars, with the current session highlighted as a bordered bar.

Traders can choose to display the raw returns by year for each season separately and select the maximum number of seasons (years) to display.

🔹 Hemispheres

Traders can select the hemisphere in which they prefer to view the data.

🔹 Season Types

Traders can select the type of seasons between meteorological (by default) and astronomical.

The meteorological seasons are as follows:

Autumn: months from September to November

Winter: months from December to February

Spring: months from March to May

Summer: months from June to August

The astronomical seasons are as follows:

Autumn: from the equinox on September 22

Winter: from the solstice on December 21

Spring: from the equinox on March 20

Summer: from the solstice on June 21

🔹 Displaying the data

Traders can choose between two display modes, average returns by season or raw returns by season and year.

🔶 SETTINGS

Max seasons: Maximum number of seasons

Hemisphere: Select NORTHERN or SOUTHERN hemisphere

Season Type: Select the type of season - ASTRONOMICAL or METEOROLOGICAL

Display: Select display mode, all four seasons, or any one of them

🔹 Style

Bar Size & Autofit: Select the size of the bars and enable/disable the autofit feature

Labels Size: Select the label size

Colors & Gradient: Select the default color for bullish and bearish returns and enable/disable the gradient feature

Machine Learning Moving Average [LuxAlgo]The Machine Learning Moving Average (MLMA) is a responsive moving average making use of the weighting function obtained Gaussian Process Regression method. Characteristic such as responsiveness and smoothness can be adjusted by the user from the settings.

The moving average also includes bands, used to highlight possible reversals.

🔶 USAGE

The Machine Learning Moving Average smooths out noisy variations from the price, directly estimating the underlying trend in the price.

A higher "Window" setting will return a longer-term moving average while increasing the "Forecast" setting will affect the responsiveness and smoothness of the moving average, with higher positive values returning a more responsive moving average and negative values returning a smoother but less responsive moving average.

Do note that an excessively high "Forecast" setting will result in overshoots, with the moving average having a poor fit with the price.

The moving average color is determined according to the estimated trend direction based on the bands described below, shifting to blue (default) in an uptrend and fushia (default) in downtrends.

The upper and lower extremities represent the range within which price movements likely fluctuate.

Signals are generated when the price crosses above or below the band extremities, with turning points being highlighted by colored circles on the chart.

🔶 SETTINGS

Window: Calculation period of the moving average. Higher values yield a smoother average, emphasizing long-term trends and filtering out short-term fluctuations.

Forecast: Sets the projection horizon for Gaussian Process Regression. Higher values create a more responsive moving average but will result in more overshoots, potentially worsening the fit with the price. Negative values will result in a smoother moving average.

Sigma: Controls the standard deviation of the Gaussian kernel, influencing weight distribution. Higher Sigma values return a longer-term moving average.

Multiplicative Factor: Adjusts the upper and lower extremity bounds, with higher values widening the bands and lowering the amount of returned turning points.

🔶 RELATED SCRIPTS

Machine-Learning-Gaussian-Process-Regression

SuperTrend-AI-Clustering

Multi Timeframe Market Formation [LuxAlgo]The Multi Timeframe Market Formation tool allows traders to analyze up to 6 different timeframes simultaneously to discover their current formation, S/R levels and their degree of synchronization with the current chart timeframe. Multi timeframe analysis made easy.

🔶 USAGE

By default, the tool displays the chart's timeframe formation plus up to 5 other formations on timeframes higher than the one in the chart.

When the chart formation is synchronized with any enabled timeframe formation, the tool displays labels and a trailing channel, it uses a gradient by default, so the more timeframes are synchronized, the more visible the labels and the trailing channel are.

All timeframes enabled in the settings panel must be higher than the chart timeframe, otherwise the tool will display an error message.

🔹 Formations

A formation is a market structure defined by a lower and an upper boundary (also known as support & resistance).

Each formation has a different symbol and color to identify it at a glance.

It helps traders to know the current market behavior and the tool displays up to 5 of them.

BULLISH (green ▲): higher high and higher low

BEARISH (red ▼): lower high and lower low

CONTRACTION (orange ◀): lower high and higher low

EXPANSION (blue ▶): higher high and lower low

SIDEWAYS (yellow ◀): Any that does not fit with the others

🔹 Multi Timeframe Formations

The tool displays up to 6 different timeframe formations, the chart timeframe plus 5 more configurable from the settings panel.

Each of them has an upper and lower limit, a timeframe, a color and an icon.

If a bound level is shared by more than one formation, the timeframes and symbols are displayed on the same line.

These are significant levels shared by different timeframes and traders need to be aware of them.

🔹 Sync With Chart Timeframe

If the current formation on the chart timeframe is in sync with any of the timeframes enabled in the settings panel, the tool will display this on the chart.

The more timeframes are in sync, the more they are visible, providing a clear visual representation of the common market behavior on multiple timeframes at the same time.

🔶 SETTINGS

Formation size: Size of market formations on the chart timeframe

🔹 Timeframes

TF1 to TF5: Activate/deactivate timeframe, set size of market formation and activate/deactivate high and low levels

🔹 Style

Show Labels: Enable/Disable Timeframe Sync Labels

Transparency Gradient: Enable/Disable Transparency Gradient

Show Trailing Channel | Multiplier: Enable/Disable Trailing Channel and set multiplier

Color for each formation

Swing Structure Scanner [LuxAlgo]The Swing Structure Scanner Indicator is a dashboard type indicator which displays a Consolidated "High/Low-Only" view of swing structure, with the capability to retrieve and display swing points from up to 6 different tickers and timeframes at once.

🔶 USAGE

This indicator displays swing structure data from up to 6 unique tickers or timeframes; Each graph represents the current swing structure retrieved from the requested chart/s.

Each swing graph displays the current live swing point positioning relative to the previous swing points. By analyzing the different formations, patterns can more easily be recognized and found across multiple tickers or timeframes at once.

This indicator serves as a nifty tool for confluence recognition, whether that's confluence throughout market tickers, or confluence through higher timeframes on the same ticker.

Alternatively, viewing the relative positioning of each swing point to each other, should give a clearer idea when higher lows or lower highs are formed. This can potentially indicate a newly forming trend, as well as serving as a warning to watch for breakouts.

The swing length can be changed to align with each individual's strategy, as well as a display look back can be adjusted to show more or less swing points at one time.

The display is fairly customizable, it is not fixed to 6 symbols at all times and can be minimized to only display the number of symbols needed; Additionally, the display can be set to vertical mode or horizontal(default) to utilize as needed.

Note: Hover over the swing point in the dashboard to get a readout of the exact price level of the swing point.

🔶 SETTINGS

Swing Length: Set the swing length for the structure calculations.

Swing Display Lookback: Sets the number of swing points (Pairs) to display in each Swing Graph display.

Symbols: Sets the Timeframe and Symbol for each Swing Graph.

Vertical Display: Display the Swing Graphs up and down, rather than side to side.

Scaling Factor: Scales the entire indicator up or down, to fit your needs.

Fibonacci Confluence Toolkit [LuxAlgo]The Fibonacci Confluence Toolkit is a technical analysis tool designed to help traders identify potential price reversal zones by combining key market signals and patterns. It highlights areas of interest where significant price action or reactions are anticipated, automatically applies Fibonacci retracement levels to outline potential pullback zones, and detects engulfing candle patterns.

Its unique strength lies in its reliance solely on price patterns, eliminating the need for user-defined inputs, ensuring a robust and objective analysis of market dynamics.

