Apple Shares (AAPL) Close to Reaching Record High

On 10 September, we noted that following the launch of new products — including the iPhone 17 — AAPL shares had fallen by approximately 1.5%, as analysts considered the model lacked the breakthrough appeal necessary to drive further growth.

However, two weeks on, media reports point to strong demand for the new product range, highlighting that:

→ orders for the new devices exceed those for last year’s iPhone 16 series;

→ Apple has asked suppliers to increase production;

→ the base model, featuring the long‑awaited 120Hz display and the powerful A19 chip, is in especially high demand.

Positive reports of long queues at Apple Stores worldwide, along with extended delivery times — which Bank of America estimates at an average of 18 days compared to 10 days for last year’s model — have only bolstered bullish sentiment. AAPL shares are rising this week, even as broader market indices are falling.

Technical Analysis of Apple (AAPL) Shares

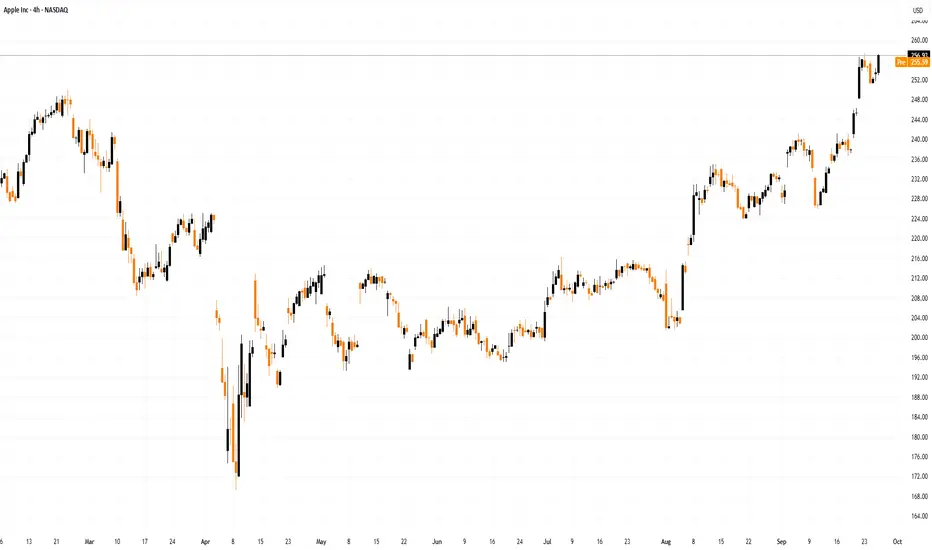

AAPL stock price movements in 2025 form a broad ascending channel (shown in blue). In this context:

→ Until early August, the price remained in a consolidation phase (shown by black lines) below the channel’s median;

→ Since then, the balance has shifted in favour of buyers — the price has demonstrated bullish momentum, forming a steep growth channel (shown in orange), with the median providing support (indicated by an arrow).

The strength of demand is confirmed by AAPL’s price action rising from $240 to $250:

→ bullish candlesticks were wide;

→ closing prices were close to the highs;

→ a bullish gap is visible on the chart.

This points to a buyers’ imbalance, giving grounds to regard this area as support in terms of a Fair Value Gap pattern.

From a bearish perspective:

→ the RSI indicator is in overbought territory;

→ shareholders may wish to take some profits.

Nevertheless, it cannot be ruled out that AAPL’s price growth will continue, driven by expectations that strong demand for the iPhone 17, as well as the updated Apple Watch Series 11 and AirPods Pro 3 with new AI features, will deliver record quarterly revenue for the company, covering the upcoming holiday season. In this scenario, bulls may target the upper boundary of the blue channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

On 10 September, we noted that following the launch of new products — including the iPhone 17 — AAPL shares had fallen by approximately 1.5%, as analysts considered the model lacked the breakthrough appeal necessary to drive further growth.

However, two weeks on, media reports point to strong demand for the new product range, highlighting that:

→ orders for the new devices exceed those for last year’s iPhone 16 series;

→ Apple has asked suppliers to increase production;

→ the base model, featuring the long‑awaited 120Hz display and the powerful A19 chip, is in especially high demand.

Positive reports of long queues at Apple Stores worldwide, along with extended delivery times — which Bank of America estimates at an average of 18 days compared to 10 days for last year’s model — have only bolstered bullish sentiment. AAPL shares are rising this week, even as broader market indices are falling.

Technical Analysis of Apple (AAPL) Shares

AAPL stock price movements in 2025 form a broad ascending channel (shown in blue). In this context:

→ Until early August, the price remained in a consolidation phase (shown by black lines) below the channel’s median;

→ Since then, the balance has shifted in favour of buyers — the price has demonstrated bullish momentum, forming a steep growth channel (shown in orange), with the median providing support (indicated by an arrow).

The strength of demand is confirmed by AAPL’s price action rising from $240 to $250:

→ bullish candlesticks were wide;

→ closing prices were close to the highs;

→ a bullish gap is visible on the chart.

This points to a buyers’ imbalance, giving grounds to regard this area as support in terms of a Fair Value Gap pattern.

From a bearish perspective:

→ the RSI indicator is in overbought territory;

→ shareholders may wish to take some profits.

Nevertheless, it cannot be ruled out that AAPL’s price growth will continue, driven by expectations that strong demand for the iPhone 17, as well as the updated Apple Watch Series 11 and AirPods Pro 3 with new AI features, will deliver record quarterly revenue for the company, covering the upcoming holiday season. In this scenario, bulls may target the upper boundary of the blue channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.