Intro:

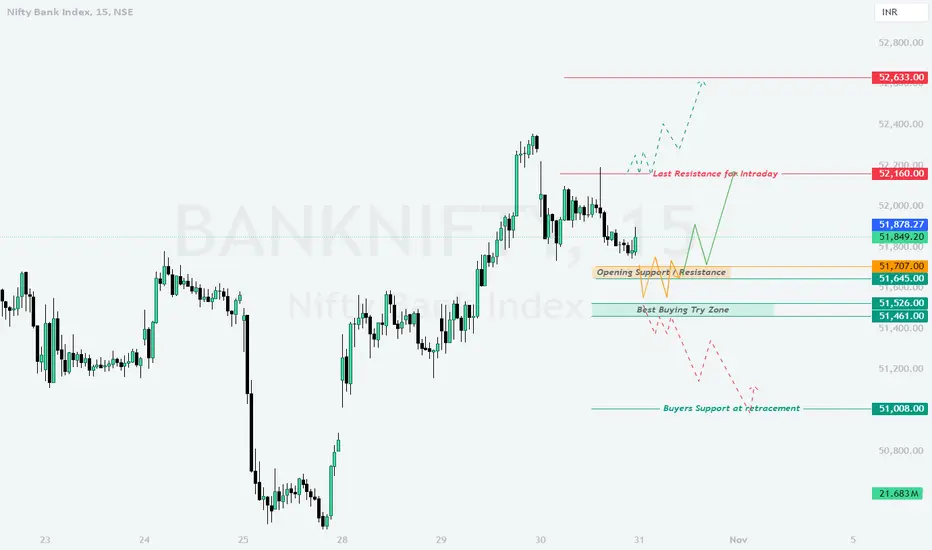

On the previous trading day, Bank Nifty experienced a range-bound movement with significant support and resistance levels being respected. For the upcoming session on 31-Oct-2024, we have identified key levels, with yellow marking the sideways trend, green indicating bullish movement, and red representing bearish tendencies. This plan includes strategies for each opening scenario.

Trading Plan for 31-Oct-2024

- Gap Up Opening (200+ points above)

If Bank Nifty opens with a 200+ point gap up, it may quickly test the Last Resistance for Intraday near 52,160. If the price can sustain above this level, a further move towards 52,633 is likely. However, if the index fails to hold above 52,160, it may experience a retracement to the Opening Support/Resistance level at 51,707.

– Watch for signs of rejection at the 52,160 level, as this may prompt a reversal towards support levels.

- Flat Opening (within 50 points of the previous close)

In the case of a flat opening, the immediate level to observe is 51,849. Sustaining above this point could enable a bullish move towards 52,160. Failure to maintain momentum above 51,849 may result in sideways movement around the Opening Support/Resistance at 51,707 or even lead to a test of the Best Buying Try Zone near 51,645.

– A move below 51,645 would likely signal weakness, potentially driving the index lower towards 51,526.

- Gap Down Opening (200+ points below)

A gap-down opening would bring Bank Nifty closer to the Best Buying Try Zone at 51,645. A bounce from this area could lead the index back to 51,849. However, if this level does not hold, watch for further decline towards the Buyers Support at Retracement at 51,008.

– Persistent weakness below 51,008 would indicate a bearish sentiment, with potential downside targets emerging.

Risk Management Tips for Options Trading

- Define your risk tolerance and adjust your position size accordingly.

- Consider using protective strategies, such as stop-loss orders, especially around key resistance/support zones.

- Avoid over-leveraging, and monitor volatility closely to avoid sudden adverse moves.

Summary and Conclusion

Key levels for Bank Nifty on 31-Oct-2024 include 52,160 on the upside and 51,645 on the downside. Monitor these levels closely for directional cues. Employ disciplined risk management to navigate through the volatility, especially when trading options.

Disclaimer:

I am not a SEBI-registered analyst. This analysis is based on technical levels and reflects my personal view. Please perform your own analysis or consult a financial advisor before trading.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.