🐉

📈 Strong RSI. Institutional Accumulation. Gamma-juiced upside.

Momentum is building — timing is key.

⸻

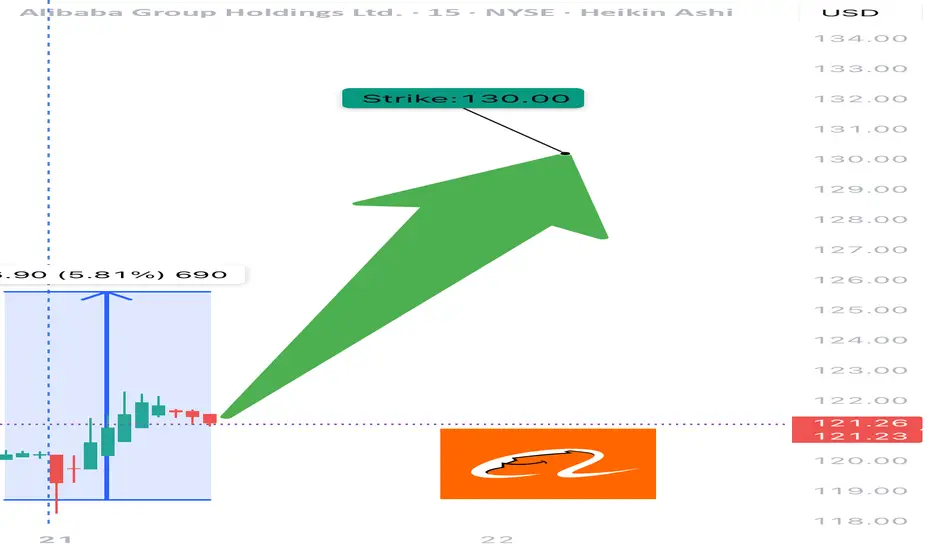

📊 Trade Setup

🔹 Type: Long Call

🎯 Strike: $130.00

📆 Expiry: July 25, 2025 (4 DTE)

💰 Entry Price: $0.52

🎯 Profit Target: $0.74 (📈 +42%)

🛑 Stop Loss: $0.30 (~40% Risk)

📈 Confidence: 70%

🕰️ Timing: Enter at Monday Open

📦 Size: 1 Contract (or scale accordingly)

⸻

🔍 Why This Trade?

✅ Daily RSI = 68.3 → Bullish momentum building

✅ Volume = 1.3x week-over-week → Institutional buying confirmed

📊 Neutral Call/Put Flow → Sentiment not overheated = better entry

🧠 Multiple models agree on MODERATE BULLISH bias

🌬️ VIX stable = ideal for controlled option premium entries

💎 Gamma risk manageable, but monitor price spikes at resistance near $130–132

⸻

⚠️ Risk Management Notes

🔸 RSI near breakout zone → monitor for fakeouts

⏳ Only 4 days to expiry → time decay risk accelerates

📉 Watch for rejection near key levels ($130.50–132.00)

🛑 Respect the stop: If momentum stalls early, exit fast

⸻

📌 Execution Strategy

🔹 Enter clean, single-leg naked call

🔹 Exit partial at 30% profit, full by Thursday unless breakout is strong

🔹 Avoid spreads: delta exposure preferred for upside spike capture

⸻

🏁 Verdict:

All models point to upside, but not full conviction.

This is a momentum + positioning trade, not a breakout gamble.

Tight structure. Moderate aggression. Execute with precision.

⸻

#BABA #OptionsTrading #CallOption #WeeklyTrade #MomentumPlay #UnusualOptionsActivity #TradingViewIdeas #GammaFlow #FlowBasedSetup #Alibaba

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.