Introduction

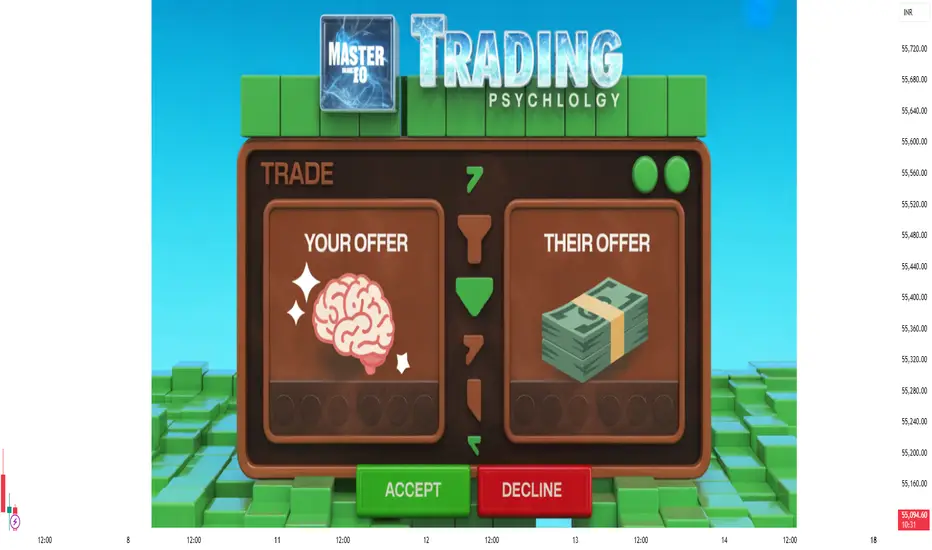

Trading is more than charts, indicators, and data. While technical analysis and strategies are critical, the psychological mindset and risk management discipline often separate successful traders from those who struggle. In fact, it’s often said: “Amateurs focus on strategy, professionals focus on psychology and risk.”

In this deep-dive, we’ll explore:

The role of psychology in trading

Emotional pitfalls and behavioral biases

Trader personality types

Importance of discipline and consistency

Core principles of risk management

Tools and techniques to manage risk

Position sizing and money management

The synergy between psychology and risk

Let’s begin by understanding the mental battlefield that trading truly is.

Part I: Trading Psychology

1. What is Trading Psychology?

Trading psychology refers to a trader's emotional and mental state while making decisions in the market. Emotions like fear, greed, hope, and regret can heavily influence judgment, often leading to irrational decisions.

In high-stakes environments like trading, where real money is involved, emotional control becomes critical. Even the best strategies can fail if the trader lacks mental discipline.

2. Core Emotions in Trading

Let’s understand how some key emotions impact trading decisions:

a. Fear

Fear causes traders to hesitate or close positions too early. A fearful trader might exit a profitable trade prematurely or avoid entering a high-probability setup due to anxiety.

b. Greed

Greed pushes traders to over-leverage, overtrade, or hold losing trades hoping for a rebound. It often results in ignoring risk parameters and chasing unrealistic profits.

c. Hope

Hope is dangerous in trading. Traders hold onto losing positions with the hope of recovery, turning small losses into large ones. Hope delays logical decision-making.

d. Regret

Regret from past losses can paralyze future decision-making or force revenge trades. It also leads to second-guessing strategies and inconsistency.

3. Common Psychological Traps

a. Overtrading

Driven by boredom, ego, or addiction, traders often take too many trades without high-quality setups. This reduces edge and increases losses.

b. FOMO (Fear of Missing Out)

When traders see a stock or asset moving fast, they jump in late, fearing they’ll miss the opportunity. This often leads to entering near the top or bottom.

c. Revenge Trading

After a loss, traders try to “win it back” quickly. This often leads to emotional, impulsive trades that dig the hole deeper.

d. Confirmation Bias

Traders selectively interpret data that confirms their existing bias. This clouds judgment and leads to poor decision-making.

e. Anchoring Bias

Traders fixate on a price point (e.g., entry price or previous high) and ignore new market information, often staying in bad trades too long.

4. Trader Personality Types

Understanding your personality helps tailor your trading style:

Personality Type Strengths Weaknesses

Analytical Strong strategy, logic-based Paralysis by analysis

Intuitive Good with price action, flow Impulsive entries

Risk-Taker Comfortable with volatility Over-leveraging

Risk-Averse Cautious, disciplined Misses opportunities

Emotional Empathetic, connected Easily shaken

Self-awareness is the first step toward mastery. Knowing your traits helps design systems to manage them.

