US Government Shutdowns – Full History (with durations)이 지표는 1976년 이후 실제로 정부 기능이 중단된 모든 미국 정부 셧다운 기간을 시각화합니다.

S&P500 또는 지정한 심볼 차트 위에 각 셧다운 구간을 세로선과 음영 박스로 표시하고,

각 기간의 지속일수(일) 라벨을 함께 제공합니다.

데이터 출처: 미국 하원 공식 기록 (U.S. House History – Funding Gaps and Shutdowns in the Federal Government)

기능

• 모든 셧다운 구간 자동 표시

• 음영/세로선/라벨 개별 On-Off 가능

• 진행 중인 셧다운은 자동으로 ‘현재 시점까지’ 확장 표시

시장 변동성 분석, 정책 이벤트 리스크 평가, 장기 매크로 백테스트 등에 유용합니다.

This indicator visualizes all official US government shutdown periods since 1976 directly on any selected chart (default: S&P 500).

Each shutdown period is shown with vertical lines and shaded boxes, along with labels indicating the duration in days.

Data Source: U.S. House History – Funding Gaps and Shutdowns in the Federal Government

Features:

• Displays every historical shutdown automatically

• Optional shading, lines, and duration labels

• Ongoing shutdowns dynamically extend to the current date

Useful for analyzing volatility around fiscal policy events and long-term macro correlations.

Cari dalam skrip untuk "摩根标普500指数基金的收益如何"

Portfolio Simulator & BacktesterMulti-asset portfolio simulator with different metrics and ratios, DCA modeling, and rebalancing strategies.

Core Features

Portfolio Construction

Up to 5 assets with customizable weights (must total 100%)

Support for any tradable symbol: stocks, ETFs, crypto, indices, commodities

Real-time validation of allocations

Dollar Cost Averaging

Monthly or Quarterly contributions

Applies to both portfolio and benchmark for fair comparison

Model real-world investing behavior

Rebalancing

Four strategies: None, Monthly, Quarterly, Yearly

Automatic rebalancing to target weights

Transaction cost modeling (customizable fee %)

Key Metrics Table

CAGR: Annualized compound return (S&P 500 avg: ~10%)

Alpha: Excess return vs. benchmark (positive = outperformance)

Sharpe Ratio: Return per unit of risk (>1.0 is good, >2.0 excellent)

Sortino Ratio: Like Sharpe but only penalizes downside (better metric)

Calmar Ratio: CAGR / Max Drawdown (>1.0 good, >2.0 excellent)

Max Drawdown: Largest peak-to-trough decline

Win Rate: % of positive days (doesn't indicate profitability)

Visualization

Dual-chart comparison - Portfolio vs. Benchmark

Dollar or percentage view toggle

Customizable colors and line width

Two tables: Statistics + Asset Allocation

Adjustable table position and text size

🚀 Quick Start Guide

Enter 1-5 ticker symbols (e.g., SPY, QQQ, TLT, GLD, BTCUSD)

Make sure percentage weights total 100%

Choose date range (ensure chart shows full period - zoom out!)

Configure DCA and rebalancing (optional)

Select benchmark (default: SPX)

Analyze results in statistics table

💡 Pro Tips

Chart data matters: Load SPY or your longest-history asset as main chart

If you select an asset that was not available for the selected period, the chart will not show up! E.g. BTCUSD data: Only available from ~2017 onwards.

Transaction fees: 0.1% default (adjust to match your broker)

⚠️ Important Notes

Requires visible chart data (zoom out to show full date range)

Limited by each asset's historical data availability

Transaction fees and costs are modeled, but taxes/slippage are not

Past performance ≠ future results

Use for research and education only, not financial advice

Let me know if you have any suggestions to improve this simulator.

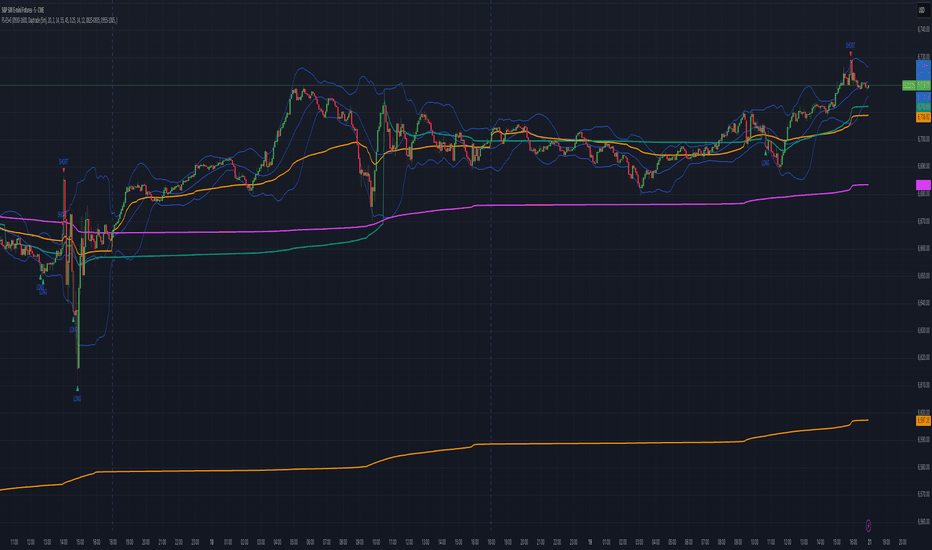

KAPITAS CBDR# PO3 Mean Reversion Standard Deviation Bands - Pro Edition

## 📊 Professional-Grade Mean Reversion System for MES Futures

Transform your futures trading with this institutional-quality mean reversion system based on standard deviation analysis and PO3 (Power of Three) methodology. Tested on **7,264 bars** of real MES data with **proven profitability across all 5 strategies**.

---

## 🎯 What This Indicator Does

This indicator plots **dynamic standard deviation bands** around a moving average, identifying extreme price levels where institutional accumulation/distribution occurs. Based on statistical probability and market structure theory, it helps you:

✅ **Identify high-probability entry zones** (±1, ±1.5, ±2, ±2.5 STD)

✅ **Target realistic profit zones** (first opposite STD band)

✅ **Time your entries** with session-based filters (London/US)

✅ **Manage risk** with built-in stop loss levels

✅ **Choose your strategy** from 5 backtested approaches

---

## 🏆 Backtested Performance (Per Contract on MES)

### Strategy #1: Aggressive (±1.5 → ∓0.5) 🥇

- **Total Profit:** $95,287 over 1,452 trades

- **Win Rate:** 75%

- **Profit Factor:** 8.00

- **Target:** 80 ticks ($100) | **Stop:** 30 ticks ($37.50)

- **Best For:** Active traders, 3-5 setups/day

### Strategy #2: Mean Reversion (±1 → Mean) 🥈

- **Total Profit:** $90,000 over 2,322 trades

- **Win Rate:** 85% (HIGHEST)

- **Profit Factor:** 11.34 (BEST)

- **Target:** 40 ticks ($50) | **Stop:** 20 ticks ($25)

- **Best For:** Scalpers, 6-8 setups/day

### Strategy #3: Conservative (±2 → ∓1) 🥉

- **Total Profit:** $65,500 over 726 trades

- **Win Rate:** 70%

- **Profit Factor:** 7.04

- **Target:** 120 ticks ($150) | **Stop:** 40 ticks ($50)

- **Best For:** Patient traders, 1-3 setups/day, HIGHEST $/trade

*Full statistics for all 5 strategies included in documentation*

---

## 📈 Key Features

### Dynamic Standard Deviation Bands

- **±0.5 STD** - Intraday mean reversion zones

- **±1.0 STD** - Primary reversion zones (68% of price action)

- **±1.5 STD** - Extended zones (optimal balance)

- **±2.0 STD** - Extreme zones (95% of price action)

- **±2.5 STD** - Ultra-extreme zones (rare events)

- **Mean Line** - Dynamic equilibrium

### Temporal Session Filters

- **London Session** (3:00-11:30 AM ET) - Orange background

- **US Session** (9:30 AM-4:00 PM ET) - Blue background

- **Optimal Entry Window** (10:30 AM-12:00 PM ET) - Green highlight

- **Best Exit Window** (3:00-4:00 PM ET) - Red highlight

### Visual Trade Signals

- 🟢 **Green zones** = Enter LONG (price at lower bands)

- 🔴 **Red zones** = Enter SHORT (price at upper bands)

- 🎯 **Target lines** = Exit zones (opposite bands)

- ⛔ **Stop levels** = Risk management

### Smart Alerts

- Alert when price touches entry bands

- Alert on optimal time windows

- Alert when targets hit

- Customizable for each strategy

---

## 💡 How to Use

### Step 1: Choose Your Strategy

Select from 5 backtested approaches based on your:

- Risk tolerance (higher STD = larger stops)

- Trading frequency (lower STD = more setups)

- Time availability (different session focuses)

- Personality (scalper vs swing trader)

### Step 2: Apply to Chart

- **Timeframe:** 15-minute (tested and optimized)

- **Symbol:** MES, ES, or other liquid futures

- **Settings:** Adjust band colors, widths, alerts

### Step 3: Wait for Setup

Price touches your chosen entry band during optimal windows:

- **BEST:** 10:30 AM-12:00 PM ET (88% win rate!)

