Directional Volume Cloud MTFThe Directional Volume Cloud MTF transforms raw volume into a visually intuitive cloud histogram that highlights directional bias and exhaustion zones.

🔍 Core Logic

- Volume bias is calculated using candle direction (bullish/bearish) and smoothed via EMA.

- Bias strength is normalized against average volume to produce a ratio from -1 to +1.

- Color and opacity dynamically reflect bias direction and strength — pale clouds indicate weak volume, while vivid clouds signal strong conviction.

Features

- Customizable bullish/bearish colors

- Dynamic opacity based on volume strength

- Declining volume signals for potential reversals

- Multi-timeframe bias overlay (e.g., daily bias on intraday chart)

📈 Use Cases

- Spot volume exhaustion before reversals

- Confirm breakout strength with bias intensity

- Compare short-term vs long-term volume pressure

Whether you're scalping intraday moves or validating swing setups, this cloud-based volume heatmap offers a clean, modular way to visualize market conviction.

Cari dalam skrip untuk "mtf"

Weis Wave Volume MTF 🎯 Indicator Name

Weis Wave Volume (Multi‑Timeframe) — adapted from the original “Weis Wave Volume by LazyBear.”

This version adds multi‑timeframe (MTF) readings, configurable colors, font size, and screen position for clear dashboard‑style display.

🧠 Concept Background — What is Weis Wave Volume (WWV)?

The Weis Wave Volume indicator originates from Wyckoff and David Weis’ techniques.

Its purpose is to link price movement “waves” with the amount of traded volume to reveal how strong or weak each wave is.

Instead of showing bars one by one, WWV accumulates the total volume while price keeps moving in the same direction.

When price direction changes (up → down or down → up), it:

Finishes the previous wave volume total.

Starts a new wave and begins accumulating again.

Those wave volumes help traders see:

Effort vs Result: Big volume with small price move ⇒ absorption; low volume with big move ⇒ weak participation.

Trend confirmation or exhaustion: High volume waves in trend direction strengthen it, while low‑volume waves hint exhaustion.

⚙️ How this Script Works

Trend & Wave Detection

Compares close with the previous bar to determine up or down movement (mov).

Detects trend reversals (when mov direction changes).

Builds “waves,” each representing a continuous run of bars in one direction.

Volume Accumulation

While price keeps the same direction, the script adds each bar’s volume to the running total (vol).

When direction flips, it resets that total and starts a new wave.

Multi‑Timeframe Computation

Calculates these wave volumes on three timeframes at once, chosen dynamically:

Active Chart Timeframe Displays WWV for:

1 min 1 min

5 min 5 min

15 min 15 min

Any other Chart TF

It uses request.security() to pull each timeframe’s latest WWV value and current wave direction.

Visual Output

Instead of plotting histogram bars, it shows a table with three numeric values:

WWV (1): 25.3 M | (15): 312 M | (240): 2.46 B

Each value is color‑coded:

user‑selected Uptrend Color when price wave = up

user‑selected Downtrend Color when wave = down

You can position this small table in any corner/center (top / bottom × left / center / right).

Font size is user‑adjustable (Tiny → Huge).

📈 How Traders Use It

Quickly gauge buying vs selling effort across multiple horizons.

Compare short‑term wave volume to higher‑timeframe waves to spot:

Alignment → all up and big volumes = strong trend

Divergence → small or opposite‑colored higher‑TF wave = potential reversal or pause

Combine with Wyckoff, VSA, or standard trend analysis to judge if a breakout or pullback has real participation.

🧩 Key Features of This Version

Feature Description

Multi‑Timeframe Panel Displays WWV values for 3 selected TFs at once

Dynamic TF Mapping Auto‑adjusts which TFs to use based on chart

Up/Down Color Coding Customizable colors for wave direction

Adjustable Font and Placement Set font size (Tiny→Huge) and screen corner/center

No Histograms Keeps chart clean; acts as a compact WWV dashboard

Zero Lag Trend Signals (MTF) [Quant Trading] V7Overview

The Zero Lag Trend Signals (MTF) V7 is a comprehensive trend-following strategy that combines Zero Lag Exponential Moving Average (ZLEMA) with volatility-based bands to identify high-probability trade entries and exits. This strategy is designed to reduce lag inherent in traditional moving averages while incorporating dynamic risk management through ATR-based stops and multiple exit mechanisms.

This is a longer term horizon strategy that takes limited trades. It is not a high frequency trading and therefore will also have limited data and not > 100 trades.

How It Works

Core Signal Generation:

The strategy uses a Zero Lag EMA (ZLEMA) calculated by applying an EMA to price data that has been adjusted for lag:

Calculate lag period: floor((length - 1) / 2)

Apply lag correction: src + (src - src )

Calculate ZLEMA: EMA of lag-corrected price

Volatility bands are created using the highest ATR over a lookback period multiplied by a band multiplier. These bands are added to and subtracted from the ZLEMA line to create upper and lower boundaries.

Trend Detection:

The strategy maintains a trend variable that switches between bullish (1) and bearish (-1):

Long Signal: Triggers when price crosses above ZLEMA + volatility band

Short Signal: Triggers when price crosses below ZLEMA - volatility band

Optional ZLEMA Trend Confirmation:

When enabled, this filter requires ZLEMA to show directional momentum before entry:

Bullish Confirmation: ZLEMA must increase for 4 consecutive bars

Bearish Confirmation: ZLEMA must decrease for 4 consecutive bars

This additional filter helps avoid false signals in choppy or ranging markets.