🔶 USAGE

The script begins by detecting CHoCH (Change of Character) points—key indicators of shifts in market direction. This script integrates the principles of pure price action as applied in Pure-Price-Action-Structures , where further details on the detection process can be found.

The detected CHoCH points serve as the foundation for defining an Area of Interest (AOI), a zone where significant price action or reactions are anticipated.

As new swing highs or lows emerge within the AOI, the tool automatically applies Fibonacci retracement levels to outline potential retracement zones. This setup enables traders to identify areas where price pullbacks may occur, offering actionable insights into potential entries or reversals.

Additionally, the toolkit highlights engulfing candle patterns within these zones, further refining entry points and enhancing confluence for better-informed trading decisions based on real-time trend dynamics and price behavior.

🔶 SETTINGS

🔹 Market Patterns

Bullish Structures: Enable or disable all bullish components of the indicator.

Bearish Structures: Enable or disable all bearish components of the indicator.

Highlight Area of Interest: Toggle the option to highlight the Areas of Interest (enabled or disabled).

CHoCH Line: Choose the line style for the CHoCH (Solid, Dashed, or Dotted).

Width: Adjust the width of the CHoCH line.

🔹 Retracement Levels

Choose which Fibonacci retracement levels to display (e.g., 0, 0.236, 0.382, etc.).

🔹 Swing Levels & Engulfing Patterns

Swing Levels: Select how swing levels are marked (symbols like ◉, △▽, or H/L).

Engulfing Candle Patterns: Choose which engulfing candle patterns to detect (All, Structure-Based, or Disabled).

🔶 RELATED SCRIPTS

Pure-Price-Action-Structures.

Horns Pattern Identifier with alertsUpdated version of LuxAlgo indicator to add the ability to change the displayed line widths and to raise alerts when the pattern is detected.

The original indicator and it's history are at

Their description:

The following script detects regular and inverted horn patterns. Detected patterns are displayed alongside their respective confirmation and take profit levels derived from the pattern measure rule. Breakout of the confirmation levels are highlighted with labels.

Breakaway Fair Value Gaps [LuxAlgo]The Breakaway Fair Value Gap (FVG) is a typical FVG located at a point where the price is breaking new Highs or Lows.

🔶 USAGE

In the screenshot above, the price range is visualized by Donchian Channels.

In theory, the Breakaway FVGs should generally be a good indication of market participation, showing favor in the FVG's breaking direction. This is a combination of buyers or sellers pushing markets quickly while already at the highest high or lowest low in recent history.

While this described reasoning seems conventional, looking into it inversely seems to reveal a more effective use of these formations.

When the price is pushed to the extremities of the current range, the price is already potentially off balance and over-extended. Then an FVG is created, extending the price further out of balance.

With this in consideration, After identifying a Breakaway FVG, we could logically look for a reversion to re-balance the gap.

However, it would be illogical to believe that the FVG will immediately mitigate after formation. Because of this, the dashboard display for this indicator shows the analysis for the mitigation likelihood and timeliness.

In the example above, the information in the dashboard would read as follows (Bearish example):

Out of 949 Bearish Breakaway FVGs, 80.19% are shown to be mitigated within 60 bars, with the average mitigation time being 13 bars.

The other 19.81% are not mitigated within 60 bars. This could mean the FVG was mitigated after 60 bars, or it was never mitigated.

The unmitigated FVGs within the analysis window will extend their mitigation level to the current bar. We can see the number of bars since the formation is represented to the right of the live mitigation level.

Utilizing the current distance readout helps to better judge the likelihood of a level being mitigated.

Additionally, when considering these mitigation levels as targets, an additional indicator or analysis can be used to identify specific entries, which would further aid in a system's reliability.

🔶 SETTINGS

Trend Length: Sets the (DC) Trend length to use for Identifying Breakaway FVGs.

Show Mitigation Levels: Optionally hide mitigation levels if you would prefer only to see the Breakaway FVGs.

Maximum Duration: Sets the analysis duration for FVGs, Past this length in bars, the FVG is counted as "Un-Mitigated".

Show Dashboard: Optionally hide the dashboard.

Use Median Duration: Display the Median of the Bar Length data set rather than the Average.

Weekly Stacked Daily Changes [LuxAlgo]The Weekly Stacked Daily Changes tool allows traders to compare daily net price changes for each day of the week, stacked by week. It provides a very convenient way to compare daily and weekly volatility at the same time.

🔶 USAGE

The tool requires no configuration and works perfectly out of the box, displaying the net price change for each day of the week as stacked boxes of the appropriate size.

Traders can adjust the width of the columns and the spacing between days and weeks, options to change the color and disable the months and new month lines are also available.

🔹 Bottom Stack Bias

This feature allows traders to compare weekly volatility in two different ways.

With this feature disabled, all weeks use zero as the bottom of the stack, so traders can see at a glance weeks with more volatility and weeks with less volatility.

Enabling this feature will cause the tool to display the stacks with the weekly net price change as the bottom, so if a stack starts below the zero line it means that week has a negative net return, and if it starts above the zero line it means that week has a positive net return.

🔶 SETTINGS

Width: Select the fixed width for each column.

Offset: Choose the fixed width between each column.

Spacing: Select the distance between each day within each column.

🔹 Style

Bottom Stack Bias: Use weekly net price change as the bottom of the stack.

Bullish Change: Color for days with positive net price change

Bearish Change: Color for days with negative net price change

Show Months: Under each week stack, display the month

Show Months Delimiter: Display a line indicating the start of a new month

Crypto Wallets Profitability & Performance [LuxAlgo]The Crypto Wallets Profitability & Performance indicator provides a comprehensive view of the financial status of cryptocurrency wallets by leveraging on-chain data from IntoTheBlock. It measures the percentage of wallets profiting, losing, or breaking even based on current market prices.

Additionally, it offers performance metrics across different timeframes, enabling traders to better assess market conditions.

This information can be crucial for understanding market sentiment and making informed trading decisions.

🔶 USAGE

🔹 Wallets Profitability

This indicator is designed to help traders and analysts evaluate the profitability of cryptocurrency wallets in real-time. It aggregates data gathered from the blockchain on the number of wallets that are in profit, loss, or breaking even and presents it visually on the chart.

Breaking even line demonstrates how realized gains and losses have changed, while the profit and the loss monitor unrealized gains and losses.

The signal line helps traders by providing a smoothed average and highlighting areas relative to profiting and losing levels. This makes it easier to identify and confirm trading momentum, assess strength, and filter out market noise.

🔹 Profitability Meter

The Profitability Meter is an alternative display that visually represents the percentage of wallets that are profiting, losing, or breaking even.

🔹 Performance

The script provides a view of the financial health of cryptocurrency wallets, showing the percentage of wallets in profit, loss, or breaking even. By combining these metrics with performance data across various timeframes, traders can gain valuable insights into overall wallet performance, assess trend strength, and identify potential market reversals.

🔹 Dashboard

The dashboard presents a consolidated view of key statistics. It allows traders to quickly assess the overall financial health of wallets, monitor trend strength, and gauge market conditions.

🔶 DETAILS

🔹 The Chart Occupation Option

The chart occupation option adjusts the occupation percentage of the chart to balance the visibility of the indicator.

🔹 The Height in Performance Options

Crypto markets often experience significant volatility, leading to rapid and substantial gains or losses. Hence, plotting performance graphs on top of the chart alongside other indicators can result in a cluttered display. The height option allows you to adjust the plotting for balanced visibility, ensuring a clearer and more organized chart.