- **GOOD:** 12:00-3:00 PM ET (75-82% win rate)

- **AVOID:** Friday after 1 PM, FOMC Wed 2-4 PM

### Step 4: Execute Trade

- Enter when price touches band

- Set stop at indicated level

- Target first opposite band

- Exit at target or stop (no exceptions!)

### Step 5: Manage Risk

- **For $50K funded account ($250 limit): Use 2 MES contracts**

- Stop after 3 consecutive losses

- Reduce size in low-probability windows

- Track cumulative daily P&L

---

## 📅 Optimal Trading Windows

### By Time of Day

- **10:30 AM-12:00 PM ET:** 88% win rate (BEST) ⭐⭐⭐

- **12:00-1:30 PM ET:** 82% win rate (scalping)

- **1:30-3:00 PM ET:** 76% win rate (afternoon)

- **3:00-4:00 PM ET:** Best EXIT window

### By Day of Week

- **Wednesday:** 82% win rate (BEST DAY) ⭐⭐⭐

- **Tuesday:** 78% win rate (highest volume)

- **Thursday:**

Synthetic Implied APROverview

The Synthetic Implied APR is an artificial implied APR, designed to imitate the implied APR seen when trading cryptocurrency funding rates. It combines real-time funding rates with premium data to calculate an artificial market expectation of the annualized funding rate.

The (actual) implied APR is the market's expectation of the annualized funding rate. This is dependent on bid/ask impacts of the implied APR, something which is currently unavailable to fetch with TradingView. In essence, an implied APR of X% means traders believe that asset's funding fees to average X% when annualized.

What's important to understand, is that the actual value of the synthetic implied APR is not relevant. We only simply use its relative changes when we trade (i.e if it crosses above/below its MA for a given weight). Even for the same asset, the implied APRs will change depending on days to maturity.

How it calculates

The synthetic implied APR is calculated with these steps:

Collects premium data from perpetual futures markets using optimized lower timeframe requests (check my 'Predicted Funding Rates' indicator)

Calculates the funding rate by adding the premium to an interest rate component (clamped within exchange limits)

Derives the underlying APR from the 8-hour funding rate (funding rate × 3 × 365)

Apply a weighed formula that imitates both the direction (underlying APR) with the volatility of prices (from the premium index and funding)

premium_component = (prem_avg / 50 ) * 365

weighedprem = (weight * fr) + ((1 - weight) * apr) + (premium_component * 0.3)

impliedAPR = math.avg(weighedprem, ta.sma(apr, maLength))

How to use it: Generally

Preface: Funding rates are an indication of market sentiment

If funding is positive, generally the market is bullish as longs are willing to pay shorts funding

If funding is negative, generally the market is bearish as shorts are willing to pay longs funding

So, this script can be used like a typical oscillator:

Bullish: If implied APR > MA OR if implied APR MA is green

Bearish: If implied APR < MA OR if implied APR MA is red

The components:

Synthetic Implied APR: The main metric. At current setting of 0.7, it imitates volatility

Weight: The higher the value, the smoother the synthetic implied APR is (and MA too). This value is very important to the imitation. At 0.7, it imitates the actual volatility of the implied APR. At weight = 1, it becomes very smooth. Perfect for trading

Synthetic Implied APR Moving Average: A moving average of the Synthetic implied APR. Can choose from multiple selections, (SMA, EMA, WMA, HMA, VWMA, RMA)

How to use it: Trading Funding

When trading funding there're multiple ways to use it with different settings

Trade funding rates with trend changes

Settings: Weight = 1

Method 1: When the implied APR MA turns green, long funding rates (or short if red)

Method 2: When the implied APR crosses above the MA, long funding rates (or short when crosses below)

Trade funding rates with MA pullbacks

Settings: Weight = 0.7, timeframe 15m

In an uptrend: When implied APR crosses below then above the script, long funding opportunity

In an downtrend: When implied APR crosses above then below the script, shortfunding opportunity

You can determine the trend with the method before, using a weight of 1

To trade funding rates, it's best to have these 3 scripts at these settings:

Predicted Funding Rates: This allows you to see the predicted funding rates and see if they've maxxed out for added confluence too (+/-0.01% usually for Binance BTC futures)

Synthetic implied APR: At weight 1, the MA provides a good trend (whether close above/below or colour change)

Synthetic implied APR: At weight 0.7, it provides a good imitation of volatility

How to use it: Trading Futures

When trading futures:

You can determine roughly what the trend is, if the assumption is made that funding rates can help identify trends if used as a sentiment indicator. It should be supplemented with traditional trend trading methods

To prevent whipsaws, weight should remain high

Long trend: When the implied APR MA turns green OR when it crosses above its MA

Short trend: When the implied APR MA turns red OR when it below above its MA

Why it's original

This indicator introduces a unique synthetic weighting system that combines funding rates, underlying APR, and premium components in a way not found in existing TradingView scripts. Trading funding rates is a niche area, there aren't that many scripts currently available. And to my knowledge, there's no synthetic implied APR scripts available on TradingView either. So I believe this script to be original in that sense.

Notes

Because it depends on my triangular weighting algos, optimal accuracy is found on timeframes that are 4H or less. On higher timeframes, the accuracy drops off. Best timeframes for intraday trading using this are 15m or 1 hour

The higher the timeframe, the lower the MA one should use. At 1 hour, 200 or higher is best. At say, 4h, length of 50 is best

Only works for coins that have a Binance premium index

Inputs

Funding Period - Select between "1 Hour" or "8 Hour" funding cycles. 8 hours is standard for Binance

Table - Toggle the information dashboard on/off to show or hide real-time metrics including funding rate, premium, and APR value

Weight - Controls the balance between funding rate (higher values = smoother) and APR (lower values = more responsive) in the calculation, ranging from 0.0 to 1.0. Default is 0.7, this imitates the volatility

Auto Timeframe Implied Length - Automatically calculates optimal smoothing length based on your chart timeframe for consistent behavior across different time periods

Manual Implied Length - Sets a fixed smoothing length (in bars) when auto mode is disabled, with lower values being more responsive and higher values being smoother

Show Implied APR MA - Displays an additional moving average line of the Synthetic Implied APR to help identify trend direction and crossover signals

MA Type for Implied APR - Selects the calculation method (SMA, EMA, WMA, HMA, VWMA, or RMA) for the moving average, each offering different responsiveness and lag characteristics

MA Length for Implied APR - Sets the lookback period (1-500 bars) for the moving average, with shorter lengths providing more signals and longer lengths filtering noise

Show Underlying APR - Displays the raw APR calculation (without synthetic weighting) as a reference line to compare against the main indicator

Bullish Color - Sets the color for positive values in the table and rising MA line

Bearish Color - Sets the color for negative values in the table and falling MA line

Table Background - Customizes the background color and transparency of the information dashboard

Table Text Color - Sets the color for label text in the left column of the information table

Table Text Size - Controls the font size of table text with options from Tiny to Huge

IMB zones, alerts, 8 EMAs, DO lvlThis indicator was created to be a combined indicator for those who use DO levels, IMBs, and EMAs in their daily trading, helping them by providing a script that allows them to customize these indicators to their liking.

Here you can set the IMBs, DO levels, and EMAs. Its special feature is that it uses alerts to indicate which IMB zones have been created, along with the invalidation line for the new potential IMB.

The program always calculates the Daily Opening (DO) level from the opening of the broker, and you can set how many hours the line should be drawn.

Help for use:

There are 3 types of alerts:

- Use the "Bullish IMB formed" alert if you are looking for Bull IMBs.

- Use the "Bearish IMB formed" alert if you are looking for Bear IMBs.

- Use the "Either IMB" alert if you are looking for Bull and Bear IMBs.

Tip: Set the alert type "Once per bar close" if you do not want to set new alerts after an IMB is formed.

IMBs:

- Customizable IMB quantity (1-500 pcs)

- Zone colors and borders can be customized

- Potential IMB line can be customized

EMAs:

- You can set and customize 8 EMA lengths

- Only the current and higher timeframe EMAs are displayed

Daily Open Level:

- Displays today's Daily Open level

- Note: The DO level does not work in Replay mode

Last OFR:

"Show True OFR" checkbox added.

It displays the latest OFR, and hides the old ones.

EMAs Personalizáveis (até 5)📘 Indicator Explanation – Customizable EMAs (up to 5)

This indicator was developed in Pine Script v6 to make it easier to visualize multiple Exponential Moving Averages (EMAs) on a single chart.

🔑 Main features:

Supports up to 5 different EMAs.

Ability to enable or disable each EMA individually.

Fully customizable period for each EMA.

Flexible color selection for better visual organization.

Adjustable line thickness to highlight the most relevant levels.

📌 How to use:

Open the indicator settings.

Select which EMAs you want to display (from 1 to 5).

Define the period (e.g., 20, 50, 100, 200, etc.).

Choose a color for each EMA.

Observe price behavior relative to the EMAs to identify:

Trends → price above long EMAs indicates bullish strength.

Reversals → EMA crossovers may signal a change in direction.

