✈️ Boeing (BA) – Final Leg of Macro Bull Run | Wave 5 to 1.618 Extension ($1200) 🚀

📅 Timeframe: Monthly (Macro Cycle Outlook)

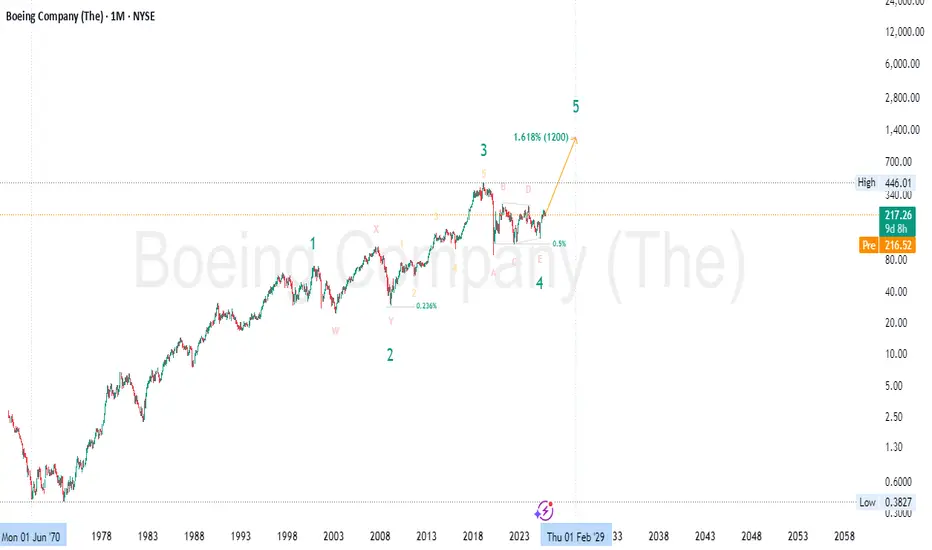

📍 Current Price: $217

🎯 Wave 5 Target: ~$1200 (1.618 Extension)

🌀 Wave Theory Structure

Boeing appears to be entering Wave 5 of a long-term Elliott Wave cycle:

This is a textbook impulsive wave structure playing out on the monthly macro scale — with a final bullish leg now unfolding.

📐 Fibonacci Confluence

🧠 Smart Money Concepts (SMC)

🔹 Accumulation Phase (2020–2024): After COVID crash and multi-year consolidation, price has shown strong accumulation characteristics

🔹 Final Sweep of Lows (E leg) flushed out late longs and retail stops before institutional re-entry

🔹 Break of Structure (BOS) confirms transition from reaccumulation to markup phase 📈

🔹 Price is now in a reprice phase — a classic SMC trait where value is rapidly adjusted after institutional positioning completes

📊 Price Action Analysis

💼 Fundamental Outlook

Boeing is regaining strength after multiple challenging years:

Although regulatory and delivery risks remain, Boeing’s turnaround story is gathering steam — aligning with the technical forecast of Wave 5 acceleration.

🔍 Summary

Boeing is entering what could be the final and most explosive leg (Wave 5) of its macro Elliott Wave cycle. Key confluences include:

✅ Elliott Wave triangle completion

✅ Fibonacci 1.618 extension to ~$1200

✅ Institutional accumulation confirmed

✅ Price Action breakout from multi-year structure

✅ Improving long-term fundamentals

This setup favors long-term swing positions, with pullbacks offering buying opportunities until the final cycle target is approached. 🧠📈

⚠️ Disclaimer: This is not financial advice. For educational purposes only. Always do your own due diligence and manage risk responsibly. 🛡️

#Boeing #BA #ElliottWave #SmartMoney #PriceAction #Fibonacci #Wave5 #TriangleBreakout #TechnicalAnalysis #LongTermInvestment #MacroTrading #StockMarket #BullishOutlook #Aerospace #WaveTheory #SwingTrading #AviationRecovery #FibonacciTargets #TradingStrategy

📅 Timeframe: Monthly (Macro Cycle Outlook)

📍 Current Price: $217

🎯 Wave 5 Target: ~$1200 (1.618 Extension)

🌀 Wave Theory Structure

Boeing appears to be entering Wave 5 of a long-term Elliott Wave cycle:

- ✅ Wave 1: Multi-decade rise until the early 2000s

- ✅ Wave 2: Complex correction (W–X–Y) into 2009 lows

- ✅ Wave 3: Powerful rally through 2019, completed with an extended 5-wave subdivision

- ✅ Wave 4: A large-scale triangle correction (ABCDE) — now completed, as price has broken structure upward

- 🚀 Wave 5: Projected move toward the 1.618 Fibonacci extension (~$1200) from the 1–3 wave distance

This is a textbook impulsive wave structure playing out on the monthly macro scale — with a final bullish leg now unfolding.

📐 Fibonacci Confluence

- Wave 2 retraced ~0.236 of Wave 1 (shallow, bullish corrective behavior)

- Wave 4 retraced ~0.5 of Wave 3 — typical for triangle patterns and expanded flats

- Wave 5 target at 1.618 Fib extension measured from Wave 1–3 aligns around $1200, completing the 5-wave macro cycle 🔺

🧠 Smart Money Concepts (SMC)

🔹 Accumulation Phase (2020–2024): After COVID crash and multi-year consolidation, price has shown strong accumulation characteristics

🔹 Final Sweep of Lows (E leg) flushed out late longs and retail stops before institutional re-entry

🔹 Break of Structure (BOS) confirms transition from reaccumulation to markup phase 📈

🔹 Price is now in a reprice phase — a classic SMC trait where value is rapidly adjusted after institutional positioning completes

📊 Price Action Analysis

- Bullish breakout from triangle structure

- Monthly higher low established at E-wave base

- Strong bullish candle from demand zone — early confirmation of trend continuation

- Break above $260 would open clean skies toward the next major resistance at ATH ($446) and beyond 🧭

💼 Fundamental Outlook

Boeing is regaining strength after multiple challenging years:

- ✈️ Rebound in global aviation demand

- 📦 Growing defense & aerospace contracts amid rising geopolitical tensions

- 💰 Expected recovery in cash flows, backlog, and profitability

- 🌐 Expansion in space and unmanned systems (future growth verticals)

Although regulatory and delivery risks remain, Boeing’s turnaround story is gathering steam — aligning with the technical forecast of Wave 5 acceleration.

🔍 Summary

Boeing is entering what could be the final and most explosive leg (Wave 5) of its macro Elliott Wave cycle. Key confluences include:

✅ Elliott Wave triangle completion

✅ Fibonacci 1.618 extension to ~$1200

✅ Institutional accumulation confirmed

✅ Price Action breakout from multi-year structure

✅ Improving long-term fundamentals

This setup favors long-term swing positions, with pullbacks offering buying opportunities until the final cycle target is approached. 🧠📈

⚠️ Disclaimer: This is not financial advice. For educational purposes only. Always do your own due diligence and manage risk responsibly. 🛡️

#Boeing #BA #ElliottWave #SmartMoney #PriceAction #Fibonacci #Wave5 #TriangleBreakout #TechnicalAnalysis #LongTermInvestment #MacroTrading #StockMarket #BullishOutlook #Aerospace #WaveTheory #SwingTrading #AviationRecovery #FibonacciTargets #TradingStrategy

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.