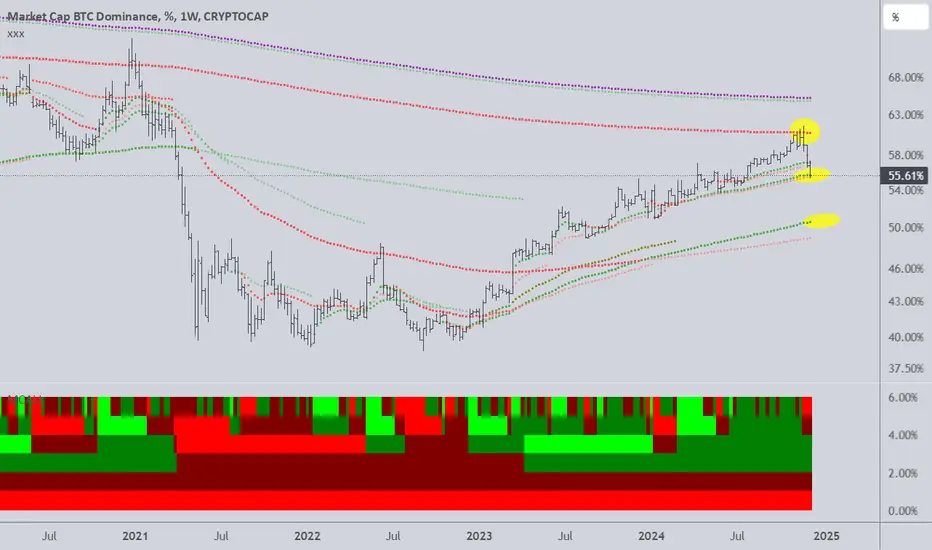

As anticipated in our previous analysis, Bitcoin dominance has encountered resistance at around 61%, subsequently declining to its current level of 55.6%, where it is now testing a significant support zone.

At this juncture, we may observe a potential bounce at the current support level. However, should the downward trend in dominance persist, the next critical support level to monitor is approximately 51%.

While we are witnessing substantial gains in altcoins, attributed to the recent decline in Bitcoin dominance, it is important to note that we are still in the early stages of this market shift. Current indicators suggest that a full-fledged altseason has yet to materialize, although we are moving in a positive direction.

In summary, the key support levels to watch are as follows:

55.6% (current level)

51%

The 2022 lows at 39%

We will continue to provide updates and further analysis as the market situation evolves.

At this juncture, we may observe a potential bounce at the current support level. However, should the downward trend in dominance persist, the next critical support level to monitor is approximately 51%.

While we are witnessing substantial gains in altcoins, attributed to the recent decline in Bitcoin dominance, it is important to note that we are still in the early stages of this market shift. Current indicators suggest that a full-fledged altseason has yet to materialize, although we are moving in a positive direction.

In summary, the key support levels to watch are as follows:

55.6% (current level)

51%

The 2022 lows at 39%

We will continue to provide updates and further analysis as the market situation evolves.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.