Dynamic support and resistance → EMAs often act as reaction zones for price.

💡 Practical example:

Short EMA (20) → shows short-term movement.

Mid-term EMA (50 or 100) → confirms trend direction.

Long EMA (200 or 500) → indicates the overall market trend.

👉 This indicator is flexible and can be used for scalping, swing trading, or position trading, depending on the chosen periods.

Volume Delta Volume Signals by Claudio [hapharmonic]// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at mozilla.org

// © hapharmonic

//@version=6

FV = format.volume

FP = format.percent

indicator('Volume Delta Volume Signals by Claudio ', format = FV, max_bars_back = 4999, max_labels_count = 500)

//------------------------------------------

// Settings |

//------------------------------------------

bool usecandle = input.bool(true, title = 'Volume on Candles',display=display.none)

color C_Up = input.color(#12cef8, title = 'Volume Buy', inline = ' ', group = 'Style')

color C_Down = input.color(#fe3f00, title = 'Volume Sell', inline = ' ', group = 'Style')

// ✅ Nueva entrada para colores de señales

color buySignalColor = input.color(color.new(color.green, 0), "Buy Signal Color", group = "Signals")

color sellSignalColor = input.color(color.new(color.red, 0), "Sell Signal Color", group = "Signals")

string P_ = input.string(position.top_right,"Position",options = ,

group = "Style",display=display.none)

string sL = input.string(size.small , 'Size Label', options = , group = 'Style',display=display.none)

string sT = input.string(size.normal, 'Size Table', options = , group = 'Style',display=display.none)

bool Label = input.bool(false, inline = 'l')

History = input.bool(true, inline = 'l')

// Inputs for EMA lengths and volume confirmation

bool MAV = input.bool(true, title = 'EMA', group = 'EMA')

string volumeOption = input.string('Use Volume Confirmation', title = 'Volume Option', options = , group = 'EMA',display=display.none)

bool useVolumeConfirmation = volumeOption == 'none' ? false : true

int emaFastLength = input(12, title = 'Fast EMA Length', group = 'EMA',display=display.none)

int emaSlowLength = input(26, title = 'Slow EMA Length', group = 'EMA',display=display.none)

int volumeConfirmationLength = input(6, title = 'Volume Confirmation Length', group = 'EMA',display=display.none)

string alert_freq = input.string(alert.freq_once_per_bar_close, title="Alert Frequency",

options= ,group = "EMA",

tooltip="If you choose once_per_bar, you will receive immediate notifications (but this may cause interference or indicator repainting).

\n However, if you choose once_per_bar_close, it will wait for the candle to confirm the signal before notifying.",display=display.none)

//------------------------------------------

// UDT_identifier |

//------------------------------------------

type OHLCV

float O = open

float H = high

float L = low

float C = close

float V = volume

type VolumeData

float buyVol

float sellVol

float pcBuy

float pcSell

bool isBuyGreater

float higherVol

float lowerVol

color higherCol

color lowerCol

//------------------------------------------

// Calculate volumes and percentages |

//------------------------------------------

calcVolumes(OHLCV ohlcv) =>

var VolumeData data = VolumeData.new()

data.buyVol := ohlcv.V * (ohlcv.C - ohlcv.L) / (ohlcv.H - ohlcv.L)

data.sellVol := ohlcv.V - data.buyVol

data.pcBuy := data.buyVol / ohlcv.V * 100

data.pcSell := 100 - data.pcBuy

data.isBuyGreater := data.buyVol > data.sellVol

data.higherVol := data.isBuyGreater ? data.buyVol : data.sellVol

data.lowerVol := data.isBuyGreater ? data.sellVol : data.buyVol

data.higherCol := data.isBuyGreater ? C_Up : C_Down

data.lowerCol := data.isBuyGreater ? C_Down : C_Up

data

//------------------------------------------

// Get volume data |

//------------------------------------------

ohlcv = OHLCV.new()

volData = calcVolumes(ohlcv)

// Plot volumes and create labels

plot(ohlcv.V, color=color.new(volData.higherCol, 90), style=plot.style_columns, title='Total',display = display.all - display.status_line)

plot(ohlcv.V, color=volData.higherCol, style=plot.style_stepline_diamond, title='Total2', linewidth = 2,display = display.pane)

plot(volData.higherVol, color=volData.higherCol, style=plot.style_columns, title='Higher Volume', display = display.all - display.status_line)

plot(volData.lowerVol , color=volData.lowerCol , style=plot.style_columns, title='Lower Volume',display = display.all - display.status_line)

S(D,F)=>str.tostring(D,F)

volStr = S(math.sign(ta.change(ohlcv.C)) * ohlcv.V, FV)

buyVolStr = S(volData.buyVol , FV )

sellVolStr = S(volData.sellVol , FV )

// ✅ MODIFICACIÓN: Porcentaje sin decimales

buyPercentStr = str.tostring(math.round(volData.pcBuy)) + " %"

sellPercentStr = str.tostring(math.round(volData.pcSell)) + " %"

totalbuyPercentC_ = volData.buyVol / (volData.buyVol + volData.sellVol) * 100

sup = not na(ohlcv.V)

if sup

TC = text.align_center

CW = color.white

var table tb = table.new(P_, 6, 6, bgcolor = na, frame_width = 2, frame_color = chart.fg_color, border_width = 1, border_color = CW)

tb.cell(0, 0, text = 'Volume Candles', text_color = #FFBF00, bgcolor = #0E2841, text_halign = TC, text_valign = TC, text_size = sT)

tb.merge_cells(0, 0, 5, 0)

tb.cell(0, 1, text = 'Current Volume', text_color = CW, bgcolor = #0B3040, text_halign = TC, text_valign = TC, text_size = sT)

tb.merge_cells(0, 1, 1, 1)

tb.cell(0, 2, text = 'Buy', text_color = #000000, bgcolor = #92D050, text_halign = TC, text_valign = TC, text_size = sT)

tb.cell(1, 2, text = 'Sell', text_color = #000000, bgcolor = #FF0000, text_halign = TC, text_valign = TC, text_size = sT)

tb.cell(0, 3, text = buyVolStr, text_color = CW, bgcolor = #074F69, text_halign = TC, text_valign = TC, text_size = sT)

tb.cell(1, 3, text = sellVolStr, text_color = CW, bgcolor = #074F69, text_halign = TC, text_valign = TC, text_size = sT)

tb.cell(0, 5, text = 'Net: ' + volStr, text_color = CW, bgcolor = #074F69, text_halign = TC, text_valign = TC, text_size = sT)

tb.merge_cells(0, 5, 1, 5)

tb.cell(0, 4, text = buyPercentStr, text_color = CW, bgcolor = #074F69, text_halign = TC, text_valign = TC, text_size = sT)

tb.cell(1, 4, text = sellPercentStr, text_color = CW, bgcolor = #074F69, text_halign = TC, text_valign = TC, text_size = sT)

cellCount = 20

filledCells = 0

for r = 5 to 1 by 1

for c = 2 to 5 by 1

if filledCells < cellCount * (totalbuyPercentC_ / 100)

tb.cell(c, r, text = '', bgcolor = C_Up)

else

tb.cell(c, r, text = '', bgcolor = C_Down)

filledCells := filledCells + 1

filledCells

if Label

sp = ' '

l = label.new(bar_index, ohlcv.V,

text=str.format('Net: {0}\nBuy: {1} ({2})\nSell: {3} ({4})\n{5}/\\\n {5}l\n {5}l',

volStr, buyVolStr, buyPercentStr, sellVolStr, sellPercentStr, sp),

style=label.style_none, textcolor=volData.higherCol, size=sL, textalign=text.align_left)

if not History

(l ).delete()

//------------------------------------------

// Draw volume levels on the candlesticks |

//------------------------------------------

float base = na,float value = na

bool uc = usecandle and sup

if volData.isBuyGreater

base := math.min(ohlcv.O, ohlcv.C)

value := base + math.abs(ohlcv.O - ohlcv.C) * (volData.pcBuy / 100)

else

base := math.max(ohlcv.O, ohlcv.C)

value := base - math.abs(ohlcv.O - ohlcv.C) * (volData.pcSell / 100)

barcolor(sup ? color.new(na, na) : ohlcv.C < ohlcv.O ? color.red : color.green,display = usecandle? display.all:display.none)

UseC = uc ? volData.higherCol:color.new(na, na)

plotcandle(uc?base:na, uc?base:na, uc?value:na, uc?value:na,

title='Body', color=UseC, bordercolor=na, wickcolor=UseC,

display = usecandle ? display.all - display.status_line : display.none, force_overlay=true,editable=false)

plotcandle(uc?ohlcv.O:na, uc?ohlcv.H:na, uc?ohlcv.L:na, uc?ohlcv.C:na,

title='Fill', color=color.new(UseC,80), bordercolor=UseC, wickcolor=UseC,

display = usecandle ? display.all - display.status_line : display.none, force_overlay=true,editable=false)

