🍏 Here’s my latest desk-style breakdown for Apple heading into Wednesday, built from the 1-hour chart and GEX option data.

1️⃣ Price Action & Market Structure

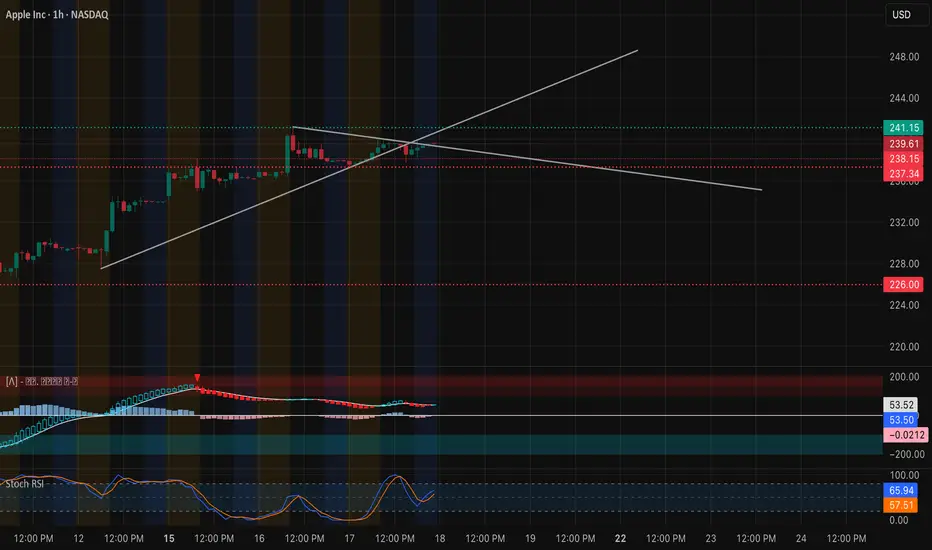

* Steady climb: AAPL continues to respect its rising trendline from last week. After a mild intraday pullback, price is back around $239.6 and hugging the 9 EMA.

* Key pivot zone: $238–239 is the near-term battleground. Holding this keeps the higher-low pattern alive.

* Next resistance: $241.1 (recent high) is the level to beat for a fresh push toward $242.5–245.

2️⃣ GEX (Options Flow) Check

* Call wall magnets: Strong gamma build-ups at $242.5 and $245 can act like upside magnets once $241.1 is taken out.

* Put support: First meaningful put walls lie much lower at $217.5 and $212.5, giving AAPL room to breathe if there’s a dip.

* Low IVR: IVR sits near 12.6 with IVx around 26.1—option premiums are relatively cheap.

3️⃣ Trading Thoughts

* Bullish play: Enter on a confirmed hourly close over $241.1. First target $242.5, stretch to $245. Protective stop under $238.

* Bearish hedge: Only consider a short if AAPL loses $238 on volume. Next downside pocket sits around $235–233.

4️⃣ Option Angles

* Upside: Cheap call spreads like 240/245 offer a defined-risk way to play the breakout.

* Neutral income: Selling puts below $220 makes sense if you expect Apple to keep grinding higher or stay range-bound.

5️⃣ My View

Apple’s chart remains constructive. As long as it keeps closing above $238 on the hourly, dips are buyable. A clean breakout over $241 could invite momentum buyers quickly.

Disclaimer: This analysis is for educational discussion only and is not financial advice. Always do your own research and manage risk before trading.

1️⃣ Price Action & Market Structure

* Steady climb: AAPL continues to respect its rising trendline from last week. After a mild intraday pullback, price is back around $239.6 and hugging the 9 EMA.

* Key pivot zone: $238–239 is the near-term battleground. Holding this keeps the higher-low pattern alive.

* Next resistance: $241.1 (recent high) is the level to beat for a fresh push toward $242.5–245.

2️⃣ GEX (Options Flow) Check

* Call wall magnets: Strong gamma build-ups at $242.5 and $245 can act like upside magnets once $241.1 is taken out.

* Put support: First meaningful put walls lie much lower at $217.5 and $212.5, giving AAPL room to breathe if there’s a dip.

* Low IVR: IVR sits near 12.6 with IVx around 26.1—option premiums are relatively cheap.

3️⃣ Trading Thoughts

* Bullish play: Enter on a confirmed hourly close over $241.1. First target $242.5, stretch to $245. Protective stop under $238.

* Bearish hedge: Only consider a short if AAPL loses $238 on volume. Next downside pocket sits around $235–233.

4️⃣ Option Angles

* Upside: Cheap call spreads like 240/245 offer a defined-risk way to play the breakout.

* Neutral income: Selling puts below $220 makes sense if you expect Apple to keep grinding higher or stay range-bound.

5️⃣ My View

Apple’s chart remains constructive. As long as it keeps closing above $238 on the hourly, dips are buyable. A clean breakout over $241 could invite momentum buyers quickly.

Disclaimer: This analysis is for educational discussion only and is not financial advice. Always do your own research and manage risk before trading.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.