Risk Management Features:

The strategy includes multiple stop-loss and take-profit mechanisms:

Volatility-Based Stops: Default stop-loss is placed at ZLEMA ± volatility band

ATR-Based Stops: Dynamic stop-loss calculated as entry price ± (ATR × multiplier)

ATR Trailing Stop: Ratcheting stop-loss that follows price but never moves against position

Risk-Reward Profit Target: Take-profit level set as a multiple of stop distance

Break-Even Stop: Moves stop to entry price after reaching specified R:R ratio

Trend-Based Exit: Closes position when price crosses EMA in opposite direction

Performance Tracking:

The strategy includes optional features for monitoring and analyzing trades:

Floating Statistics Table: Displays key metrics including win rate, GOA (Gain on Account), net P&L, and max drawdown

Trade Log Labels: Shows entry/exit prices, P&L, bars held, and exit reason for each closed trade

CSV Export Fields: Outputs trade data for external analysis

Default Strategy Settings

Commission & Slippage:

Commission: 0.1% per trade

Slippage: 3 ticks

Initial Capital: $1,000

Position Size: 100% of equity per trade

Main Calculation Parameters:

Length: 70 (range: 70-7000) - Controls ZLEMA calculation period

Band Multiplier: 1.2 - Adjusts width of volatility bands

Entry Conditions (All Disabled by Default):

Use ZLEMA Trend Confirmation: OFF - Requires ZLEMA directional momentum

Re-Enter on Long Trend: OFF - Allows multiple entries during sustained trends

Short Trades:

Allow Short Trades: OFF - Strategy is long-only by default

Performance Settings (All Disabled by Default):

Use Profit Target: OFF

Profit Target Risk-Reward Ratio: 2.0 (when enabled)

Dynamic TP/SL (All Disabled by Default):

Use ATR-Based Stop-Loss & Take-Profit: OFF

ATR Length: 14

Stop-Loss ATR Multiplier: 1.5

Profit Target ATR Multiplier: 2.5

Use ATR Trailing Stop: OFF

Trailing Stop ATR Multiplier: 1.5

Use Break-Even Stop-Loss: OFF

Move SL to Break-Even After RR: 1.5

Use Trend-Based Take Profit: OFF

EMA Exit Length: 9

Trade Data Display (All Disabled by Default):

Show Floating Stats Table: OFF

Show Trade Log Labels: OFF

Enable CSV Export: OFF

Trade Label Vertical Offset: 0.5

Backtesting Date Range:

Start Date: January 1, 2018

End Date: December 31, 2069

Important Usage Notes

Default Configuration: The strategy operates in its most basic form with default settings - using only ZLEMA crossovers with volatility bands and volatility-based stop-losses. All advanced features must be manually enabled.

Stop-Loss Priority: If multiple stop-loss methods are enabled simultaneously, the strategy will use whichever condition is hit first. ATR-based stops override volatility-based stops when enabled.

Long-Only by Default: Short trading is disabled by default. Enable "Allow Short Trades" to trade both directions.

Performance Monitoring: Enable the floating stats table and trade log labels to visualize strategy performance during backtesting.

Exit Mechanisms: The strategy can exit trades through multiple methods: stop-loss hit, take-profit reached, trend reversal, or trailing stop activation. The trade log identifies which exit method was used.

Re-Entry Logic: When "Re-Enter on Long Trend" is enabled with ZLEMA trend confirmation, the strategy can take multiple long positions during extended uptrends as long as all entry conditions remain valid.

Capital Efficiency: Default setting uses 100% of equity per trade. Adjust "default_qty_value" to manage position sizing based on risk tolerance.

Realistic Backtesting: Strategy includes commission (0.1%) and slippage (3 ticks) to provide realistic performance expectations. These values should be adjusted based on your broker and market conditions.

Recommended Use Cases

Trending Markets: Best suited for markets with clear directional moves where trend-following strategies excel

Medium to Long-Term Trading: The default length of 70 makes this strategy more appropriate for swing trading rather than scalping

Risk-Conscious Traders: Multiple stop-loss options allow traders to customize risk management to their comfort level

Backtesting & Optimization: Comprehensive performance tracking features make this strategy ideal for testing different parameter combinations

Limitations & Considerations

Like all trend-following strategies, performance may suffer in choppy or ranging markets

Default 100% position sizing means full capital exposure per trade - consider reducing for conservative risk management

Higher length values (70+) reduce signal frequency but may improve signal quality

Multiple simultaneous risk management features may create conflicting exit signals

Past performance shown in backtests does not guarantee future results

Customization Tips

For more aggressive trading:

Reduce length parameter (minimum 70)

Decrease band multiplier for tighter bands

Enable short trades

Use lower profit target R:R ratios

For more conservative trading:

Increase length parameter

Enable ZLEMA trend confirmation

Use wider ATR stop-loss multipliers

Enable break-even stop-loss

Reduce position size from 100% default

For optimal choppy market performance:

Enable ZLEMA trend confirmation

Increase band multiplier

Use tighter profit targets

Avoid re-entry on trend continuation

Visual Elements

The strategy plots several elements on the chart:

ZLEMA line (color-coded by trend direction)

Upper and lower volatility bands

Long entry markers (green triangles)

Short entry markers (red triangles, when enabled)

Stop-loss levels (when positions are open)

Take-profit levels (when enabled and positions are open)

Trailing stop lines (when enabled and positions are open)

Optional ZLEMA trend markers (triangles at highs/lows)

Optional trade log labels showing complete trade information

Exit Reason Codes (for CSV Export)

When CSV export is enabled, exit reasons are coded as:

0 = Manual/Other

1 = Trailing Stop-Loss

2 = Profit Target

3 = ATR Stop-Loss

4 = Trend Change

Conclusion

Zero Lag Trend Signals V7 provides a robust framework for trend-following with extensive customization options. The strategy balances simplicity in its core logic with sophisticated risk management features, making it suitable for both beginner and advanced traders. By reducing moving average lag while incorporating volatility-based signals, it aims to capture trends earlier while managing risk through multiple configurable exit mechanisms.

The modular design allows traders to start with basic trend-following and progressively add complexity through ZLEMA confirmation, multiple stop-loss methods, and advanced exit strategies. Comprehensive performance tracking and export capabilities make this strategy an excellent tool for systematic testing and optimization.

Note: This strategy is provided for educational and backtesting purposes. All trading involves risk. Past performance does not guarantee future results. Always test thoroughly with paper trading before risking real capital, and adjust position sizing and risk parameters according to your risk tolerance and account size.

