Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!!

________________________________________________________

________________________________________________________

..........✋NFA👍..........

📈Technical/Fundamental/Target Standpoint⬅️

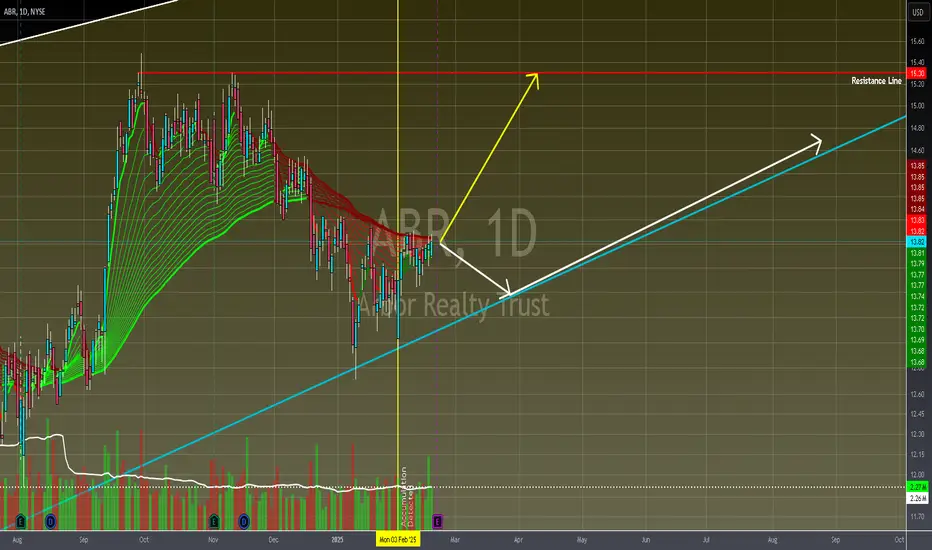

1.) Technical Momentum Shift: Recent trading activity suggests a bullish sentiment, with multiple attempts to flip the moving averages into a positive trend.

2.) Strong Support Level: The stock successfully defended a key support level twice recently, indicating potential strength.

3.) Accumulation Pattern: Accumulation of shares has been observed since February 3rd, 2025.

4.) Consistent Financial Performance: Revenue has shown year-over-year growth since 2019, while net income has remained relatively stable since 2021.

5.) Dividend Growth: The company's history of increasing dividends is a positive sign for investors.

🌎Global Market Sentiment⬅️

1.) As we move into the historically bearish months of March and April, the market's direction in the coming weeks will be crucial.

==============================

...🎉🎉🎉Before You Go🎉🎉🎉…

==============================

Leave a like👍 and/or comment💬.

We appreciate and value everyone's feedback!

- RoninAITrader

________________________________________________________

________________________________________________________

..........✋NFA👍..........

📈Technical/Fundamental/Target Standpoint⬅️

1.) Technical Momentum Shift: Recent trading activity suggests a bullish sentiment, with multiple attempts to flip the moving averages into a positive trend.

2.) Strong Support Level: The stock successfully defended a key support level twice recently, indicating potential strength.

3.) Accumulation Pattern: Accumulation of shares has been observed since February 3rd, 2025.

4.) Consistent Financial Performance: Revenue has shown year-over-year growth since 2019, while net income has remained relatively stable since 2021.

5.) Dividend Growth: The company's history of increasing dividends is a positive sign for investors.

🌎Global Market Sentiment⬅️

1.) As we move into the historically bearish months of March and April, the market's direction in the coming weeks will be crucial.

==============================

...🎉🎉🎉Before You Go🎉🎉🎉…

==============================

Leave a like👍 and/or comment💬.

We appreciate and value everyone's feedback!

- RoninAITrader

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.