Description:

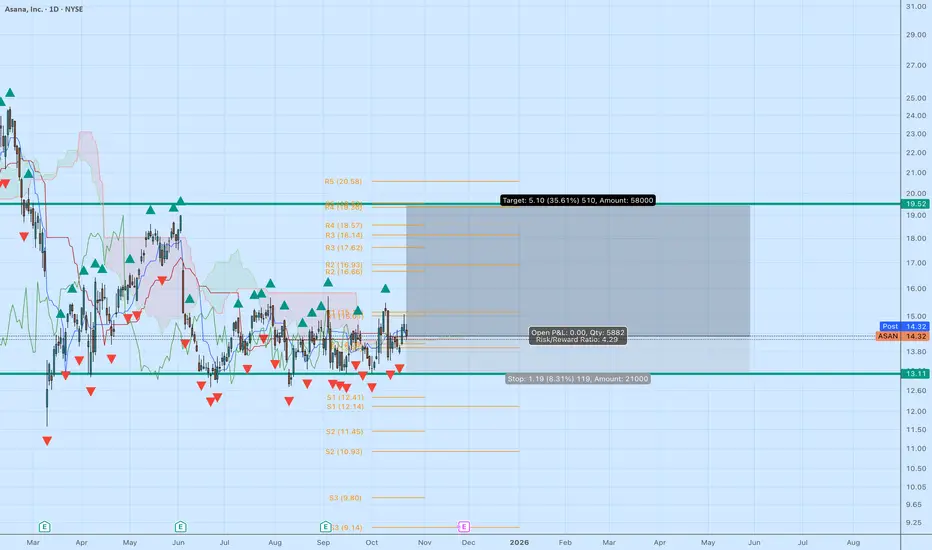

Asana (ASAN) is consolidating tightly around $14.30, coiling beneath key resistance and showing early signs of a potential breakout. Price is now sitting right at the Kijun and Tenkan cross zone, with the Ichimoku Cloud flattening and narrowing — a setup that often precedes trend expansion.

Technical Breakdown:

Ichimoku: Price testing the underside of the cloud. A clean close above $14.70–$15.00 with volume would confirm a bullish Kumo breakout. Span A is beginning to turn upward, while Lagging Span (Chikou) is approaching a clear path above price — an early bullish signal.

Support: $13.10 (base floor)

Resistance: $14.90 → $17.60 → $19.50

Stop: Below $13.00

Target Zone: $17.00 (analyst avg) → $19.50 (upper technical target)

Risk/Reward: ~4.2 : 1

RSI: Neutral at ~55 — plenty of room for expansion.

Volume: Accumulation phase showing upticks on green candles.

Analyst Consensus:

Average 12-month price target: $17.00 (+18% upside).

High-end estimates: $20–21, aligning with the top of the current resistance band.

Analysts maintain a “Hold / Modest Buy” stance, but improving enterprise adoption and potential margin expansion through AI-driven efficiency remain catalysts into 2026.

Trade Plan:

▶ Watch for a daily close above $15 to confirm breakout.

▶ Initial target $17, extended $19.50.

▶ Stop below $13.00 to protect capital.

▶ If breakout holds, consider trailing stops or layering covered calls above $19–$20.

This setup offers asymmetric reward potential for traders anticipating a late-year software rebound as sentiment shifts back toward SaaS names.

Asana (ASAN) is consolidating tightly around $14.30, coiling beneath key resistance and showing early signs of a potential breakout. Price is now sitting right at the Kijun and Tenkan cross zone, with the Ichimoku Cloud flattening and narrowing — a setup that often precedes trend expansion.

Technical Breakdown:

Ichimoku: Price testing the underside of the cloud. A clean close above $14.70–$15.00 with volume would confirm a bullish Kumo breakout. Span A is beginning to turn upward, while Lagging Span (Chikou) is approaching a clear path above price — an early bullish signal.

Support: $13.10 (base floor)

Resistance: $14.90 → $17.60 → $19.50

Stop: Below $13.00

Target Zone: $17.00 (analyst avg) → $19.50 (upper technical target)

Risk/Reward: ~4.2 : 1

RSI: Neutral at ~55 — plenty of room for expansion.

Volume: Accumulation phase showing upticks on green candles.

Analyst Consensus:

Average 12-month price target: $17.00 (+18% upside).

High-end estimates: $20–21, aligning with the top of the current resistance band.

Analysts maintain a “Hold / Modest Buy” stance, but improving enterprise adoption and potential margin expansion through AI-driven efficiency remain catalysts into 2026.

Trade Plan:

▶ Watch for a daily close above $15 to confirm breakout.

▶ Initial target $17, extended $19.50.

▶ Stop below $13.00 to protect capital.

▶ If breakout holds, consider trailing stops or layering covered calls above $19–$20.

This setup offers asymmetric reward potential for traders anticipating a late-year software rebound as sentiment shifts back toward SaaS names.

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.