================================================================================

TAGS:

================================================================================

trend following, ZLEMA, zero lag, volatility bands, ATR stops, risk management, swing trading, momentum, trend confirmation, backtesting

================================================================================

CATEGORY:

================================================================================

Strategies

================================================================================

CHART SETUP RECOMMENDATIONS:

================================================================================

For optimal visualization when publishing:

Use a clean chart with no other indicators overlaid

Select a timeframe that shows multiple trade signals (4H or Daily recommended)

Choose a trending asset (crypto, forex major pairs, or trending stocks work well)

Show at least 6-12 months of data to demonstrate strategy across different market conditions

Enable the floating stats table to display key performance metrics

Ensure all indicator lines (ZLEMA, bands, stops) are clearly visible

Use the default chart type (candlesticks) - avoid Heikin Ashi, Renko, etc.

Make sure symbol information and timeframe are clearly visible

================================================================================

COMPLIANCE NOTES:

================================================================================

✅ Open-source publication with complete code visibility

✅ English-only title and description

✅ Detailed explanation of methodology and calculations

✅ Realistic commission (0.1%) and slippage (3 ticks) included

✅ All default parameters clearly documented

✅ Performance limitations and risks disclosed

✅ No unrealistic claims about performance

✅ No guaranteed results promised

✅ Appropriate for public library (original trend-following implementation with ZLEMA)

✅ Educational disclaimers included

✅ All features explained in detail

================================================================================

Multi-Confluence MTF S/R Signal5 Confluences:

RSI - Detects oversold/overbought conditions with momentum

MACD - Confirms trend direction and momentum shifts

Moving Average Trend - Validates price position relative to 50 SMA and 20 EMA

Volume - Ensures strong participation (1.5x average volume)

Price Action - Confirms breakout (higher high for buys, lower low for sells)

Features:

Green triangles below bars = BUY signal (all 5 confluences bullish)

Red triangles above bars = SELL signal (all 5 confluences bearish)

Background coloring when signals occur

Real-time dashboard showing each confluence status

Built-in alerts you can enable

Customizable parameters for all indicators

Multi-Timeframe Features:

Higher Timeframe Analysis (Default: 60 min)

HTF Trend - Checks if price is above/below moving averages on higher timeframe

HTF MACD - Confirms momentum direction

HTF RSI - Validates not overbought/oversold

Signal Types:

Strong Signals (Full triangles with text)

✅ All 5 current timeframe confluences aligned

✅ Higher timeframe confirmation (2 of 3 HTF conditions)

GREEN "BUY" or RED "SELL" labels

Weak Signals (Small transparent triangles with "?")

✅ All 5 current timeframe confluences aligned

❌ NO higher timeframe confirmation

Use with caution - may signal counter-trend trades

Dashboard Updates:

Shows Current Timeframe section (all 5 confluences)

Shows HTF status (your chosen higher timeframe)

Displays final signal strength

Customizable Settings:

Enable/Disable MTF - Toggle multi-timeframe confirmation

Higher Timeframe - Choose any timeframe (15m, 60m, 4H, D, etc.)

Require HTF - Force HTF confirmation or allow weak signals

Alerts:

Strong Buy/Sell - Full confirmation

Weak Buy/Sell - No HTF confirmation

Period Separator - MTF with Price LevelsPeriod Separator - MTF with Price Levels

A customizable multi-timeframe period separator indicator that displays a user-defined number of vertical lines with corresponding horizontal price levels.

Key Features:

Multi-Timeframe Support: Works with all timeframes from 1-minute to yearly (12M, 3M, M, W, D, 4H, 1H, 15m, 5m, 1m)

Complete Price Level Analysis: Shows horizontal lines for High, Low, 0.75, 0.50, 0.25, and Open levels for all visible periods between vertical separators

Seconds Chart Compatibility: Special 1-minute separator option for seconds timeframes

Full Customization: Independent color, style, and width settings for all lines

Smart Alerts: Optional price break alerts for high/low levels with sound options

Clean Memory Management: Automatically manages line objects to prevent chart clutter

Sliding Window Display: Set exactly how many vertical separator lines to show (1-20), with older lines automatically removed as new periods begin

Perfect for:

Session/period analysis with controlled visual complexity

Support/resistance level identification across multiple periods

Fibonacci-style level trading between defined time periods

Clean chart presentation with limited historical data display

Settings:

Number of Vertical Lines: Controls exactly how many period separators are visible

All price levels can be toggled on/off independently

Comprehensive styling options for professional chart presentation

Ideal for traders who want period-based analysis without overwhelming their charts with too many historical lines.

EMA 89 và EMA 34 - MTF AlertEMA34/89 in MTF and alert. If you want to find indicator for alert, I thing it for you

RSI Momentum Trend MM with Risk Per Trade [MTF]This is a comprehensive and highly customizable trend-following strategy based on RSI momentum. The core logic identifies strong directional moves when the RSI crosses user-defined thresholds, combined with an EMA trend confirmation. It is designed for traders who want granular control over their strategy's parameters, from signal generation to risk management and exit logic.

This script evolves a simple concept into a powerful backtesting tool, allowing you to test various money management and trade management theories across different timeframes.

Key Features

- RSI Momentum Signals: Uses RSI crosses above a "Positive" level or below a "Negative" level to generate trend signals. An EMA filter ensures entries align with the immediate trend.

- Multi-Timeframe (MTF) Analysis: The core RSI and EMA signals can be calculated on a higher timeframe (e.g., using 4H signals to trade on a 1H chart) to align trades with the larger trend. This feature helps to reduce noise and improve signal quality.

Advanced Money Management

- Risk per Trade %: Calculate position size based on a fixed percentage of equity you want to risk per trade.

- Full Equity: A more aggressive option to open each position with 100% of the available strategy equity.

Flexible Exit Logic: Choose from three distinct exit strategies to match your trading style

- Percentage (%) Based: Set a fixed Stop Loss and Take Profit as a percentage of the entry price.

- ATR Multiplier: Base your Stop Loss and Take Profit on the Average True Range (ATR), making your exits adaptive to market volatility.

- Trend Reversal: A true trend-following mode. A long position is held until an opposite "Negative" signal appears, and a short position is held until a "Positive" signal appears. This allows you to "let your winners run."

