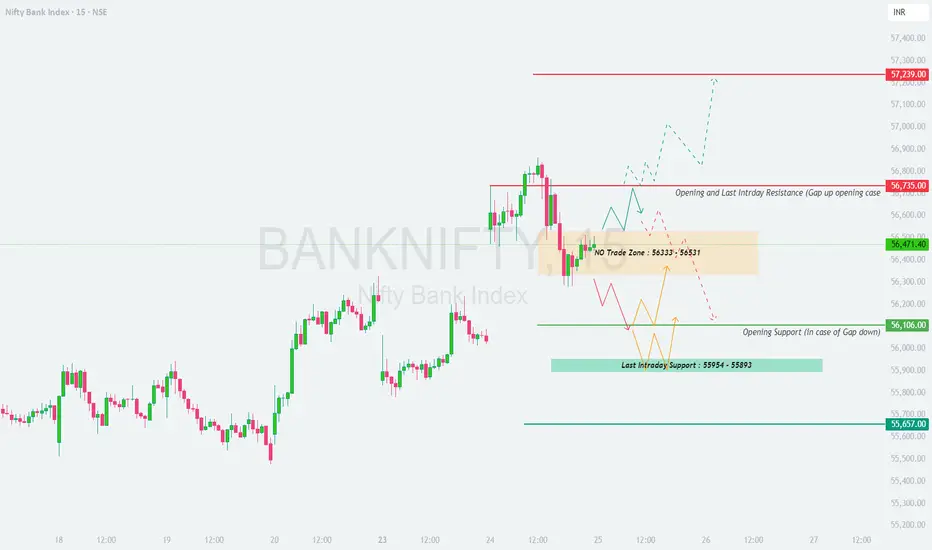

\📊 BANKNIFTY TRADING PLAN – 25-Jun-2025\

📍 \Previous Close:\ 56,471.40

📏 \Gap Threshold Considered:\ 200+ points

📉 \Chart Basis:\ 15-min Timeframe

📌 \Volume Watch:\ 11M (important for confirmation near key levels)

---

\

\[\*]\🚀 GAP-UP OPENING (Above 56,735):\

If BankNifty opens above \56,735\, it enters the prior \Last Intraday Resistance and Opening Resistance Zone\, which could act as a potential supply area. A further move toward \57,239\ (upper target) is possible only on sustained momentum.

✅ \Plan of Action:\

• Let the price stabilize for 15–30 minutes.

• A breakout above 56,735 with volume can attract follow-up buying.

• However, any hesitation near this zone may trigger intraday profit booking.

🎯 \Trade Setup:\

– Long above 56,735 (only if candle sustains with strength)

– Target: 56,900 / 57,239

– SL: 56,550

– Short opportunity arises if price reverses from 56,735 zone with bearish wick

📘 \Pro Tip:\ Use trailing SL when riding bullish momentum post-gap-up.

\[\*]\⚖️ FLAT OPENING (Between 56,333 – 56,531):\

This zone is marked as a \No Trade / Decision Zone\. The market might consolidate here before a decisive move either way.

✅ \Plan of Action:\

• Avoid early trades in this choppy zone.

• Watch for breakout above 56,531 = bullish signal

• Breakdown below 56,333 = early weakness

🎯 \Trade Setup:\

– Long above 56,531

– Short below 56,333

– SL: 40–60 pts depending on volatility

– Prefer breakout + retest pattern

📘 \Pro Tip:\ Patience pays here — don't get trapped in false moves inside the range.

\[\*]\📉 GAP-DOWN OPENING (Below 56,106):\

A gap-down below \56,106 (Opening Support)\ will shift the focus to the \Last Intraday Support Zone – 55,954 to 55,893\. If these supports fail, deeper correction may follow toward \55,657\.

✅ \Plan of Action:\

• Watch reaction at 55,954–55,893

• If price bounces here with volume, expect a quick intraday reversal trade

• A breakdown here confirms bearish grip toward 55,657

🎯 \Trade Setup:\

– Short below 55,893 with confirmation

– Target: 55,657

– SL: 56,050

– Long only if strong bullish reversal candle forms in green zone

📘 \Pro Tip:\ Avoid knife-catching. Let the support prove itself before going long.

---

\💼 OPTIONS RISK MANAGEMENT TIPS:\

✅ \1. Avoid buying options blindly on gap opens—wait for confirmation\

✅ \2. Use spreads in consolidation zones to minimize theta loss\

✅ \3. Track volume + price together; high IV = better premium opportunity\

✅ \4. Never risk more than 2% of capital in a single trade\

✅ \5. For index options, always define SL by candle close (15-min preferred)\

---

\📌 SUMMARY – KEY LEVELS TO WATCH:\

🔴 \Major Resistance:\ 57,239

🟥 \Opening & Intraday Resistance:\ 56,735

🟧 \No Trade Zone:\ 56,333 – 56,531

🟩 \Opening Support:\ 56,106

🟦 \Intraday Support Zone:\ 55,954 – 55,893

🟫 \Major Breakdown Level:\ 55,657

---

\🧭 CONCLUSION:\

• 🔼 \Above 56,735:\ Bullish if sustains — target 57,239

• ⏸ \Between 56,333–56,531:\ Avoid trading until breakout/breakdown

• 🔽 \Below 56,106:\ Weak bias — eyes on supports at 55,954 and 55,657

Stick to process, not prediction. Observe structure, manage risk, and stay adaptable. 🎯📊💼

---

\⚠️ DISCLAIMER:\

I am not a SEBI-registered analyst. This trading plan is shared for educational purposes only. Please consult your financial advisor before making any trading decisions. Always use strict risk management and stay disciplined. 📉📚🛡️

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.