🔶 SETTINGS

The script offers a range of customizable settings to tailor the analysis to your trading needs.

Chart Occupation %: Adjust the occupation percentage of the chart to balance the visibility of the indicator.

🔹 Profiting Wallets

Profiting Percentage: Toggle to display the percentage of wallets in profit.

Smoothing: Adjust the smoothing period for the profiting percentage line.

Signal Line: Choose a signal line type (SMA, EMA, RMA, or None) to overlay on the profiting percentage.

🔹 Losing Wallets

Losing Percentage: Toggle to display the percentage of wallets in loss.

Smoothing: Adjust the smoothing period for the losing percentage line.

Signal Line: Choose a signal line type (SMA, EMA, RMA, or None) to overlay on the losing percentage.

🔹 Breaking Even Wallets

Breaking-Even Percentage: Toggle to display the percentage of wallets breaking even.

Smoothing: Adjust the smoothing period for the breaking-even percentage line.

🔹 Profitability Meter

Profitability Meter: Enable or disable the meter display, set its width, and adjust the offset.

🔹 Performance

Performance Metrics: Choose the timeframe for performance metrics (Day to Date, Week to Date, etc.).

Height: Adjust the height of the chart visuals to balance the visibility of the indicator.

🔹 Dashboard

Block Profitability Stats: Toggle the display of profitability stats.

Performance Stats: Toggle the display of performance stats.

Dashboard Size and Position: Customize the size and position of the performance dashboard on the chart.

🔶 RELATED SCRIPTS

Market-Sentiment-Technicals

Multi-Chart-Widget

High/Low Location Frequency [LuxAlgo]The High/Low Location Frequency tool provides users with probabilities of tops and bottoms at user-defined periods, along with advanced filters that offer deep and objective market information about the likelihood of a top or bottom in the market.

🔶 USAGE

There are four different time periods that traders can select for analysis of probabilities:

HOUR OF DAY: Probability of occurrence of top and bottom prices for each hour of the day

DAY OF WEEK: Probability of occurrence of top and bottom prices for each day of the week

DAY OF MONTH: Probability of occurrence of top and bottom prices for each day of the month

MONTH OF YEAR: Probability of occurrence of top and bottom prices for each month

The data is displayed as a dashboard, which users can position according to their preferences. The dashboard includes useful information in the header, such as the number of periods and the date from which the data is gathered. Additionally, users can enable active filters to customize their view. The probabilities are displayed in one, two, or three columns, depending on the number of elements.

🔹 Advanced Filters

Advanced Filters allow traders to exclude specific data from the results. They can choose to use none or all filters simultaneously, inputting a list of numbers separated by spaces or commas. However, it is not possible to use both separators on the same filter.

The tool is equipped with five advanced filters:

HOURS OF DAY: The permitted range is from 0 to 23.

DAYS OF WEEK: The permitted range is from 1 to 7.

DAYS OF MONTH: The permitted range is from 1 to 31.

MONTHS: The permitted range is from 1 to 12.

YEARS: The permitted range is from 1000 to 2999.

It should be noted that the DAYS OF WEEK advanced filter has been designed for use with tickers that trade every day, such as those trading in the crypto market. In such cases, the numbers displayed will range from 1 (Sunday) to 7 (Saturday). Conversely, for tickers that do not trade over the weekend, the numbers will range from 1 (Monday) to 5 (Friday).

To illustrate the application of this filter, we will exclude results for Mondays and Tuesdays, the first five days of each month, January and February, and the years 2020, 2021, and 2022. Let us review the results:

DAYS OF WEEK: `2,3` or `2 3` (for crypto) or `1,2` or `1 2` (for the rest)

DAYS OF MONTH: `1,2,3,4,5` or `1 2 3 4 5`

MONTHS: `1,2` or `1 2`

YEARS: `2020,2021,2022` or `2020 2021 2022`

🔹 High Probability Lines

The tool enables traders to identify the next period with the highest probability of a top (red) and/or bottom (green) on the chart, marked with two horizontal lines indicating the location of these periods.

🔹 Top/Bottom Labels and Periods Highlight

The tool is capable of indicating on the chart the upper and lower limits of each selected period, as well as the commencement of each new period, thus providing traders with a convenient reference point.

🔶 SETTINGS

Period: Select how many bars (hours, days, or months) will be used to gather data from, max value as default.

Execution Window: Select how many bars (hours, days, or months) will be used to gather data from

🔹 Advanced Filters

Hours of day: Filter which hours of the day are excluded from the data, it accepts a list of hours from 0 to 23 separated by commas or spaces, users can not mix commas or spaces as a separator, must choose one

Days of week: Filter which days of the week are excluded from the data, it accepts a list of days from 1 to 5 for tickers not trading weekends, or from 1 to 7 for tickers trading all week, users can choose between commas or spaces as a separator, but can not mix them on the same filter.

Days of month: Filter which days of the month are excluded from the data, it accepts a list of days from 1 to 31, users can choose between commas or spaces as separator, but can not mix them on the same filter.

Months: Filter months to exclude from data. Accepts months from 1 to 12. Choose one separator: comma or space.

Years: Filter years to exclude from data. Accepts years from 1000 to 2999. Choose one separator: comma or space.

🔹 Dashboard

Dashboard Location: Select both the vertical and horizontal parameters for the desired location of the dashboard.

Dashboard Size: Select size for dashboard.

🔹 Style

High Probability Top Line: Enable/disable `High Probability Top` vertical line and choose color

High Probability Bottom Line: Enable/disable `High Probability Bottom` vertical line and choose color

Top Label: Enable/disable period top labels, choose color and size.

Bottom Label: Enable/disable period bottom labels, choose color and size.

Highlight Period Changes: Enable/disable vertical highlight at start of period

Swing Breakout Sequence [LuxAlgo]The Swing Breakout Sequence tool enables traders to identify a directional price action scalping sequence comprising two unsuccessful breakouts in the same direction, with the expectation of a third.

🔶 USAGE

This sequence looks for pressure on one side of a swing zone.

The market tried to break out of the zone twice but failed. This led to a pullback into the zone after each attempt. Once a reversal inside the zone is identified, the sequence is complete. It is expected that the market will move from the final reversal within the zone to the final breakout attempt outside the zone.

The sequence of price action is as follows:

Point 1: Breakout attempt out of the swing zone

Point 2: Pullback into the zone

Point 3: Breakout attempt out of Point 1

Point 4: Pullback into the zone, tapping into Point 2 liquidity

Point 5: Reversal structure with Point 4 in the form of a double top or double bottom

This sequence assumes traders will be caught off-guard when they try to capitalize on the initial breakout at Point 1, which is likely to result in a loss. If the breakout at Point 3 fails, all traders will be caught out and switch positions.

If there is enough pressure in the swing zone to cause a reversal at Point 5, the trapped traders could be the start of the next breakout attempt.

🔹 Sequence Detection

Traders can define sequence behavior and adjust detection with three parameters from the Settings panel.

Disabling Points 4 and 5 will detect the most uncompleted sequences.

🔹 Showing/Hiding Elements

Traders can change the look of sequences by showing or hiding their parts using the Style settings.

🔶 SETTINGS

Swing Length: Number of candles to confirm a swing high or swing low. A higher number detects larger swings.

Internal Length: Number of candles to confirm a internal high or internal low. A lower number detects smaller swings. It must be the same size or smaller than the swing length.

🔹 Detection

Point 4 Beyond Point 2: It only detects sequences where Point 4 is beyond Point 2.