5. Developing Psychological Discipline

Here’s how traders can build mental resilience:

a. Journaling

Keeping a trading journal helps track decisions, emotions, and performance. Reviewing this builds self-awareness and accountability.

b. Meditation & Mindfulness

Mindfulness helps traders stay present and reduce emotional reactivity. Even 10 minutes daily can improve clarity.

c. Visualization

Visualizing trade scenarios (successes and failures) prepares the mind for real action. Athletes use this technique—so should traders.

d. Set Trading Rules

Rules reduce the emotional burden of decision-making. Whether it’s stop-loss placement or daily loss limits, rules act as mental guardrails.

e. Take Breaks

If you’re tilted or emotionally disturbed, step away. Recalibrating is better than revenge trading.

Part II: Risk Management in Trading

1. What is Risk Management?

Risk management involves identifying, analyzing, and controlling risk in trading. It’s not about avoiding risk—but managing it wisely. Risk is inevitable, but ruin is optional.

Without risk management, even the best strategy can lead to large losses and psychological burnout.

2. Core Principles of Risk Management

a. Risk per Trade

Never risk more than a certain percentage of capital per trade. Most professionals risk 0.5%–2% per trade. This ensures survival during losing streaks.

b. Stop Loss

A stop-loss is your safety net. It’s not a weakness—it’s smart trading. Place it based on volatility, not emotion.

c. Reward-to-Risk Ratio (RRR)

Always aim for at least a 2:1 RRR. For example, risk ₹1000 to make ₹2000. Even with 40% win rate, this can be profitable.

d. Position Sizing

Lot size should be calculated based on stop-loss and risk amount. Avoid fixed lot trading unless capital is large enough.

e. Maximum Daily Loss

Set a “circuit breaker” to stop trading after losing a certain percentage of your capital in a day. This protects from emotional spiral.

3. Position Sizing Formula

Let’s break down a basic formula:

Position Size = (Account Capital × % Risk per Trade) / Stop-Loss Points

Example:

Capital: ₹1,00,000

Risk per trade: 1% = ₹1,000

Stop-loss: 10 points

Therefore, ₹1,000 / 10 = 100 quantity

4. Capital Allocation Strategy

Diversify your capital. Don’t put everything in one trade or asset.

Sample allocation plan:

Core strategy: 50% capital

Short-term trades: 30%

Experimental / new setups: 10%

Emergency buffer: 10%

This helps weather drawdowns.

5. Risk of Ruin

Risk of ruin is the probability of losing all your capital. Poor risk management increases this dramatically.

With proper rules (like risking 1% per trade), even 10 losses in a row only reduces capital by 10%.

Part III: Psychology + Risk Management: A Powerful Synergy

1. Why They Must Work Together

Good psychology without risk management = Emotional control, but no safety net

Risk management without psychology = Tools in place, but emotional sabotage

Both together = Long-term survival and consistent performance

2. How Risk Management Supports Psychology

Risk management builds confidence. When you know the maximum loss, you trade with calm. This reduces fear and hesitation.

Example:

Without risk rule: “What if I lose 20%?” → Fear

With risk rule: “Max I lose is 1%” → Confidence

3. How Psychology Supports Risk Management

Even the best rules fail without discipline. Psychology helps follow those rules during emotional highs and lows.

Example:

You set stop-loss, but price nears it

Without discipline: You remove the stop

With discipline: You let it hit or bounce as per plan

4. Creating a Psychological-Risk Framework

Here’s a basic blueprint:

Component Psychological Rule Risk Rule

Entry No FOMO trades Enter only if setup matches plan

Stop-loss Accept loss without panic Always place a stop before trade

Position Size No overconfidence Use formula-based sizing

Exit No greed for “just a little more” Exit at planned target or trailing stop

Daily Routine Mindfulness, journaling Stop trading after daily loss hit

Part IV: Building a Trading System with Psychology & Risk Focus

1. Create a Written Trading Plan

Include:

Setup criteria

Entry/Exit rules

Position sizing logic

Risk per trade

Daily/weekly limits

Emotional management (e.g., walk away after 2 consecutive losses)

2. Review and Adjust Regularly

Track:

Win rate

Risk-reward consistency

Psychological notes (nervous? overconfident?)

Your trading journal is your mirror.

3. Embrace Losing

Losses are part of the game. Like a poker player folding weak hands, traders must learn to lose small often to win big occasionally.

