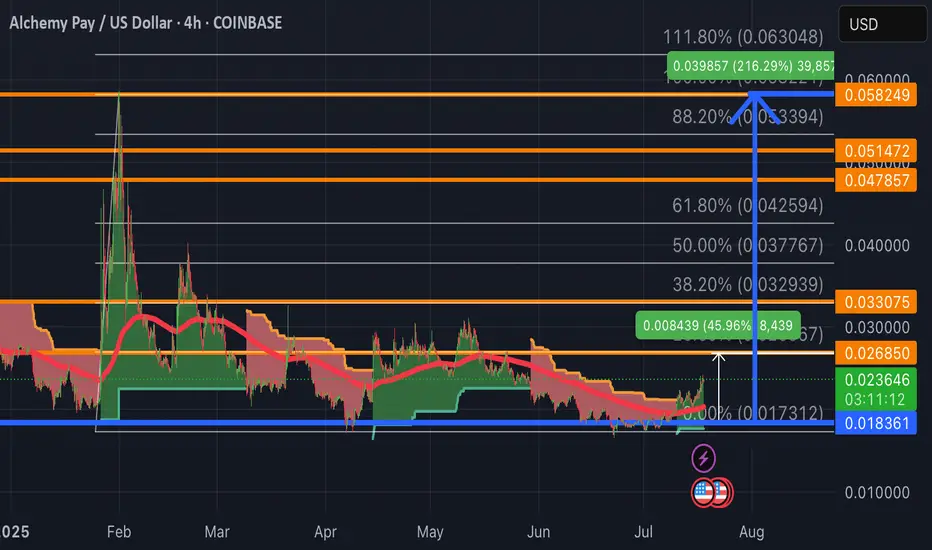

ACH is setup nicely for a bullish swing. Apologies for the delay in posting. Was waiting for a bullish confirmation first. My entry is $0.018361.

I plotted 5 targets for us.

SuperTrend on 4 Hour TF signaling green. As you can see the reliability of previous SuperTrend flips to green.

Alchemy Pay secured access to SFC Type 1/4/9 licenses on July 17 via a strategic investment in HTF Securities. This positions ACH as a compliant gateway for virtual asset services in Asia’s financial hub, aligning with Hong Kong’s pro-crypto regulatory shift.

Supporting factors: Ripple RLUSD integration Alchemy Pay’s role in Ripple’s European RLUSD rollout (announced July 15) enables fiat purchases of the stable coin across 170+ countries.

RLUSD’s $94M daily volume creates fee revenue potential for ACH through transaction flows.

Technical context: Overbought but bullish • RSI(7): 81.37 signals overbought conditions but reflects strong momentum.

MACD: Bullish crossover (histogram +0.000439) since July 16.

Fibonacci: Price broke above 23.6% retracement ($0.0222), eyeing 127.2% extension at $0.0259.

Conclusion ACH’s rally combines regulatory tailwinds, partnership-driven utility growth, and technical momentum. While short-term consolidation is possible given overbought signals, the licensing roadmap and RWA platform launch (August 2025) suggest sustained institutional interest.

What to watch: Can ACH hold above the 23.6% Fib level ($0.0222) as Hong Kong license upgrades progress?

I plotted 5 targets for us.

SuperTrend on 4 Hour TF signaling green. As you can see the reliability of previous SuperTrend flips to green.

Alchemy Pay secured access to SFC Type 1/4/9 licenses on July 17 via a strategic investment in HTF Securities. This positions ACH as a compliant gateway for virtual asset services in Asia’s financial hub, aligning with Hong Kong’s pro-crypto regulatory shift.

Supporting factors: Ripple RLUSD integration Alchemy Pay’s role in Ripple’s European RLUSD rollout (announced July 15) enables fiat purchases of the stable coin across 170+ countries.

RLUSD’s $94M daily volume creates fee revenue potential for ACH through transaction flows.

Technical context: Overbought but bullish • RSI(7): 81.37 signals overbought conditions but reflects strong momentum.

MACD: Bullish crossover (histogram +0.000439) since July 16.

Fibonacci: Price broke above 23.6% retracement ($0.0222), eyeing 127.2% extension at $0.0259.

Conclusion ACH’s rally combines regulatory tailwinds, partnership-driven utility growth, and technical momentum. While short-term consolidation is possible given overbought signals, the licensing roadmap and RWA platform launch (August 2025) suggest sustained institutional interest.

What to watch: Can ACH hold above the 23.6% Fib level ($0.0222) as Hong Kong license upgrades progress?

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.