📘 BANK NIFTY TRADING PLAN – 21-Apr-2025

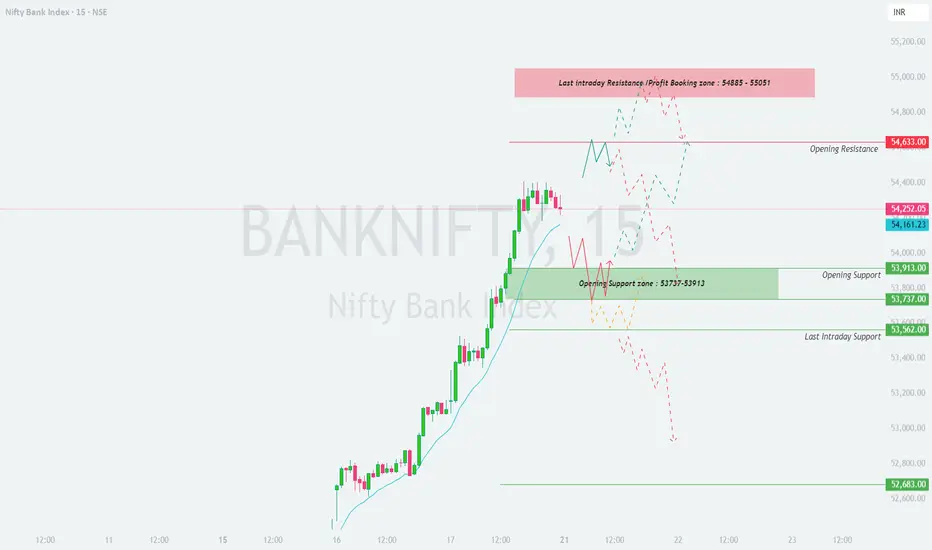

📊 Index Spot Close: 54,252.05 | ⏱ Timeframe: 15-Min | 🔍 Gap Opening Threshold: 200+ Points

🔼 Scenario 1: Gap-Up Opening (Above 54,452+)

A gap-up above 54,452 will push Bank Nifty closer to a profit booking/resistance zone at 54,885–55,051. The index has recently witnessed a sharp rally, so aggressive continuation is less probable unless strong volumes support the move.

📌 Plan of Action:

💡 Educational Tip:

Gap-ups into resistance zones often invite profit booking. Wait for confirmation of strength before entering. Avoid chasing the rally blindly.

⚖️ Scenario 2: Flat Opening (Between 54,161 – 54,452)

This is a balanced zone where volatility can expand either way. There’s support around 54,161, while resistance near 54,633 needs to be breached for any bullish continuation.

📌 Plan of Action:

💡 Educational Tip:

Flat openings provide best risk/reward only when range breakouts occur. Don’t force trades — let the market give you direction.

🔽 Scenario 3: Gap-Down Opening (Below 53,913)

A 200+ point gap-down below 53,913 could lead to swift reactions, as the price enters a critical support zone. Immediate demand lies between 53,737–53,562, followed by a final intraday support near 52,683.

📌 Plan of Action:

💡 Educational Tip:

Support zones trap emotional shorters. Only short if you see clean breakdowns with volume. Never guess support breaks without confirmation.

🛡️ Risk Management Tips for Options Traders 🔐💼

✅ Trade ATM or slightly ITM options — better price movement, lesser decay

✅ Don’t trade in first 15 minutes — avoid opening volatility traps

✅ Set SL based on candle close, not absolute premium values

✅ Use spreads (bull call/bear put) on high IV days to reduce directional risk

✅ Never risk more than 1–2% of capital per trade

✅ Avoid averaging losers — exit and re-enter based on structure

✅ Maintain a trading journal — log reasons, emotions, and learnings

✅ Avoid revenge trading after a loss — clear head = better trades

🧾 Summary & Conclusion 🧠📊

📍 Gap-Up (Above 54,452): Momentum possible toward 54,885–55,051, watch for reversals in red zone

📍 Flat Open (54,161–54,452): Wait for range breakout → Play structure-based trades

📍 Gap-Down (Below 53,913): Breakdown if below 53,737 → Targets: 53,562 & 52,683

📍 Key Level to Watch:** 53,913 – flip zone between bulls & bears

🧘♂️ Final Note: Don’t trade predictions, trade reactions. Patience + discipline is what keeps traders in the game long term.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This trading plan is created for educational purposes only. Please consult with a financial advisor or do your own research before making any trading decisions. Markets involve risk — manage your capital wisely.