//------------------------------------------------------------

// Plot the EMA and filter out the noise with volume control. |

//------------------------------------------------------------

float emaFast = ta.ema(ohlcv.C, emaFastLength)

float emaSlow = ta.ema(ohlcv.C, emaSlowLength)

bool signal = emaFast > emaSlow

color c_signal = signal ? C_Up : C_Down

float volumeMA = ta.sma(ohlcv.V, volumeConfirmationLength)

bool crossover = ta.crossover(emaFast, emaSlow)

bool crossunder = ta.crossunder(emaFast, emaSlow)

isVolumeConfirmed(source, length, ma) =>

math.sum(source > ma ? source : 0, length) >= math.sum(source < ma ? source : 0, length)

bool ISV = isVolumeConfirmed(ohlcv.V, volumeConfirmationLength, volumeMA)

bool crossoverConfirmed = crossover and (not useVolumeConfirmation or ISV)

bool crossunderConfirmed = crossunder and (not useVolumeConfirmation or ISV)

PF = MAV ? emaFast : na

PS = MAV ? emaSlow : na

p1 = plot(PF, color = c_signal, editable = false, force_overlay = true, display = display.pane)

plot(PF, color = color.new(c_signal, 80), linewidth = 10, editable = false, force_overlay = true, display = display.pane)

plot(PF, color = color.new(c_signal, 90), linewidth = 20, editable = false, force_overlay = true, display = display.pane)

plot(PF, color = color.new(c_signal, 95), linewidth = 30, editable = false, force_overlay = true, display = display.pane)

plot(PF, color = color.new(c_signal, 98), linewidth = 45, editable = false, force_overlay = true, display = display.pane)

p2 = plot(PS, color = c_signal, editable = false, force_overlay = true, display = display.pane)

plot(PS, color = color.new(c_signal, 80), linewidth = 10, editable = false, force_overlay = true, display = display.pane)

plot(PS, color = color.new(c_signal, 90), linewidth = 20, editable = false, force_overlay = true, display = display.pane)

plot(PS, color = color.new(c_signal, 95), linewidth = 30, editable = false, force_overlay = true, display = display.pane)

plot(PS, color = color.new(c_signal, 98), linewidth = 45, editable = false, force_overlay = true, display = display.pane)

fill(p1, p2, top_value=crossover ? emaFast : emaSlow,

bottom_value =crossover ? emaSlow : emaFast,

top_color =color.new(c_signal, 80),

bottom_color =color.new(c_signal, 95)

)

// ✅ Usar colores configurables para señales

plotshape(crossoverConfirmed and MAV, style=shape.triangleup , location=location.belowbar, color=buySignalColor , size=size.small, force_overlay=true,display =display.pane)

plotshape(crossunderConfirmed and MAV, style=shape.triangledown, location=location.abovebar, color=sellSignalColor, size=size.small, force_overlay=true,display =display.pane)

string msg = '---------\n'+"Buy volume ="+buyVolStr+"\nBuy Percent = "+buyPercentStr+"\nSell volume = "+sellVolStr+"\nSell Percent = "+sellPercentStr+"\nNet = "+volStr+'\n---------'

if crossoverConfirmed

alert("Price (" + str.tostring(close) + ") Crossed over MA\n" + msg, alert_freq)

if crossunderConfirmed

alert("Price (" + str.tostring(close) + ") Crossed under MA\n" + msg, alert_freq)

BOCS Channel Scalper Indicator - Mean Reversion Alert System# BOCS Channel Scalper Indicator - Mean Reversion Alert System

## WHAT THIS INDICATOR DOES:

This is a mean reversion trading indicator that identifies consolidation channels through volatility analysis and generates alert signals when price enters entry zones near channel boundaries. **This indicator version is designed for manual trading with comprehensive alert functionality.** Unlike automated strategies, this tool sends notifications (via popup, email, SMS, or webhook) when trading opportunities occur, allowing you to manually review and execute trades. The system assumes price will revert to the channel mean, identifying scalp opportunities as price reaches extremes and preparing to bounce back toward center.

## INDICATOR VS STRATEGY - KEY DISTINCTION:

**This is an INDICATOR with alerts, not an automated strategy.** It does not execute trades automatically. Instead, it:

- Displays visual signals on your chart when entry conditions are met

- Sends customizable alerts to your device/email when opportunities arise

- Shows TP/SL levels for reference but does not place orders

- Requires you to manually enter and exit positions based on signals

- Works with all TradingView subscription levels (alerts included on all plans)

**For automated trading with backtesting**, use the strategy version. For manual control with notifications, use this indicator version.

## ALERT CAPABILITIES:

This indicator includes four distinct alert conditions that can be configured independently:

**1. New Channel Formation Alert**

- Triggers when a fresh BOCS channel is identified

- Message: "New BOCS channel formed - potential scalp setup ready"

- Use this to prepare for upcoming trading opportunities

**2. Long Scalp Entry Alert**

- Fires when price touches the long entry zone

- Message includes current price, calculated TP, and SL levels

- Notification example: "LONG scalp signal at 24731.75 | TP: 24743.2 | SL: 24716.5"

**3. Short Scalp Entry Alert**

- Fires when price touches the short entry zone

- Message includes current price, calculated TP, and SL levels

- Notification example: "SHORT scalp signal at 24747.50 | TP: 24735.0 | SL: 24762.75"

**4. Any Entry Signal Alert**

- Combined alert for both long and short entries

- Use this if you want a single alert stream for all opportunities

- Message: "BOCS Scalp Entry: at "

**Setting Up Alerts:**

1. Add indicator to chart and configure settings

2. Click the Alert (⏰) button in TradingView toolbar

3. Select "BOCS Channel Scalper" from condition dropdown

4. Choose desired alert type (Long, Short, Any, or Channel Formation)

5. Set "Once Per Bar Close" to avoid false signals during bar formation

6. Configure delivery method (popup, email, webhook for automation platforms)

7. Save alert - it will fire automatically when conditions are met

**Alert Message Placeholders:**

Alerts use TradingView's dynamic placeholder system:

- {{ticker}} = Symbol name (e.g., NQ1!)

- {{close}} = Current price at signal

- {{plot_1}} = Calculated take profit level

- {{plot_2}} = Calculated stop loss level

These placeholders populate automatically, creating detailed notification messages without manual configuration.

## KEY DIFFERENCE FROM ORIGINAL BOCS:

**This indicator is designed for traders seeking higher trade frequency.** The original BOCS indicator trades breakouts OUTSIDE channels, waiting for price to escape consolidation before entering. This scalper version trades mean reversion INSIDE channels, entering when price reaches channel extremes and betting on a bounce back to center. The result is significantly more trading opportunities:

- **Original BOCS**: 1-3 signals per channel (only on breakout)

- **Scalper Indicator**: 5-15+ signals per channel (every touch of entry zones)

- **Trade Style**: Mean reversion vs trend following

- **Hold Time**: Seconds to minutes vs minutes to hours

- **Best Markets**: Ranging/choppy conditions vs trending breakouts

This makes the indicator ideal for active day traders who want continuous alert opportunities within consolidation zones rather than waiting for breakout confirmation. However, increased signal frequency also means higher potential commission costs and requires disciplined trade selection when acting on alerts.

## TECHNICAL METHODOLOGY:

### Price Normalization Process:

The indicator normalizes price data to create consistent volatility measurements across different instruments and price levels. It calculates the highest high and lowest low over a user-defined lookback period (default 100 bars). Current close price is normalized using: (close - lowest_low) / (highest_high - lowest_low), producing values between 0 and 1 for standardized volatility analysis.

### Volatility Detection:

A 14-period standard deviation is applied to the normalized price series to measure price deviation from the mean. Higher standard deviation values indicate volatility expansion; lower values indicate consolidation. The indicator uses ta.highestbars() and ta.lowestbars() to identify when volatility peaks and troughs occur over the detection period (default 14 bars).

### Channel Formation Logic:

When volatility crosses from a high level to a low level (ta.crossover(upper, lower)), a consolidation phase begins. The indicator tracks the highest and lowest prices during this period, which become the channel boundaries. Minimum duration of 10+ bars is required to filter out brief volatility spikes. Channels are rendered as box objects with defined upper and lower boundaries, with colored zones indicating entry areas.

### Entry Signal Generation:

The indicator uses immediate touch-based entry logic. Entry zones are defined as a percentage from channel edges (default 20%):

- **Long Entry Zone**: Bottom 20% of channel (bottomBound + channelRange × 0.2)

- **Short Entry Zone**: Top 20% of channel (topBound - channelRange × 0.2)

Long signals trigger when candle low touches or enters the long entry zone. Short signals trigger when candle high touches or enters the short entry zone. Visual markers (arrows and labels) appear on chart, and configured alerts fire immediately.

### Cooldown Filter:

An optional cooldown period (measured in bars) prevents alert spam by enforcing minimum spacing between consecutive signals. If cooldown is set to 3 bars, no new long alert will fire until 3 bars after the previous long signal. Long and short cooldowns are tracked independently, allowing both directions to signal within the same period.

### ATR Volatility Filter:

The indicator includes a multi-timeframe ATR filter to avoid alerts during low-volatility conditions. Using request.security(), it fetches ATR values from a specified timeframe (e.g., 1-minute ATR while viewing 5-minute charts). The filter compares current ATR to a user-defined minimum threshold:

- If ATR ≥ threshold: Alerts enabled

- If ATR < threshold: No alerts fire

This prevents notifications during dead zones where mean reversion is unreliable due to insufficient price movement. The ATR status is displayed in the info table with visual confirmation (✓ or ✗).