Backtest Date Range Filter: Easily configure a start and end date to backtest the strategy's performance during specific market periods (e.g., bull markets, bear markets, or high-volatility periods).

How to Use

RSI Settings

- Higher Timeframe: Set the timeframe for signal calculation. This must be higher than your chart's timeframe.

- RSI Length, Positive above, Negative below: Configure the core parameters for the RSI signals.

Money Management

Position Sizing Mode

- Choose "Risk per Trade" to use the Risk per Trade (%) input for precise risk control.

- Choose "Full Equity" to use 100% of your capital for each trade.

- Risk per Trade (%): Define the percentage of your equity to risk on a single trade (only works with the corresponding sizing mode).

SL/TP Calculation Mode

Select your preferred exit method from the dropdown. The strategy will automatically use the relevant inputs (e.g., % values, ATR Multiplier values, or the trend reversal logic).

Backtest Period Settings

Use the Start Date and End Date inputs to isolate a specific period for your backtest analysis.

License & Disclaimer

© waranyu.trkm — MIT License.

This script is for educational purposes only and should not be considered financial advice. Trading involves significant risk, and past performance is not indicative of future results. Always conduct your own research and risk assessment before making any trading decisions.

NN Crypto Scalping ULTIMATE v6 - MTF mapercivNeural Network Crypto Trading System v6.1

Complete Technical Documentation

Author

: Neural Network Ensemble Trading System

Version

: 6.1 - MTF Corrected & Bias Fixed

Date

: January 2025

Platform

: TradingView PineScript v6

Executive Summary

The

Neural Network Crypto Trading System v6.1

is an advanced algorithmic trading system that combines three specialized neural networks into an intelligent ensemble to generate cryptocurrency trading signals. The system integrates multi-timeframe analysis, crypto-specific optimizations, dynamic risk management, and continuous learning to maximize performance in highly volatile markets.

Key Features:

Ensemble of 3 specialized Neural Networks

(Primary, Momentum, Volatility)

Multi-Timeframe Analysis

with 5 timeframes (5m, 15m, 1h, 4h, 1D)

22 Advanced Features

for each model

Anti-repainting

guaranteed with confirmed data

8 Market Regime

automatic detections

6 Signal Levels

(Strong/Moderate/Weak Buy/Sell)

Professional dashboard

with 15+ real-time metrics

Intelligent alert system

with webhook integration

HalfTrend Histogram (MTF)This indicator shows the halftrend on a histogram (rather than a line on the chart) and has an option for Multi timeframe (MTF).

It uses the logic of the original halftrend coded by Everget.

The halftrend is a trend-following indicator that uses volatility to to determine change in bias.

VWAP MTF Scalping ModuleThe VWAP MTF indicator allows you to visualize anchored VWAP across multiple timeframes, while maintaining a clean and responsive display.

Designed for intraday traders, scalpers, and swing traders, this module offers a clear view of volume-weighted average price zones across key timeframes (1m, 5m, 15m, 1h... customizable).

ADX MTF mura visionOverview

ADX MTF — mura vision measures trend strength and visualizes a higher-timeframe (HTF) ADX on any chart. The current-TF ADX is drawn as a line; the HTF ADX is rendered as “step” segments to reflect closed HTF bars without repainting. Optional soft fills highlight the 20–25 (trend forming) and 40–50 (strong trend) zones.

How it works

ADX (current TF) : Classic Wilder formulation using DI components and RMA smoothing.

HTF ADX : Requested via request.security(..., lookahead_off, gaps_off).

When a new HTF bar opens, the previous value is frozen as a horizontal segment.

The current HTF bar is shown as a live moving segment.

This staircase look is expected on lower timeframes.

Auto timeframe mapping

If “Auto” is selected, the HTF is derived from the chart TF:

<30m → 60m, 30–<240m → 240m, 240m–<1D → 1D, 1D → 1W, 1W/2W → 1M, ≥1M → same.

Inputs

DI Length and ADX Smoothing — core ADX parameters.

Higher Time Frame — Auto or a fixed TF.

Line colors/widths for current ADX and HTF ADX.

Fill zone 20–25 and Fill zone 40–50 — optional light background fills.

Number of HTF ADX Bars — limits stored HTF segments to control chart load.

Reading the indicator

ADX < 20: typically range-bound conditions; trend setups require extra caution.

20–25: trend emergence; breakouts and continuation structures gain validity.

40–50: strong trend; favor continuation and manage with trailing stops.

>60 and turning down: possible trend exhaustion or transition toward range.

Note: ADX measures strength, not direction. Combine with your directional filter (e.g., price vs. MA, +DI/−DI, structure/levels).

Non-repainting behavior

HTF values use lookahead_off; closed HTF bars are never revised.

The only moving piece is the live segment for the current HTF bar.

Best practices

Use HTF ADX as a regime filter; time entries with the current-TF ADX rising through your threshold.

Pair with ATR-based stops and a MA/structure filter for direction.

Consider higher thresholds on highly volatile altcoins.

Performance notes

The script draws line segments for HTF bars. If your chart becomes heavy, reduce “Number of HTF ADX Bars.”

Disclaimer

This script is for educational purposes only and does not constitute financial advice. Trading involves risk.

FibADX MTF Dashboard — DMI/ADX with Fibonacci DominanceFibADX MTF Dashboard — DMI/ADX with Fibonacci Dominance (φ)

This indicator fuses classic DMI/ADX with the Fibonacci Golden Ratio to score directional dominance and trend tradability across multiple timeframes in one clean panel.

What’s unique

• Fibonacci dominance tiers:

• BULL / BEAR → one side slightly stronger

• STRONG when one DI ≥ 1.618× the other (φ)

• EXTREME when one DI ≥ 2.618× (φ²)

• Rounded dominance % in the +DI/−DI columns (e.g., STRONG BULL 72%).

• ADX column modes: show the value (with strength bar ▂▃▅… and slope ↗/↘) or a tier (Weak / Tradable / Strong / Extreme).

• Configurable intraday row (30m/1H/2H/4H) + D/W/M toggles.

• Threshold line: color & width; Extended (infinite both ways) or Not extended (historical plot).