Show Point 5: Enable/disable Point 5 detection.

Require Equal H/L at Point 5: Enable/Disable double top/bottom detection at Point 5 within a given threshold. A bigger value detects more sequences.

🔹 Style

Show Sequence Path: Enable/disable a line between sequence points.

Show Boxes: Enable/disable colored boxes for each sequence.

Show Lines: Enable/disable horizontal lines from each point of the sequence.

Default Color: Define the color or enable/disable auto color.

Liquidity Pools [LuxAlgo]The Liquidity Pools indicator identifies and displays estimated liquidity pools on the chart by analyzing high and low wicked price areas, along with the amount, and frequency of visits to each zone.

🔶 USAGE

Liquidity Pools are areas where smaller participants are likely to place stop-limit orders to manage risks at reasonable swing points. These zones attract institutional traders who use the pending orders as liquidity to enter larger positions, aiming to influence price movements. By monitoring these zones, traders can anticipate market movements and potentially benefit from these dynamics.

Beyond general liquidity theory, identifying zones consistently visited by price aids in using them as support and resistance zones. By analyzing these areas, we can assess how effectively participants enter or exit these zones, helping to gauge their importance.

In the screenshots below, we will explore both sides of the same chart in more detail to display how each zone could be viewed from a bullish and bearish perspective.

Bullish Zones Example:

Bearish Zones Example:

🔶 DETAILS

The method behind this indicator focuses on identifying a swing point and tracking future interactions with it. It adaptively identifies high and low "potential zones". These zones are monitored over time; if a zone meets the user-defined criteria, the script marks and displays these zones on the chart.

🔹 Identification

The method to identify Liquidity Pools in this indicator revolves around 3 main parameters. By utilizing these settings, the indicator can be tailored to produce zones that fit the specific strategic needs of each trader.

Zone Identification Parameters

Zone Contact Amount: This setting determines the number of times each zone must be in contact with the price (and bought or sold out of) before being identified by the indicator as a Liquidity Pool.

For example: When a zone is first displayed, it is considered as having been reached 1 time. When the zone is re-tested for the first time, this is considered the 2nd contact, since the price has seen the zone a total of 2 times.

Bars Required Between Each Contact: This is used to rule out (or in) consecutive candles reaching each zone from the calculation, adding a separation length between zone contact points to refine the zones produced.

For example: When set to "2", the first contact point (first re-test) will be ignored by the script if it is not at least 2 bars away from the initial zone proposal point.

Confirmation Bars: After a zone has reached the desired Contact Amount, this setting will cause the script to wait a specified number of bars before identifying a zone. While this might initially seem counterintuitive, by waiting, we are able to watch the market's reaction to the proposed zone and respond accordingly. If the price were to continue through the potential liquidity zone Immediately, it would not be logical to consider this area as a valid Liquidity Pool.

Displayed in this screenshot, you will see the specific points we are looking for in order to identify these zones.

🔹 Display

After a Liquidity Pool is identified, its boundary line is extended to the current price to keep it in view for reference. This extension will continue until the zone is mitigated (price has closed above or below the zone), after which it will stop extending.

Candles can optionally be colored when returning to the most recent Liquidity Pool if it is still unmitigated, and will only color after the zone is displayed on the chart. Because of this, if a candle is colored within a zone, then its color comes from being inside a previously unmitigated zone.

🔹 Volume

Each time a candle overlaps an Unmitigated Zone, a percentage of its volume will be accumulated to the total for each specific zone. The volume total is displayed on the right end of the extended boundary lines.

This volume data could help to determine the importance of specific zones based on the amount of volume traded within.

Note: This volume is fractional to the percentage of candles that are contained within the zone. If a candle is 50% within a zone, The zone will receive 50% of the candle's volume added to its current total.

🔶 SETTINGS

See above for a more detailed explanation of the "Zone Identification" parameters.

Zone Contact Amount: The number of times the price must bounce from this zone before considering it as a liquidity pool.

Bars Required Between Each Contact: The number of bars to wait before checking for another zone contact.

Confirmation Bars: The number of bars to wait before identifying a zone to confirm validity.

Display Volume Labels: Toggles the display for the volume readout for each Liquidity Pool.

Fill Candles Inside Zones: Toggles the display of colored candles within Liquidity Pools.

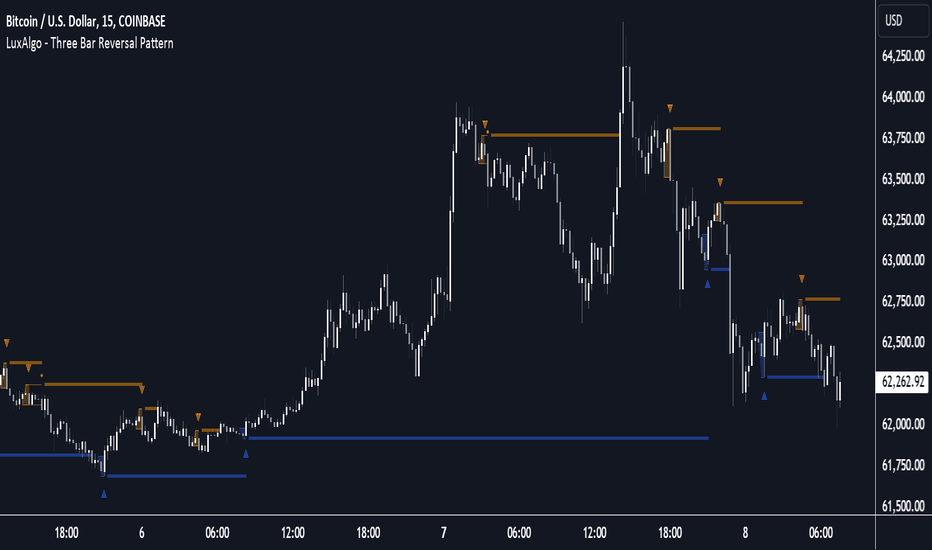

Three Bar Reversal Pattern [LuxAlgo]The Three Bar Reversal Pattern indicator identifies and highlights three bar reversal patterns on the user price chart.

The script also provides an option for incorporating various trend indicators used to filter out detected signals, allowing them to enhance their accuracy and help obtain a more comprehensive analysis.

🔶 USAGE

The script automates the detection of three-bar reversal patterns and provides a clear, visually identifiable signal for potential trend reversals.

When a reversal chart pattern is confirmed and price action aligns with the pattern, the pattern's boundaries are extended, forming levels, with the upper boundary often acting as a resistance and the lower boundary as a support.

The script allows users to filter patterns based on a specific trend direction detected by multiple trend indicators. Users can choose to view patterns that are either aligned with the detected trend or opposite to it.

Included trend indicators are: Moving Average Cloud, Supertrend, and Donchian Channels.

🔶 DETAILS

The three-bar reversal pattern is a technical analysis pattern that signals a potential reversal in the prevailing trend. The pattern consists of three consecutive bar formations:

First Bar and Second Bar: 2 consecutive of the same sentiment, representing the prevailing trend in the market.

Third Bar: Confirms the reversal by closing beyond the high or low of the first bar, signaling a potential change in market sentiment.

Various types of three-bar reversal patterns are documented. The script supports two main types:

Normal Pattern: Detects three-bar reversal patterns without requiring the third bar closing price to surpass the high (bullish pattern) or low (bearish pattern) of the first bar. It identifies basic formations signaling potential trend reversals.