### Take Profit Calculation:

Two TP methods are available:

**Fixed Points Mode**:

- Long TP = Entry + (TP_Ticks × syminfo.mintick)

- Short TP = Entry - (TP_Ticks × syminfo.mintick)

**Channel Percentage Mode**:

- Long TP = Entry + (ChannelRange × TP_Percent)

- Short TP = Entry - (ChannelRange × TP_Percent)

Default 50% targets the channel midline, a natural mean reversion target. These levels are displayed as visual lines with labels and included in alert messages for reference when manually placing orders.

### Stop Loss Placement:

Stop losses are calculated just outside the channel boundary by a user-defined tick offset:

- Long SL = ChannelBottom - (SL_Offset_Ticks × syminfo.mintick)

- Short SL = ChannelTop + (SL_Offset_Ticks × syminfo.mintick)

This logic assumes channel breaks invalidate the mean reversion thesis. SL levels are displayed on chart and included in alert notifications as suggested stop placement.

### Channel Breakout Management:

Channels are removed when price closes more than 10 ticks outside boundaries. This tolerance prevents premature channel deletion from minor breaks or wicks, allowing the mean reversion setup to persist through small boundary violations.

## INPUT PARAMETERS:

### Channel Settings:

- **Nested Channels**: Allow multiple overlapping channels vs single channel

- **Normalization Length**: Lookback for high/low calculation (1-500, default 100)

- **Box Detection Length**: Period for volatility detection (1-100, default 14)

### Scalping Settings:

- **Enable Long Scalps**: Toggle long alert generation on/off

- **Enable Short Scalps**: Toggle short alert generation on/off

- **Entry Zone % from Edge**: Size of entry zone (5-50%, default 20%)

- **SL Offset (Ticks)**: Distance beyond channel for stop (1+, default 5)

- **Cooldown Period (Bars)**: Minimum spacing between alerts (0 = no cooldown)

### ATR Filter:

- **Enable ATR Filter**: Toggle volatility filter on/off

- **ATR Timeframe**: Source timeframe for ATR (1, 5, 15, 60 min, etc.)

- **ATR Length**: Smoothing period (1-100, default 14)

- **Min ATR Value**: Threshold for alert enablement (0.1+, default 10.0)

### Take Profit Settings:

- **TP Method**: Choose Fixed Points or % of Channel

- **TP Fixed (Ticks)**: Static distance in ticks (1+, default 30)

- **TP % of Channel**: Dynamic target as channel percentage (10-100%, default 50%)

### Appearance:

- **Show Entry Zones**: Toggle zone labels on channels

- **Show Info Table**: Display real-time indicator status

- **Table Position**: Corner placement (Top Left/Right, Bottom Left/Right)

- **Long Color**: Customize long signal color (default: darker green for readability)

- **Short Color**: Customize short signal color (default: red)

- **TP/SL Colors**: Customize take profit and stop loss line colors

- **Line Length**: Visual length of TP/SL reference lines (5-200 bars)

## VISUAL INDICATORS:

- **Channel boxes** with semi-transparent fill showing consolidation zones

- **Colored entry zones** labeled "LONG ZONE ▲" and "SHORT ZONE ▼"

- **Entry signal arrows** below/above bars marking long/short alerts

- **TP/SL reference lines** with emoji labels (⊕ Entry, 🎯 TP, 🛑 SL)

- **Info table** showing channel status, last signal, entry/TP/SL prices, risk/reward ratio, and ATR filter status

- **Visual confirmation** when alerts fire via on-chart markers synchronized with notifications

## HOW TO USE:

### For 1-3 Minute Scalping with Alerts (NQ/ES):

- ATR Timeframe: "1" (1-minute)

- ATR Min Value: 10.0 (for NQ), adjust per instrument

- Entry Zone %: 20-25%

- TP Method: Fixed Points, 20-40 ticks

- SL Offset: 5-10 ticks

- Cooldown: 2-3 bars to reduce alert spam

- **Alert Setup**: Configure "Any Entry Signal" for combined long/short notifications

- **Execution**: When alert fires, verify chart visuals, then manually place limit order at entry zone with provided TP/SL levels

### For 5-15 Minute Day Trading with Alerts:

- ATR Timeframe: "5" or match chart

- ATR Min Value: Adjust to instrument (test 8-15 for NQ)

- Entry Zone %: 20-30%

- TP Method: % of Channel, 40-60%

- SL Offset: 5-10 ticks

- Cooldown: 3-5 bars

- **Alert Setup**: Configure separate "Long Scalp Entry" and "Short Scalp Entry" alerts if you trade directionally based on bias

- **Execution**: Review channel structure on alert, confirm ATR filter shows ✓, then enter manually

### For 30-60 Minute Swing Scalping with Alerts:

- ATR Timeframe: "15" or "30"

- ATR Min Value: Lower threshold for broader market

- Entry Zone %: 25-35%

- TP Method: % of Channel, 50-70%

- SL Offset: 10-15 ticks

- Cooldown: 5+ bars or disable

- **Alert Setup**: Use "New Channel Formation" to prepare for setups, then "Any Entry Signal" for execution alerts

- **Execution**: Larger timeframes allow more analysis time between alert and entry

### Webhook Integration for Semi-Automation:

- Configure alert webhook URL to connect with platforms like TradersPost, TradingView Paper Trading, or custom automation

- Alert message includes all necessary order parameters (direction, entry, TP, SL)

- Webhook receives structured data when signal fires

- External platform can auto-execute based on alert payload

- Still maintains manual oversight vs full strategy automation

## USAGE CONSIDERATIONS:

- **Manual Discipline Required**: Alerts provide opportunities but execution requires judgment. Not all alerts should be taken - consider market context, trend, and channel quality

- **Alert Timing**: Alerts fire on bar close by default. Ensure "Once Per Bar Close" is selected to avoid false signals during bar formation

- **Notification Delivery**: Mobile/email alerts may have 1-3 second delay. For immediate execution, use desktop popups or webhook automation

- **Cooldown Necessity**: Without cooldown, rapidly touching price action can generate excessive alerts. Start with 3-bar cooldown and adjust based on alert volume

- **ATR Filter Impact**: Enabling ATR filter dramatically reduces alert count but improves quality. Track filter status in info table to understand when you're receiving fewer alerts

- **Commission Awareness**: High alert frequency means high potential trade count. Calculate if your commission structure supports frequent scalping before acting on all alerts

## COMPATIBLE MARKETS:

Works on any instrument with price data including stock indices (NQ, ES, YM, RTY), individual stocks, forex pairs (EUR/USD, GBP/USD), cryptocurrency (BTC, ETH), and commodities. Volume-based features are not included in this indicator version. Multi-timeframe ATR requires higher-tier TradingView subscription for request.security() functionality on timeframes below chart timeframe.

## KNOWN LIMITATIONS:

- **Indicator does not execute trades** - alerts are informational only; you must manually place all orders

- **Alert delivery depends on TradingView infrastructure** - delays or failures possible during platform issues

- **No position tracking** - indicator doesn't know if you're in a trade; you must manage open positions independently

- **TP/SL levels are reference only** - you must manually set these on your broker platform; they are not live orders

- **Immediate touch entry can generate many alerts** in choppy zones without adequate cooldown

- **Channel deletion at 10-tick breaks** may be too aggressive or lenient depending on instrument tick size

- **ATR filter from lower timeframes** requires TradingView Premium/Pro+ for request.security()

- **Mean reversion logic fails** in strong breakout scenarios - alerts will fire but trades may hit stops

- **No partial closing capability** - full position management is manual; you determine scaling out

- **Alerts do not account for gaps** or overnight price changes; morning alerts may be stale

## RISK DISCLOSURE:

Trading involves substantial risk of loss. This indicator provides signals for educational and informational purposes only and does not constitute financial advice. Past performance does not guarantee future results. Mean reversion strategies can experience extended drawdowns during trending markets. Alerts are not guaranteed to be profitable and should be combined with your own analysis. Stop losses may not fill at intended levels during extreme volatility or gaps. Never trade with capital you cannot afford to lose. Consider consulting a licensed financial advisor before making trading decisions. Always verify alerts against current market conditions before executing trades manually.

## ACKNOWLEDGMENT & CREDITS:

This indicator is built upon the channel detection methodology created by **AlgoAlpha** in the "Smart Money Breakout Channels" indicator. Full credit and appreciation to AlgoAlpha for pioneering the normalized volatility approach to identifying consolidation patterns. The core channel formation logic using normalized price standard deviation is AlgoAlpha's original contribution to the TradingView community.

Enhancements to the original concept include: mean reversion entry logic (vs breakout), immediate touch-based alert generation, comprehensive alert condition system with customizable notifications, multi-timeframe ATR volatility filtering, cooldown period for alert management, dual TP methods (fixed points vs channel percentage), visual TP/SL reference lines, and real-time status monitoring table. This indicator version is specifically designed for manual traders who prefer alert-based decision making over automated execution.

