Good Afternoon,

I hope all is well. I have not posted lately - so here is one !

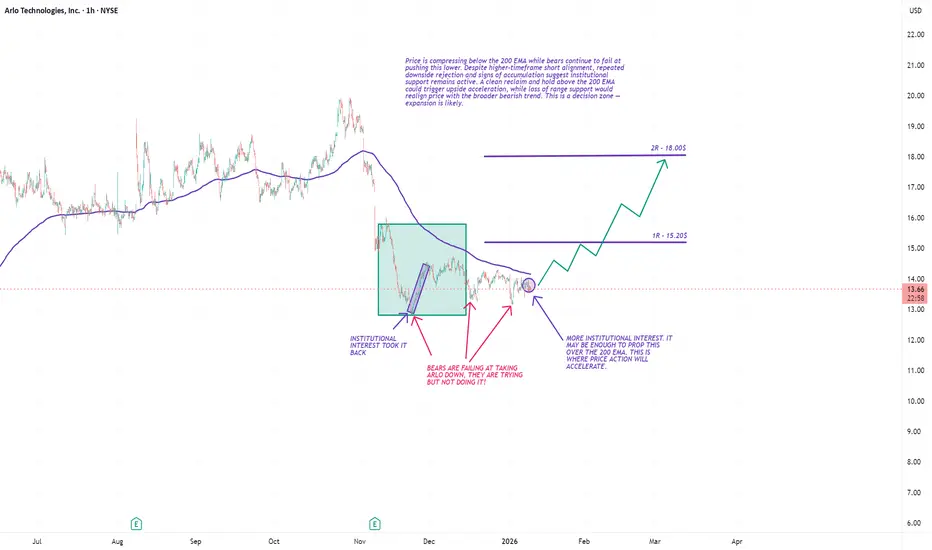

Scenario 1: Bullish Continuation / Breakout (Higher Probability if Confirmed)

Thesis:

Institutions defend current range and push price through the 200 EMA, triggering acceleration.

What confirms it

Clean 1h close above the 200 EMA

Follow-through volume expansion

Successful retest of EMA as support

Targets

$14.30–14.60 (prior range highs / supply)

Extension toward $15.00–15.50 if momentum builds

Risk Management

Invalidation: loss of $13.20

Ideal stop: below the consolidation base

Why it works

Bears have failed multiple breakdowns

Accumulation + compression often resolves upward

Short positioning can fuel a squeeze

Scenario 2: Range Extension / Continued Chop (Neutral)

Thesis:

Price remains trapped between range support and the 200 EMA, frustrating both sides.

What it looks like

Repeated EMA rejections

Higher lows but no follow-through

Declining volatility after spikes

Range

Support: $13.00–13.20

Resistance: $13.90–14.00

Trading Approach

Fade extremes (mean reversion)

Reduce size, quicker profit-taking

Wait for HTF confirmation

Risk

Overtrading in low-quality conditions

Scenario 3: Bearish Breakdown / HTF Alignment (Lower Probability, Higher Impact)

Thesis:

Institutional support fails and higher-timeframe shorts regain control.

What confirms it

Strong impulsive breakdown below $13.00

Acceptance below range (not a wick)

Volume expansion to the downside

Targets

$12.40–12.60 (prior demand)

Extension to $11.80–12.00 if selling accelerates

Risk Management

Invalidation: reclaim of $13.50

Avoid shorting into support without confirmation

Trade Safely!

Enjoy!

I hope all is well. I have not posted lately - so here is one !

Scenario 1: Bullish Continuation / Breakout (Higher Probability if Confirmed)

Thesis:

Institutions defend current range and push price through the 200 EMA, triggering acceleration.

What confirms it

Clean 1h close above the 200 EMA

Follow-through volume expansion

Successful retest of EMA as support

Targets

$14.30–14.60 (prior range highs / supply)

Extension toward $15.00–15.50 if momentum builds

Risk Management

Invalidation: loss of $13.20

Ideal stop: below the consolidation base

Why it works

Bears have failed multiple breakdowns

Accumulation + compression often resolves upward

Short positioning can fuel a squeeze

Scenario 2: Range Extension / Continued Chop (Neutral)

Thesis:

Price remains trapped between range support and the 200 EMA, frustrating both sides.

What it looks like

Repeated EMA rejections

Higher lows but no follow-through

Declining volatility after spikes

Range

Support: $13.00–13.20

Resistance: $13.90–14.00

Trading Approach

Fade extremes (mean reversion)

Reduce size, quicker profit-taking

Wait for HTF confirmation

Risk

Overtrading in low-quality conditions

Scenario 3: Bearish Breakdown / HTF Alignment (Lower Probability, Higher Impact)

Thesis:

Institutional support fails and higher-timeframe shorts regain control.

What confirms it

Strong impulsive breakdown below $13.00

Acceptance below range (not a wick)

Volume expansion to the downside

Targets

$12.40–12.60 (prior demand)

Extension to $11.80–12.00 if selling accelerates

Risk Management

Invalidation: reclaim of $13.50

Avoid shorting into support without confirmation

Trade Safely!

Enjoy!

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.