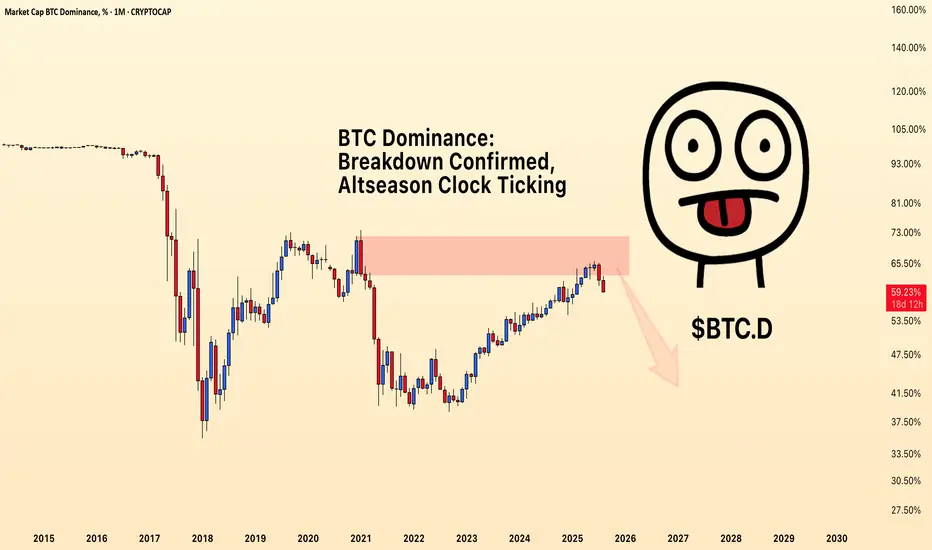

BTC Dominance just tagged a well-defined monthly supply zone and got rejected hard. Rotation into alts, led by ETH, is picking up momentum. The charts are flashing early signs that the uptrend in BTC Dominance might be done. In my view, June 27th marked the top for $BTC.D.

A bearish BTC.D doesn’t mean Bitcoin itself is bearish. BTC can still push higher while dominance fades, that’s the classic setup for alt season. Bitcoin holds its ground, and capital starts pouring into ETH and high-beta alts. Right now, that rotation is clearly gaining traction.

If this holds, ETH likely continues to lead the rotation, followed by high-beta alts in trending narratives (AI, Memes, etc.). The “new altseason” is more selective and you need to rotate into strength, not sit in 2021 bags and pray.

The real question isn’t whether BTC.D is weakening — it’s how far it will fall, and how aggressively altcoins will respond.

📊 Market Structure

📉 Moving Averages

📝 Support and Resistance

⚡️ Technical Confluences

📈 Narrative

🧠 TLDR

BTC dominance is rolling over from a heavy supply zone, and the technicals are stacked against the bulls. A break below 56% could open the floodgates toward 48–49%, giving altcoins their window to run. The bias here is bearish unless we reclaim 62.5% cleanly.

✅ What’s your read on this move?

Is this the real rotation to alts, or just a pause before BTC takes back control? Drop your take or send this to someone watching dominance this week. 📢

⚠️ Disclaimer

This content is provided solely for educational and informational purposes. It does not constitute financial, investment, or trading advice, nor should it be relied upon as such. I am not a licensed financial advisor. Any investment or trading decisions you make are entirely at your own risk, and you should always conduct your own research and due diligence. Where appropriate, seek guidance from a qualified financial professional before acting on any information contained herein.

(And if all else fails, you can still run it by your cat. 🐱)

A bearish BTC.D doesn’t mean Bitcoin itself is bearish. BTC can still push higher while dominance fades, that’s the classic setup for alt season. Bitcoin holds its ground, and capital starts pouring into ETH and high-beta alts. Right now, that rotation is clearly gaining traction.

If this holds, ETH likely continues to lead the rotation, followed by high-beta alts in trending narratives (AI, Memes, etc.). The “new altseason” is more selective and you need to rotate into strength, not sit in 2021 bags and pray.

📊 Market Structure

- Monthly supply zone (66–70%) acting as macro resistance

- Lower high confirmed on weekly after rejection

- Daily: recent breakdown from lower high confirms near-term bearish structure

- Dominance stalling at resistance while altcoins begin outperforming

📉 Moving Averages

- Daily: rejection from 200MA cloud cluster (bearish sign)

- No bullish crossover or momentum confirmation; trend is losing strength

- Watch for interaction with 50MA below for short-term bounce attempt

- Unless BTC.D can recover above the 200MA cluster (~62.8%), this rejection stays dominant.

📝 Support and Resistance

- Resistance: 66–70% (monthly supply), 62.5–63% (daily & weekly confluence), 60% (psych level & recent breakdown)

- Support: 56% (yearly open), 54% (minor level), 48.9% and 39.6% as key structural targets

- Flip zones: 59–60% range is current battleground (retest zone)

⚡️ Technical Confluences

- Weekly supply + breaker + FVG stacked = strong rejection zone

- Current drop aligns with rejection off confluence

- Daily demand around 59–60% may offer short-term support

- Trendline support + prior accumulation zone near 49% is a key magnet if structure breaks

- 60% breakdown is key: flipping this zone confirms sustained altcoin strength

📈 Narrative

- Since April, alt market cap added $830B

- BTC.D fell from 66% to sub-59%, a 7-point drop

- ETH moved from $1,300 to $4,700, showing clear leadership

- TradFi inflows into ETH ETFs hit $1B in one day

- Yet sentiment still lags, with disbelief about altseason widespread — classic early-stage behavior

🧠 TLDR

BTC dominance is rolling over from a heavy supply zone, and the technicals are stacked against the bulls. A break below 56% could open the floodgates toward 48–49%, giving altcoins their window to run. The bias here is bearish unless we reclaim 62.5% cleanly.

✅ What’s your read on this move?

Is this the real rotation to alts, or just a pause before BTC takes back control? Drop your take or send this to someone watching dominance this week. 📢

⚠️ Disclaimer

This content is provided solely for educational and informational purposes. It does not constitute financial, investment, or trading advice, nor should it be relied upon as such. I am not a licensed financial advisor. Any investment or trading decisions you make are entirely at your own risk, and you should always conduct your own research and due diligence. Where appropriate, seek guidance from a qualified financial professional before acting on any information contained herein.

(And if all else fails, you can still run it by your cat. 🐱)

I build communities where traders feel understood and supported. 🔥

Trading is lonely, but it doesn’t have to be.

Want to grow with people who get it?

📈 Join my FREE Telegram → t.me/johntradingwick

🤝 Connect on Twitter → x.com/tradingwick_

Trading is lonely, but it doesn’t have to be.

Want to grow with people who get it?

📈 Join my FREE Telegram → t.me/johntradingwick

🤝 Connect on Twitter → x.com/tradingwick_

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

I build communities where traders feel understood and supported. 🔥

Trading is lonely, but it doesn’t have to be.

Want to grow with people who get it?

📈 Join my FREE Telegram → t.me/johntradingwick

🤝 Connect on Twitter → x.com/tradingwick_

Trading is lonely, but it doesn’t have to be.

Want to grow with people who get it?

📈 Join my FREE Telegram → t.me/johntradingwick

🤝 Connect on Twitter → x.com/tradingwick_

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.