• Theme presets (Dark / Light / High Contrast) or full custom colors.

• Optional panel shading when all selected TFs are strong (and optionally directionally aligned).

How to use

1. Choose an intraday TF (30/60/120/240). Enable D/W/M as needed.

2. Use ADX ≥ threshold (e.g., 21 / 34 / 55) to find tradable trends.

3. Read the +DI/−DI labels to confirm bias (BULL/BEAR) and conviction (STRONG/EXTREME).

4. Prefer multi-TF alignment (e.g., 4H & D & W all strong bull).

5. Treat EXTREME as a momentum regime—trail tighter and scale out into spikes.

Alerts

• All selected TFs: Strong BULL alignment

• All selected TFs: Strong BEAR alignment

Notes

• Smoothing selectable: RMA (Wilder) / EMA / SMA.

• Percentages are whole numbers (72%, not 72.18%).

• Shorttitle is FibADX to comply with TV’s 10-char limit.

Why We Use Fibonacci in FibADX

Traditional DMI/ADX indicators rely on fixed numeric thresholds (e.g., ADX > 20 = “tradable”), but they ignore the relationship between +DI and −DI, which is what really determines trend conviction.

FibADX improves on this by introducing the Fibonacci Golden Ratio (φ ≈ 1.618) to measure directional dominance and classify trend strength more intelligently.

⸻

1. Fibonacci as a Natural Strength Threshold

The golden ratio φ appears everywhere in nature, growth cycles, and fractals.

Since financial markets also behave fractally, Fibonacci levels reflect natural crowd behavior and trend acceleration points.

In FibADX:

• When one DI is slightly larger than the other → BULL or BEAR (mild advantage).

• When one DI is at least 1.618× the other → STRONG BULL or STRONG BEAR (trend conviction).

• When one DI is 2.618× or more → EXTREME BULL or EXTREME BEAR (high momentum regime).

This approach adds structure and consistency to trend classification.

⸻

2. Why 1.618 and 2.618 Instead of Random Numbers

Other traders might pick thresholds like 1.5 or 2.0, but φ has special mathematical properties:

• φ is the most irrational ratio, meaning proportions based on φ retain structure even when scaled.

• Using φ makes FibADX naturally adaptive to all timeframes and asset classes — stocks, crypto, forex, commodities.

⸻

3 . Trading Advantages

Using the Fibonacci Golden Ratio inside DMI/ADX has several benefits:

• Better trend filtering → Avoid false DI crossovers without conviction.

• Catch early momentum shifts → Spot when dominance ratios approach φ before ADX reacts.

• Consistency across markets → Because φ is scalable and fractal, it works everywhere.

⸻

4. How FibADX Uses This

FibADX combines:

• +DI vs −DI ratio → Measures directional dominance.

• φ thresholds (1.618, 2.618) → Classifies strength into BULL, STRONG, EXTREME.

• ADX threshold → Confirms whether the move is tradable or just noise.

• Multi-timeframe dashboard → Aligns bias across 4H, D, W, M.

⸻

Quick Blurb for TradingView

FibADX uses the Fibonacci Golden Ratio (φ ≈ 1.618) to classify trend strength.

Unlike classic DMI/ADX, FibADX measures how much one side dominates:

• φ (1.618) = STRONG trend conviction

• φ² (2.618) = EXTREME momentum regime

This creates an adaptive, fractal-aware framework that works across stocks, crypto, forex, and commodities.

⚠️ Disclaimer : This script is provided for educational purposes only.

It does not constitute financial advice.

Use at your own risk. Always do your own research before making trading decisions.

Created by @nomadhedge

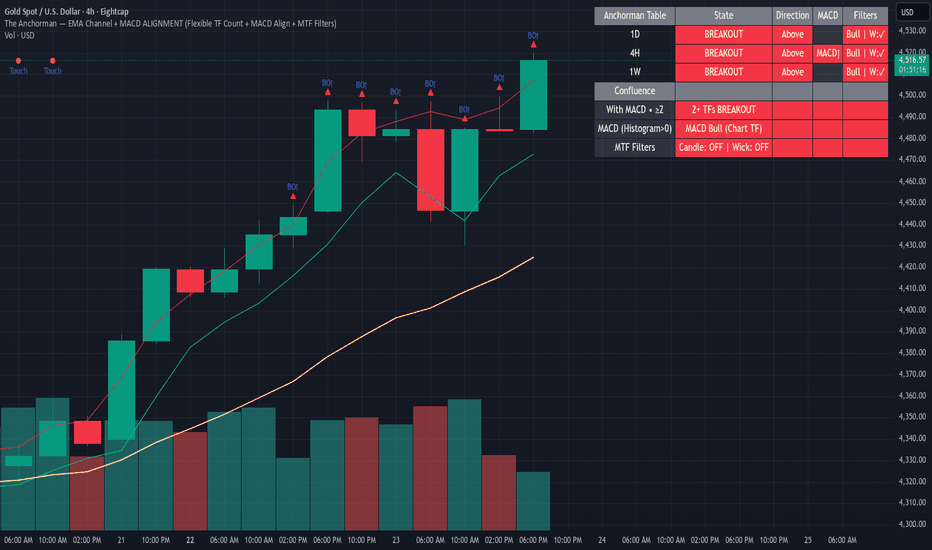

Anchorman - EMA Channel + EMA + MTF Status Table PRICE BREAKOUTUses a high/low EMA Channel to tell you when strong price breakouts are happening plus comes with a EMA to help follow the trend if you like. I designed it so it can alert you when a single TF touch happens or a breakout alignment on MTF happens (I recommend this) its up to you also its single alert so no need to do bullish or bearish signals just one signal will alert you when a breakout happens in EITHER direction.

Tabela de Tendência e RSI MTF - Tabela em BaixoTabela de Tendência e RSI MTF - Tabela em Baixo

This custom TradingView indicator provides a consolidated view of trend and Relative Strength Index (RSI) across multiple timeframes, all within an intuitive table directly on your chart. Designed for traders seeking quick and efficient analysis of market momentum and direction across different time horizons, this indicator automatically adapts to the asset you are currently viewing.