Part V: Tools, Techniques, and Mindset Habits

1. Risk Management Tools

Risk Calculator Apps

Trailing Stops

Volatility-based Position Sizing

Max Drawdown Alerts

Diversification

2. Psychological Techniques

Breathing Exercises: Calms nervous system

Affirmations: Reinforce trading beliefs

Post-Trade Reviews: Not just what, but why

Simulation/Backtesting: Builds conviction

3. Mental Habits of Top Traders

Habit Description

Consistency Follow system, not emotions

Detachment Trade like a business, not a casino

Patience Wait for setup, not excitement

Humility Markets are bigger than ego

Focus Quality over quantity of trades

Conclusion

Trading success is 80% psychology and risk control, and 20% strategy. Without emotional mastery and risk discipline, even the best system will fail over time.

Your edge is not just in your charts—it's in your mindset, your rules, and your ability to control what you can. In a market where randomness is unavoidable, the best traders are those who control their behavior, manage their losses, and stay in the game long enough to thrive.

Mastering psychology and risk management is not an event—it’s a lifelong practice. But once you do, you’ll not just protect your capital—you’ll unlock your full potential as a trader.

Trading is more than charts, indicators, and data. While technical analysis and strategies are critical, the psychological mindset and risk management discipline often separate successful traders from those who struggle. In fact, it’s often said: “Amateurs focus on strategy, professionals focus on psychology and risk.”

In this deep-dive, we’ll explore:

The role of psychology in trading

Emotional pitfalls and behavioral biases

Trader personality types

Importance of discipline and consistency

Core principles of risk management

Tools and techniques to manage risk

Position sizing and money management

The synergy between psychology and risk

Let’s begin by understanding the mental battlefield that trading truly is.

Part I: Trading Psychology

1. What is Trading Psychology?

Trading psychology refers to a trader's emotional and mental state while making decisions in the market. Emotions like fear, greed, hope, and regret can heavily influence judgment, often leading to irrational decisions.

In high-stakes environments like trading, where real money is involved, emotional control becomes critical. Even the best strategies can fail if the trader lacks mental discipline.

2. Core Emotions in Trading

Let’s understand how some key emotions impact trading decisions:

a. Fear

Fear causes traders to hesitate or close positions too early. A fearful trader might exit a profitable trade prematurely or avoid entering a high-probability setup due to anxiety.

b. Greed

Greed pushes traders to over-leverage, overtrade, or hold losing trades hoping for a rebound. It often results in ignoring risk parameters and chasing unrealistic profits.

c. Hope

Hope is dangerous in trading. Traders hold onto losing positions with the hope of recovery, turning small losses into large ones. Hope delays logical decision-making.

d. Regret

Regret from past losses can paralyze future decision-making or force revenge trades. It also leads to second-guessing strategies and inconsistency.

3. Common Psychological Traps

a. Overtrading

Driven by boredom, ego, or addiction, traders often take too many trades without high-quality setups. This reduces edge and increases losses.

b. FOMO (Fear of Missing Out)

When traders see a stock or asset moving fast, they jump in late, fearing they’ll miss the opportunity. This often leads to entering near the top or bottom.

c. Revenge Trading

After a loss, traders try to “win it back” quickly. This often leads to emotional, impulsive trades that dig the hole deeper.

d. Confirmation Bias

Traders selectively interpret data that confirms their existing bias. This clouds judgment and leads to poor decision-making.

e. Anchoring Bias

Traders fixate on a price point (e.g., entry price or previous high) and ignore new market information, often staying in bad trades too long.

4. Trader Personality Types

Understanding your personality helps tailor your trading style:

Personality Type Strengths Weaknesses

Analytical Strong strategy, logic-based Paralysis by analysis

Intuitive Good with price action, flow Impulsive entries

Risk-Taker Comfortable with volatility Over-leveraging

Risk-Averse Cautious, disciplined Misses opportunities

Emotional Empathetic, connected Easily shaken

Self-awareness is the first step toward mastery. Knowing your traits helps design systems to manage them.

5. Developing Psychological Discipline

Here’s how traders can build mental resilience:

a. Journaling

Keeping a trading journal helps track decisions, emotions, and performance. Reviewing this builds self-awareness and accountability.

b. Meditation & Mindfulness

Mindfulness helps traders stay present and reduce emotional reactivity. Even 10 minutes daily can improve clarity.

c. Visualization

Visualizing trade scenarios (successes and failures) prepares the mind for real action. Athletes use this technique—so should traders.

d. Set Trading Rules

Rules reduce the emotional burden of decision-making. Whether it’s stop-loss placement or daily loss limits, rules act as mental guardrails.

e. Take Breaks

If you’re tilted or emotionally disturbed, step away. Recalibrating is better than revenge trading.

Part II: Risk Management in Trading

1. What is Risk Management?

Risk management involves identifying, analyzing, and controlling risk in trading. It’s not about avoiding risk—but managing it wisely. Risk is inevitable, but ruin is optional.

