ALAB: High-Quality Breakout With Strong Structure and 3.2 R/R

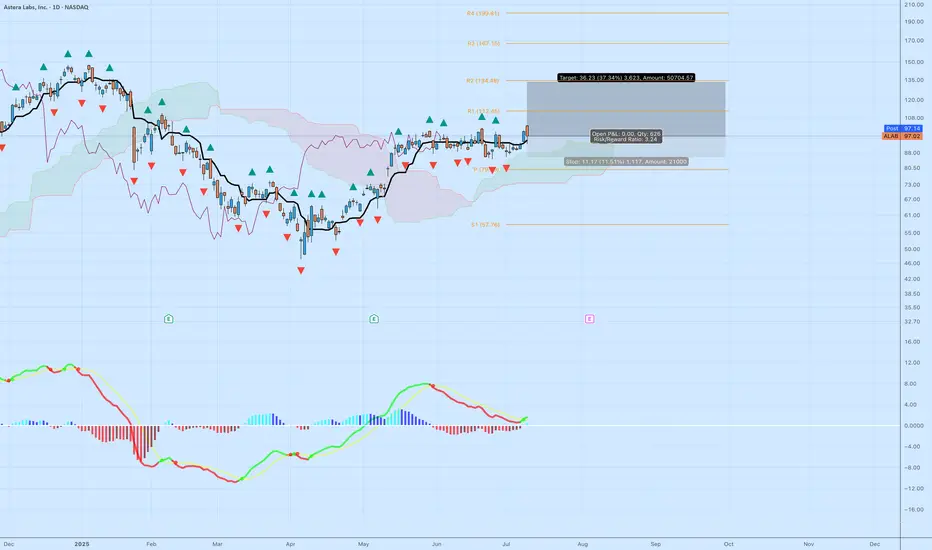

Astera Labs ( ALAB) just delivered a clean technical breakout above multi-week resistance, paired with bullish confirmation from momentum and Ichimoku structure. This isn’t a hype trade — this is what a textbook continuation breakout looks like.

ALAB) just delivered a clean technical breakout above multi-week resistance, paired with bullish confirmation from momentum and Ichimoku structure. This isn’t a hype trade — this is what a textbook continuation breakout looks like.

📊 Key Technical Breakdown

Base Breakout

After weeks of tight consolidation, ALAB just broke above horizontal resistance at ~$95. The breakout candle is strong, with above-average range and a decisive close.

ALAB just broke above horizontal resistance at ~$95. The breakout candle is strong, with above-average range and a decisive close.

Ichimoku Cloud

Price is well above the cloud — this confirms bullish trend.

The Kijun (black line) is sloping upward, and the cloud is thick and rising.

Pullbacks toward $88–90 could act as support if the breakout retests.

MACD Reversal

The MACD has flipped green, signaling a momentum shift.

Histogram is expanding upward again, showing renewed buying pressure.

This is happening as price reclaims the top of the recent range — a great alignment.

🎯 Trade Specs

Entry: $97.02

Target: $133.25 (+37.34%)

Stop: $85.32 (–11.51%)

Risk/Reward: 3.24 — solid skew for a growth name

Context: Strong prior trend, healthy consolidation, and now continuation. This isn’t a bottom-pick — it’s trend-following at a breakout moment.

🧠 Why This Trade Works

Structure: You’re not chasing green candles. This breakout comes after a long base and clears prior congestion.

Asymmetry: A 3.2+ R/R setup means you can be wrong more than half the time and still come out ahead — if you stick to your stops.

Momentum Alignment: Momentum and price are moving together — never fade a breakout with confirmation from both price action and indicators.

📌 Tip for Readers:

If you’re new to swing trading, study how this base formed and what conditions led to the breakout. The goal isn’t prediction — it’s positioning at the right moments with risk defined.

📊 Key Technical Breakdown

Base Breakout

After weeks of tight consolidation,

Ichimoku Cloud

Price is well above the cloud — this confirms bullish trend.

The Kijun (black line) is sloping upward, and the cloud is thick and rising.

Pullbacks toward $88–90 could act as support if the breakout retests.

MACD Reversal

The MACD has flipped green, signaling a momentum shift.

Histogram is expanding upward again, showing renewed buying pressure.

This is happening as price reclaims the top of the recent range — a great alignment.

🎯 Trade Specs

Entry: $97.02

Target: $133.25 (+37.34%)

Stop: $85.32 (–11.51%)

Risk/Reward: 3.24 — solid skew for a growth name

Context: Strong prior trend, healthy consolidation, and now continuation. This isn’t a bottom-pick — it’s trend-following at a breakout moment.

🧠 Why This Trade Works

Structure: You’re not chasing green candles. This breakout comes after a long base and clears prior congestion.

Asymmetry: A 3.2+ R/R setup means you can be wrong more than half the time and still come out ahead — if you stick to your stops.

Momentum Alignment: Momentum and price are moving together — never fade a breakout with confirmation from both price action and indicators.

📌 Tip for Readers:

If you’re new to swing trading, study how this base formed and what conditions led to the breakout. The goal isn’t prediction — it’s positioning at the right moments with risk defined.

Dagangan aktif

Dagangan ditutup secara manual

Taking profit here at 122.58If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.