________________________________________________________________________________

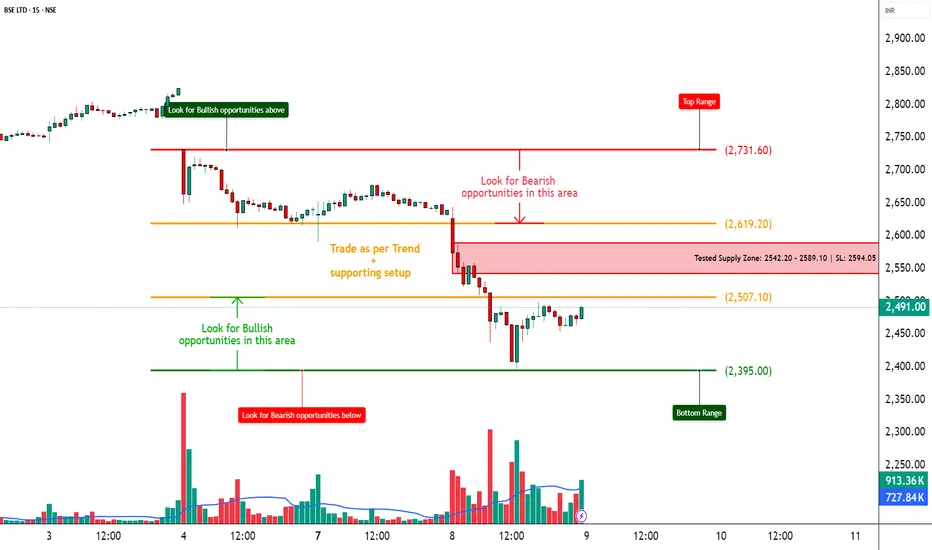

📈 BSE – Strong Call Writing Below 2600 | Tested Supply Zone in Play

🕒 Chart: 15-Min

📆 July 8, 2025

________________________________________________________________________________

🔍 What’s Catching Our Eye:

Massive Call writing seen from ₹2400 to ₹2900, clearly indicating resistance at higher levels.

________________________________________________________________________________📌 What We’re Watching For:

Price is facing selling near the ₹2542–₹2589 supply zone; a rejection here can drag it toward ₹2395 or below.

________________________________________________________________________________📌 OI Inference:

CEs are heavily sold across all levels – especially 2600, 2500, 2700, and 2400 CE.

Strong Put buying from 2400 down to 2000 PE → Market participants are expecting downside.

________________________________________________________________________________🔁 Trend Bias:

🔴 Bearish to Range-Bound – unless price breaks above ₹2594.05 with volume and CE unwinding.

________________________________________________________________________________🧠 Trade Logic / Reasoning:

• 12+ Call Strikes under Short Build-Up = strong ceiling

• Long Build-Up in deep Puts (2500, 2400, 2300, even 2000)

• Tested supply zone between ₹2542–₹2589 = rejection likely

• PE IVs rising = fear building up, especially below 2500

________________________________________________________________________________📍 Important Levels to Mark:

🔺 Top Range (Resistance): ₹2731.6

🔻 Bottom Range (Support): ₹2395

🟢 Demand Zone: NA

🔴 Supply Zone: ₹2542.20 – ₹2589.10 | SL: ₹2594.05(Tested Zone)

________________________________________________________________________________🎯 Trade Plan (Educational Purpose Only):

✅ Sell (Equity): Near ₹2542–₹2589 if price rejects the supply zone

✅ Buy (Equity): Only above ₹2594.05 with strong volume

✅ Best Put to Buy: ₹2500 PE or ₹2400 PE on breakdown

❌ Avoid Call Buying: All Calls are under heavy selling

📌 Strategy Idea (Low Risk):

Bear Put Spread – Buy 2500 PE, Sell 2400 PE

→ Profitable if stock drops, risk stays limited

________________________________________________________________________________⚠️ Invalidation Levels:

🔺 Above ₹2594.05 = bearish setup may fail

🔻 Below ₹2395 = confirms breakdown and trend continuation

________________________________________________________________________________

⚠️ Disclaimer:

This post is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for any trading decisions based on this content.

________________________________________________________________________________

💬 Will BSE break supply and fly, or get rejected again?

⬇️ Share your view in the comments!

🔁 Repost this if you're watching BSE

✅ Follow STWP for clean Options + Price Action insights

🚀 Let’s trade with clarity and confidence!

________________________________________________________________________________

📈 BSE – Strong Call Writing Below 2600 | Tested Supply Zone in Play

🕒 Chart: 15-Min

📆 July 8, 2025

________________________________________________________________________________

🔍 What’s Catching Our Eye:

Massive Call writing seen from ₹2400 to ₹2900, clearly indicating resistance at higher levels.

________________________________________________________________________________📌 What We’re Watching For:

Price is facing selling near the ₹2542–₹2589 supply zone; a rejection here can drag it toward ₹2395 or below.

________________________________________________________________________________📌 OI Inference:

CEs are heavily sold across all levels – especially 2600, 2500, 2700, and 2400 CE.

Strong Put buying from 2400 down to 2000 PE → Market participants are expecting downside.

________________________________________________________________________________🔁 Trend Bias:

🔴 Bearish to Range-Bound – unless price breaks above ₹2594.05 with volume and CE unwinding.

________________________________________________________________________________🧠 Trade Logic / Reasoning:

• 12+ Call Strikes under Short Build-Up = strong ceiling

• Long Build-Up in deep Puts (2500, 2400, 2300, even 2000)

• Tested supply zone between ₹2542–₹2589 = rejection likely

• PE IVs rising = fear building up, especially below 2500

________________________________________________________________________________📍 Important Levels to Mark:

🔺 Top Range (Resistance): ₹2731.6

🔻 Bottom Range (Support): ₹2395

🟢 Demand Zone: NA

🔴 Supply Zone: ₹2542.20 – ₹2589.10 | SL: ₹2594.05(Tested Zone)

________________________________________________________________________________🎯 Trade Plan (Educational Purpose Only):

✅ Sell (Equity): Near ₹2542–₹2589 if price rejects the supply zone

✅ Buy (Equity): Only above ₹2594.05 with strong volume

✅ Best Put to Buy: ₹2500 PE or ₹2400 PE on breakdown

❌ Avoid Call Buying: All Calls are under heavy selling

📌 Strategy Idea (Low Risk):

Bear Put Spread – Buy 2500 PE, Sell 2400 PE

→ Profitable if stock drops, risk stays limited

________________________________________________________________________________⚠️ Invalidation Levels:

🔺 Above ₹2594.05 = bearish setup may fail

🔻 Below ₹2395 = confirms breakdown and trend continuation

________________________________________________________________________________

⚠️ Disclaimer:

This post is for educational purposes only.

STWP is not a SEBI-registered advisor.

No buy/sell recommendations are made.

Please consult your financial advisor before trading.

STWP is not responsible for any trading decisions based on this content.

________________________________________________________________________________

💬 Will BSE break supply and fly, or get rejected again?

⬇️ Share your view in the comments!

🔁 Repost this if you're watching BSE

✅ Follow STWP for clean Options + Price Action insights

🚀 Let’s trade with clarity and confidence!

________________________________________________________________________________

STWP | Mentor & Demand-Supply Specialist | Empowering traders through structured learning |

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

STWP | Mentor & Demand-Supply Specialist | Empowering traders through structured learning |

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

simpletradewithpatience.com

Community: chat.whatsapp.com/BEYz0tkqP0fJPBCWf59uel

wa.me/message/6IOPHGOXMGZ4N1

Educational Only

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.