With the table down

BarLibrary "Bar"

A comprehensive library for creating and managing custom multi-timeframe (MTF) candlestick bars without using request.security calls, providing enhanced visualization and analytical capabilities with improved performance

Candle()

Creates a new candle object initialized with current bar's OHLC data

Returns: A new _Candle instance with current market data

method body(this)

Calculates the absolute size of the candle body (distance between open and close)

Namespace types: _Candle

Parameters:

this (_Candle)

Returns: The absolute difference between closing and opening prices

method topWick(this)

Calculates the length of the upper wick (shadow above the candle body)

Namespace types: _Candle

Parameters:

this (_Candle)

Returns: The distance from the higher of open/close to the high price

method bottomWick(this)

Calculates the length of the lower wick (shadow below the candle body)

Namespace types: _Candle

Parameters:

this (_Candle)

Returns: The distance from the low price to the lower of open/close

method display(this, bullishColor, bearishColor, transp, borderWidth, lineWidth)

Renders the candle visually on the chart with customizable colors and styling options

Namespace types: _Candle

Parameters:

this (_Candle)

bullishColor (color)

bearishColor (color)

transp (int)

borderWidth (int)

lineWidth (int)

candles(tf, autoDisplay)

Creates and manages an array of custom timeframe candles with optional automatic display

Parameters:

tf (string) : Target timeframe string (e.g., "60", "240", "D") for candle aggregation

autoDisplay (bool)

Returns: Array containing all completed candles for the specified timeframe

_Candle

Custom candlestick data structure that stores OHLCV data with visual rendering components

Fields:

start (series int) : Opening timestamp of the candle period

end (series int) : Closing timestamp of the candle period

o (series float) : Opening price of the candle

h (series float) : Highest price reached during the candle period

l (series float) : Lowest price reached during the candle period

c (series float) : Closing price of the candle

v (series float) : Volume traded during the candle period

bodyBox (series box)

wickLine (series line)

Example Usage

// Change version with latest version

import EmreKb/Bar/1 as bar

// "240" for 4h timeframe

// true for auto display candles on chart (default: false)

candlesArr = bar.candles("240", true)

BOT MTF NASDAQ | Breakout + Rebond | TP/SL | DashboardBOT MTF NASDAQ | Breakout + Rebond | TP/SL | Dashboard

Keltner Channels MTFKeltner Channels MTF | Adapted 🌌

Navigate the market’s wild waves with these Keltner Channels, a sleek spin on AlchimistOfCrypto’s Bollinger Bands! This Pine Script v6 indicator tracks price action like a radar, highlighting trends with scientific precision. 🧪

Key Features:

Customizable Channels: Adjust period and multiplier to map market volatility, signaling potential reversals when prices hit the upper or lower bands. 📈

MA Options: Switch between Exponential or Simple Moving Average for trend clarity. ⚙️

Band Styles: Select Average True Range, True Range, or Range to define volatility edges. 📏

Glow Effect: Illuminate bands with 8 vibrant themes (Neon, Grayscale, etc.) for visual pop. ✨

Trend Signals: Spot bullish/bearish shifts with glowing circles, flagging momentum changes. 💡

Alerts: Catch price breakouts or trend reversals at band edges, warning of potential market U-turns. 🚨

Perfect for traders decoding market trends with a touch of cosmic style! 🌠

Support/Resistance MTF Merge ZonesIndicator Introduction

Support/Resistance MTF Merge Zones is an advanced technical analysis tool that automatically identifies and merges key support/resistance zones by analyzing highs and lows from multiple timeframes (15M, 1H, 4H, Daily).

Key Features

Multi-Timeframe Analysis: Integrates data from 15M, 1H, 4H, and Daily charts

Smart Zone Merging: Automatically consolidates levels within a specified percentage range into unified zones

Dynamic Color System: Distinguishes support/resistance zones based on position relative to current price

Strength Indication: Highlights zones where multiple levels converge as strong zones

Usage Guide

Configuration Parameters

Lookback Period (10): Period for calculating highs/lows

Adjustable range: 5-30

Higher values detect more long-term levels

Zone Merge % (0.5): Percentage threshold for zone merging

Range: 0.1-2.0%

Higher values merge levels across wider price ranges

Min Levels for Zone (2): Minimum number of levels required to form a zone

Range: 2-5 levels

Higher values display only more confirmed zones

Box Opacity (7): Transparency level of zone boxes

Range: 0-100%

Color Scheme

Red: Resistance zones above current price

Blue: Support zones below current price

Orange: Strong zones (3+ merged levels)

Candle Ghosts: MTF 3 Candle Viewer by Chaitu50cCandle Ghosts: MTF 3 Candle Viewer helps you see candles from other timeframes directly on your chart. It shows the last 3 candles from a selected timeframe as semi-transparent boxes, so you can compare different timeframes without switching charts.

You can choose to view candles from 30-minute, 1-hour, 4-hour, daily, or weekly timeframes. The candles are drawn with their full open, high, low, and close values, including the wicks, so you get a clear view of their actual shape and size.

The indicator lets you adjust the position of the candles using horizontal and vertical offset settings. You can also control the spacing between the candles for better visibility.

An optional EMA (Exponential Moving Average) from the selected timeframe is also included to help you understand the overall trend direction.

This tool is useful for:

Intraday traders who want to see higher timeframe candles for better decisions

Swing traders checking lower timeframe setups

Anyone doing top-down analysis using multiple timeframes on a single chart

This is a simple and visual way to study how candles from different timeframes behave together in one place.

Ultimate JLines & MTF EMA (Configurable, Labels)## Ultimate JLines & MTF EMA (Configurable, Labels) — Script Overview

This Pine Script is a comprehensive, multi-timeframe indicator based on J Trader concepts. It overlays various Exponential Moving Averages (EMAs), VWAP, inside bar highlights, and dynamic labels onto price charts. The script is highly configurable, allowing users to tailor which elements are displayed and how they appear.

