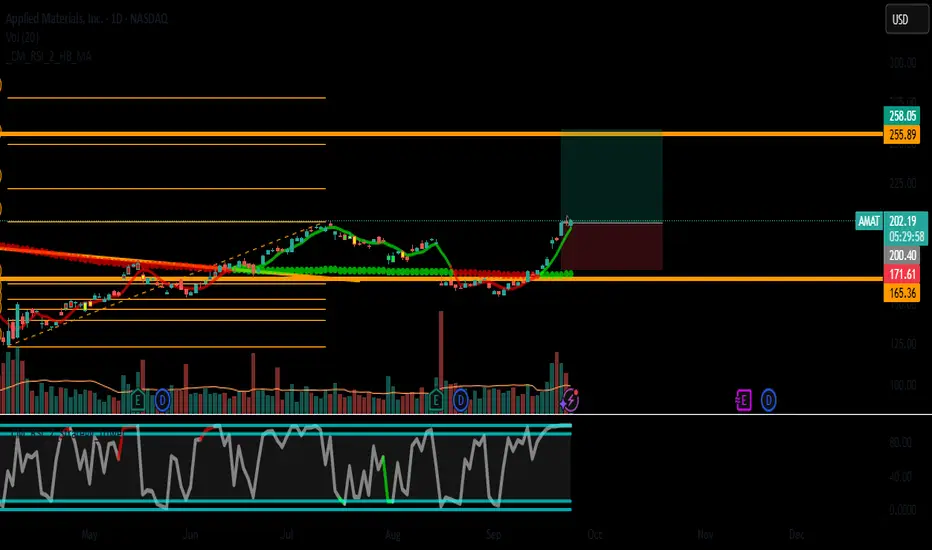

🎯 Idea: LONG

⏰ Timeframe: Daily / Weekly (Position Trade)

📊 Pattern: Bullish Trend Continuation

Fundamental Context (General Knowledge - Not from provided data):

Business: World's Largest Semiconductor Equipment Supplier.

Catalyst: AI Boom, Advanced Packaging, CHIPS Act Beneficiary.

Sector Trend: Strong structural demand for semiconductor manufacturing equipment.

Technical Setup:

Trend (D1): Bullish ✅

Entry: $202.30 (Pullback to key support / moving average confluence).

Stop Loss (SL): $170.00 (Below major swing low and psychological support).

Take Profit (TP): $258.00 (Projected upside based on measured move and historical resistance).

Momentum: Price trading above key moving averages, trend structure intact.

Risk Management:

Risk/Reward (R:R): 1:1.7

Note: Wider stop due to stock's volatility. Adjust position size accordingly.

Summary: A position trade on the leader in semiconductor capital equipment, capitalizing on the long-term secular growth in AI and advanced chip manufacturing.

⚠️ Disclaimer: Not Financial Advice

This analysis is for educational and informational purposes only. It is NOT a recommendation to buy or sell any security.

Conduct your own research (DYOR) before making any investment decisions.

You are solely responsible for your own trades and investments.

Past performance is never indicative of future results.

Trading involves significant risk of loss and is not suitable for all investors.

#TradingView #AMAT #Long #Semiconductors #SemiconductorEquipment #AI #CHIPSAct #Technology #PositionTrade

⏰ Timeframe: Daily / Weekly (Position Trade)

📊 Pattern: Bullish Trend Continuation

Fundamental Context (General Knowledge - Not from provided data):

Business: World's Largest Semiconductor Equipment Supplier.

Catalyst: AI Boom, Advanced Packaging, CHIPS Act Beneficiary.

Sector Trend: Strong structural demand for semiconductor manufacturing equipment.

Technical Setup:

Trend (D1): Bullish ✅

Entry: $202.30 (Pullback to key support / moving average confluence).

Stop Loss (SL): $170.00 (Below major swing low and psychological support).

Take Profit (TP): $258.00 (Projected upside based on measured move and historical resistance).

Momentum: Price trading above key moving averages, trend structure intact.

Risk Management:

Risk/Reward (R:R): 1:1.7

Note: Wider stop due to stock's volatility. Adjust position size accordingly.

Summary: A position trade on the leader in semiconductor capital equipment, capitalizing on the long-term secular growth in AI and advanced chip manufacturing.

⚠️ Disclaimer: Not Financial Advice

This analysis is for educational and informational purposes only. It is NOT a recommendation to buy or sell any security.

Conduct your own research (DYOR) before making any investment decisions.

You are solely responsible for your own trades and investments.

Past performance is never indicative of future results.

Trading involves significant risk of loss and is not suitable for all investors.

#TradingView #AMAT #Long #Semiconductors #SemiconductorEquipment #AI #CHIPSAct #Technology #PositionTrade

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.