📊 Index Spot Close: 54,252.05 | ⏱ Timeframe: 15-Min | 🔍 Gap Opening Threshold: 200+ Points

🔼 Scenario 1: Gap-Up Opening (Above 54,452+)

A gap-up above 54,452 will push Bank Nifty closer to a profit booking/resistance zone at 54,885–55,051. The index has recently witnessed a sharp rally, so aggressive continuation is less probable unless strong volumes support the move.

📌 Plan of Action:

- [] Allow the first 15–30 minutes for price action to settle. Avoid entering in the initial volatility.

[] If price consolidates above 54,452 and reclaims 54,633, consider long entries targeting the upper resistance zone (54,885–55,051).

[] Trail SL strictly as price approaches the red zone — signs of exhaustion could trigger a sharp reversal.

[] If the price opens in the red zone (above 54,885), look for bearish reversal patterns (e.g., Doji, bearish engulfing). Short positions may be considered with SL above 55,051. - A failure to hold above 54,452 could result in a fade toward 54,161.23.

💡 Educational Tip:

Gap-ups into resistance zones often invite profit booking. Wait for confirmation of strength before entering. Avoid chasing the rally blindly.

⚖️ Scenario 2: Flat Opening (Between 54,161 – 54,452)

This is a balanced zone where volatility can expand either way. There’s support around 54,161, while resistance near 54,633 needs to be breached for any bullish continuation.

📌 Plan of Action:

- [] Wait for the first 15-min candle to form. Avoid premature trades in tight ranges.

[] A breakout above 54,452–54,633 with volume could lead to a test of 54,885. Take long positions cautiously with strict SL below breakout candle.

[] If Bank Nifty fails to hold 54,161, expect a slide toward the green zone (Opening Support Zone: 53,913–53,737).

[] Short trades are valid if price retests and gets rejected from 54,452–54,633, targeting 53,913–53,737. - Avoid trading within 54,161–54,452 unless structure forms (ascending triangle, flag pattern, etc.).

💡 Educational Tip:

Flat openings provide best risk/reward only when range breakouts occur. Don’t force trades — let the market give you direction.

🔽 Scenario 3: Gap-Down Opening (Below 53,913)

A 200+ point gap-down below 53,913 could lead to swift reactions, as the price enters a critical support zone. Immediate demand lies between 53,737–53,562, followed by a final intraday support near 52,683.

📌 Plan of Action:

- [] Let the index stabilize for the first 15–30 minutes; don’t rush into shorts.

[] If price fails to reclaim 53,913 and breaks below 53,737, initiate shorts for targets 53,562 → 52,683.

[] Watch out for bullish reversal patterns near 53,562 and 52,683. If formed with volumes, consider bounce trades with targets back to 53,913.

[] Avoid shorting near demand zones unless there’s a clean breakdown structure (e.g., breakdown + retest). - If price reclaims 53,913 and sustains, avoid shorts — it could signal short-covering.

💡 Educational Tip:

Support zones trap emotional shorters. Only short if you see clean breakdowns with volume. Never guess support breaks without confirmation.

🛡️ Risk Management Tips for Options Traders 🔐💼

✅ Trade ATM or slightly ITM options — better price movement, lesser decay

✅ Don’t trade in first 15 minutes — avoid opening volatility traps

✅ Set SL based on candle close, not absolute premium values

✅ Use spreads (bull call/bear put) on high IV days to reduce directional risk

✅ Never risk more than 1–2% of capital per trade

✅ Avoid averaging losers — exit and re-enter based on structure

✅ Maintain a trading journal — log reasons, emotions, and learnings

✅ Avoid revenge trading after a loss — clear head = better trades

🧾 Summary & Conclusion 🧠📊

📍 Gap-Up (Above 54,452): Momentum possible toward 54,885–55,051, watch for reversals in red zone

📍 Flat Open (54,161–54,452): Wait for range breakout → Play structure-based trades

📍 Gap-Down (Below 53,913): Breakdown if below 53,737 → Targets: 53,562 & 52,683

📍 Key Level to Watch:** 53,913 – flip zone between bulls & bears

🧘♂️ Final Note: Don’t trade predictions, trade reactions. Patience + discipline is what keeps traders in the game long term.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This trading plan is created for educational purposes only. Please consult with a financial advisor or do your own research before making any trading decisions. Markets involve risk — manage your capital wisely.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.