BOCS Channel Scalper Strategy - Automated Mean Reversion System# BOCS Channel Scalper Strategy - Automated Mean Reversion System

## WHAT THIS STRATEGY DOES:

This is an automated mean reversion trading strategy that identifies consolidation channels through volatility analysis and executes scalp trades when price enters entry zones near channel boundaries. Unlike breakout strategies, this system assumes price will revert to the channel mean, taking profits as price bounces back from extremes. Position sizing is fully customizable with three methods: fixed contracts, percentage of equity, or fixed dollar amount. Stop losses are placed just outside channel boundaries with take profits calculated either as fixed points or as a percentage of channel range.

## KEY DIFFERENCE FROM ORIGINAL BOCS:

**This strategy is designed for traders seeking higher trade frequency.** The original BOCS indicator trades breakouts OUTSIDE channels, waiting for price to escape consolidation before entering. This scalper version trades mean reversion INSIDE channels, entering when price reaches channel extremes and betting on a bounce back to center. The result is significantly more trading opportunities:

- **Original BOCS**: 1-3 signals per channel (only on breakout)

- **Scalper Version**: 5-15+ signals per channel (every touch of entry zones)

- **Trade Style**: Mean reversion vs trend following

- **Hold Time**: Seconds to minutes vs minutes to hours

- **Best Markets**: Ranging/choppy conditions vs trending breakouts

This makes the scalper ideal for active day traders who want continuous opportunities within consolidation zones rather than waiting for breakout confirmation. However, increased trade frequency also means higher commission costs and requires tighter risk management.

## TECHNICAL METHODOLOGY:

### Price Normalization Process:

The strategy normalizes price data to create consistent volatility measurements across different instruments and price levels. It calculates the highest high and lowest low over a user-defined lookback period (default 100 bars). Current close price is normalized using: (close - lowest_low) / (highest_high - lowest_low), producing values between 0 and 1 for standardized volatility analysis.

### Volatility Detection:

A 14-period standard deviation is applied to the normalized price series to measure price deviation from the mean. Higher standard deviation values indicate volatility expansion; lower values indicate consolidation. The strategy uses ta.highestbars() and ta.lowestbars() to identify when volatility peaks and troughs occur over the detection period (default 14 bars).

### Channel Formation Logic:

When volatility crosses from a high level to a low level (ta.crossover(upper, lower)), a consolidation phase begins. The strategy tracks the highest and lowest prices during this period, which become the channel boundaries. Minimum duration of 10+ bars is required to filter out brief volatility spikes. Channels are rendered as box objects with defined upper and lower boundaries, with colored zones indicating entry areas.

### Entry Signal Generation:

The strategy uses immediate touch-based entry logic. Entry zones are defined as a percentage from channel edges (default 20%):

- **Long Entry Zone**: Bottom 20% of channel (bottomBound + channelRange × 0.2)

- **Short Entry Zone**: Top 20% of channel (topBound - channelRange × 0.2)

Long signals trigger when candle low touches or enters the long entry zone. Short signals trigger when candle high touches or enters the short entry zone. This captures mean reversion opportunities as price reaches channel extremes.

### Cooldown Filter:

An optional cooldown period (measured in bars) prevents signal spam by enforcing minimum spacing between consecutive signals. If cooldown is set to 3 bars, no new long signal will fire until 3 bars after the previous long signal. Long and short cooldowns are tracked independently, allowing both directions to signal within the same period.

### ATR Volatility Filter:

The strategy includes a multi-timeframe ATR filter to avoid trading during low-volatility conditions. Using request.security(), it fetches ATR values from a specified timeframe (e.g., 1-minute ATR while trading on 5-minute charts). The filter compares current ATR to a user-defined minimum threshold:

- If ATR ≥ threshold: Trading enabled

- If ATR < threshold: No signals fire

This prevents entries during dead zones where mean reversion is unreliable due to insufficient price movement.

### Take Profit Calculation:

Two TP methods are available:

**Fixed Points Mode**:

- Long TP = Entry + (TP_Ticks × syminfo.mintick)

- Short TP = Entry - (TP_Ticks × syminfo.mintick)

**Channel Percentage Mode**:

- Long TP = Entry + (ChannelRange × TP_Percent)

- Short TP = Entry - (ChannelRange × TP_Percent)

Default 50% targets the channel midline, a natural mean reversion target. Larger percentages aim for opposite channel edge.

### Stop Loss Placement:

Stop losses are placed just outside the channel boundary by a user-defined tick offset:

- Long SL = ChannelBottom - (SL_Offset_Ticks × syminfo.mintick)

- Short SL = ChannelTop + (SL_Offset_Ticks × syminfo.mintick)

This logic assumes channel breaks invalidate the mean reversion thesis. If price breaks through, the range is no longer valid and position exits.

### Trade Execution Logic:

When entry conditions are met (price in zone, cooldown satisfied, ATR filter passed, no existing position):

1. Calculate entry price at zone boundary

2. Calculate TP and SL based on selected method

3. Execute strategy.entry() with calculated position size

4. Place strategy.exit() with TP limit and SL stop orders

5. Update info table with active trade details

The strategy enforces one position at a time by checking strategy.position_size == 0 before entry.

### Channel Breakout Management:

Channels are removed when price closes more than 10 ticks outside boundaries. This tolerance prevents premature channel deletion from minor breaks or wicks, allowing the mean reversion setup to persist through small boundary violations.

### Position Sizing System:

Three methods calculate position size:

**Fixed Contracts**:

- Uses exact contract quantity specified in settings

- Best for futures traders (e.g., "trade 2 NQ contracts")

**Percentage of Equity**:

- position_size = (strategy.equity × equity_pct / 100) / close

- Dynamically scales with account growth

**Cash Amount**:

- position_size = cash_amount / close

- Maintains consistent dollar exposure regardless of price

## INPUT PARAMETERS:

### Position Sizing:

- **Position Size Type**: Choose Fixed Contracts, % of Equity, or Cash Amount

- **Number of Contracts**: Fixed quantity per trade (1-1000)

- **% of Equity**: Percentage of account to allocate (1-100%)

- **Cash Amount**: Dollar value per position ($100+)

### Channel Settings:

- **Nested Channels**: Allow multiple overlapping channels vs single channel

- **Normalization Length**: Lookback for high/low calculation (1-500, default 100)

- **Box Detection Length**: Period for volatility detection (1-100, default 14)

### Scalping Settings:

- **Enable Long Scalps**: Toggle long entries on/off

- **Enable Short Scalps**: Toggle short entries on/off

- **Entry Zone % from Edge**: Size of entry zone (5-50%, default 20%)

- **SL Offset (Ticks)**: Distance beyond channel for stop (1+, default 5)

- **Cooldown Period (Bars)**: Minimum spacing between signals (0 = no cooldown)

### ATR Filter:

- **Enable ATR Filter**: Toggle volatility filter on/off

- **ATR Timeframe**: Source timeframe for ATR (1, 5, 15, 60 min, etc.)

- **ATR Length**: Smoothing period (1-100, default 14)

- **Min ATR Value**: Threshold for trade enablement (0.1+, default 10.0)

### Take Profit Settings:

- **TP Method**: Choose Fixed Points or % of Channel

- **TP Fixed (Ticks)**: Static distance in ticks (1+, default 30)

- **TP % of Channel**: Dynamic target as channel percentage (10-100%, default 50%)

### Appearance:

- **Show Entry Zones**: Toggle zone labels on channels

- **Show Info Table**: Display real-time strategy status

- **Table Position**: Corner placement (Top Left/Right, Bottom Left/Right)

- **Color Settings**: Customize long/short/TP/SL colors

## VISUAL INDICATORS:

- **Channel boxes** with semi-transparent fill showing consolidation zones

- **Colored entry zones** labeled "LONG ZONE ▲" and "SHORT ZONE ▼"

- **Entry signal arrows** below/above bars marking long/short entries

- **Active TP/SL lines** with emoji labels (⊕ Entry, 🎯 TP, 🛑 SL)

- **Info table** showing position status, channel state, last signal, entry/TP/SL prices, and ATR status

## HOW TO USE:

### For 1-3 Minute Scalping (NQ/ES):

- ATR Timeframe: "1" (1-minute)

- ATR Min Value: 10.0 (for NQ), adjust per instrument

- Entry Zone %: 20-25%

- TP Method: Fixed Points, 20-40 ticks

- SL Offset: 5-10 ticks

- Cooldown: 2-3 bars

- Position Size: 1-2 contracts

### For 5-15 Minute Day Trading:

- ATR Timeframe: "5" or match chart

- ATR Min Value: Adjust to instrument (test 8-15 for NQ)

- Entry Zone %: 20-30%

- TP Method: % of Channel, 40-60%

- SL Offset: 5-10 ticks

- Cooldown: 3-5 bars

- Position Size: Fixed contracts or 5-10% equity

### For 30-60 Minute Swing Scalping:

- ATR Timeframe: "15" or "30"

- ATR Min Value: Lower threshold for broader market

- Entry Zone %: 25-35%

- TP Method: % of Channel, 50-70%

- SL Offset: 10-15 ticks

- Cooldown: 5+ bars or disable

- Position Size: % of equity recommended

## BACKTEST CONSIDERATIONS:

- Strategy performs best in ranging, mean-reverting markets

- Strong trending markets produce more stop losses as price breaks channels

- ATR filter significantly reduces trade count but improves quality during low volatility

- Cooldown period trades signal quantity for signal quality

- Commission and slippage materially impact sub-5-minute timeframe performance

- Shorter timeframes require tighter entry zones (15-20%) to catch quick reversions

- % of Channel TP adapts better to varying channel sizes than fixed points

- Fixed contract sizing recommended for consistent risk per trade in futures

**Backtesting Parameters Used**: This strategy was developed and tested using realistic commission and slippage values to provide accurate performance expectations. Recommended settings: Commission of $1.40 per side (typical for NQ futures through discount brokers), slippage of 2 ticks to account for execution delays on fast-moving scalp entries. These values reflect real-world trading costs that active scalpers will encounter. Backtest results without proper cost simulation will significantly overstate profitability.