Without risk management, even the best strategy can lead to large losses and psychological burnout.

2. Core Principles of Risk Management

a. Risk per Trade

Never risk more than a certain percentage of capital per trade. Most professionals risk 0.5%–2% per trade. This ensures survival during losing streaks.

b. Stop Loss

A stop-loss is your safety net. It’s not a weakness—it’s smart trading. Place it based on volatility, not emotion.

c. Reward-to-Risk Ratio (RRR)

Always aim for at least a 2:1 RRR. For example, risk ₹1000 to make ₹2000. Even with 40% win rate, this can be profitable.

d. Position Sizing

Lot size should be calculated based on stop-loss and risk amount. Avoid fixed lot trading unless capital is large enough.

e. Maximum Daily Loss

Set a “circuit breaker” to stop trading after losing a certain percentage of your capital in a day. This protects from emotional spiral.

3. Position Sizing Formula

Let’s break down a basic formula:

Position Size = (Account Capital × % Risk per Trade) / Stop-Loss Points

Example:

Capital: ₹1,00,000

Risk per trade: 1% = ₹1,000

Stop-loss: 10 points

Therefore, ₹1,000 / 10 = 100 quantity

4. Capital Allocation Strategy

Diversify your capital. Don’t put everything in one trade or asset.

Sample allocation plan:

Core strategy: 50% capital

Short-term trades: 30%

Experimental / new setups: 10%

Emergency buffer: 10%

This helps weather drawdowns.

5. Risk of Ruin

Risk of ruin is the probability of losing all your capital. Poor risk management increases this dramatically.

With proper rules (like risking 1% per trade), even 10 losses in a row only reduces capital by 10%.

Part III: Psychology + Risk Management: A Powerful Synergy

1. Why They Must Work Together

Good psychology without risk management = Emotional control, but no safety net

Risk management without psychology = Tools in place, but emotional sabotage

Both together = Long-term survival and consistent performance

2. How Risk Management Supports Psychology

Risk management builds confidence. When you know the maximum loss, you trade with calm. This reduces fear and hesitation.

Example:

Without risk rule: “What if I lose 20%?” → Fear

With risk rule: “Max I lose is 1%” → Confidence

3. How Psychology Supports Risk Management

Even the best rules fail without discipline. Psychology helps follow those rules during emotional highs and lows.

Example:

You set stop-loss, but price nears it

Without discipline: You remove the stop

With discipline: You let it hit or bounce as per plan

4. Creating a Psychological-Risk Framework

Here’s a basic blueprint:

Component Psychological Rule Risk Rule

Entry No FOMO trades Enter only if setup matches plan

Stop-loss Accept loss without panic Always place a stop before trade

Position Size No overconfidence Use formula-based sizing

Exit No greed for “just a little more” Exit at planned target or trailing stop

Daily Routine Mindfulness, journaling Stop trading after daily loss hit

Part IV: Building a Trading System with Psychology & Risk Focus

1. Create a Written Trading Plan

Include:

Setup criteria

Entry/Exit rules

Position sizing logic

Risk per trade

Daily/weekly limits

Emotional management (e.g., walk away after 2 consecutive losses)

2. Review and Adjust Regularly

Track:

Win rate

Risk-reward consistency

Psychological notes (nervous? overconfident?)

Your trading journal is your mirror.

3. Embrace Losing

Losses are part of the game. Like a poker player folding weak hands, traders must learn to lose small often to win big occasionally.

Part V: Tools, Techniques, and Mindset Habits

1. Risk Management Tools

Risk Calculator Apps

Trailing Stops

Volatility-based Position Sizing

Max Drawdown Alerts

Diversification

2. Psychological Techniques

Breathing Exercises: Calms nervous system

Affirmations: Reinforce trading beliefs

Post-Trade Reviews: Not just what, but why

Simulation/Backtesting: Builds conviction

3. Mental Habits of Top Traders

Habit Description

Consistency Follow system, not emotions

Detachment Trade like a business, not a casino

Patience Wait for setup, not excitement

Humility Markets are bigger than ego

Focus Quality over quantity of trades

Conclusion

Trading success is 80% psychology and risk control, and 20% strategy. Without emotional mastery and risk discipline, even the best system will fail over time.

Your edge is not just in your charts—it's in your mindset, your rules, and your ability to control what you can. In a market where randomness is unavoidable, the best traders are those who control their behavior, manage their losses, and stay in the game long enough to thrive.

Mastering psychology and risk management is not an event—it’s a lifelong practice. But once you do, you’ll not just protect your capital—you’ll unlock your full potential as a trader.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.