### Key Features

#### 1. **Multi-Timeframe JLines**

- **JLines** are pairs of EMAs (default lengths: 72 and 89) calculated on several timeframes:

- 1 minute (1m)

- 3 minutes (3m)

- 5 minutes (5m)

- 1 hour (1h)

- Custom timeframe (user-selectable)

- Each pair can be visualized as individual lines and as a "cloud" (shaded area between the two EMAs).

- Colors and opacity for each timeframe are user-configurable.

#### 2. **200 EMA on Multiple Timeframes**

- Plots the 200-period EMA on selectable timeframes: 1m, 3m, 5m, 15m, and 1h.

- Each can be toggled independently and colored as desired.

#### 3. **9 EMA and VWAP**

- Plots a 9-period EMA, either on the chart’s current timeframe or a user-specified one.

- Plots VWAP (Volume-Weighted Average Price) for additional trend context.

#### 4. **5/15 EMA Cross Cloud (5min)**

- Calculates and optionally displays a shaded "cloud" between the 5-period and 15-period EMAs on the 5-minute chart.

- Highlights bullish (5 EMA above 15 EMA) and bearish (5 EMA below 15 EMA) conditions with different colors.

- Optionally displays the 5 and 15 EMA lines themselves.

#### 5. **Inside Bar Highlighting**

- Highlights bars where the current high is less than or equal to the previous high and the low is greater than or equal to the previous low (inside bars).

- Color is user-configurable.

#### 6. **9 EMA / VWAP Cross Arrows**

- Plots up/down arrows when the 9 EMA crosses above or below the VWAP.

- Arrow colors and visibility are configurable.

#### 7. **Dynamic Labels**

- On the most recent bar, displays labels for each enabled line (EMAs, VWAP), offset to the right for clarity.

- Labels include the timeframe, type, and current value.

### Customization Options

- **Visibility:** Each plot (line, cloud, arrow, label) can be individually toggled on/off.

- **Colors:** All lines, clouds, and arrows can be colored to user preference, including opacity for clouds.

- **Timeframes:** JLines and EMAs can be calculated on different timeframes, including a custom one.

- **Label Text:** Labels dynamically reflect current indicator values and are color-coded to match their lines.

### Technical Implementation Highlights

- **Helper Functions:** Functions abstract away the logic for multi-timeframe EMA calculation.

- **Security Calls:** Uses `request.security` to fetch data from other timeframes, ensuring accurate multi-timeframe plotting.

- **Efficient Label Management:** Deletes old labels and creates new ones only on the last bar to avoid clutter and maintain performance.

- **Conditional Plotting:** All visual elements are conditionally plotted based on user input, making the indicator highly flexible.

### Use Cases

- **Trend Identification:** Multiple EMAs and VWAP help traders quickly identify trend direction and strength across timeframes.

- **Support/Resistance:** 200 EMA and JLines often act as dynamic support/resistance levels.

- **Entry/Exit Signals:** Crosses between 9 EMA and VWAP, as well as 5/15 EMA clouds, can signal potential trade entries or exits.

- **Pattern Recognition:** Inside bar highlights aid in spotting consolidation and breakout patterns.

### Summary Table of Configurable Elements

| Feature | Timeframes | Cloud Option | Label Option | Color Customizable | Description |

|----------------------------|-------------------|--------------|--------------|--------------------|-----------------------------------------------|

| JLines (72/89 EMA) | 1m, 3m, 5m, 1h, Custom | Yes | Yes | Yes | Key trend-following EMAs with cloud fill |

| 200 EMA | 1m, 3m, 5m, 15m, 1h | No | Yes | Yes | Long-term trend indicator |

| 9 EMA | Any | No | Yes | Yes | Short-term trend indicator |

| VWAP | Chart TF | No | Yes | Yes | Volume-weighted average price |

| 5/15 EMA Cloud (5m) | 5m | Yes | No | Yes | Bullish/bearish cloud between 5/15 EMAs |

| Inside Bar Highlight | Chart TF | No | N/A | Yes | Highlights price consolidation |

| 9 EMA / VWAP Cross Arrows | Chart TF | No | N/A | Yes | Marks EMA/VWAP crossovers with arrows |

This script is ideal for traders seeking a robust, multi-timeframe overlay that combines trend, momentum, and pattern signals in a single, highly customizable indicator. I do not advocate to subscribe to JTrades or the system they tout. This is based on my own observations and not a copy of any JTrades scripts. It is open source to allow full transparency.

MP MTF LiquidityMP MTF Liquidity

Multi-Timeframe Liquidity Levels – Automatic High/Low Tracking

This indicator automatically tracks and draws liquidity levels (recent highs and lows) from up to 6 custom timeframes directly on your chart. It’s designed for advanced traders who want to visualize important swing points and liquidity pools across multiple timeframes—ideal for Smart Money Concepts (SMC), ICT, and price action trading.

Key Features:

Multi-Timeframe Support:

Select up to 6 different timeframes (ex: 1H, 4H, Daily, Weekly, etc.), each with separate color and visibility controls.

Real Liquidity (No Repaint):

Levels are only drawn from fully closed bars on each timeframe—no lines from currently forming candles, ensuring accuracy and no forward-looking bias.

Automatic Detection:

Highs and lows are detected automatically. Levels that get swept (price breaks through) are converted to dashed lines for easy visual distinction.

Customizable:

Choose line colors for highs/lows and set the maximum number of active levels per timeframe to keep charts clean.

Extended Lines:

All levels are extended to the right, helping you see how current price interacts with past liquidity.

How It Works:

On every new bar of your chosen higher timeframe(s), the indicator records the high and low of the previous (just-closed) candle.

These levels are extended as rays until price sweeps (crosses) them.

When a level is swept, it is redrawn as a dashed line to highlight liquidity grabs or stop hunts.

No lines are drawn for the “live” bar—only confirmed, closed levels are displayed.

Who is this for?

SMC, ICT, and price action traders seeking high-confidence liquidity zones.

Intraday, swing, and multi-timeframe traders who want an automated, visual edge.

Anyone wanting to avoid repainting or “fake” levels from unfinished candles.

Tip:

Combine this indicator with your favorite order block, fair value gap (FVG), or market structure tools for even greater context and confluence.