Enhanced Pattern: Specifically identifies three-bar reversal patterns where the third bar closing price surpasses the high (bullish pattern) or low (bearish pattern) of the first bar. This type provides a more selective signal for stronger trend reversals.

🔶 SETTINGS

Pattern Type: Users can choose the type of 3-bar reversal patterns to detect: Normal, Enhanced, or All. "Normal" detects patterns that do not necessarily surpass the high/low of the first bar. "Enhanced" detects patterns where the third bar surpasses the high/low of the first bar. "All" detects both Normal and Enhanced patterns.

Derived Support and Resistance: Toggles the visibility of the support and resistance levels/zones.

🔹 Trend Filtering

Filtering: Allows users to filter patterns based on the trend indicators: Moving Average Cloud, Supertrend, and Donchian Channels. The "Aligned" option only detects patterns that align with the trend and conversely, the "Opposite" option detects patterns that go against the trend.

🔹 Trend Indicator Settings

Moving Average Cloud: Allows traders to choose the type of moving averages (SMA, EMA, HMA, etc.) and set the lengths for fast and slow-moving averages.

Supertrend: Options to set the ATR length and factor for Supertrend.

Donchian Channels: Option to set the length for the channel calculation.

🔶 RELATED SCRIPTS

Reversal-Candlestick-Structure .

Reversal-Signals .

FVG Channel [LuxAlgo]The FVG Channel indicator displays a channel constructed from the averages of unmitigated historical fair value gaps (FVG), allowing to identify trends and potential reversals in the market.

Users can control the amount of FVGs to consider for the calculation of the channels, as well as their degree of smoothness through user settings.

🔶 USAGE

The FVG Channel is constructed by averaging together recent unmitigated Bullish FVGs (contributing to the creation of the upper bands), and Bearish unmitigated FVGs (contributing to the creation of the lower bands) within a lookback determined by the user. A higher lookback will return longer-term indications from the indicator.

The channel includes 5 bands, with one upper and one lower outer extremities, as well as an inner series of values determined using the Fibonacci ratios (respectively 0.786, 0.5, 0.236) from the channel's outer extremities.

An uptrend can be identified by price holding above the inner upper band (obtained from the 0.786 ratio), this band can also provide occasional support when the price retraces to it while in an uptrend.

Breaking below the inner upper band with an unwillingness to reach above again is a clear sign of hesitation in the market and can be indicative of an upcoming consolidation or reversal.

This can directly be applied to downtrends as well, below are examples displaying both scenarios.

Uptrend Example:

Downtrend Example:

🔹 Breakout Levels

When the price mitigates all FVGs in a single direction except for 1, the indicator will display a "Breakout Level". This is the level that price will need to cross in order for all FVGs in that direction to be mitigated, because of this they can also be aptly called "Last Stand Levels".

These levels can be considered as potential support and resistance levels, however, should always be monitored for breakouts since a substantial push above or below these points would indicate strong momentum.

🔹 Signals

The indicator includes Bullish and Bearish Signals, these signals fire when all FVGs for a single direction have been mitigated and an engulfing candle occurs in the opposite direction. These are reversal signals and should be used alongside other indicators to appropriately manage risk.

Note: When all FVGs in a single direction have been mitigated, the candles will change colors accordingly.

🔶 DETAILS

The script uses a typical identification method for FVGs. Once identified, the script collects and stores the mitigation levels of the respective bullish and bearish FVGs:

For Bullish FVGs this is the bottom of the FVG.

For Bearish FVGs this is the top of the FVG.

The data is managed to only consider a specific amount of FVG mitigation levels, determined by the set "Unmitigated FVG Lookback". If an FVG is mitigated, it frees up a spot in the memory for a new FVG, however, if the memory is full, the oldest will be deleted.

The averages displayed (Channel Upper and Lower) are created from 2 calculation steps, the first step involves taking the raw average of the FVG mitigation levels, and the second step applies a simple moving average (SMA) smoothing of the precedent obtained averages.

Note: To view the mitigation levels average obtained in the first step, the "Smoothing Length" can be set to 1.

🔶 SETTINGS

Unmitigated FVG Lookback: Sets the maximum number of Unmitigated FVG mitigation levels that the script will use to calculate the channel.

Smoothing Length: Sets the smoothing length for the channel to reduce noise from the raw data.

Periodic Linear Regressions [LuxAlgo]The Periodic Linear Regressions (PLR) indicator calculates linear regressions periodically (similar to the VWAP indicator) based on a user-set period (anchor).

This allows for estimating underlying trends in the price, as well as providing potential supports/resistances.

🔶 USAGE

The Periodic Linear Regressions indicator calculates a linear regression over a user-selected interval determined from the selected "Anchor Period".

The PLR can be visualized as a regular linear regression (Static), with a fit readjusting for new data points until the end of the selected period, or as a moving average (Rolling), with new values obtained from the last point of a linear regression fitted over the calculation interval. While the static method line is prone to repainting, it has value since it can further emphasize the linearity of an underlying trend, as well as suggest future trend directions by extrapolating the fit.

Extremities are included in the indicator, these are obtained from the root mean squared error (RMSE) between the price and calculated linear regression. The Multiple setting allows the users to control how far each extremity is from the other.

Periodic Linear Regressions can be helpful in finding support/resistance areas or even opportunities when ranging in a channel.

The anchor - where a new period starts - can be shown (in this case in the top right corner).

The shown bands can be visualized by enabling Show Extremities in settings ( Rolling or Static method).

The script includes a background gradient color option for the bands, which only applies when using the Rolling method.

The indicator colors can be suggestive of the detected trend and are determined as follows:

Method Rolling: a gradient color between red and green indicates the trend; more green if the output is rising, suggesting an uptrend, and more red if it is decreasing, suggesting a downtrend.

Method Static: green if the slope of the line is positive, suggesting an uptrend, red if negative, suggesting a downtrend.

🔶 DETAILS

🔹 Anchor Type

When the Anchor Type is set to Periodic , the indicator will be reset when the "Anchor Period" changes, after which calculations will start again.

An anchored rolling line set at First Bar won't reset at a new session; it will continue calculating the linear regression from the first bar to the last; in other words, every bar is included in the calculation. This can be useful to detect potential long-term tops/bottoms.

Note that a linear regression needs at least two values for its calculation, which explains why you won't see a static line at the first bar of the session. The rolling linear regression will only show from the 3rd bar of the session since it also needs a previous value.

🔹 Rolling/Static

When Anchor Type is set at Periodic , a linear regression is calculated between the first bar of the chosen session and the current bar, aiming to find the line that best fits the dataset.

The example above shows the lines drawn during the session. The offered script, though, shows the last calculated point connected to the previous point when the Rolling method is chosen, while the Static method shows the latest line.

Note that linear regression needs at least two values, which explains why you won't see a static line at the first bar of the session. The rolling line will only show from the 3rd bar of the session since it also needs a previous value.

🔶 SETTINGS

Method: Indicator method used, with options: "Static" (straight line) / "Rolling" (rolling linear regression).

Anchor Type: "Periodic / First Bar" (the latter works only when "Method" is set to "Rolling").

Anchor Period: Only applicable when "Anchor Type" is set at "Periodic".

Source: open, high, low, close, ...

Multiple: Alters the width of the bands when "Show Extremities" is enabled.

Show Extremities: Display one upper and one lower extremity.

🔹 Color Settings

Mono Color: color when "Bicolor" is disabled

Bicolor: Toggle on/off + Colors

Gradient: Background color when "Show extremities" is enabled + level of gradient

🔹 Dashboard

Show Dashboard

Location of dashboard

Text size

Birdies [LuxAlgo]The Birdies indicator uses a unique technique to provide support/resistance curves based on a circle connecting the last swing high/low.