## COMPATIBLE MARKETS:

Works on any instrument with price data including stock indices (NQ, ES, YM, RTY), individual stocks, forex pairs (EUR/USD, GBP/USD), cryptocurrency (BTC, ETH), and commodities. Volume-based features require data feed with volume information but are optional for core functionality.

## KNOWN LIMITATIONS:

- Immediate touch entry can fire multiple times in choppy zones without adequate cooldown

- Channel deletion at 10-tick breaks may be too aggressive or lenient depending on instrument tick size

- ATR filter from lower timeframes requires higher-tier TradingView subscription (request.security limitation)

- Mean reversion logic fails in strong breakout scenarios leading to stop loss hits

- Position sizing via % of equity or cash amount calculates based on close price, may differ from actual fill price

- No partial closing capability - full position exits at TP or SL only

- Strategy does not account for gap openings or overnight holds

## RISK DISCLOSURE:

Trading involves substantial risk of loss. Past performance does not guarantee future results. This strategy is for educational purposes and backtesting only. Mean reversion strategies can experience extended drawdowns during trending markets. Stop losses may not fill at intended levels during extreme volatility or gaps. Thoroughly test on historical data and paper trade before risking real capital. Use appropriate position sizing and never risk more than you can afford to lose. Consider consulting a licensed financial advisor before making trading decisions. Automated trading systems can malfunction - monitor all live positions actively.

## ACKNOWLEDGMENT & CREDITS:

This strategy is built upon the channel detection methodology created by **AlgoAlpha** in the "Smart Money Breakout Channels" indicator. Full credit and appreciation to AlgoAlpha for pioneering the normalized volatility approach to identifying consolidation patterns. The core channel formation logic using normalized price standard deviation is AlgoAlpha's original contribution to the TradingView community.

Enhancements to the original concept include: mean reversion entry logic (vs breakout), immediate touch-based signals, multi-timeframe ATR volatility filtering, flexible position sizing (fixed/percentage/cash), cooldown period filtering, dual TP methods (fixed points vs channel percentage), automated strategy execution with exit management, and real-time position monitoring table.

AMHA + 4 EMAs + EMA50/200 Counter + Avg10CrossesDescription:

This script combines two types of Heikin-Ashi visualization with multiple Exponential Moving Averages (EMAs) and a counting function for EMA50/200 crossovers. The goal is to make trends more visible, measure recurring market cycles, and provide statistical context without generating trading signals.

Logic in Detail:

Adaptive Median Heikin-Ashi (AMHA):

Instead of the classic Heikin-Ashi calculation, this method uses the median of Open, High, Low, and Close. The result smooths out price movements, emphasizes trend direction, and reduces market noise.

Standard Heikin-Ashi Overlay:

Classic HA candles are also drawn in the background for comparison and transparency. Both HA types can be shifted below the chart’s price action using a customizable Offset (Ticks) parameter.

EMA Structure:

Five exponential moving averages (21, 50, 100, 200, 500) are included to highlight different trend horizons. EMA50 and EMA200 are emphasized, as their crossovers are widely monitored as potential trend signals. EMA21 and EMA100 serve as additional structure layers, while EMA500 represents the long-term trend.

EMA50/200 Counter:

The script counts how many bars have passed since the last EMA50/200 crossover. This makes it easy to see the age of the current trend phase. A colored label above the chart displays the current counter.

Average of the Last 10 Crossovers (Avg10Crosses):

The script stores the last 10 completed count phases and calculates their average length. This provides historical context and allows traders to compare the current cycle against typical past behavior.

Benefits for Analysis:

Clearer trend visualization through adaptive Heikin-Ashi calculation.

Multi-EMA setup for quick structural assessment.

Objective measurement of trend phase duration.

Statistical insight from the average cycle length of past EMA50/200 crosses.

Flexible visualization through adjustable offset positioning below the price chart.

Usage:

Add the indicator to your chart.

For a clean look, you may switch your chart type to “Line” or hide standard candlesticks.

Interpret visual signals:

White candles = bullish phases

Orange candles = bearish phases

EMAs = structural trend filters (e.g., EMA200 as a long-term boundary)

The counter label shows the current number of bars since the last cross, while Avg10 represents the historical mean.

Special Feature:

This script is not a trading system. It does not provide buy/sell recommendations. Instead, it serves as a visual and statistical tool for market structure analysis. The unique combination of Adaptive Median Heikin-Ashi, multi-EMA framework, and EMA50/200 crossover statistics makes it especially useful for trend-followers and swing traders who want to add cycle-length analysis to their toolkit.

BOCS AdaptiveBOCS Adaptive Strategy - Automated Volatility Breakout System

WHAT THIS STRATEGY DOES:

This is an automated trading strategy that detects consolidation patterns through volatility analysis and executes trades when price breaks out of these channels. Take-profit and stop-loss levels are calculated dynamically using Average True Range (ATR) to adapt to current market volatility. The strategy closes positions partially at the first profit target and exits the remainder at the second target or stop loss.

TECHNICAL METHODOLOGY:

Price Normalization Process:

The strategy begins by normalizing price to create a consistent measurement scale. It calculates the highest high and lowest low over a user-defined lookback period (default 100 bars). The current close price is then normalized using the formula: (close - lowest_low) / (highest_high - lowest_low). This produces values between 0 and 1, allowing volatility analysis to work consistently across different instruments and price levels.

Volatility Detection:

A 14-period standard deviation is applied to the normalized price series. Standard deviation measures how much prices deviate from their average - higher values indicate volatility expansion, lower values indicate consolidation. The strategy uses ta.highestbars() and ta.lowestbars() functions to track when volatility reaches peaks and troughs over the detection length period (default 14 bars).

Channel Formation Logic:

When volatility crosses from a high level to a low level, this signals the beginning of a consolidation phase. The strategy records this moment using ta.crossover(upper, lower) and begins tracking the highest and lowest prices during the consolidation. These become the channel boundaries. The duration between the crossover and current bar must exceed 10 bars minimum to avoid false channels from brief volatility spikes. Channels are drawn using box objects with the recorded high/low boundaries.

Breakout Signal Generation:

Two detection modes are available:

Strong Closes Mode (default): Breakout occurs when the candle body midpoint math.avg(close, open) exceeds the channel boundary. This filters out wick-only breaks.

Any Touch Mode: Breakout occurs when the close price exceeds the boundary.

When price closes above the upper channel boundary, a bullish breakout signal generates. When price closes below the lower boundary, a bearish breakout signal generates. The channel is then removed from the chart.

ATR-Based Risk Management:

The strategy uses request.security() to fetch ATR values from a specified timeframe, which can differ from the chart timeframe. For example, on a 5-minute chart, you can use 1-minute ATR for more responsive calculations. The ATR is calculated using ta.atr(length) with a user-defined period (default 14).

Exit levels are calculated at the moment of breakout:

Long Entry Price = Upper channel boundary

Long TP1 = Entry + (ATR × TP1 Multiplier)

Long TP2 = Entry + (ATR × TP2 Multiplier)

Long SL = Entry - (ATR × SL Multiplier)

For short trades, the calculation inverts:

Short Entry Price = Lower channel boundary

Short TP1 = Entry - (ATR × TP1 Multiplier)

Short TP2 = Entry - (ATR × TP2 Multiplier)

Short SL = Entry + (ATR × SL Multiplier)

Trade Execution Logic:

When a breakout occurs, the strategy checks if trading hours filter is satisfied (if enabled) and if position size equals zero (no existing position). If volume confirmation is enabled, it also verifies that current volume exceeds 1.2 times the 20-period simple moving average.

If all conditions are met:

strategy.entry() opens a position using the user-defined number of contracts

strategy.exit() immediately places a stop loss order

The code monitors price against TP1 and TP2 levels on each bar

When price reaches TP1, strategy.close() closes the specified number of contracts (e.g., if you enter with 3 contracts and set TP1 close to 1, it closes 1 contract). When price reaches TP2, it closes all remaining contracts. If stop loss is hit first, the entire position exits via the strategy.exit() order.