Disclaimer:

No indicator guarantees profits. Always use with proper risk management and in conjunction with your trading plan.

4-EMA Signals + MTF Analysis4-EMA Signals + MTF Analysis Indicator: User Guide

This indicator is designed for active traders; from scalpers / intra-day traders to swing-traders who simply want an easy to understand, simple, but yet comprehensive and easy-to-understand indicator with a quick overview of initial market momentum and overall market direction to assist the trader in their initial trading.

The main feature of this indicator is that It overlays four exponential moving averages (EMAs), and provides a dashboard of real-time trend signals for both buy and sell (long/short) scenarios.

Settings Overview

MA Period Setup

Custom: Set your own EMA periods.

Conservative, Aggressive, Fibonacci: Quickly apply preset EMA period combinations for different trading styles.

EMA Periods (Custom Setup)

Fast EMA: Shortest EMA, reacts quickly to price (default 7).

Medium-Short EMA: Intermediate speed (default 25).

Medium-Long EMA: Slower, filters out more noise (default 70).

Slow EMA: Longest-term trend (default 200).

(These settings can be adjusted to suit your individual needs)

Main Indicator Features

Four EMAs : Plotted in distinct colors (green, yellow, orange, red) for quick trend recognition - this can be altered in colour to your personal preferences.

Buy/Sell Signals : Triangles appear below/above bars when EMA crossovers occur, optionally filtered by volume - the volume filter when applied greatly reduces the influx of signals, only giving high-quality signals!

Trading Sessions + Backgrounds : A trading session feature has been added: (London, New York, Asia, Sydney) with the choice of a background to indicate each global trading session.

Volume Overlay : Volume bars and a blue volume moving average line for context.

Dashboard Table (Top Right):

Market Direction: Shows the overall EMA alignment (bullish, bearish, weak, consolidating).

The initial trend on the 5m, 15m, 1H, and 4H time-frame to give a quick snapshot of overall trend direction.

How to Use

Trend Identification :

-- Use the EMA alignment and dashboard table to quickly see if the market is bullish, bearish, or consolidating.

EMA Set-up

-- Adjust the EMA settings to your specific requirements, the signals will alter depending on the volatility of the instrument your trading.

Signal Confirmation :

-- ''Buy'' signals simply appear when the faster EMAs cross above slower EMAs in and ''Sell'' signals simply appear when they cross below.

Volume Context :

--Use the volume moving average and the optional volume filter to avoid signals during low-activity periods.

No Repainting :

-- All signals and dashboard readings are calculated using only confirmed, closed bars. What you see in real time is exactly what will appear in your back-test — no repainting or look-ahead bias.

Alerts / Notifications

Now for the fun part:

1. Enable Buy/Sell Signal Alerts: Get notifications when buy or sell signals occur.

2. For Alerts to function correctly, set the ''condition'' to the indicator itself.

3. Select ''EMA Bearish Cross'' or ''EMA Bullish Cross'' depending whether you want alerts for either buy/sell signals - Or one can simply set alerts for both scenarios.

4. For ''Interval'' set to ''Same as chart'' - So, the time-frame which you'd like to trade on.

5. For ''Trigger'' set to ''Once Per Bar Close''.

6. Save.

7. Wait for a signal to occur!

NOTE: Before placing a trade, it's often best to also assess the market conditions at that time also - and not rely solely on the signals, the signals are to assist, and it's often occurred a signal has shown, but a pull-back occurs, and a FVG in discount holds -- it's this FVG holding, accompanied by volume, that's the real entry, possibly.

Tip: For the cleanest results, use the indicator during the most active sessions and always check multi-time-frame trend alignment before entering trades. Good Luck! :)

A.K Dynamic EMA/SMA / MTF S&R Zones Toolkit with AlertsThe A.K Dynamic EMA/SMA / MTF Support & Resistance Zones Toolkit is a powerful all-in-one technical analysis tool designed for traders who want a clean yet comprehensive market view. Whether you're scalping lower timeframes or swing trading higher timeframes, this indicator gives you both the structure and signals to take action with confidence.

Key Features:

✅ Customizable EMA/SMA Suite

Display key Exponential and Simple Moving Averages including 5, 9, 20, 50, 100, and 200 EMAs, plus optional 50 SMA for trend filtering. Each line can be toggled individually and color-customized.

✅ Multi-Timeframe Support & Resistance Zones

Automatically detects dynamic S/R zones on key timeframes (5min, 15min, 30min, 1H, 4H, 1D) using swing highs/lows. Zones are color-coded by strength and whether they're broken or active, providing a clear visual roadmap for price reaction levels.

✅ Zone Strength & Break Detection

Distinguishes between strong and weak zones based on price proximity and reaction depth, with visual shading and automatic label updates when a level is broken.

✅ Price Action-Based Buy/Sell Signals

Generates BUY signals when bullish candles react to strong support (supply) zones, and SELL signals when bearish candles react to strong resistance (demand) zones. All logic is adjustable — including candle body vs wick detection, tolerance range, and strength thresholds.

✅ Alerts Engine

Built-in TradingView alerts for price touching support/resistance or triggering buy/sell signals. Perfect for automation or hands-free monitoring.

✅ Optional Candle & Trend Filters

Highlight bullish/bearish candles visually for additional confirmation.

Optional RSI display and 50-period SMA trend filter to guide directional bias.

🧠 Use Case Scenarios:

Identify dynamic supply & demand zones across multiple timeframes.

Confirm trend direction with EMAs and SMA filters.

React quickly to clean BUY/SELL signals based on actual price interaction with strong zones.

Customize it fully to suit scalping, day trading, or swing trading strategies.

📌 Recommended Settings:

Use default zone transparency (65%) and offset (250 bars) for optimal visual clarity.

Enable alerts to get notified when price enters key S/R levels or when a trade signal occurs.

Combine this tool with your entry/exit plan for better decision-making under pressure.

💡 Pro Tip: Add this indicator to a clean chart and let the zones + EMAs guide your directional bias. Use alerts to avoid screen-watching and improve discipline.

Created by:

Version: Pine Script v6

Platform: TradingView