A specific, customizable part of this circle acts as a curve of interest, which can trigger visual breakout signals.

🔶 USAGE

The script projects a bird-like pattern when a valid Swing point is found. Multiple customization options are included.

🔹 Trend & Support/Resistance Tool

The color fill patterns and the wing boundaries can give insights into the current trend direction as well as serve as potential support/resistance areas.

In the example above, "Birdies" coincide with pullback and support/resistance zones.

🔹 Swing Length & Buffer

Besides the "Swing Length", with higher values returning longer-term Swing Levels, the script's behavior can be fine-tuned with filters ("Settings" - "Validation").

🔹 Validation

To minimize clutter, three filters are included:

Minimum X-Distance: The minimum amount of bars between subsequent Swings

Minimum Y-Distance: The minimum amount of bars between subsequent Swings

Buffer (Multiple of ATR)

The "Minimum X/Y-Distance" creates a zone where a new Swing is considered invalid. Only when the Swing is out of the zone, can it be considered valid.

In other words, in the example above, a Swing High can only be valid when enough bars/time have passed, and the difference between the last Swing and the previous is more than the ATR multiplied by the "Minimum Y-Distance" factor.

The "Buffer" creates a line above/below the "Birdy", derived from the measured ATR at the conception of the "Birdy" multiplied with a factor ("Buffer").

When the closing price crosses the "Birdy", it must also surpass this buffer line to produce a valid signal, lowering the risk of clutter as a result.

🔶 DETAILS

Birdies are derived from a circle that connects two Swing points. The left-wing curve originates from the most recent "Swing point" to the last value on the circle before crossing its midline. The mirror image of the left wing creates the right wing.

Enabling "Origine" will draw a line from the last Swing to the first.

🔹 Style

The publication includes a style setting with four options.

The first, "Birdy," shows a bird-like shape derived from a circle connecting the last Swing High and Swing Low.

The second option holds everything from the first option but connects both wingtips, providing potential horizontal levels of interest.

When setting "Birdy" to "None", the visual breakout signals will not defer from previous settings, but the focus is shifted towards the fill color, which can help detect potential trend shift.

A fourth setting, "Left Wing", will only show the left part of the "Birdy" pattern, removing the right part from the equation. This will change the visual breakout signals, providing alternative signals.

🔶 SETTINGS

Swing Length: The period used for swing detection, with higher values returning longer-term Swing Levels.

🔹 Validation

Minimum X-Distance: The minimum amount of bars between subsequent Swings

Minimum Y-Distance: The minimum amount of bars between subsequent Swings

Buffer (Multiple of ATR)

🔹 Style

Bullish Patterns: Enable / color

Bearish Patterns: Enable / color

Buffer Zone: Show / Color

Color Fill: Show color fill between two Birdies (if available)

Origine: Show the line between both Swing Points

🔹 Calculation

Calculated Bars: Allows the usage of fewer bars for performance/speed improvement

Opening Range with Breakouts & Targets [LuxAlgo]Opening Range with Breakouts & Targets is based on the long-standing Opening Range Breakout strategy popularized by traders such as Toby Crabel and Mark Fisher.

This indicator measures and displays the price range created from the first period within a new trading session, along with price breakouts from that range and targets associated with the range width.

🔶 USAGE

The Opening Range (OR) can be a powerful tool for making a clear distinction between ranging and trending trading days. Using a rigid structure for drawing a range, provides a consistent basis to make judgments and comparisons that will better assist the user in determining a hypothesis for the day's price action.

NOTE: During a suspected "Range Day", the Opening Range can be used for reversion strategies, typically targeting the opposite extreme of the range or the mean of the range. However, more commonly the Opening Range is used for breakouts on suspected "Trend Days", targeting further upward or downward market movement.

The common Opening Range Breakout Strategy (ORB) outlines a structure to enter and exit positions based on rigid points determined by the Opening Range. This methodology can be adjusted based on markets or trading styles.

Determine Opening Range High & Low: These are the high and low price within a chosen period of time after the market opens. This can be customized to the user's trading style and preference. Common Ranges are from 5-60 mins.

Watch for a Breakout with Volume: A Breakout occurs when price crosses the OR High (ORH) or OR Low (ORL), an increase in volume is typically desired when witnessing these breakouts to confirm a stronger movement.

Manage Risk: Based on user preference and the appropriately determined amount of risk, multiple ways can be determined to manage risk by using Opening Range.

For Example: A stop-loss could be set at OR Mean (ORM) or the opposite side of the range, while a profit target could optionally be set at the first price target generated by the script.

Alternatively, a user might want to use a Moving Average (MA) as an adaptive stop-loss and use price targets to scale out. These are just 2 examples of the possible options, both capable with this tool.

🔹 Signals

Signals will fire based on the break of the opening range, this is indicated by arrows above and below the range boundaries.

Optionally, a bias can be added to these signals to aid in mitigating false signals by using a directional filter based on the current day's OR relative to the previous day's OR.

Regardless of the signal bias being enabled, the Opening Range Zone will always be colored directionally according to this.

If the current day's OR is above the previous day's OR, the Zone will be Green.

If the current day's OR is below the previous day's OR, the Zone will be Red.

By enabling the signal bias, signals in the opposite direction of the daily bias will fire on the cross of the first target in that direction.

🔹 Targets

In this indicator, targets are not limited and will generate infinitely based on a % width of the Opening Range.

Additionally, there are 2 display methods for these targets.

Extended: Extends the targets to the current bar and displays all targets that have been crossed so far within the session.

Adaptive: Extends only the 2 closest targets surrounding price, allowing for a display consisting of fewer lines at one time.

🔶 DETAILS

🔹 Historical Display

This indicator can be utilized in multiple ways, for use in real-time, and for historical analysis to form methods. Because of this, the indicator has an option to display only the current day's data or the entire historical data. This can also help clean up the chart when it is in use.

🔹 Time Period

The specific time period to create the opening range is entirely up to each user's preference, by default it is set to 30 mins; however, this time period can be edited with full control if desired.

Simply toggle on the "Custom Range" and input a range of time to create the range.

🔹 Session Moving Average

The Session Moving Average is a common Moving Average, which resets at the beginning of a new session. This allows for an unbiased MA that was created entirely from the current session's price action.

Note: The start of the session is determined by the start of the Opening Range if using a custom range of time.

🔶 SETTINGS

Show Historical Data: Choose to display only the current session's data or the full history of data.

Opening Range Time Period: Select the time period to form the opening range from. This operates on Session Start, so it will change with the chart.

Custom Range: Opt for a custom Range by enabling this and inputting your range times as well as your needed timezone.

Breakout Signal Bias: Select if the Breakout Signals will use a Daily Directional Bias for firing.

Target % of Range: Sets the % of the Range width that will be used as an increment for the Targets to display in.

Target Cross Source: Choose to use the Close price or High/Low price as the crossing level for Target displays. When this source crosses a target it will generate more targets.

Target Display: Choose which style of display to use for targets.

Session Moving Average: Optionally enable a Moving average of your choice that resets at the beginning of each session (start of opening range).

Pure Price Action ICT Tools [LuxAlgo]The Pure Price Action ICT Tools indicator is designed for pure price action analysis, automatically identifying real-time market structures, liquidity levels, order & breaker blocks, and liquidity voids.