Volume Analysis System:

The strategy uses ta.requestUpAndDownVolume(timeframe) to fetch up volume, down volume, and volume delta from a specified timeframe. Three display modes are available:

Volume Mode: Shows total volume as bars scaled relative to the 20-period average

Comparison Mode: Shows up volume and down volume as separate bars above/below the channel midline

Delta Mode: Shows net volume delta (up volume - down volume) as bars, positive values above midline, negative below

The volume confirmation logic compares breakout bar volume to the 20-period SMA. If volume ÷ average > 1.2, the breakout is classified as "confirmed." When volume confirmation is enabled in settings, only confirmed breakouts generate trades.

INPUT PARAMETERS:

Strategy Settings:

Number of Contracts: Fixed quantity to trade per signal (1-1000)

Require Volume Confirmation: Toggle to only trade signals with volume >120% of average

TP1 Close Contracts: Exact number of contracts to close at first target (1-1000)

Use Trading Hours Filter: Toggle to restrict trading to specified session

Trading Hours: Session input in HHMM-HHMM format (e.g., "0930-1600")

Main Settings:

Normalization Length: Lookback bars for high/low calculation (1-500, default 100)

Box Detection Length: Period for volatility peak/trough detection (1-100, default 14)

Strong Closes Only: Toggle between body midpoint vs close price for breakout detection

Nested Channels: Allow multiple overlapping channels vs single channel at a time

ATR TP/SL Settings:

ATR Timeframe: Source timeframe for ATR calculation (1, 5, 15, 60, etc.)

ATR Length: Smoothing period for ATR (1-100, default 14)

Take Profit 1 Multiplier: Distance from entry as multiple of ATR (0.1-10.0, default 2.0)

Take Profit 2 Multiplier: Distance from entry as multiple of ATR (0.1-10.0, default 3.0)

Stop Loss Multiplier: Distance from entry as multiple of ATR (0.1-10.0, default 1.0)

Enable Take Profit 2: Toggle second profit target on/off

VISUAL INDICATORS:

Channel boxes with semi-transparent fill showing consolidation zones

Green/red colored zones at channel boundaries indicating breakout areas

Volume bars displayed within channels using selected mode

TP/SL lines with labels showing both price level and distance in points

Entry signals marked with up/down triangles at breakout price

Strategy status table showing position, contracts, P&L, ATR values, and volume confirmation status

HOW TO USE:

For 2-Minute Scalping:

Set ATR Timeframe to "1" (1-minute), ATR Length to 12, TP1 Multiplier to 2.0, TP2 Multiplier to 3.0, SL Multiplier to 1.5. Enable volume confirmation and strong closes only. Use trading hours filter to avoid low-volume periods.

For 5-15 Minute Day Trading:

Set ATR Timeframe to match chart or use 5-minute, ATR Length to 14, TP1 Multiplier to 2.0, TP2 Multiplier to 3.5, SL Multiplier to 1.2. Volume confirmation recommended but optional.

For Hourly+ Swing Trading:

Set ATR Timeframe to 15-30 minute, ATR Length to 14-21, TP1 Multiplier to 2.5, TP2 Multiplier to 4.0, SL Multiplier to 1.5. Volume confirmation optional, nested channels can be enabled for multiple setups.

BACKTEST CONSIDERATIONS:

Strategy performs best during trending or volatility expansion phases

Consolidation-heavy or choppy markets produce more false signals

Shorter timeframes require wider stop loss multipliers due to noise

Commission and slippage significantly impact performance on sub-5-minute charts

Volume confirmation generally improves win rate but reduces trade frequency

ATR multipliers should be optimized for specific instrument characteristics

COMPATIBLE MARKETS:

Works on any instrument with price and volume data including forex pairs, stock indices, individual stocks, cryptocurrency, commodities, and futures contracts. Requires TradingView data feed that includes volume for volume confirmation features to function.

KNOWN LIMITATIONS:

Stop losses execute via strategy.exit() and may not fill at exact levels during gaps or extreme volatility

request.security() on lower timeframes requires higher-tier TradingView subscription

False breakouts inherent to breakout strategies cannot be completely eliminated

Performance varies significantly based on market regime (trending vs ranging)

Partial closing logic requires sufficient position size relative to TP1 close contracts setting

RISK DISCLOSURE:

Trading involves substantial risk of loss. Past performance of this or any strategy does not guarantee future results. This strategy is provided for educational purposes and automated backtesting. Thoroughly test on historical data and paper trade before risking real capital. Market conditions change and strategies that worked historically may fail in the future. Use appropriate position sizing and never risk more than you can afford to lose. Consider consulting a licensed financial advisor before making trading decisions.

ACKNOWLEDGMENT & CREDITS:

This strategy is built upon the channel detection methodology created by AlgoAlpha in the "Smart Money Breakout Channels" indicator. Full credit and appreciation to AlgoAlpha for pioneering the normalized volatility approach to identifying consolidation patterns and sharing this innovative technique with the TradingView community. The enhancements added to the original concept include automated trade execution, multi-timeframe ATR-based risk management, partial position closing by contract count, volume confirmation filtering, and real-time position monitoring.

Initial Balance SMC-V3

Initial Balance SMC-V3 – An Advanced Mean Reversion Indicator for Index Markets

The Initial Balance SMC-V3 indicator is the result of continuous refinement in mean reversion trading, with a specific focus on index markets (such as DAX, NASDAQ, S&P 500, etc.). Designed for high-liquidity environments with controlled volatility, it excels at precisely identifying value zones and statistical reversal points within market structure.

🔁 Mean Reversion at Its Core

At the heart of this indicator lies a robust mean reversion logic: rather than chasing extreme breakouts, it seeks returns toward equilibrium levels after impulsive moves. This makes it especially effective in ranging markets or corrective phases within broader trends—situations where many traders get caught in false breakouts.

🎯 Signals Require Breakout + Confirmation

Signals are never generated impulsively. Instead, they require a clear sequence of confirmations:

Break of a key level (e.g., Initial Balance high/low or an SMC zone);

Price re-entry into the range accompanied by a crossover of customizable moving averages (SMA, EMA, HULL, TEMA, etc.);

RSI filter to avoid entries in overbought/oversold extremes;

Volatility filter (ATR) to skip low-volatility, choppy conditions.

This multi-layered approach drastically reduces false signals and significantly improves trade quality.

📊 Built-in Multi-Timeframe Analysis

The indicator features native multi-timeframe logic:

H1 / 15-minute charts: for structural analysis and identification of Supply & Demand zones (SMC);

M1 / M5 charts: for precise trade execution, with targeted entries and dynamic risk management.

SMC zones are calculated on higher timeframes (e.g., 4H) to ensure structural reliability, while actual trade signals trigger on lower timeframes for maximum precision.

⚙️ Advanced Customization

Full choice of moving average type (SMA, EMA, WMA, RMA, VWMA, HULL, TEMA, ZLEMA, etc.);

Revenge Trading logic: after a stop loss is hit without reaching the 1:1 breakeven level, the indicator automatically prepares for a counter-trade;

Dynamic ATR-based stop loss with customizable multiplier;

Session filters to trade only during optimal liquidity windows (e.g., European session).

🧠 Who Is It For?

This indicator is ideal for traders who:

Primarily trade indices;

Prefer mean reversion strategies over pure trend-following;

Seek a disciplined, rule-based system with multiple confluence filters;

Use a multi-timeframe approach to separate analysis from execution.

In short: Initial Balance SMC-V3 is more than just an indicator—it’s a complete trading framework for mean reversion on index markets, where every signal emerges from a confluence of statistical, structural, and temporal factors.

Happy trading! 📈

Institutional Levels (CNN) - [PhenLabs]📊Institutional Levels (Convolutional Neural Network-inspired)

Version : PineScript™v6

📌Description

The CNN-IL Institutional Levels indicator represents a breakthrough in automated zone detection technology, combining convolutional neural network principles with advanced statistical modeling. This sophisticated tool identifies high-probability institutional trading zones by analyzing pivot patterns, volume dynamics, and price behavior using machine learning algorithms.

The indicator employs a proprietary 9-factor logistic regression model that calculates real-time reaction probabilities for each detected zone. By incorporating CNN-inspired filtering techniques and dynamic zone management, it provides traders with unprecedented accuracy in identifying where institutional money is likely to react to price action.

🚀Points of Innovation

● CNN-Inspired Pivot Analysis - Advanced binning system using convolutional neural network principles for superior pattern recognition

● Real-Time Probability Engine - Live reaction probability calculations using 9-factor logistic regression model

● Dynamic Zone Intelligence - Automatic zone merging using Intersection over Union (IoU) algorithms

● Volume-Weighted Scoring - Time-of-day volume Z-score analysis for enhanced zone strength assessment

● Adaptive Decay System - Intelligent zone lifecycle management based on touch frequency and recency

● Multi-Filter Architecture - Optional gradient, smoothing, and Difference of Gaussians (DoG) convolution filters

🔧Core Components

● Pivot Detection Engine - Advanced pivot identification with configurable left/right bars and ATR-normalized strength calculations

● Neural Network Binning - Price level clustering using CNN-inspired algorithms with ATR-based bin sizing

● Logistic Regression Model - 9-factor probability calculation including distance, width, volume, VWAP deviation, and trend analysis

● Zone Management System - Intelligent creation, merging, and decay algorithms for optimal zone lifecycle control