Its unique feature lies in its exclusive reliance on price patterns, without being constrained by any user-defined inputs, ensuring a robust and objective analysis of market dynamics.

🔶 MARKET STRUCTURES

A Market Structure Shift, also known as a Change of Character (CHoCH), is a pivotal event in price action analysis indicating a potential change in market sentiment or direction. An MSS occurs when the price reverses from an established trend, signaling that the prevailing trend may be losing momentum and a reversal might be underway. This shift is often identified by key technical patterns, such as a higher low in a downtrend or a lower high in an uptrend, which indicate a weakening of the current trend's strength.

A Break of Structure typically indicates the continuation of the current market trend. This event occurs when the price decisively moves beyond a previous swing high or low, confirming the strength of the prevailing trend. In an uptrend, a BOS is marked by the price breaking above a previous high, while in a downtrend, it is identified by the price breaking below a previous low.

While a Market Structure Shift (MSS) can indicate a potential trend reversal and a Break of Structure (BOS) often confirms trend continuation, they do not assure a complete reversal or continuation. MSS and BOS levels can also function as liquidity zones or areas of price consolidation rather than definitively signaling a change in market direction. Traders should approach these signals cautiously and validate them with additional factors before making trading decisions. For further details on other components of the tool, please refer to the following sections.

🔶 ORDER & BREAKER BLOCKS

Order and Breaker Blocks are key concepts in price action analysis that help traders identify significant levels in the market structure.

Order Blocks are specific price zones where significant buying or selling activity has occurred. These zones often represent the actions of large institutional traders or market makers, who execute substantial orders that impact the market.

Breaker Blocks are specific price zones where a strong reversal occurs, causing a break in the prevailing market structure. These blocks indicate areas where the price encountered significant resistance or support, leading to a reversal.

In summary, Order and Breaker Blocks are essential tools in price action analysis, providing insights into significant market levels influenced by institutional trading activities. These blocks help traders make informed decisions about potential support and resistance levels, trend reversals, and breakout confirmations.

🔶 BUYSIDE & SELLSIDE LIQUIDITY

Both buy-side and sell-side liquidity zones are critical for identifying potential turning points in the market. These zones are where significant buying or selling interest is concentrated, influencing future price movements.

In summary, buy-side and sell-side liquidity provide crucial insights into market demand and supply dynamics, helping traders make informed decisions based on the availability of orders at different price levels.

🔶 LIQUIDITY VOIDS

Liquidity voids are gaps or areas on a price chart where there is a lack of trading activity. These voids represent zones with minimal to no buy or sell orders, often resulting in sharp price movements when the market enters these areas.

In summary, liquidity voids are crucial areas on a price chart characterized by a lack of trading activity. These voids can lead to rapid price movements and increased volatility, making them essential considerations for traders in their analysis and decision-making processes.

🔶 SWING POINTS

Reversal price points are commonly referred to as swing points. Traders often analyze historical swing points to discern market trends and pinpoint potential trade entry and exit points.

Do note that in this script these are subject to backpainting, that is they are not located where they are detected.

The detection of swing points and the unique feature of this script rely exclusively on price action, eliminating the need for numerical user-defined settings. The process begins with detecting short-term swing points:

Short-Term Swing High (STH): Identified as a price peak surrounded by lower highs on both sides.

Short-Term Swing Low (STL): Recognized as a price trough surrounded by higher lows on both sides.

Intermediate-term and long-term swing points are detected using the same approach but with a slight modification. Instead of directly analyzing price candles, previously detected short-term swing points are utilized. For intermediate-term swing points, short-term swing points are analyzed, while for long-term swing points, intermediate-term ones are used.

This method ensures a robust and objective analysis of market dynamics, offering traders reliable insights into market structures. Detected swing points serve as the foundation for identifying market structures, buy-side/sell-side liquidity levels, and order and breaker blocks presented with this tool.

In summary, swing points are essential elements in technical analysis, helping traders identify trends, support, and resistance levels, and optimal entry and exit points. Understanding swing points allows traders to make informed decisions based on the natural price movements in the market.

🔶 SETTINGS

🔹 Market Structures

Market Structures: Toggles the visibility of the market structures, both shifts and breaks.

Detection: An option that allows users to detect market structures based on the significance of swing levels, including short-term, intermediate-term, and long-term.

Market Structure Labels: Controls the visibility of labels that highlight the type of market structure.

Line Style: Customizes the style of the lines representing the market structure.

🔹 Order & Breaker Blocks

Order & Breaker Blocks: Toggles the visibility of the order & breaker blocks.

Detection: An option that allows users to detect order & breaker blocks based on the significance of swing levels, including short-term, intermediate-term, and long-term.

Last Bullish Blocks: Number of the most recent bullish order/breaker blocks to display on the chart.

Last Bearish Blocks: Number of the most recent bearish order/breaker blocks to display on the chart.

Use Candle Body: Allows users to use candle bodies as order block areas instead of the full candle range.

🔹 Buyside & Sellside Liquidity

Buyside & Sellside Liquidity: Toggles the visibility of the buyside & sellside liquidity levels.

Detection: An option that allows users to detect buy-side & sell-side liquidity based on the significance of swing levels, including short-term, intermediate-term, and long-term.

Margin: Sets margin/sensitivity for a liquidity level detection.

Visible Levels: Controls the amount of the liquidity levels/zones to be visualized.

🔹 Liquidity Voids

Liquidity Voids: Enable display of both bullish and bearish liquidity voids.

Threshold Multiplier: Defines the multiplier for the threshold, which is hard-coded to the 200-period ATR range.

Mode: Controls the lookback length for detection and visualization. Present considers the last X bars specified in the option, while Historical includes all available data.

Label: Enable display of a label indicating liquidity voids.

🔹 Swing Highs/Lows

Swing Highs/Lows: Toggles the visibility of the swing levels.

Detection: An option that allows users to detect swing levels based on the significance of swing levels, including short-term, intermediate-term, and long-term.

Label Size: Control the size of swing level labels.

🔶 RELATED SCRIPTS

Pure-Price-Action-Structures.

Market-Structures-(Intrabar).

Buyside-Sellside-Liquidity.

Order-Breaker-Blocks.

VWAP Periodic Close [LuxAlgo]The VWAP Periodic Close script offers an advanced tool for analyzing the Volume Weighted Average Price (VWAP) across various timeframes.

This tool enables traders to visualize VWAP close levels for daily, weekly, monthly, quarterly, and yearly periods, offering a comprehensive view of price behavior across different time frames. It helps in identifying key levels where the VWAP closes at the end of each specified period.

🔶 USAGE

This script is designed to enhance your trading strategy by plotting VWAP close levels on your chart for different time periods. This helps traders easily identify historical VWAP levels and analyze price action relative to these levels, particularly useful for identifying key support and resistance levels providing insights into potential future price behavior.

Supports VWAP closes for multiple timeframes, including historical periods (e.g., 3 months back, 3 quarters back, 3 years back). The labels provide context and detailed information about the VWAP close at a specific point in time and enhance the clarity and usefulness of the VWAP data presented on the chart.

Users can toggle the display of VWAP lines for different periods and customize the colors for each timeframe (e.g., distinct colors for monthly, quarterly, and yearly closes).

🔶 SETTINGS

The script offers a range of customizable settings to tailor the analysis to your trading needs.

🔹 Volume Weighted Average Price (VWAP)

VWAP Close Level: Toggle the display of VWAP levels at the end of each period (daily, weekly, monthly, quarterly, yearly).

VWAP Origin: Toggle the display of the VWAP line for each period.

VWAP Source: Choose the data source for VWAP calculations (default is HLC3).

Historical Closes: Define the number of historical VWAP levels to plot.

Line/Label Offset: Adjust the offset for positioning lines and labels on the chart.

🔹 Themes

Theme Selection: Choose between "Day," "Night," or "Custom" themes to adjust the color scheme of VWAP lines and labels.

N Bar Reversal Detector [LuxAlgo]The N Bar Reversal Detector is designed to detect and highlight N-bar reversal patterns in user charts, where N represents the length of the candle sequence used to detect the patterns. The script incorporates various trend indicators to filter out detected signals and offers a range of customizable settings to fit different trading strategies.

🔶 USAGE

The N-bar reversal pattern extends the popular 3-bar reversal pattern. While the 3-bar reversal pattern involves identifying a sequence of three bars signaling a potential trend reversal, the N-bar reversal pattern builds on this concept by incorporating additional bars based on user settings. This provides a more comprehensive indication of potential trend reversals. The script automates the identification of these patterns and generates clear, visually distinct signals to highlight potential trend changes.

When a reversal chart pattern is confirmed and aligns with the price action, the pattern's boundaries are extended to create levels. The upper boundary serves as resistance, while the lower boundary acts as support.

The script allows users to filter patterns based on the trend direction identified by various trend indicators. Users can choose to view patterns that align with the detected trend or those that are contrary to it.

🔶 DETAILS

🔹 The N-bar Reversal Pattern

The N-bar reversal pattern is a technical analysis tool designed to signal potential trend reversals in the market. It consists of N consecutive bars, with the first N-1 bars used to identify the prevailing trend and the Nth bar confirming the reversal. Here’s a detailed look at the pattern:

Bullish Reversal : In a bullish reversal setup, the first bar is the highest among the first N-1 bars, indicating a prevailing downtrend. Most of the remaining bars in this sequence should be bearish (closing lower than where they opened), reinforcing the existing downward momentum. The Nth (most recent) bar confirms a bullish reversal if its high price is higher than the high of the first bar in the sequence (standard pattern). For a stronger signal, the closing price of the Nth bar should also be higher than the high of the first bar.

Bearish Reversal : In a bearish reversal setup, the first bar is the lowest among the first N-1 bars, indicating a prevailing uptrend. Most of the remaining bars in this sequence should be bullish (closing higher than where they opened), reinforcing the existing upward momentum. The Nth bar confirms a bearish reversal if its low price is lower than the low of the first bar in the sequence (standard pattern). For a stronger signal, the closing price of the Nth bar should also be lower than the low of the first bar.

🔹 Min Percentage of Required Candles

This parameter specifies the minimum percentage of candles that must be bullish (for a bearish reversal) or bearish (for a bullish reversal) among the first N-1 candles in a pattern. For higher values of N, it becomes more challenging for all of the first N-1 candles to be consistently bullish or bearish. By setting a percentage value, P, users can adjust the requirement so that only a minimum of P percent of the first N-1 candles need to meet the bullish or bearish condition. This allows for greater flexibility in pattern recognition, accommodating variations in market conditions.

🔶 SETTINGS

Pattern Type: Users can choose the type of the N-bar reversal patterns to detect: Normal, Enhanced, or All. "Normal" detects patterns that do not necessarily surpass the high/low of the first bar. "Enhanced" detects patterns where the last bar surpasses the high/low of the first bar. "All" detects both Normal and Enhanced patterns.

Reversal Pattern Sequence Length: Specifies the number of candles (N) in the sequence used to identify a reversal pattern.

Min Percentage of Required Candles: Sets the minimum percentage of the first N-1 candles that must be bullish (for a bearish reversal) or bearish (for a bullish reversal) to qualify as a valid reversal pattern.

Derived Support and Resistance: Toggles the visibility of the support and resistance levels/zones.

🔹 Trend Filtering

Filtering: Allows users to filter patterns based on the trend indicators: Moving Average Cloud, Supertrend, and Donchian Channels. The "Aligned" option only detects patterns that align with the trend and conversely, the "Opposite" option detects patterns that go against the trend.

🔹 Trend Indicator Settings

Moving Average Cloud: Allows traders to choose the type of moving averages (SMA, EMA, HMA, etc.) and set the lengths for fast and slow moving averages.

Supertrend: Options to set the ATR length and factor for Supertrend.

Donchian Channels: Option to set the length for the channel calculation.

🔶 RELATED SCRIPTS

Reversal-Candlestick-Structure.

Reversal-Signals.

D-Shape Breakout Signals [LuxAlgo]The D-Shape Breakout Signals indicator uses a unique and novel technique to provide support/resistance curves, a trailing stop loss line, and visual breakout signals from semi-circular shapes.

🔶 USAGE

D-shape is a new concept where the distance between two Swing points is used to create a semi-circle/arc, where the width is expressed as a user-defined percentage of the radius. The resulting arc can be used as a potential support/resistance as well as a source of breakouts.

Users can adjust this percentage (width of the D-shape) in the settings ( "D-Width" ), which will influence breakouts and the Stop-Loss line.

🔹 Breakouts of D-Shape

The arc of this D-shape is used for detecting breakout signals between the price and the curve. Only one breakout per D-shape can occur.

A breakout is highlighted with a colored dot, signifying its location, with a green dot being used when the top part of the arc is exceeded, and red when the bottom part of the arc is surpassed.

When the price reaches the right side of the arc without breaking the arc top/bottom, a blue-colored dot is highlighted, signaling a "Neutral Breakout".

🔹 Trailing Stop-Loss Line

The script includes a Trailing Stop-Loss line (TSL), which is only updated when a breakout of the D-Shape occurs. The TSL will return the midline of the D-Shape subject to a breakout.

The TSL can be used as a stop-loss or entry-level but can also act as a potential support/resistance level or trend visualization.

🔶 DETAILS

A D-shape will initially be colored green when a Swing Low is followed by a Swing High, and red when a Swing Low is followed by a Swing High.

A breakout of the upper side of the D-shape will always update the color to green or to red when the breakout occurs in the lower part. A Neutral Breakout will result in a blue-colored D-shape. The transparency is lowered in the event of a breakout.

In the event of a D-shape breakout, the shape will be removed when the total number of visible D-Shapes exceeds the user set "Minimum Patterns" setting. Any D-shape whose boundaries have not been exceeded (and therefore still active) will remain visible.

🔹 Trailing Stop-Loss Line

Only when a breakout occurs will the midline of the D-shape closest to the closing price potentially become the new Trailing Stop value.

The script will only consider middle lines below the closing price on an upward breakout or middle lines above the closing price when it concerns a downward breakout.

In an uptrend, with an already available green TSL, the potential new Stop-Loss value must be higher than the previous TSL value; while in a downtrend, the new TSL value must be lower.

The Stop-Loss line won't be updated when a "Neutral Breakout" occurs.

🔶 SETTINGS

Swing Length: Period used for the swing detection, with higher values returning longer-term Swing Levels.

🔹 D-Patterns

Minimum Patterns: Minimum amount of visible D-Shape patterns.

D-Width: Width of the D-Shape as a percentage of the distance between both Swing Points.

Included Swings: Include "Swing High" (followed by a Swing Low), "Swing Low" (followed by a Swing High), or "Both"

Style Historical Patterns: Show the "Arc", "Midline" or "Both" of historical patterns.

🔹 Style

Label Size/Colors

Connecting Swing Level: Shows a line connecting the first Swing Point.

Color Fill: colorfill of Trailing Stop-Loss